Consumer packaging solutions provider Graphic Packaging Holding (NYSE: GPK) met Wall Street’s revenue expectations in Q1 CY2025, but sales fell by 6.2% year on year to $2.12 billion. On the other hand, the company’s full-year revenue guidance of $8.35 billion at the midpoint came in 3.7% below analysts’ estimates. Its non-GAAP profit of $0.51 per share was 11.5% below analysts’ consensus estimates.

Is now the time to buy Graphic Packaging Holding? Find out by accessing our full research report, it’s free.

Graphic Packaging Holding (GPK) Q1 CY2025 Highlights:

- Revenue: $2.12 billion vs analyst estimates of $2.13 billion (6.2% year-on-year decline, in line)

- Adjusted EPS: $0.51 vs analyst expectations of $0.58 (11.5% miss)

- Adjusted EBITDA: $365 million vs analyst estimates of $397.5 million (17.2% margin, 8.2% miss)

- The company dropped its revenue guidance for the full year to $8.35 billion at the midpoint from $8.8 billion, a 5.1% decrease

- Management lowered its full-year Adjusted EPS guidance to $2 at the midpoint, a 24.7% decrease

- EBITDA guidance for the full year is $1.5 billion at the midpoint, below analyst estimates of $1.68 billion

- Operating Margin: 10.4%, down from 12.3% in the same quarter last year

- Free Cash Flow was -$483 million compared to -$328 million in the same quarter last year

- Market Capitalization: $7.64 billion

Michael Doss, the Company's President and CEO said, "First quarter results fell short of our expectations in a challenging economic and consumer environment. Consumers are redoubling their efforts to find value as food prices continue to rise. Meanwhile, promotional activity is driving mix and brand switching, rather than incremental foot traffic and volume gains. Against that backdrop, we saw a small volume decline in the Americas business, but continued improvement in our International business. Leveraging our growing cost and quality advantage and the strength of our innovation portfolio, we continue to gain market position as we partner with customers in a rapidly changing market.

Company Overview

Founded in 1991, Graphic Packaging (NYSE: GPK) is a provider of paper-based packaging solutions for a wide range of products.

Sales Growth

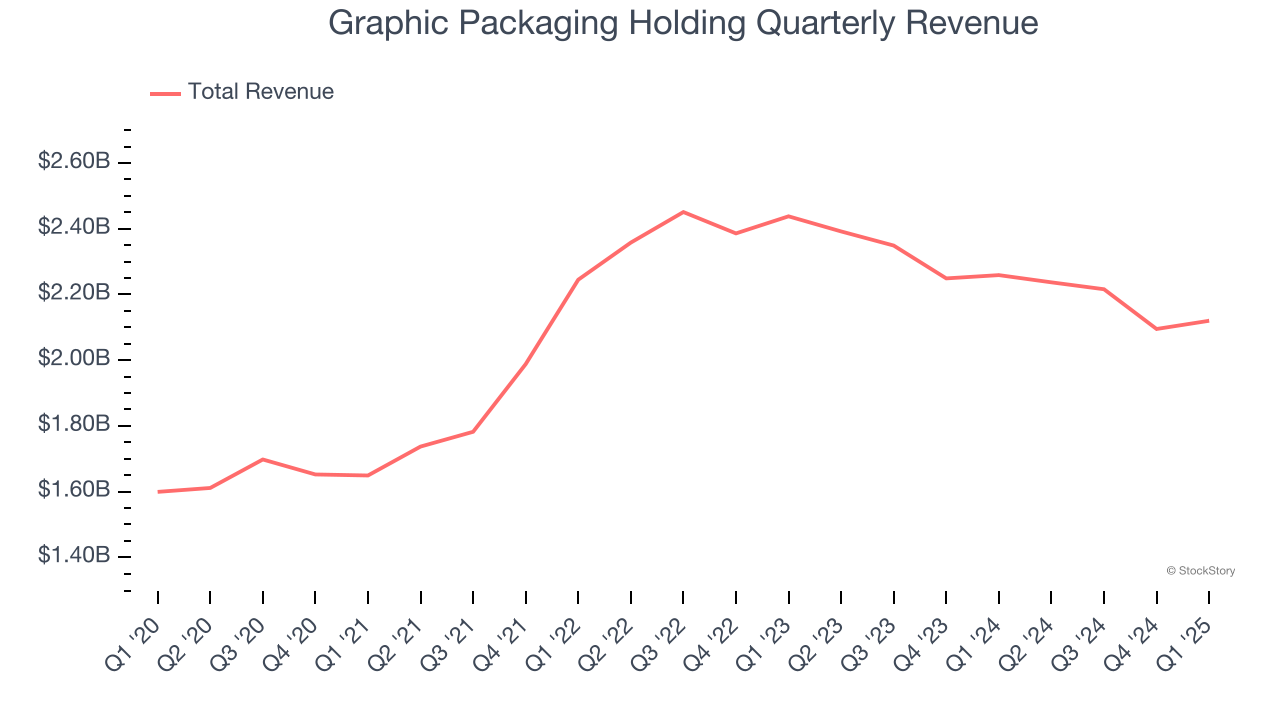

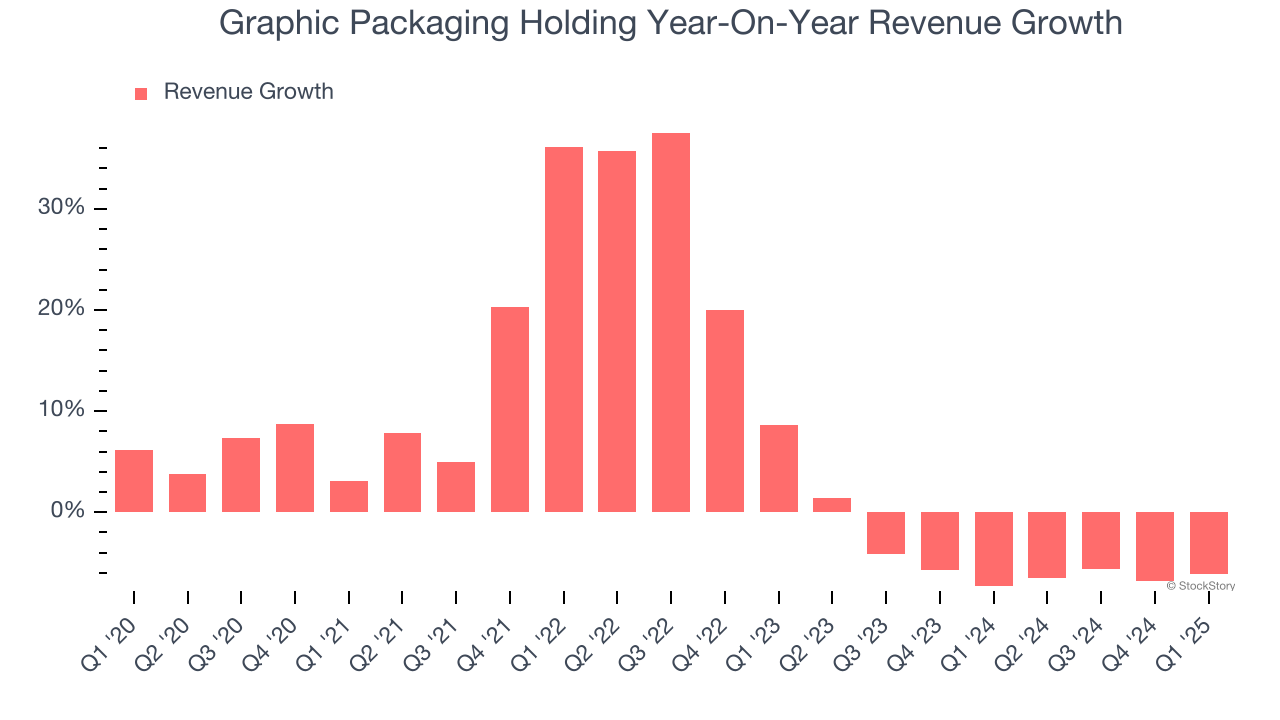

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Graphic Packaging Holding grew its sales at a mediocre 6.7% compounded annual growth rate. This was below our standard for the industrials sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Graphic Packaging Holding’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 5.1% annually. Graphic Packaging Holding isn’t alone in its struggles as the Industrial Packaging industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

This quarter, Graphic Packaging Holding reported a rather uninspiring 6.2% year-on-year revenue decline to $2.12 billion of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. While this projection suggests its newer products and services will catalyze better top-line performance, it is still below the sector average.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

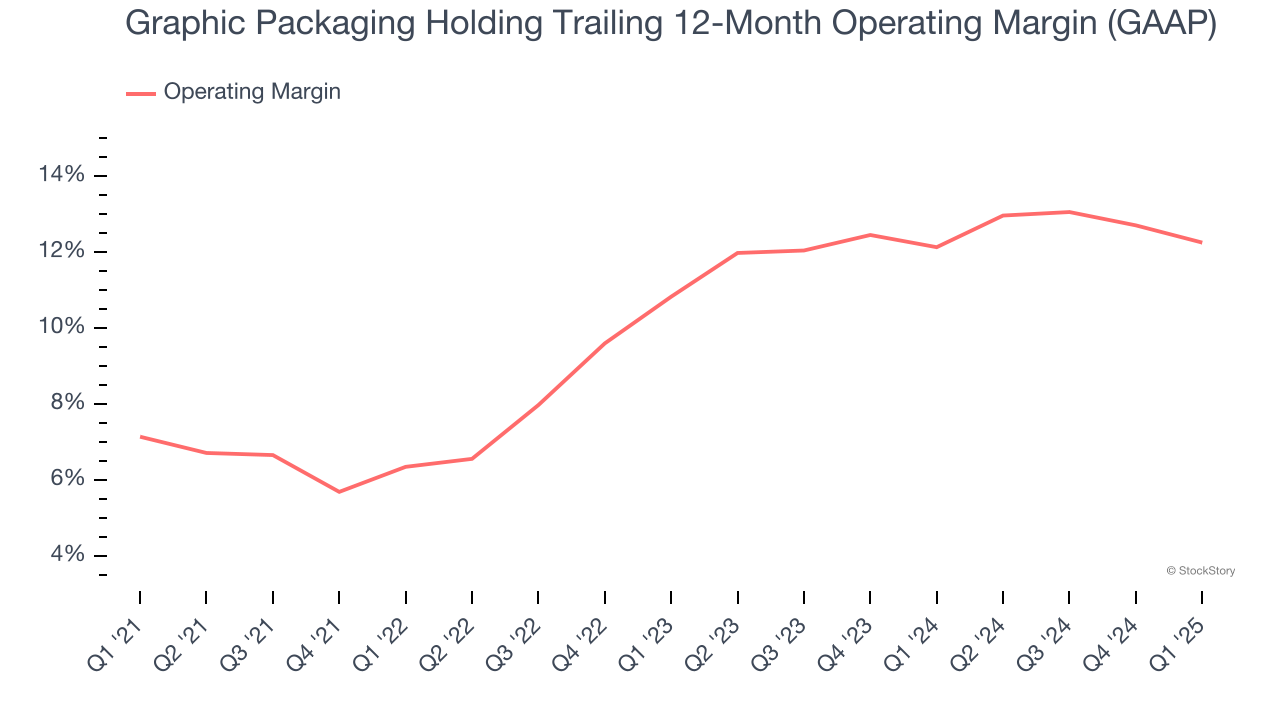

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Graphic Packaging Holding has managed its cost base well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 10%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, Graphic Packaging Holding’s operating margin rose by 5.1 percentage points over the last five years, as its sales growth gave it operating leverage. Its expansion was impressive, especially when considering the cycle turned in the wrong direction and most of its Industrial Packaging peers observed plummeting revenue and margins.

This quarter, Graphic Packaging Holding generated an operating profit margin of 10.4%, down 1.9 percentage points year on year. Since Graphic Packaging Holding’s gross margin decreased more than its operating margin, we can assume its recent inefficiencies were driven more by weaker leverage on its cost of sales rather than increased marketing, R&D, and administrative overhead expenses.

Earnings Per Share

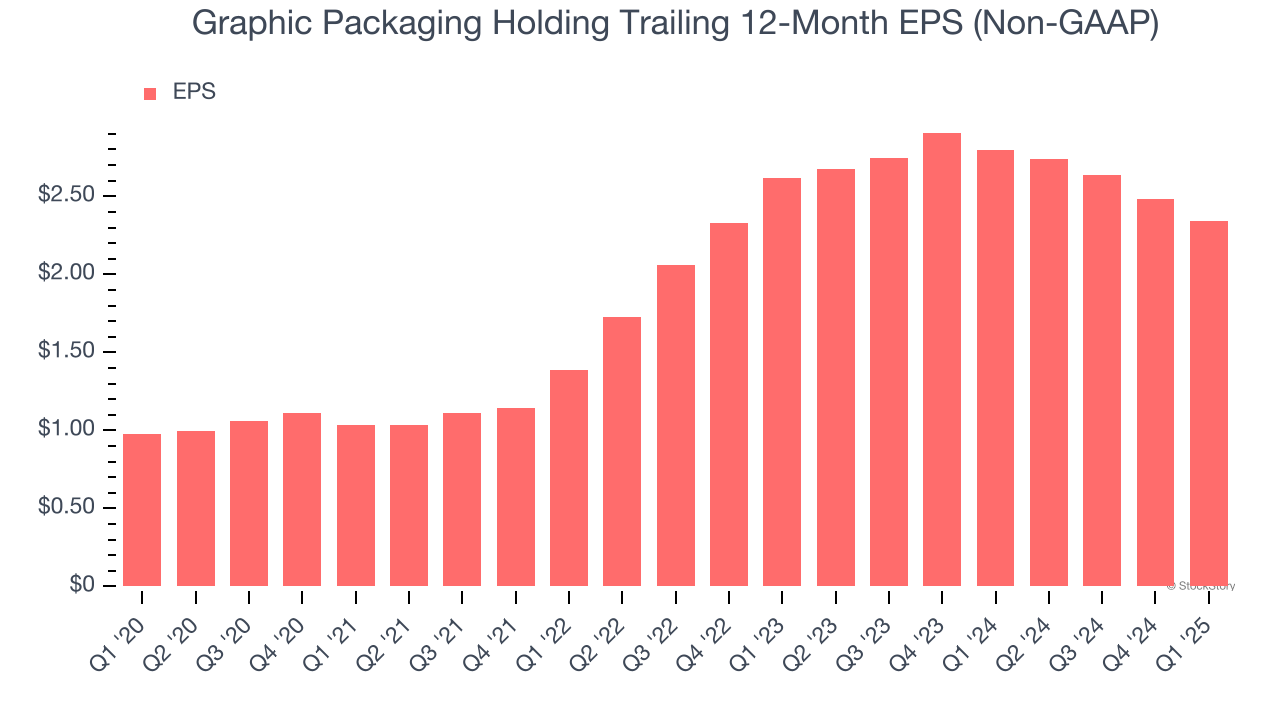

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Graphic Packaging Holding’s EPS grew at an astounding 19.1% compounded annual growth rate over the last five years, higher than its 6.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of Graphic Packaging Holding’s earnings can give us a better understanding of its performance. As we mentioned earlier, Graphic Packaging Holding’s operating margin declined this quarter but expanded by 5.1 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Graphic Packaging Holding, its two-year annual EPS declines of 5.4% mark a reversal from its (seemingly) healthy five-year trend. We hope Graphic Packaging Holding can return to earnings growth in the future.

In Q1, Graphic Packaging Holding reported EPS at $0.51, down from $0.66 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Graphic Packaging Holding’s full-year EPS of $2.34 to grow 5.5%.

Key Takeaways from Graphic Packaging Holding’s Q1 Results

We struggled to find many positives in these results. EPS in the quarter missed by a wide margin on in-line revenue. Its full-year revenue and EPS guidance were both lowered. Overall, this quarter could have been better. The stock traded down 5% to $24.02 immediately following the results.

Graphic Packaging Holding’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.