Healthcare distributor and services company Cardinal Health (NYSE: CAH) missed Wall Street’s revenue expectations in Q1 CY2025, with sales flat year on year at $54.88 billion. Its non-GAAP profit of $2.35 per share was 9.4% above analysts’ consensus estimates.

Is now the time to buy Cardinal Health? Find out by accessing our full research report, it’s free.

Cardinal Health (CAH) Q1 CY2025 Highlights:

- Revenue: $54.88 billion vs analyst estimates of $55.46 billion (flat year on year, 1% miss)

- Adjusted EPS: $2.35 vs analyst estimates of $2.15 (9.4% beat)

- Adjusted EBITDA: $957 million vs analyst estimates of $876.8 million (1.7% margin, 9.1% beat)

- Adjusted EPS guidance for the full year is $8.10 at the midpoint, beating analyst estimates by 1.7%

- Operating Margin: 1.3%, in line with the same quarter last year

- Free Cash Flow was $2.79 billion, up from -$161 million in the same quarter last year

- Market Capitalization: $34.13 billion

"Our strong momentum continued into our third quarter as our team's ongoing focus on operational execution and value creation led to excellent financial results," said Jason Hollar, CEO of Cardinal Health.

Company Overview

Operating as a critical link in the healthcare supply chain since 1979, Cardinal Health (NYSE: CAH) distributes pharmaceuticals and manufactures medical products for hospitals, pharmacies, and healthcare providers across the global healthcare supply chain.

Sales Growth

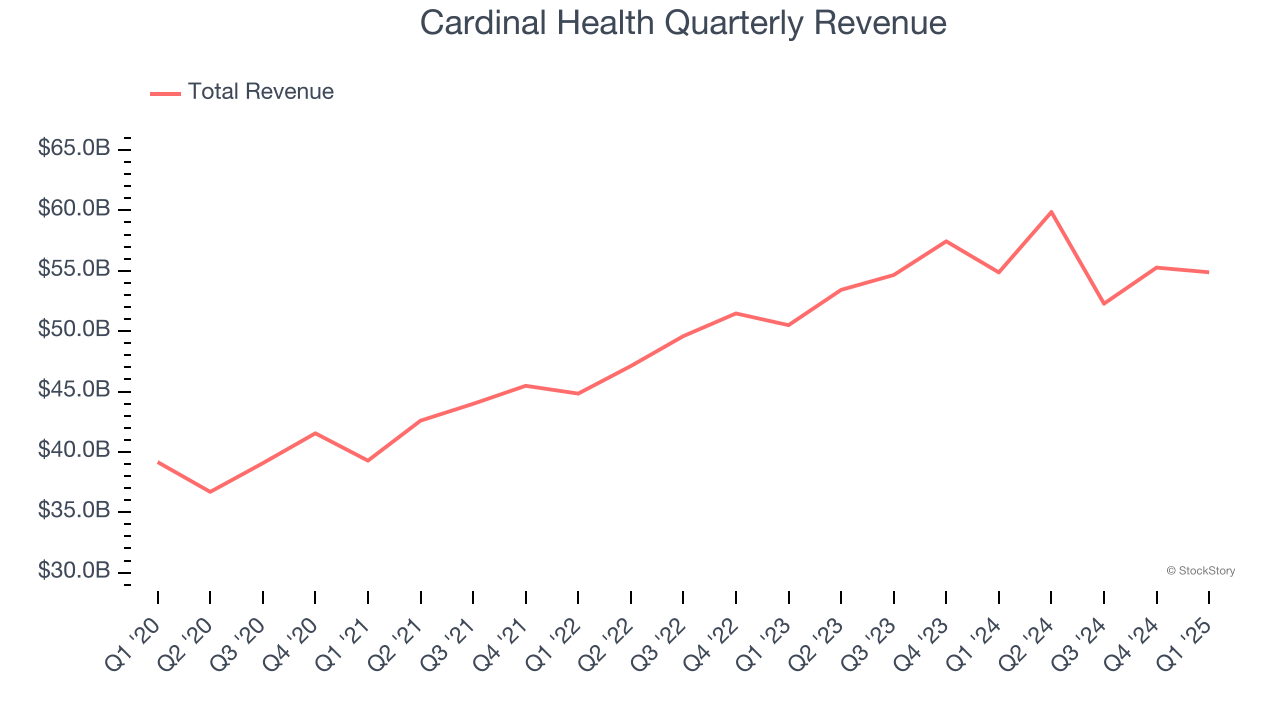

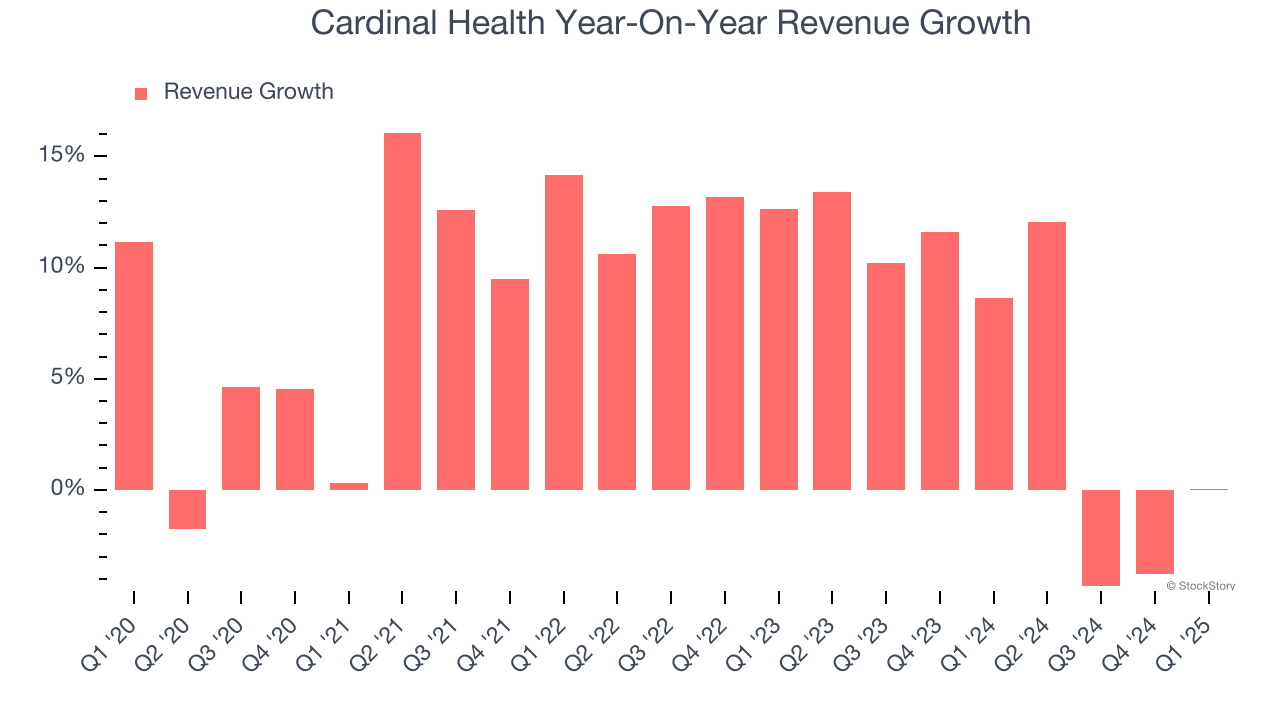

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, Cardinal Health’s 7.7% annualized revenue growth over the last five years was decent. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Cardinal Health’s recent performance shows its demand has slowed as its annualized revenue growth of 5.8% over the last two years was below its five-year trend.

This quarter, Cardinal Health’s $54.88 billion of revenue was flat year on year, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 8.3% over the next 12 months, an improvement versus the last two years. This projection is particularly noteworthy for a company of its scale and implies its newer products and services will fuel better top-line performance.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

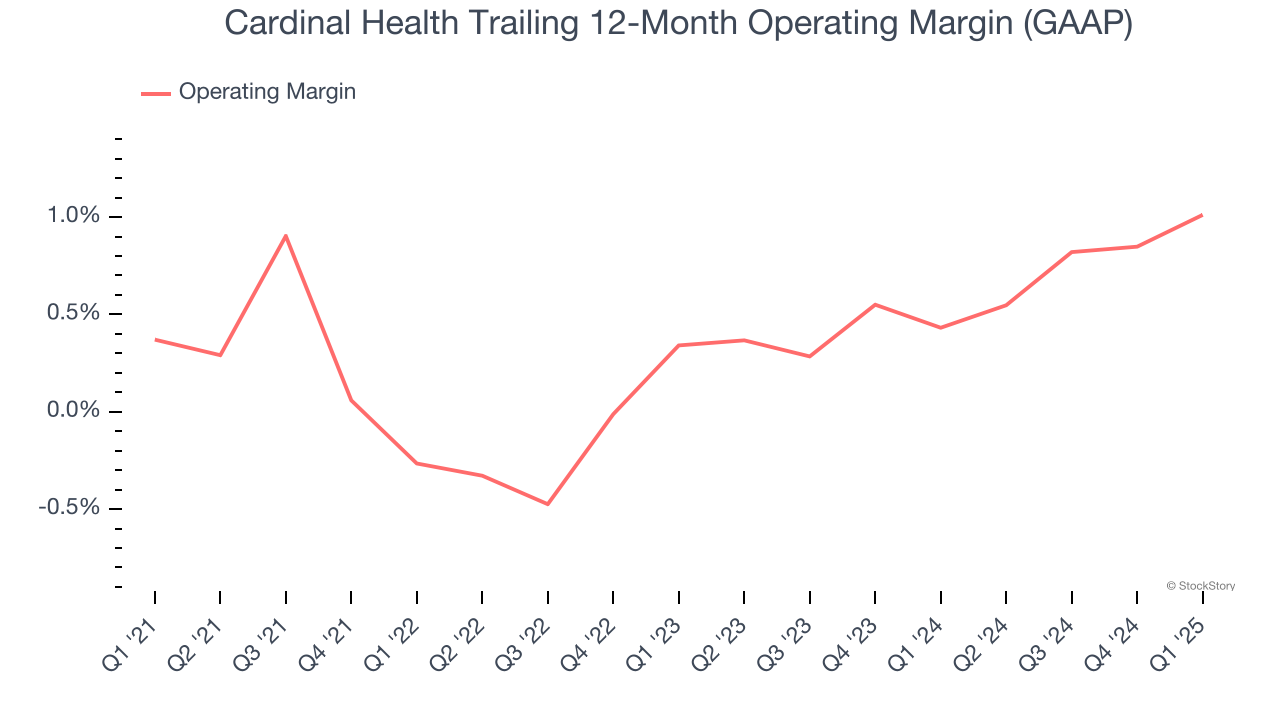

Cardinal Health was roughly breakeven when averaging the last five years of quarterly operating profits, lousy for a healthcare business.

Looking at the trend in its profitability, Cardinal Health’s operating margin might fluctuated slightly but has generally stayed the same over the last five years, meaning it will take a fundamental shift in the business model to change.

This quarter, Cardinal Health generated an operating profit margin of 1.3%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

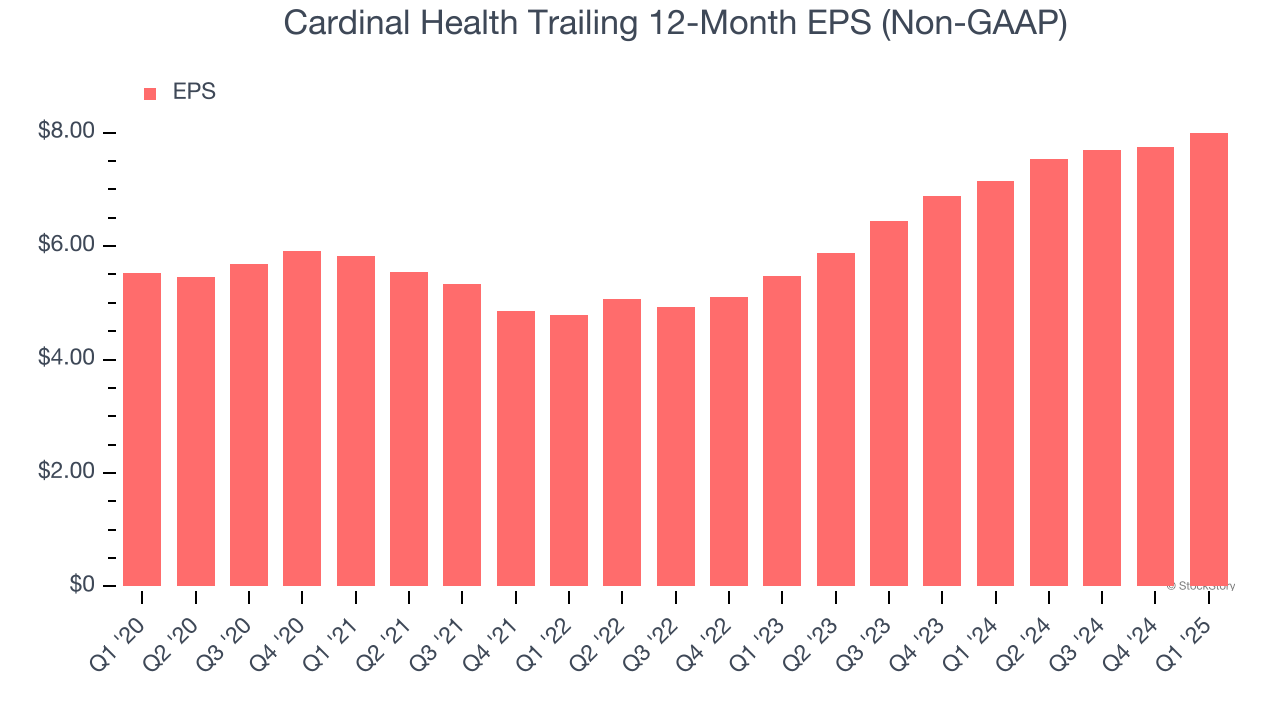

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Cardinal Health’s solid 7.7% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

In Q1, Cardinal Health reported EPS at $2.35, up from $2.09 in the same quarter last year. This print beat analysts’ estimates by 9.4%. Over the next 12 months, Wall Street expects Cardinal Health’s full-year EPS of $8 to grow 9.3%.

Key Takeaways from Cardinal Health’s Q1 Results

It was encouraging to see Cardinal Health beat analysts’ EPS expectations this quarter. We were also happy its full-year EPS guidance outperformed Wall Street’s estimates. On the other hand, its revenue slightly missed. Zooming out, we think this was a mixed quarter. The stock remained flat at $141.29 immediately after reporting.

So do we think Cardinal Health is an attractive buy at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.