Taylor Morrison Home has followed the market’s trajectory closely. The stock is down 12.8% to $58.82 per share over the past six months while the S&P 500 has lost 14.3%. This may have investors wondering how to approach the situation.

Is now the time to buy Taylor Morrison Home, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Despite the more favorable entry price, we're sitting this one out for now. Here are three reasons why we avoid TMHC and a stock we'd rather own.

Why Is Taylor Morrison Home Not Exciting?

Named “America’s Most Trusted Home Builder” in 2019, Taylor Morrison Home (NYSE: TMHC) builds single family homes and communities across the United States.

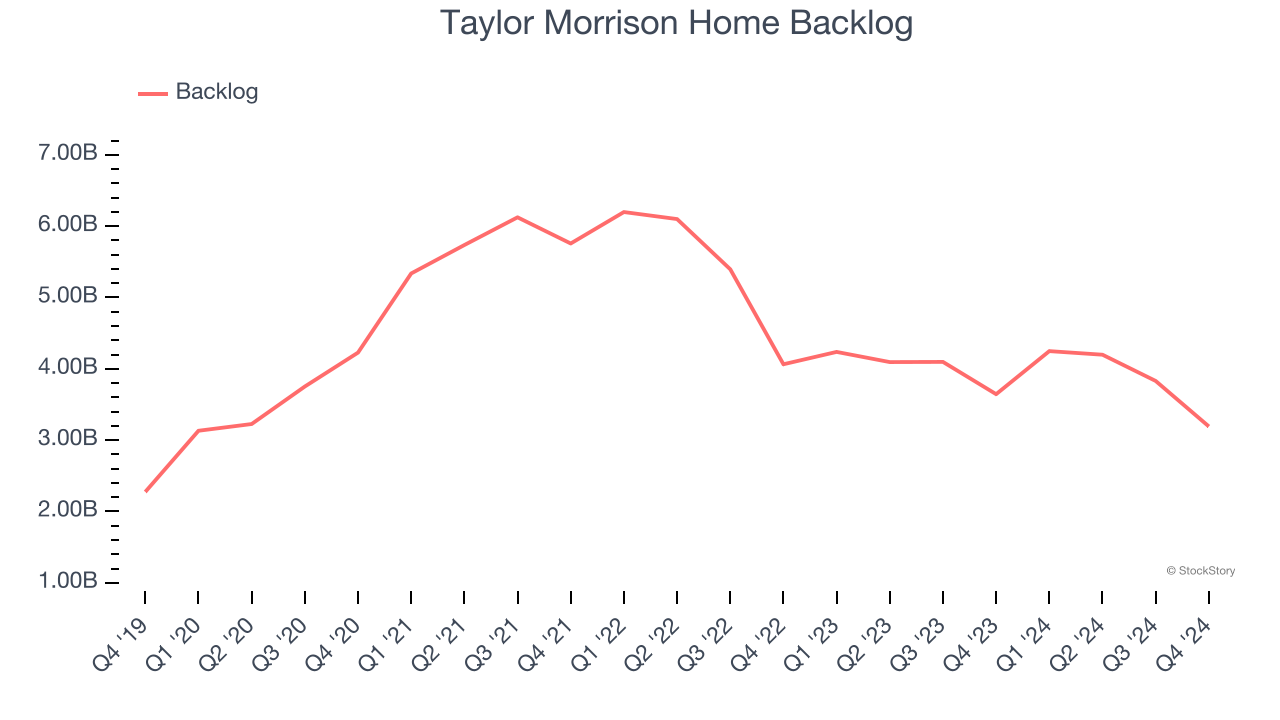

1. Backlog Declines as Orders Drop

Investors interested in Home Builders companies should track backlog in addition to reported revenue. This metric shows the value of outstanding orders that have not yet been executed or delivered, giving visibility into Taylor Morrison Home’s future revenue streams.

Taylor Morrison Home’s backlog came in at $3.19 billion in the latest quarter, and it averaged 14.4% year-on-year declines over the last two years. This performance was underwhelming and shows the company is not winning new orders. It also suggests there may be increasing competition or market saturation.

2. EPS Took a Dip Over the Last Two Years

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for Taylor Morrison Home, its EPS declined by 3.4% annually over the last two years while its revenue was flat. This tells us the company struggled to adjust to choppy demand.

3. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Taylor Morrison Home’s margin dropped by 15.6 percentage points over the last five years. If its declines continue, it could signal increasing investment needs and capital intensity. Taylor Morrison Home’s free cash flow margin for the trailing 12 months was 2.1%.

Final Judgment

Taylor Morrison Home’s business quality ultimately falls short of our standards. After the recent drawdown, the stock trades at 6.7× forward price-to-earnings (or $58.82 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're pretty confident there are more exciting stocks to buy at the moment. We’d recommend looking at a safe-and-steady industrials business benefiting from an upgrade cycle.

Stocks We Would Buy Instead of Taylor Morrison Home

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.