Environmental solutions provider CECO Environmental (NASDAQ: CECO) reported Q1 CY2025 results beating Wall Street’s revenue expectations, with sales up 39.9% year on year to $176.7 million. The company’s full-year revenue guidance of $725 million at the midpoint came in 3.5% above analysts’ estimates. Its non-GAAP profit of $0.10 per share was 17.6% above analysts’ consensus estimates.

Is now the time to buy CECO Environmental? Find out by accessing our full research report, it’s free.

CECO Environmental (CECO) Q1 CY2025 Highlights:

- Revenue: $176.7 million vs analyst estimates of $151.1 million (39.9% year-on-year growth, 17% beat)

- Adjusted EPS: $0.10 vs analyst estimates of $0.09 (17.6% beat)

- Adjusted EBITDA: $14 million vs analyst estimates of $13.35 million (7.9% margin, 4.9% beat)

- The company reconfirmed its revenue guidance for the full year of $725 million at the midpoint

- EBITDA guidance for the full year is $95 million at the midpoint, above analyst estimates of $91.51 million

- Operating Margin: 35%, up from 6.1% in the same quarter last year

- Free Cash Flow was -$15.1 million compared to -$1.9 million in the same quarter last year

- Market Capitalization: $676.2 million

Todd Gleason, CECO's Chief Executive Officer commented, “We started 2025 with outstanding first quarter record orders of $228 million, which helped drive new record levels of backlog and revenue for the company. This is a powerful statement on the strength of our well-positioned portfolio, which is closely aligned to key long-term growth themes of industrial manufacturing reshoring, electrification, power generation, natural gas infrastructure, and industrial water investments. This marks the second consecutive quarter with bookings greater than $200 million, which has enabled our backlog to exceed $600 million for the first time in Company history. With our order pursuit pipeline now over $5 billion, we remain highly confident in our continued growth outlook.”

Company Overview

With roots dating back to 1869 and a focus on creating cleaner industrial operations, CECO Environmental (NASDAQ: CECO) provides technology and expertise that helps industrial companies reduce emissions, treat water, and improve energy efficiency across various sectors.

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $608.3 million in revenue over the past 12 months, CECO Environmental is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

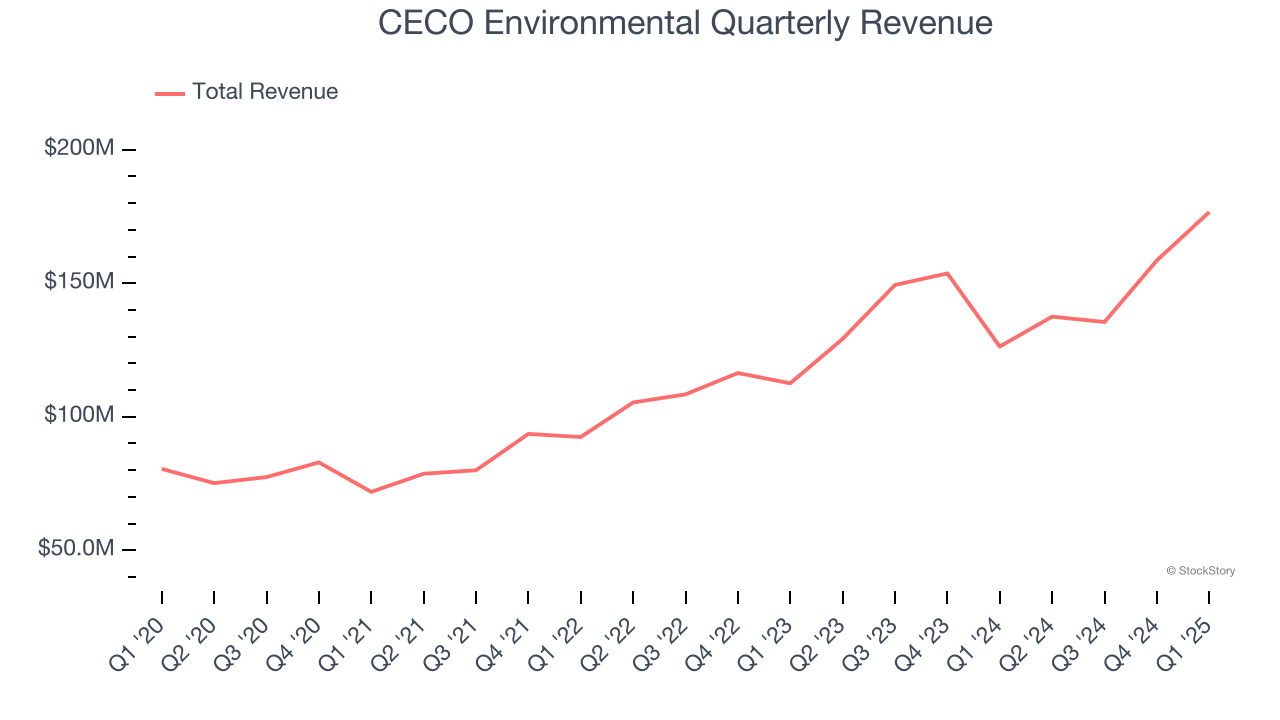

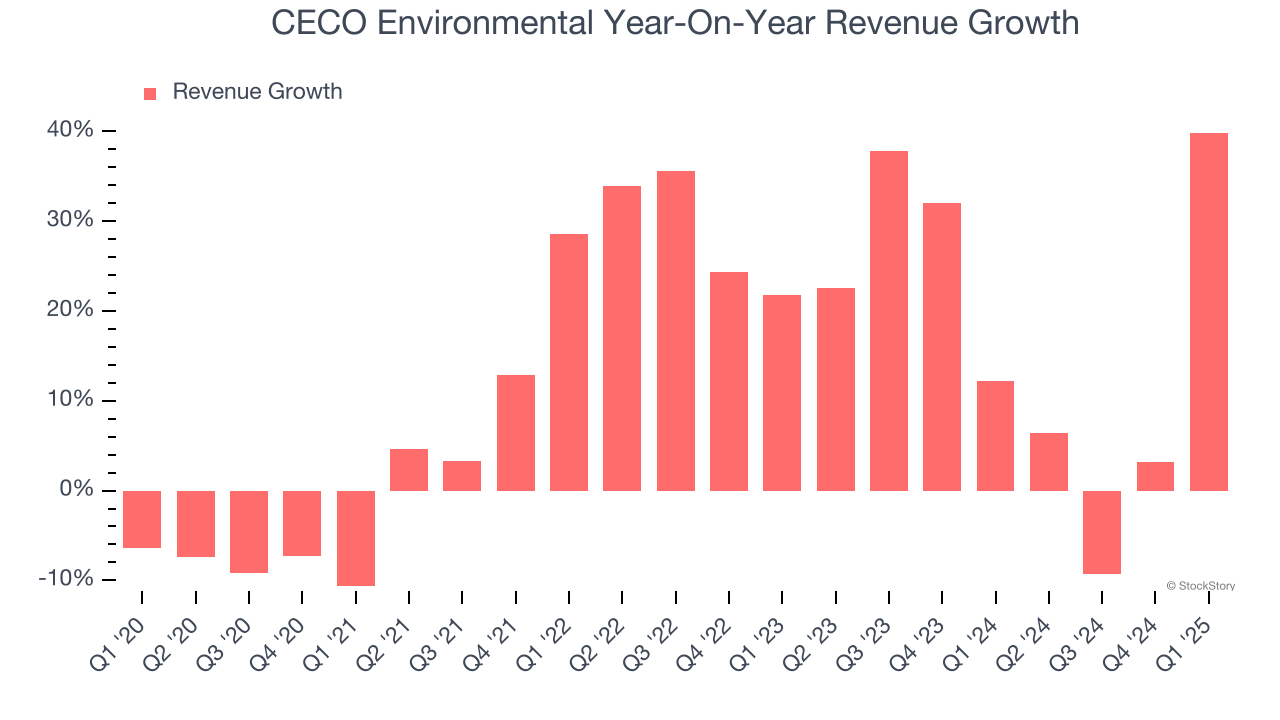

As you can see below, CECO Environmental grew its sales at an excellent 12.6% compounded annual growth rate over the last five years. This is an encouraging starting point for our analysis because it shows CECO Environmental’s demand was higher than many business services companies.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. CECO Environmental’s annualized revenue growth of 17.2% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, CECO Environmental reported wonderful year-on-year revenue growth of 39.9%, and its $176.7 million of revenue exceeded Wall Street’s estimates by 17%.

Looking ahead, sell-side analysts expect revenue to grow 18.2% over the next 12 months, similar to its two-year rate. This projection is eye-popping and indicates the market sees success for its products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

CECO Environmental was profitable over the last five years but held back by its large cost base. Its average operating margin of 7.6% was weak for a business services business.

On the plus side, CECO Environmental’s operating margin rose by 10.8 percentage points over the last five years, as its sales growth gave it immense operating leverage.

In Q1, CECO Environmental generated an operating profit margin of 35%, up 28.9 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

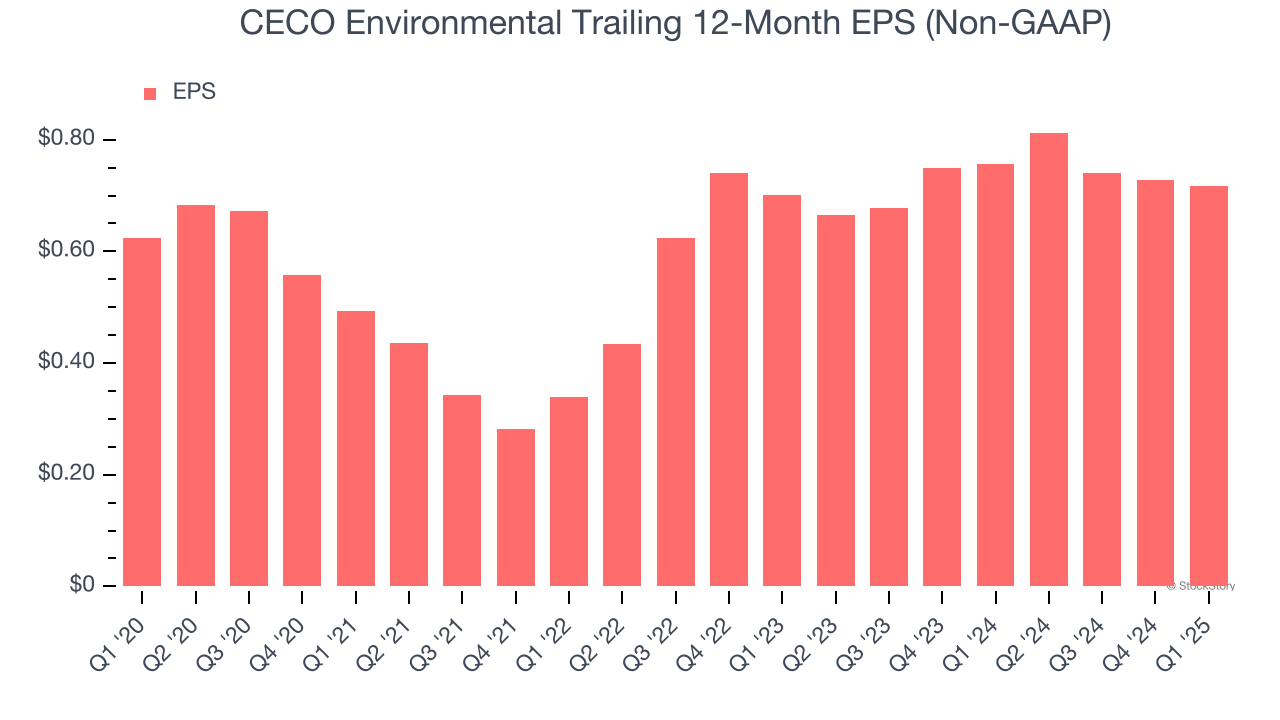

CECO Environmental’s EPS grew at a weak 2.8% compounded annual growth rate over the last five years, lower than its 12.6% annualized revenue growth. However, its operating margin actually expanded during this time, telling us that non-fundamental factors such as interest expenses and taxes affected its ultimate earnings.

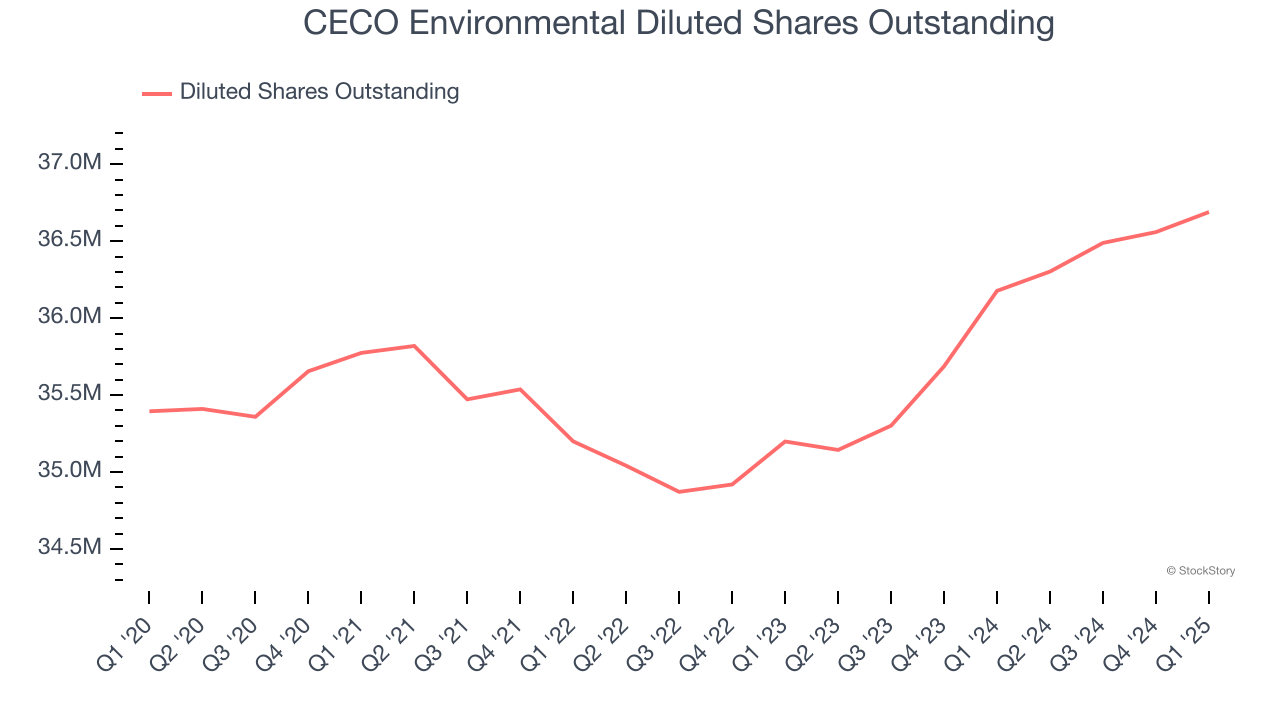

Diving into the nuances of CECO Environmental’s earnings can give us a better understanding of its performance. A five-year view shows CECO Environmental has diluted its shareholders, growing its share count by 3.7%. This dilution overshadowed its increased operating efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q1, CECO Environmental reported EPS at $0.10, down from $0.11 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects CECO Environmental’s full-year EPS of $0.72 to grow 79.6%.

Key Takeaways from CECO Environmental’s Q1 Results

We were impressed by how significantly CECO Environmental blew past analysts’ EPS expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid quarter. The stock traded up 3.1% to $19.79 immediately after reporting.

Sure, CECO Environmental had a solid quarter, but if we look at the bigger picture, is this stock a buy? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.