Wellness company Medifast (NYSE: MED) missed Wall Street’s revenue expectations in Q1 CY2025, with sales falling 33.8% year on year to $115.7 million. Next quarter’s revenue guidance of $95 million underwhelmed, coming in 15.4% below analysts’ estimates. Its GAAP loss of $0.07 per share was 72% above analysts’ consensus estimates.

Is now the time to buy Medifast? Find out by accessing our full research report, it’s free.

Medifast (MED) Q1 CY2025 Highlights:

- Revenue: $115.7 million vs analyst estimates of $116.4 million (33.8% year-on-year decline, 0.6% miss)

- EPS (GAAP): -$0.07 vs analyst estimates of -$0.25 (72% beat)

- Revenue Guidance for Q2 CY2025 is $95 million at the midpoint, below analyst estimates of $112.3 million

- EPS (GAAP) guidance for Q2 CY2025 is -$0.28 at the midpoint, missing analyst estimates by 293%

- Operating Margin: -1.1%, down from 5.3% in the same quarter last year

- Market Capitalization: $131.5 million

"In today's health and wellness landscape, more people than ever are seeking guidance not just for weight loss but for learning how to lead a healthier lifestyle," said Dan Chard, CEO of Medifast.

Company Overview

Known for its Optavia program that combines portion-controlled meal replacements with coaching, Medifast (NYSE: MED) has a broad product portfolio of bars, snacks, drinks, and desserts for those looking to lose weight or consume healthier foods.

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $543.5 million in revenue over the past 12 months, Medifast is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

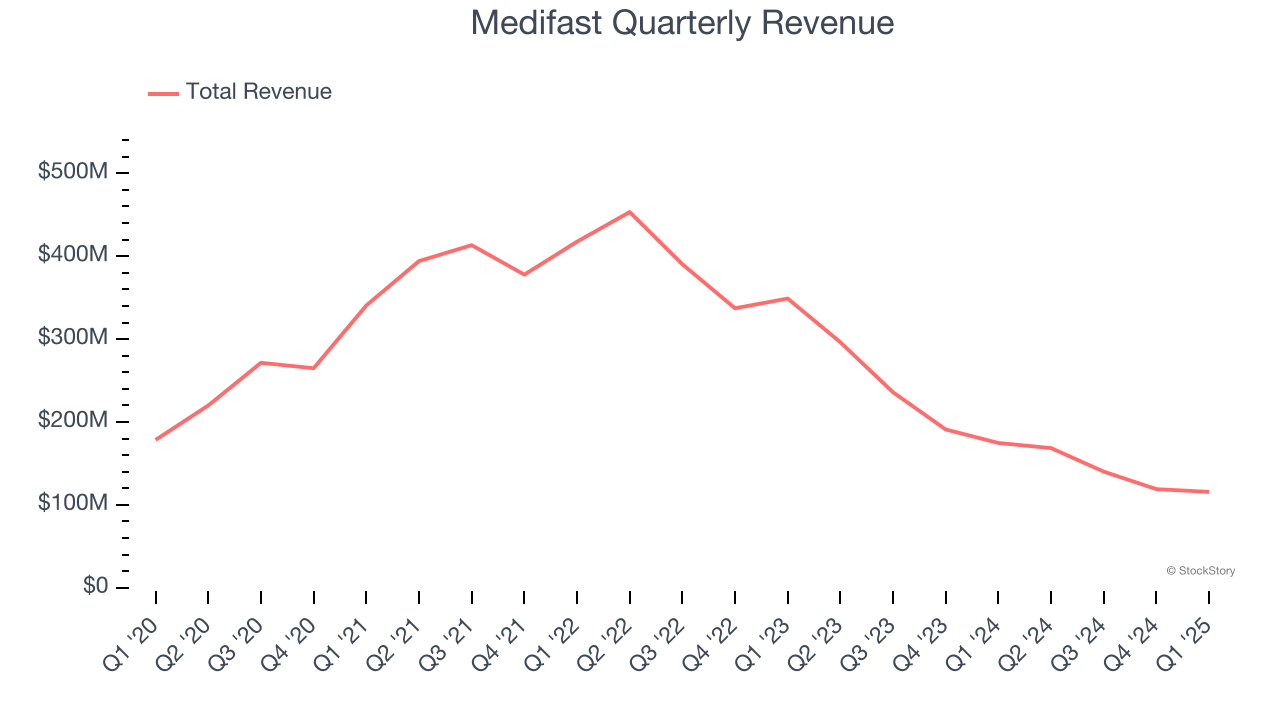

As you can see below, Medifast’s demand was weak over the last three years. Its sales fell by 30.3% annually, a tough starting point for our analysis.

This quarter, Medifast missed Wall Street’s estimates and reported a rather uninspiring 33.8% year-on-year revenue decline, generating $115.7 million of revenue. Company management is currently guiding for a 43.6% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 27.8% over the next 12 months. While this projection is better than its three-year trend, it's tough to feel optimistic about a company facing demand difficulties.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

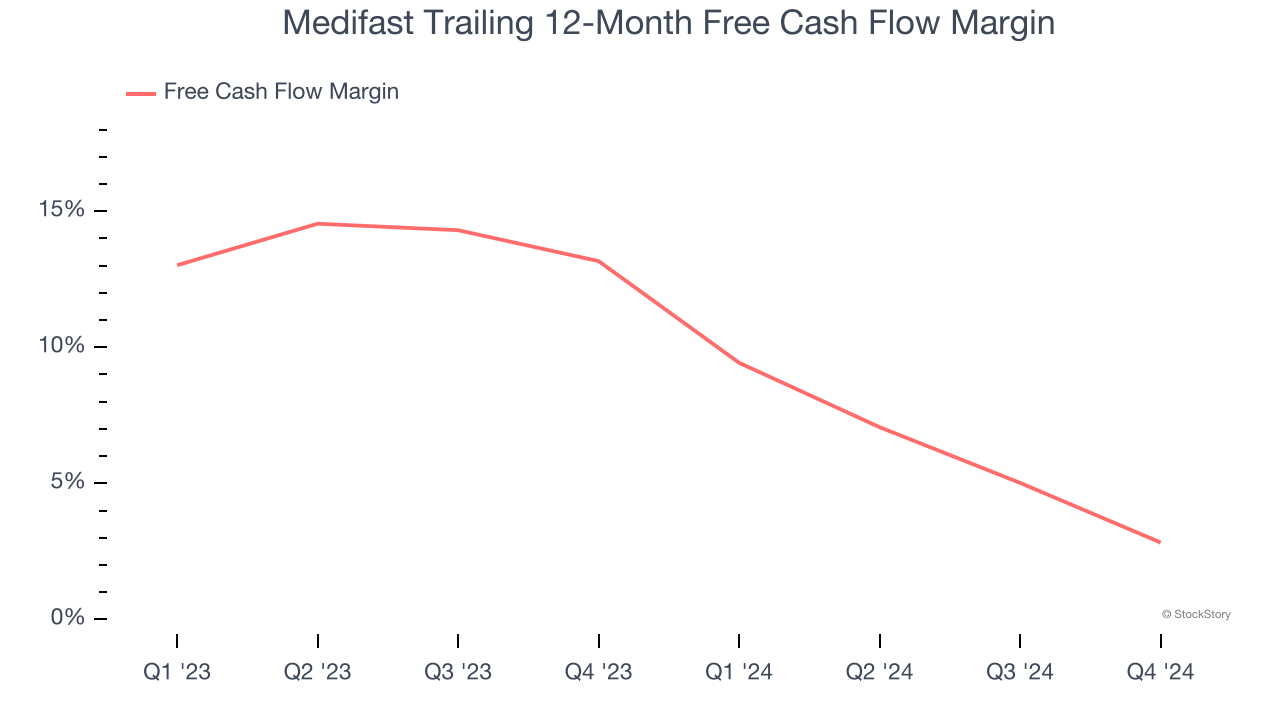

Medifast has shown impressive cash profitability, driven by its attractive business model that gives it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 7.3% over the last two years, better than the broader consumer staples sector. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Key Takeaways from Medifast’s Q1 Results

We were impressed by how significantly Medifast blew past analysts’ EPS expectations this quarter. On the other hand, its revenue missed and its guidance for next quarter fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 4.6% to $12 immediately following the results.

Medifast underperformed this quarter, but does that create an opportunity to invest right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.