Rail equipment company Westinghouse Air Brake Technologies (NYSE: WAB) fell short of the market’s revenue expectations in Q1 CY2025 as sales rose 4.5% year on year to $2.61 billion. The company’s full-year revenue guidance of $10.88 billion at the midpoint came in 0.8% below analysts’ estimates. Its non-GAAP profit of $2.28 per share was 12.5% above analysts’ consensus estimates.

Is now the time to buy Wabtec? Find out by accessing our full research report, it’s free.

Wabtec (WAB) Q1 CY2025 Highlights:

- Revenue: $2.61 billion vs analyst estimates of $2.63 billion (4.5% year-on-year growth, 0.8% miss)

- Adjusted EPS: $2.28 vs analyst estimates of $2.03 (12.5% beat)

- Adjusted EBITDA: $608 million vs analyst estimates of $561 million (23.3% margin, 8.4% beat)

- The company reconfirmed its revenue guidance for the full year of $10.88 billion at the midpoint

- Management raised its full-year Adjusted EPS guidance to $8.65 at the midpoint, a 1.2% increase

- Operating Margin: 18.2%, up from 16.5% in the same quarter last year

- Free Cash Flow Margin: 7.3%, down from 12.1% in the same quarter last year

- Backlog: $22.3 billion at quarter end

- Organic Revenue rose 4.5% year on year (11.9% in the same quarter last year)

- Market Capitalization: $29.36 billion

“The Wabtec team has started the year strong, delivering over 20% in earnings per share growth and highlighting the continued business momentum across both the Freight and Transit segments,” said Rafael Santana, Wabtec’s President and CEO.

Company Overview

Also known as Wabtec, Westinghouse Air Brake Technologies (NYSE: WAB) provides equipment, systems, and related software for the railway industry.

Heavy Transportation Equipment

Heavy transportation equipment companies are investing in automated vehicles that increase efficiencies and connected machinery that collects actionable data. Some are also developing electric vehicles and mobility solutions to address customers’ concerns about carbon emissions, creating new sales opportunities. Additionally, they are increasingly offering automated equipment that increases efficiencies and connected machinery that collects actionable data. On the other hand, heavy transportation equipment companies are at the whim of economic cycles. Interest rates, for example, can greatly impact the construction and transport volumes that drive demand for these companies’ offerings.

Sales Growth

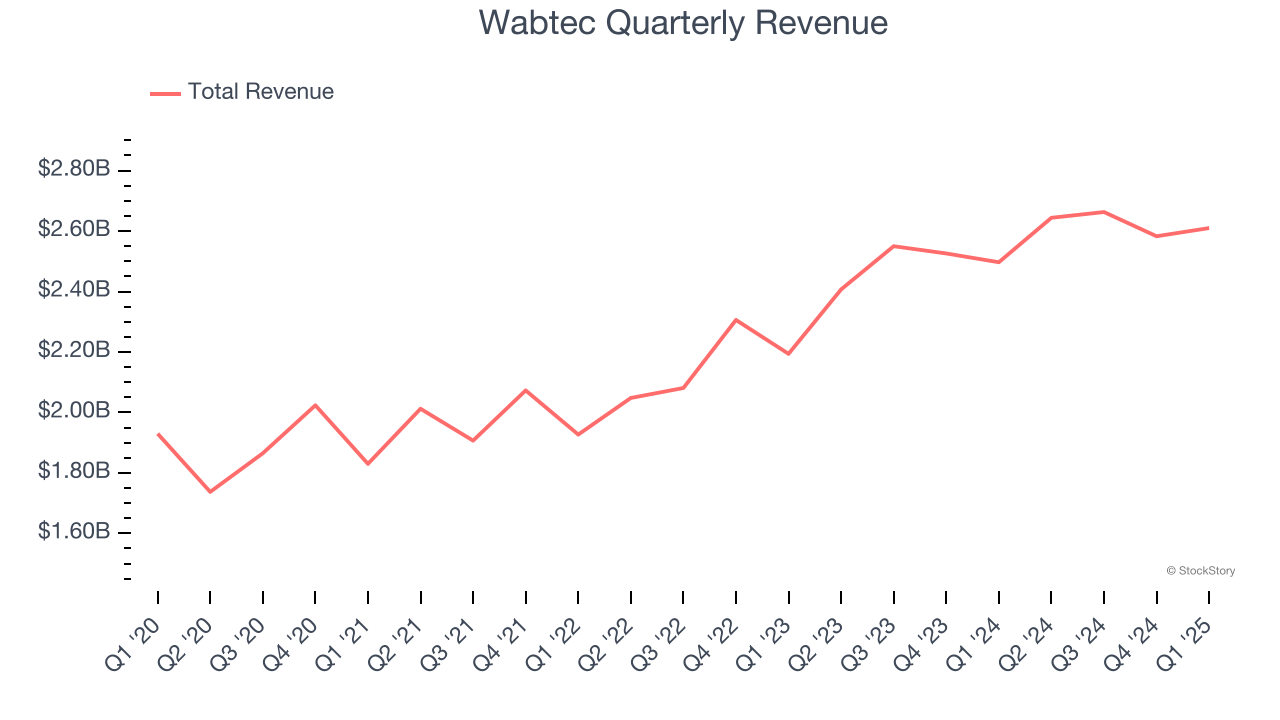

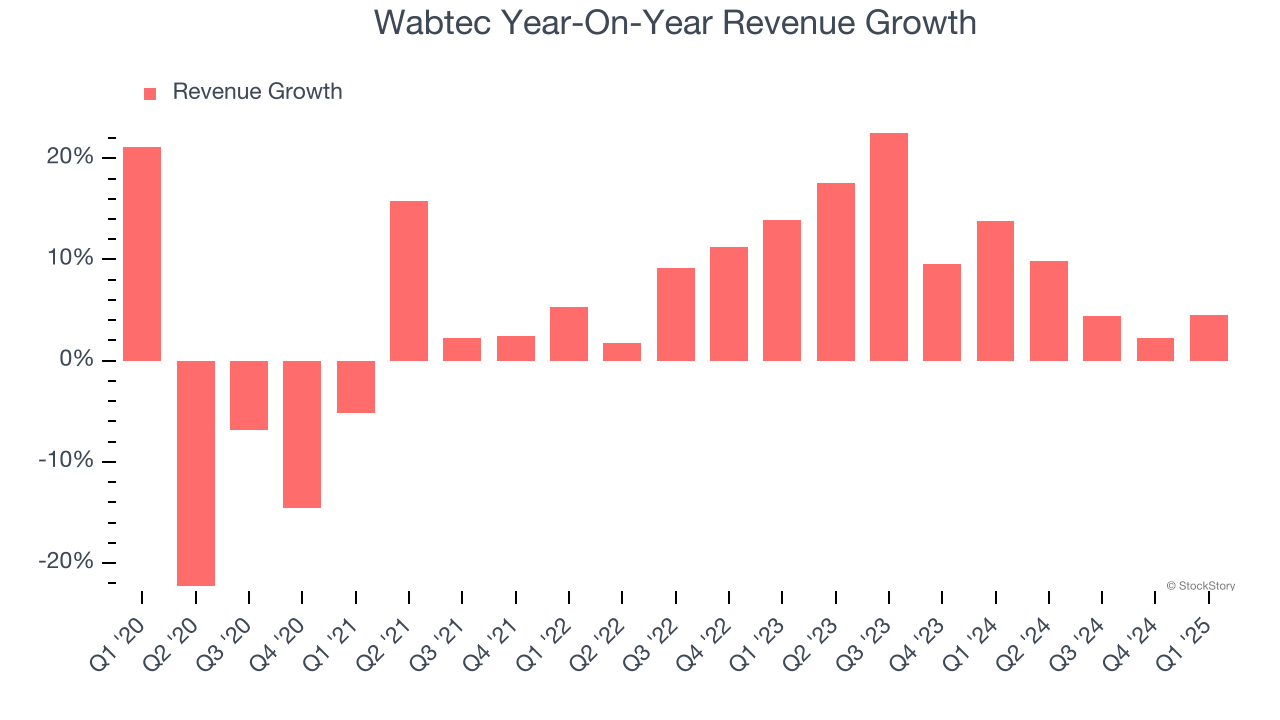

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, Wabtec’s sales grew at a sluggish 4.2% compounded annual growth rate over the last five years. This wasn’t a great result compared to the rest of the industrials sector, but there are still things to like about Wabtec.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Wabtec’s annualized revenue growth of 10.3% over the last two years is above its five-year trend, suggesting its demand recently accelerated. Wabtec’s recent performance shows it’s one of the better Heavy Transportation Equipment businesses as many of its peers faced declining sales because of cyclical headwinds.

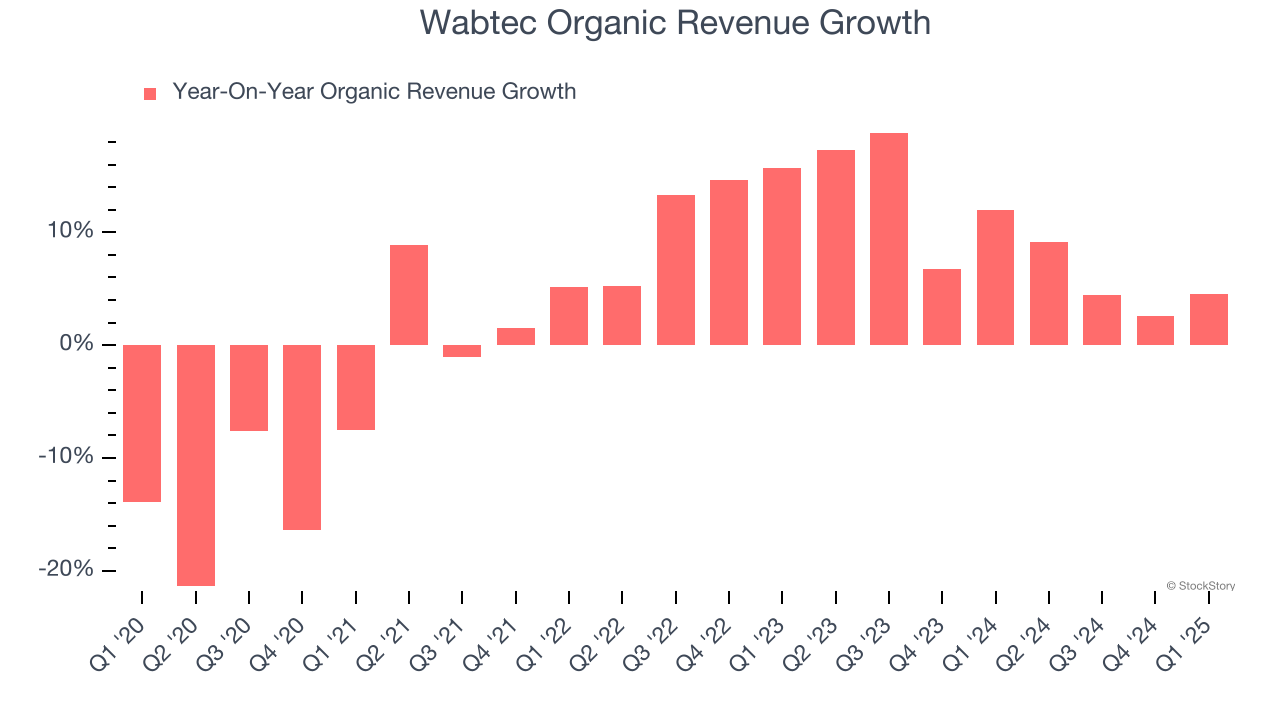

We can better understand the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Wabtec’s organic revenue averaged 9.4% year-on-year growth. Because this number aligns with its normal revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, Wabtec’s revenue grew by 4.5% year on year to $2.61 billion, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 6.1% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and implies its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Wabtec has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 13%.

Looking at the trend in its profitability, Wabtec’s operating margin rose by 6.3 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Wabtec generated an operating profit margin of 18.2%, up 1.7 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

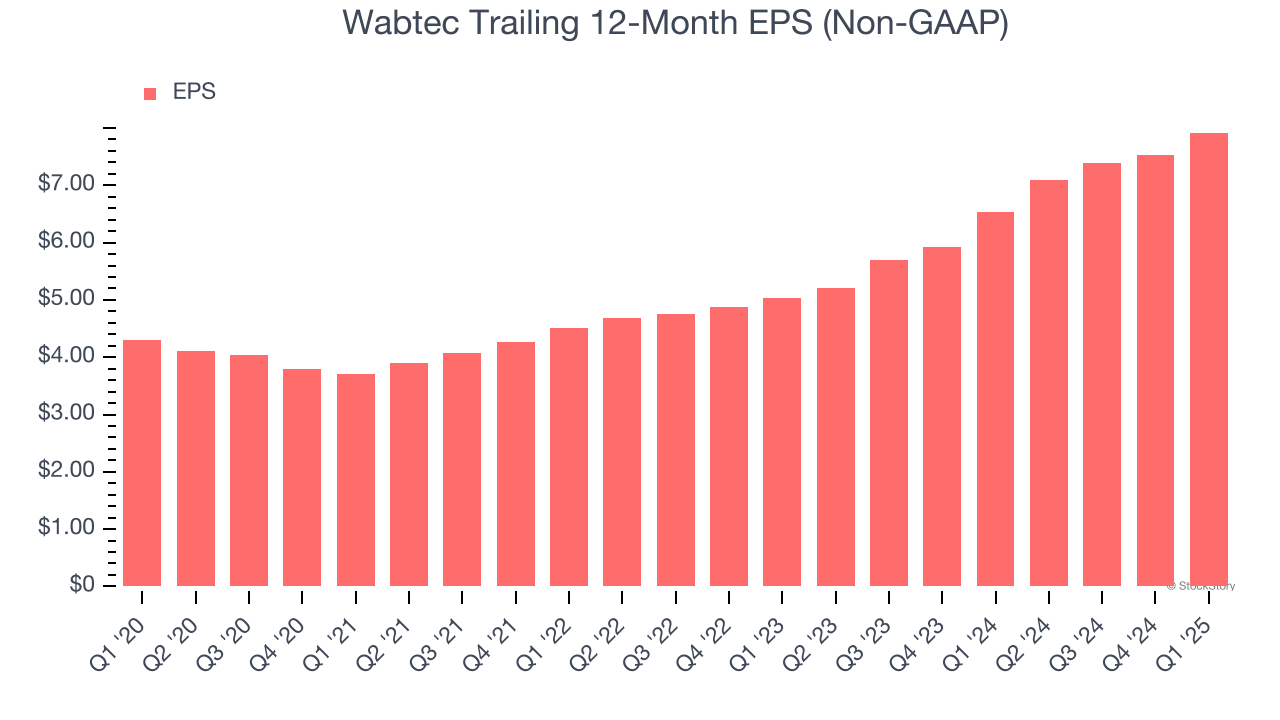

Wabtec’s EPS grew at a remarkable 13% compounded annual growth rate over the last five years, higher than its 4.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

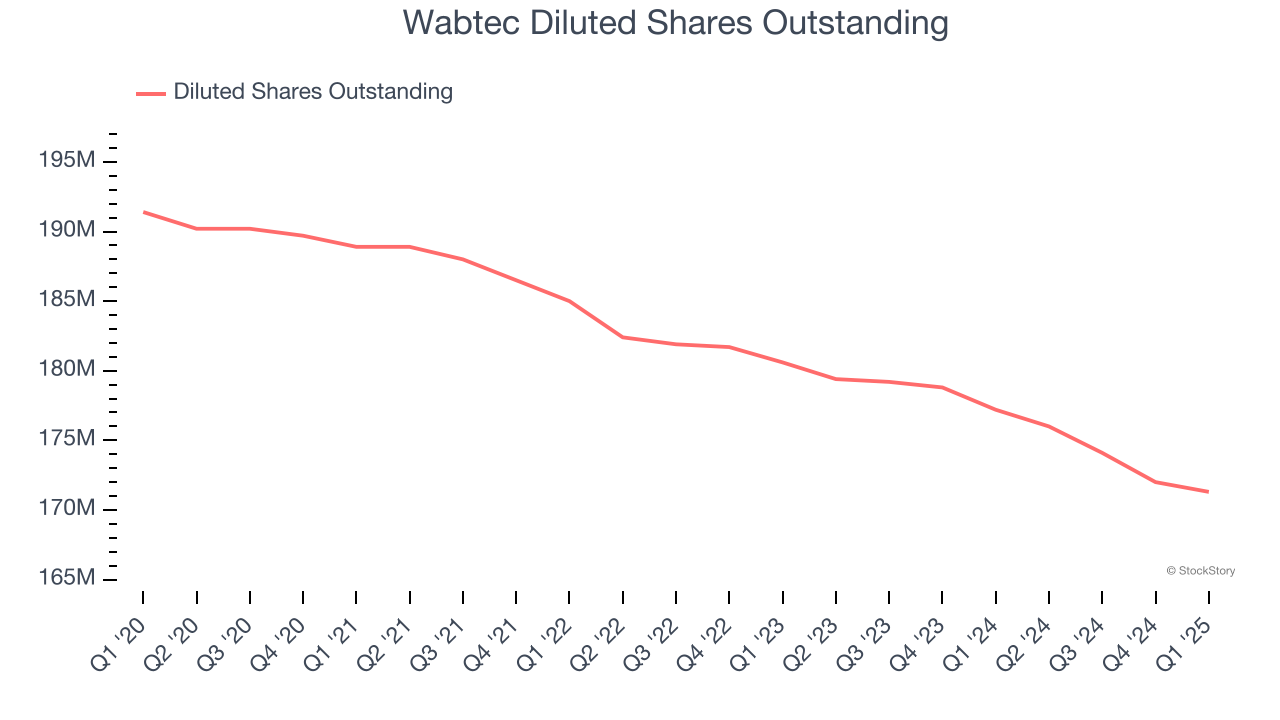

Diving into Wabtec’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, Wabtec’s operating margin expanded by 6.3 percentage points over the last five years. On top of that, its share count shrank by 10.5%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Wabtec, its two-year annual EPS growth of 25.5% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q1, Wabtec reported EPS at $2.28, up from $1.89 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Wabtec’s full-year EPS of $7.92 to grow 9.9%.

Key Takeaways from Wabtec’s Q1 Results

While Wabtec's organic revenue missed and its revenue fell slightly short of Wall Street’s estimates, EPS beat handily on better profitability. Looking ahead, management reaffirmed previously-provided full-year revenue guidance and raised full-year EPS guidance, which is a positive. Management highlighted the strength of its international business and added that the company is “...approaching the remainder of the year with caution but with the discipline and focus to take the necessary actions to deliver against our commitments in an uncertain and volatile economic landscape.” Overall, this quarter was mixed. The stock remained flat at $172.20 immediately following the results.

Is Wabtec an attractive investment opportunity at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.