Medical device company Boston Scientific (NYSE: BSX) reported revenue ahead of Wall Street’s expectations in Q1 CY2025, with sales up 20.9% year on year to $4.66 billion. Guidance for next quarter’s revenue was better than expected at $4.88 billion at the midpoint, 2% above analysts’ estimates. Its non-GAAP profit of $0.75 per share was 11.5% above analysts’ consensus estimates.

Is now the time to buy Boston Scientific? Find out by accessing our full research report, it’s free.

Boston Scientific (BSX) Q1 CY2025 Highlights:

- Revenue: $4.66 billion vs analyst estimates of $4.57 billion (20.9% year-on-year growth, 2% beat)

- Adjusted EPS: $0.75 vs analyst estimates of $0.67 (11.5% beat)

- Revenue Guidance for Q2 CY2025 is $4.88 billion at the midpoint, above analyst estimates of $4.79 billion

- Management raised its full-year Adjusted EPS guidance to $2.91 at the midpoint, a 2.5% increase

- Operating Margin: 19.8%, up from 17.5% in the same quarter last year

- Organic Revenue rose 18.2% year on year (13.1% in the same quarter last year)

- Market Capitalization: $140.6 billion

"We delivered an exceptional quarter to start the year, reflecting the effectiveness of our highly engaged global team and the strength of our product portfolio," said Mike Mahoney, chairman and chief executive officer, Boston Scientific.

Company Overview

Founded in 1979 with a mission to advance less-invasive medicine, Boston Scientific (NYSE: BSX) develops and manufactures medical devices used in minimally invasive procedures across cardiovascular, urological, neurological, and gastrointestinal specialties.

Medical Devices & Supplies - Diversified

The medical devices industry operates a business model that balances steady demand with significant investments in innovation and regulatory compliance. The industry benefits from recurring revenue streams tied to consumables, maintenance services, and incremental upgrades to the latest technologies. However, the capital-intensive nature of product development, coupled with lengthy regulatory pathways and the need for clinical validation, can weigh on profitability and timelines. In addition, there are constant pricing pressures from healthcare systems and insurers maximizing cost efficiency. Over the next several years, one tailwind is demographic–aging populations means rising chronic disease rates that drive greater demand for medical interventions and monitoring solutions. Advances in digital health, such as remote patient monitoring and smart devices, are also expected to unlock new demand by shortening upgrade cycles. On the other hand, the industry faces headwinds from pricing and reimbursement pressures as healthcare providers increasingly adopt value-based care models. Additionally, the integration of cybersecurity for connected devices adds further risk and complexity for device manufacturers.

Sales Growth

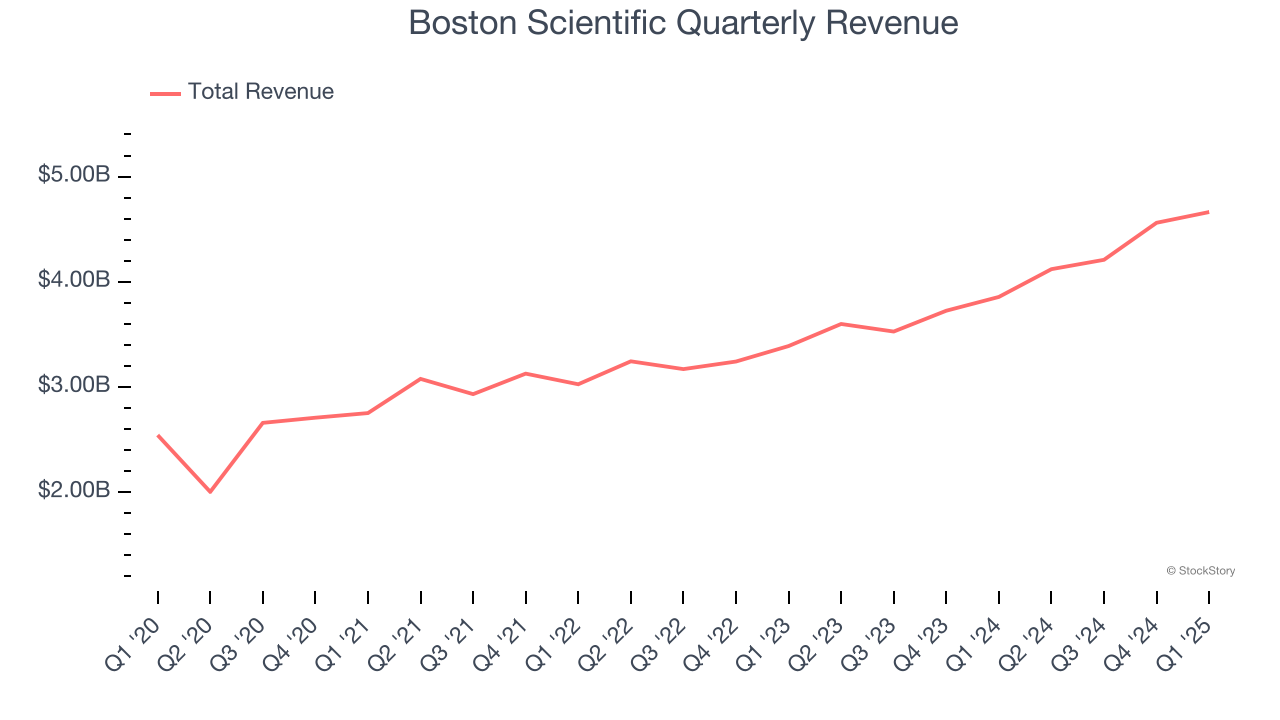

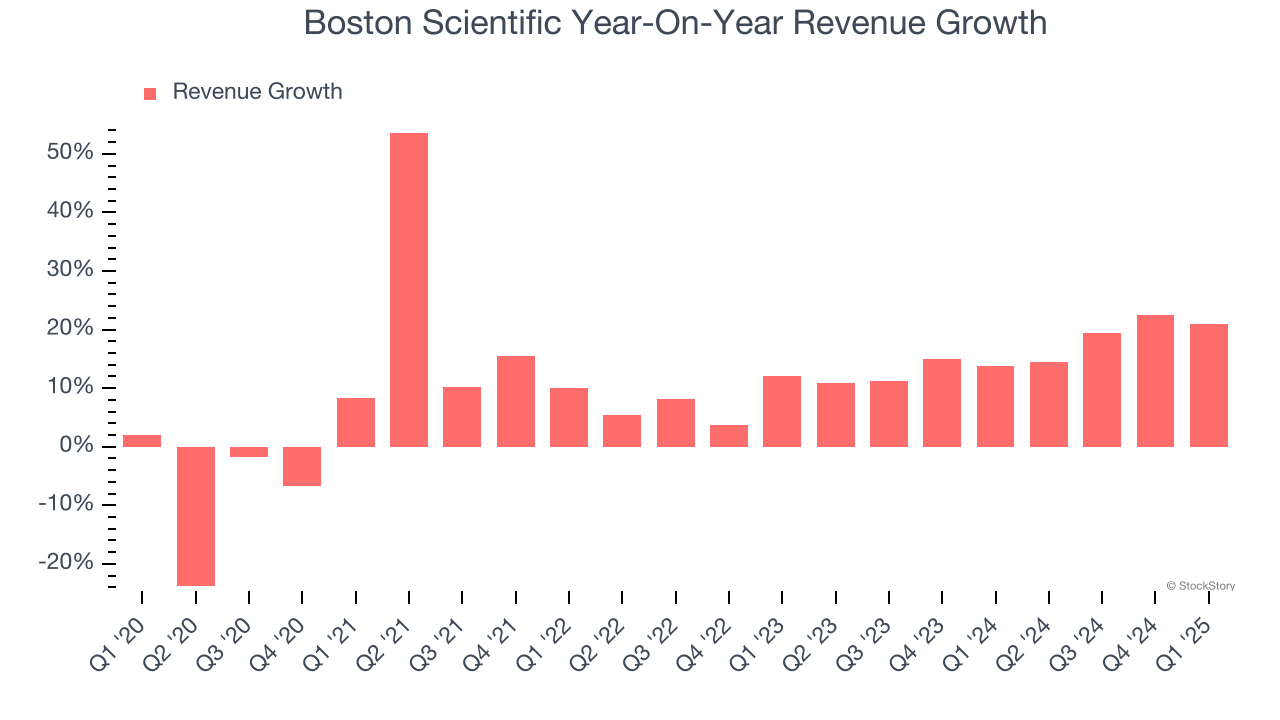

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Thankfully, Boston Scientific’s 10.2% annualized revenue growth over the last five years was decent. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Boston Scientific’s annualized revenue growth of 16% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

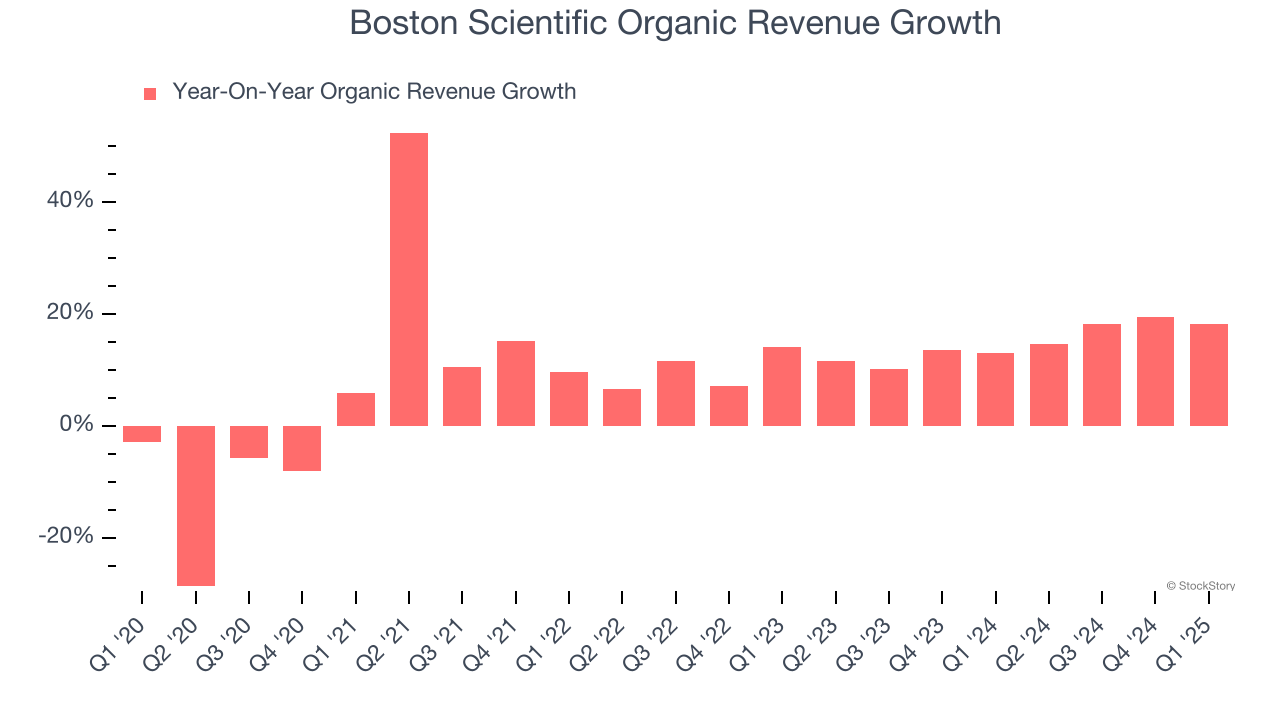

We can better understand the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Boston Scientific’s organic revenue averaged 14.9% year-on-year growth. Because this number aligns with its normal revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, Boston Scientific reported robust year-on-year revenue growth of 20.9%, and its $4.66 billion of revenue topped Wall Street estimates by 2%. Company management is currently guiding for a 18.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 12% over the next 12 months, a deceleration versus the last two years. We still think its growth trajectory is attractive given its scale and suggests the market is baking in success for its products and services.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

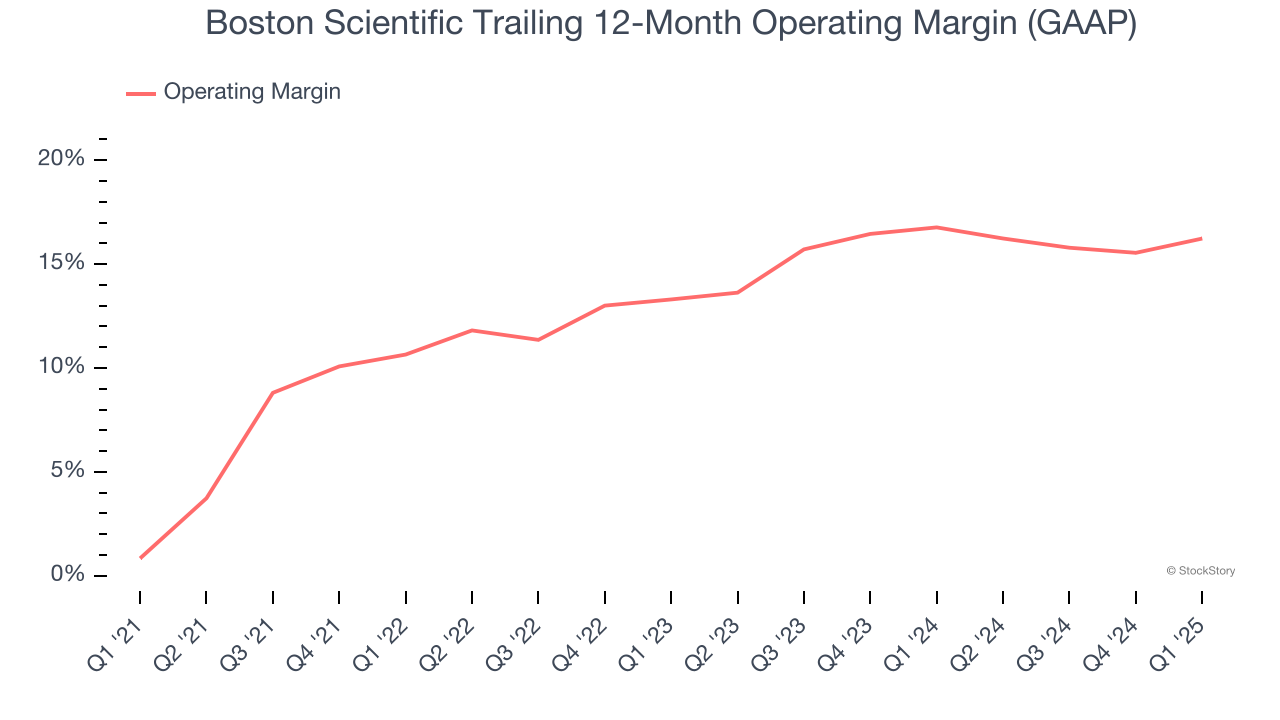

Boston Scientific has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 12.5%, higher than the broader healthcare sector.

Looking at the trend in its profitability, Boston Scientific’s operating margin rose by 15.4 percentage points over the last five years, as its sales growth gave it immense operating leverage. Zooming in on its more recent performance, we can see the company’s trajectory is intact as its margin has also increased by 2.9 percentage points on a two-year basis. These data points are very encouraging and shows momentum is on its side.

This quarter, Boston Scientific generated an operating profit margin of 19.8%, up 2.2 percentage points year on year. This increase was a welcome development and shows it was more efficient.

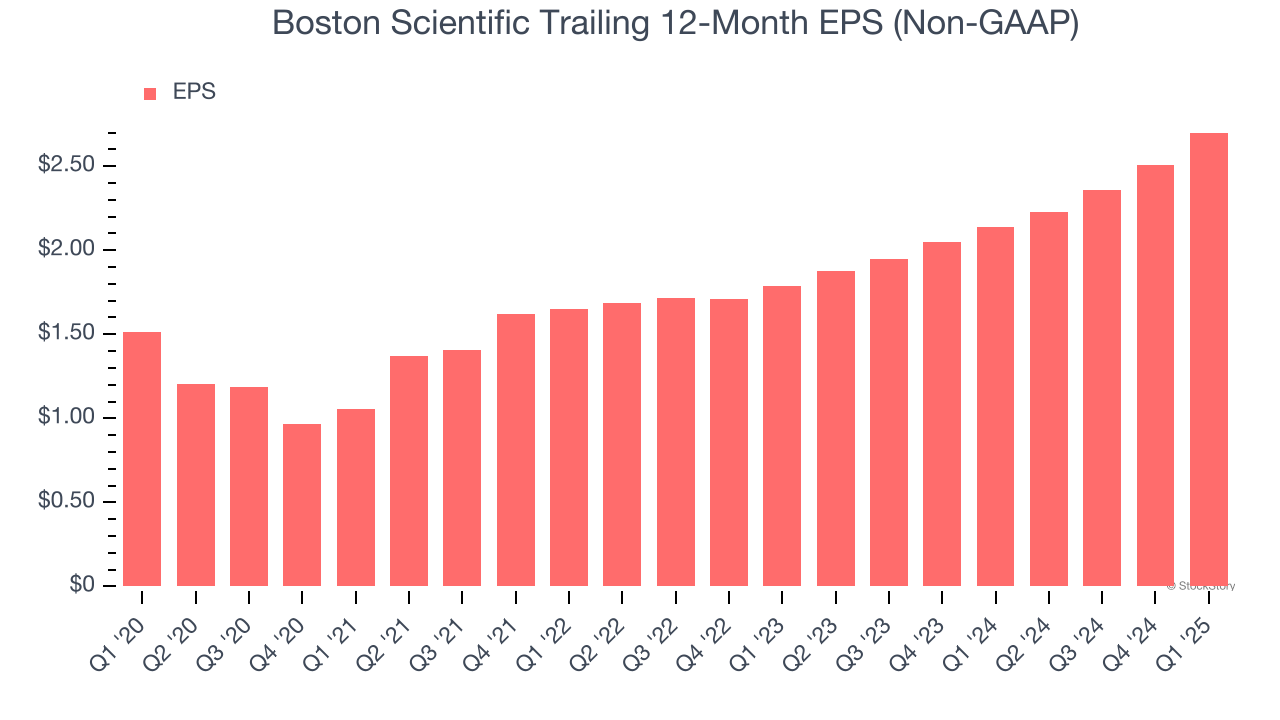

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Boston Scientific’s EPS grew at a spectacular 12.3% compounded annual growth rate over the last five years, higher than its 10.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of Boston Scientific’s earnings can give us a better understanding of its performance. As we mentioned earlier, Boston Scientific’s operating margin expanded by 15.4 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q1, Boston Scientific reported EPS at $0.75, up from $0.56 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Boston Scientific’s full-year EPS of $2.70 to grow 9.1%.

Key Takeaways from Boston Scientific’s Q1 Results

We enjoyed seeing Boston Scientific beat analysts’ organic revenue expectations this quarter. We were also glad its revenue guidance for next quarter exceeded Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 4.8% to $99.50 immediately following the results.

Boston Scientific had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.