In a sliding market, Coca-Cola has defied the odds, trading up to $73.26 per share. Its 5.5% gain since October 2024 has outpaced the S&P 500’s 10.7% drop. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Coca-Cola, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Despite the momentum, we're sitting this one out for now. Here are three reasons why we avoid KO and a stock we'd rather own.

Why Is Coca-Cola Not Exciting?

A pioneer and behemoth in carbonated soft drinks, Coca-Cola (NYSE: KO) is a storied beverage company best known for its flagship soda.

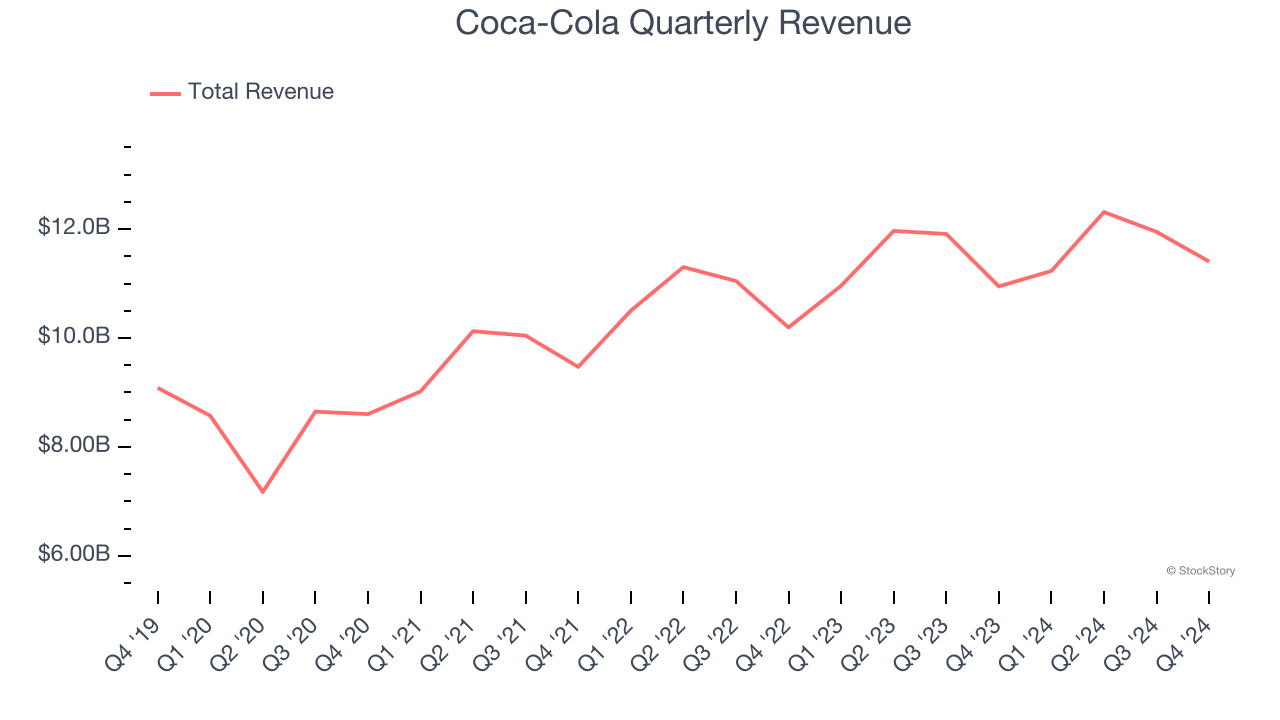

1. Long-Term Revenue Growth Disappoints

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Coca-Cola’s sales grew at a mediocre 6.7% compounded annual growth rate over the last three years. This fell short of our benchmark for the consumer staples sector.

2. Shrinking Operating Margin

Operating margin is an important measure of profitability accounting for key expenses such as marketing and advertising, IT systems, wages, and other administrative costs.

Analyzing the trend in its profitability, Coca-Cola’s operating margin decreased by 3.4 percentage points over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Its operating margin for the trailing 12 months was 21.3%.

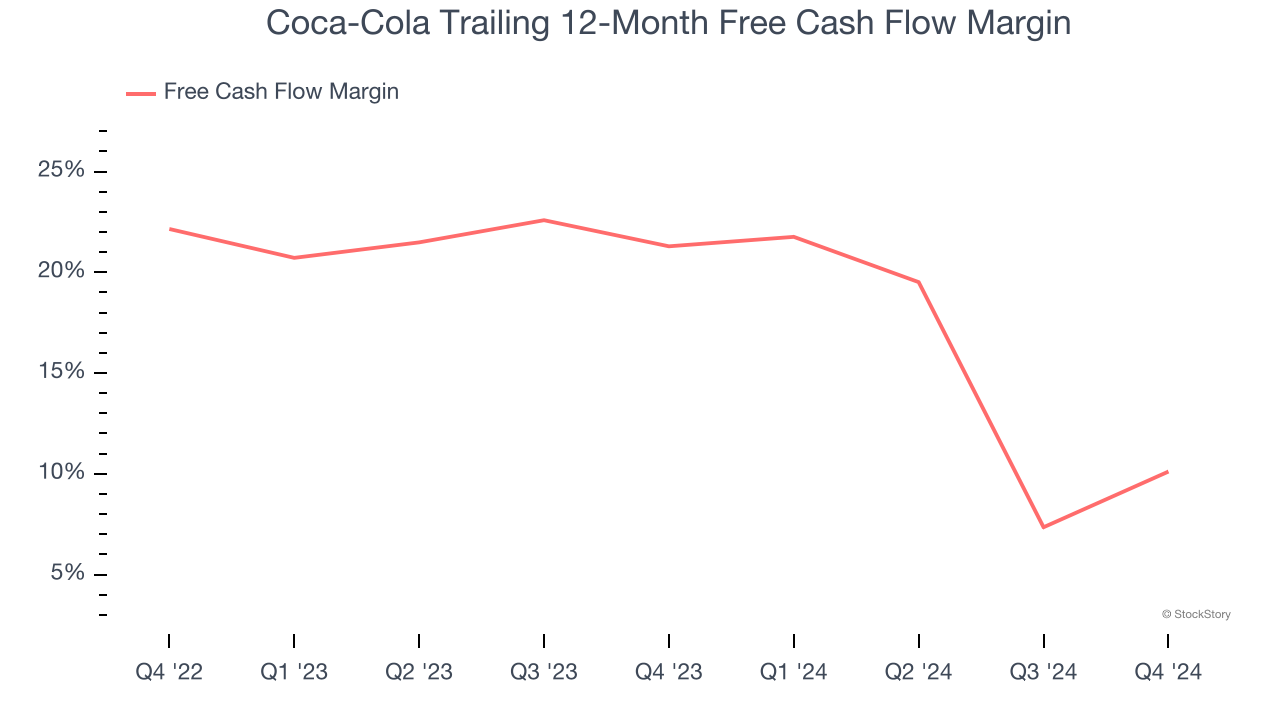

3. Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Coca-Cola’s margin dropped by 11.2 percentage points over the last year. If its declines continue, it could signal increasing investment needs and capital intensity. Coca-Cola’s free cash flow margin for the trailing 12 months was 10.1%.

Final Judgment

Coca-Cola’s business quality ultimately falls short of our standards. With its shares outperforming the market lately, the stock trades at 25× forward price-to-earnings (or $73.26 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - you can find better investment opportunities elsewhere. We’d recommend looking at one of Charlie Munger’s all-time favorite businesses.

Stocks We Would Buy Instead of Coca-Cola

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.