What a brutal six months it’s been for Kimball Electronics. The stock has dropped 24.9% and now trades at $13.49, rattling many shareholders. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Kimball Electronics, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Even though the stock has become cheaper, we don't have much confidence in Kimball Electronics. Here are three reasons why you should be careful with KE and a stock we'd rather own.

Why Do We Think Kimball Electronics Will Underperform?

Founded in 1961, Kimball Electronics (NYSE: KE) is a global contract manufacturer specializing in electronics and manufacturing solutions for automotive, medical, and industrial markets.

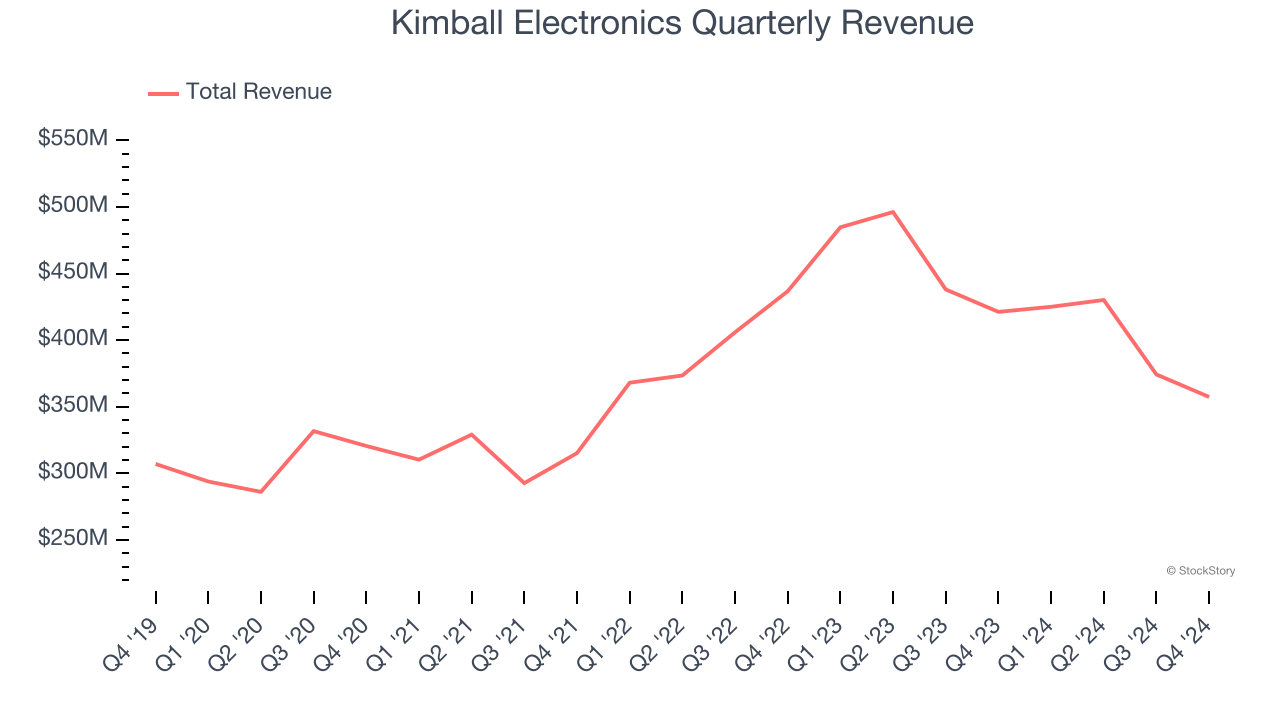

1. Long-Term Revenue Growth Disappoints

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Regrettably, Kimball Electronics’s sales grew at a tepid 4.8% compounded annual growth rate over the last five years. This was below our standard for the industrials sector.

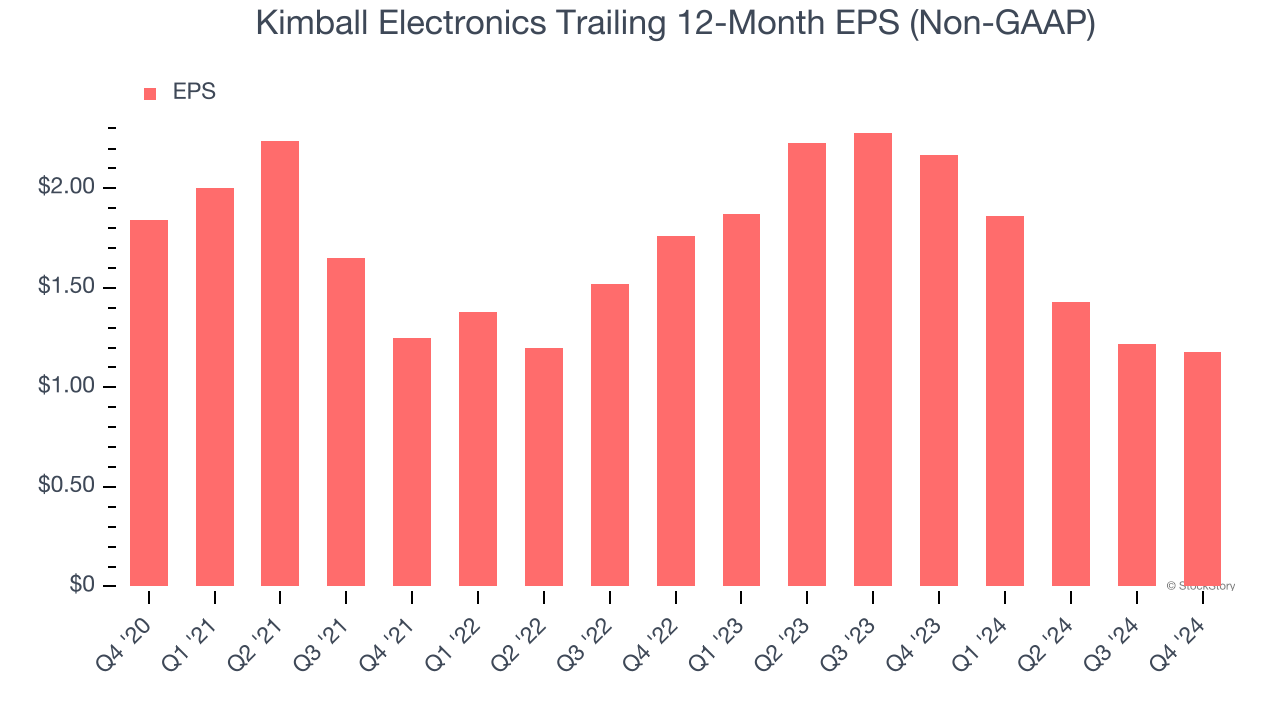

2. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Kimball Electronics’s full-year EPS dropped 49.2%, or 10.5% annually, over the last four years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Kimball Electronics’s low margin of safety could leave its stock price susceptible to large downswings.

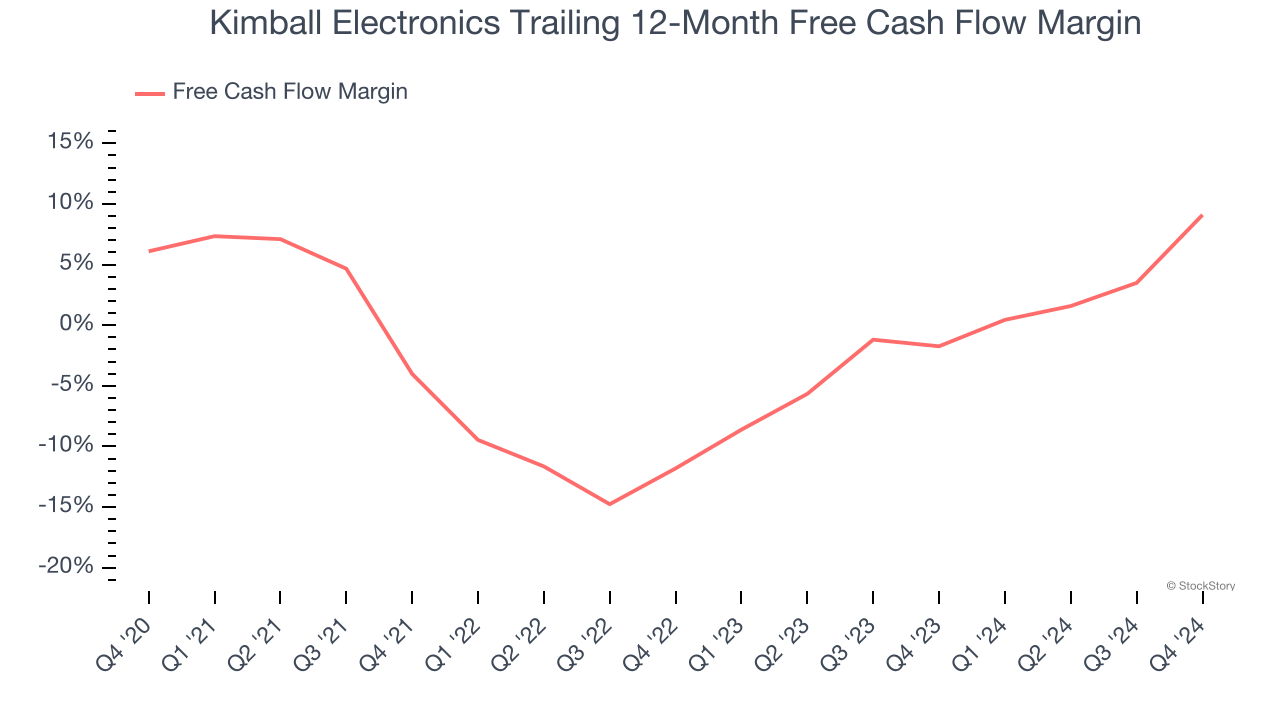

3. Breakeven Free Cash Flow Limits Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Kimball Electronics broke even from a free cash flow perspective over the last five years, giving the company limited opportunities to return capital to shareholders.

Final Judgment

We cheer for all companies making their customers lives easier, but in the case of Kimball Electronics, we’ll be cheering from the sidelines. After the recent drawdown, the stock trades at 8.7× forward price-to-earnings (or $13.49 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better stocks to buy right now. We’d recommend looking at an all-weather company that owns household favorite Taco Bell.

Stocks We Like More Than Kimball Electronics

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.