Let’s dig into the relative performance of Perma-Fix (NASDAQ: PESI) and its peers as we unravel the now-completed Q4 waste management earnings season.

Waste management companies can possess licenses permitting them to handle hazardous materials. Furthermore, many services are performed through contracts and statutorily mandated, non-discretionary, or recurring, leading to more predictable revenue streams. However, regulation can be a headwind, rendering existing services obsolete or forcing companies to invest precious capital to comply with new, more environmentally-friendly rules. Lastly, waste management companies are at the whim of economic cycles. Interest rates, for example, can greatly impact industrial production or commercial projects that create waste and byproducts.

The 9 waste management stocks we track reported a slower Q4. As a group, revenues missed analysts’ consensus estimates by 1.2%.

While some waste management stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 4.9% since the latest earnings results.

Perma-Fix (NASDAQ: PESI)

Tackling hazardous waste challenges since 1990, Perma-Fix (NASDAQ: PESI) provides environmental waste treatment services.

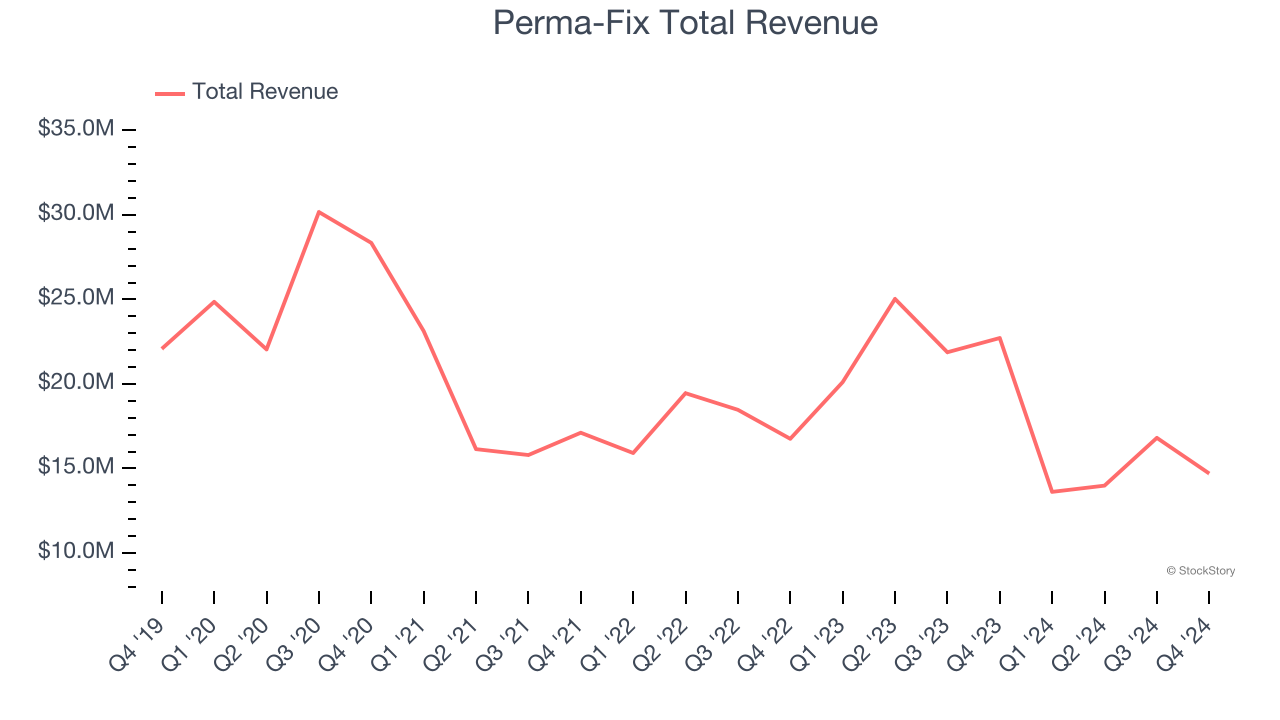

Perma-Fix reported revenues of $14.7 million, down 35.3% year on year. This print fell short of analysts’ expectations by 6.9%. Overall, it was a disappointing quarter for the company with a significant miss of analysts’ EBITDA and EPS estimates.

Mark Duff, President and CEO of the Company, commented, “While our financial performance in the fourth quarter of 2024 was impacted by ongoing yet temporary delays in project starts and waste receipts, we remain confident in the overall outlook and significant opportunities that lie ahead. In the first quarter of 2025, we see improving waste volume receipts and backlog, positioning us to resume revenue growth. Importantly, our waste treatment operations have ramped up in February, with expanded shifts at our Perma-Fix Northwest (PFNW) and Diversified Scientific Services (DSSI) facilities to meet increasing demand, and we are actively preparing for the U.S. Department of Energy’s (DOE) Direct-Feed Low-Activity Waste (DFLAW) program at Hanford, which remains on schedule to begin operations this summer under legally binding milestones.”

Perma-Fix delivered the weakest performance against analyst estimates and slowest revenue growth of the whole group. The stock is down 1.7% since reporting and currently trades at $7.12.

Read our full report on Perma-Fix here, it’s free.

Best Q4: Casella Waste Systems (NASDAQ: CWST)

Starting with the founder picking up garbage with a pickup truck he purchased using savings from high school, Casella (NASDAQ: CWST) offers waste management services for businesses, residents, and the government.

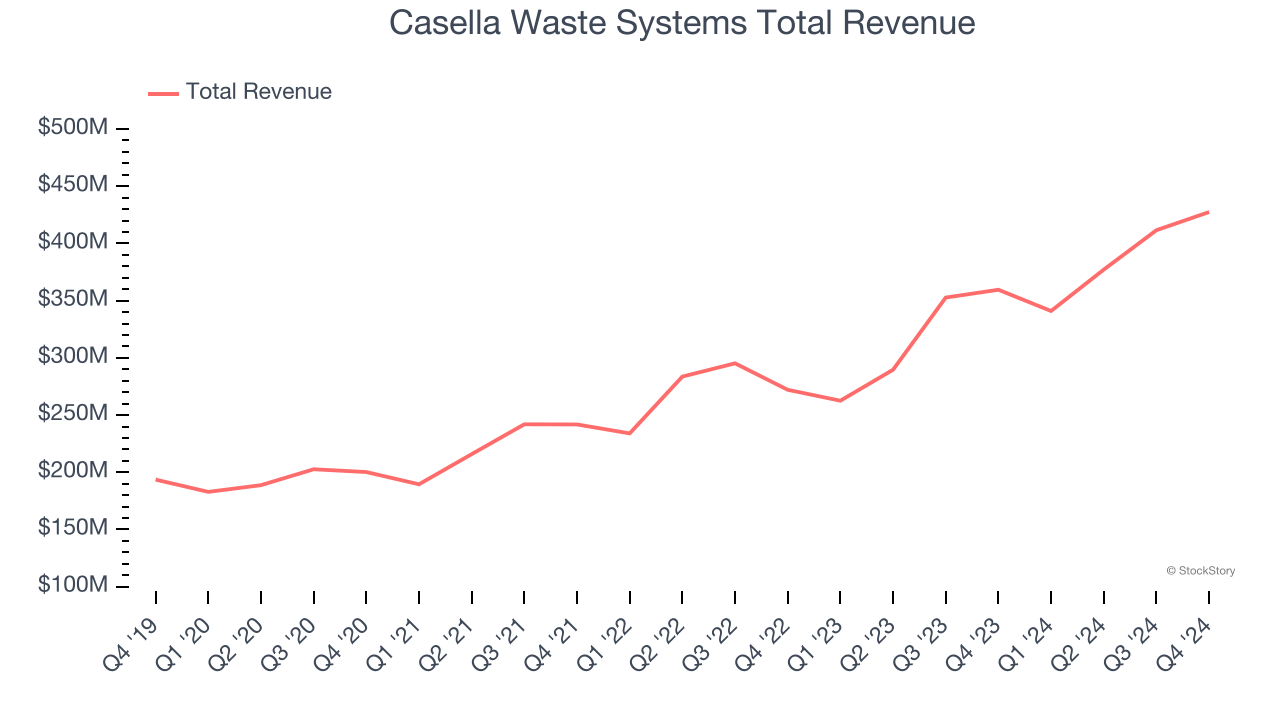

Casella Waste Systems reported revenues of $427.5 million, up 18.9% year on year, outperforming analysts’ expectations by 2.3%. The business had an exceptional quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

Casella Waste Systems scored the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise among its peers. The market seems content with the results as the stock is up 4.3% since reporting. It currently trades at $111.34.

Is now the time to buy Casella Waste Systems? Access our full analysis of the earnings results here, it’s free.

Quest Resource (NASDAQ: QRHC)

Recycling corporate waste to help companies be more sustainable, Quest Resource (NASDAQ: QRHC) is a provider of waste and recycling services.

Quest Resource reported revenues of $69.97 million, flat year on year, falling short of analysts’ expectations by 5%. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA and EPS estimates.

As expected, the stock is down 27.6% since the results and currently trades at $2.80.

Read our full analysis of Quest Resource’s results here.

Enviri (NYSE: NVRI)

Cooling America’s first indoor ice rink in the 19th century, Enviri (NYSE: NVRI) offers steel and waste handling services.

Enviri reported revenues of $558.7 million, up 5.7% year on year. This print missed analysts’ expectations by 3.5%. It was a softer quarter as it also logged full-year EBITDA guidance missing analysts’ expectations.

The stock is down 12% since reporting and currently trades at $7.69.

Read our full, actionable report on Enviri here, it’s free.

Montrose (NYSE: MEG)

Founded to protect a tree-lined two-lane road, Montrose (NYSE: MEG) provides air quality monitoring, environmental laboratory testing, compliance, and environmental consulting services.

Montrose reported revenues of $189.1 million, up 14.1% year on year. This number beat analysts’ expectations by 0.6%. Taking a step back, it was a mixed quarter as it also produced a solid beat of analysts’ EPS estimates but a significant miss of analysts’ organic revenue estimates.

Montrose had the weakest full-year guidance update among its peers. The stock is down 12.3% since reporting and currently trades at $15.30.

Read our full, actionable report on Montrose here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.