Looking back on leisure facilities stocks’ Q4 earnings, we examine this quarter’s best and worst performers, including Planet Fitness (NYSE: PLNT) and its peers.

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

The 11 leisure facilities stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1.3% while next quarter’s revenue guidance was 1.6% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 9.1% since the latest earnings results.

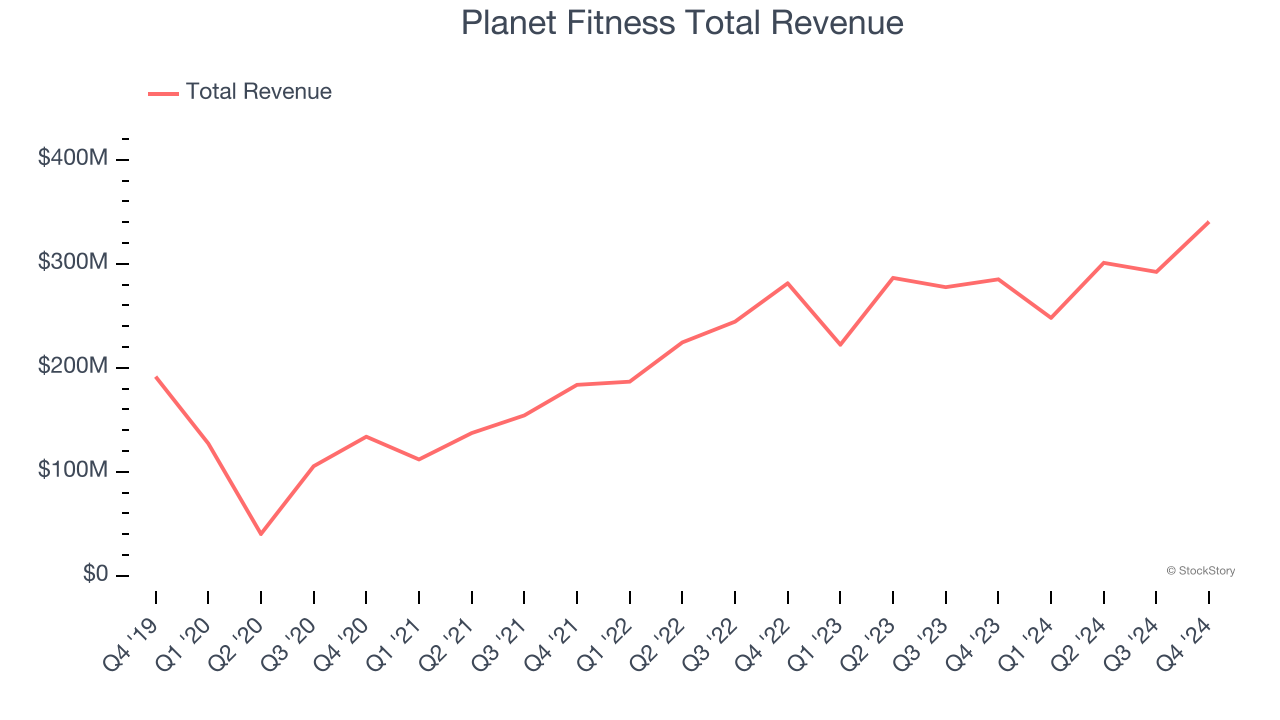

Planet Fitness (NYSE: PLNT)

Founded by two brothers who purchased a struggling gym, Planet Fitness (NYSE: PLNT) is a gym franchise that caters to casual fitness users by providing a friendly and inclusive atmosphere.

Planet Fitness reported revenues of $340.5 million, up 19.4% year on year. This print exceeded analysts’ expectations by 4.9%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ adjusted operating income estimates and an impressive beat of analysts’ EPS estimates.

"We had strong results in 2024 and closed out the year with 19.7 million members, posting revenue growth of more than 10% and growing Adjusted EBITDA by approximately 12%," said Colleen Keating, Chief Executive Officer.

Planet Fitness scored the fastest revenue growth of the whole group. The stock is up 1.5% since reporting and currently trades at $101.

Is now the time to buy Planet Fitness? Access our full analysis of the earnings results here, it’s free.

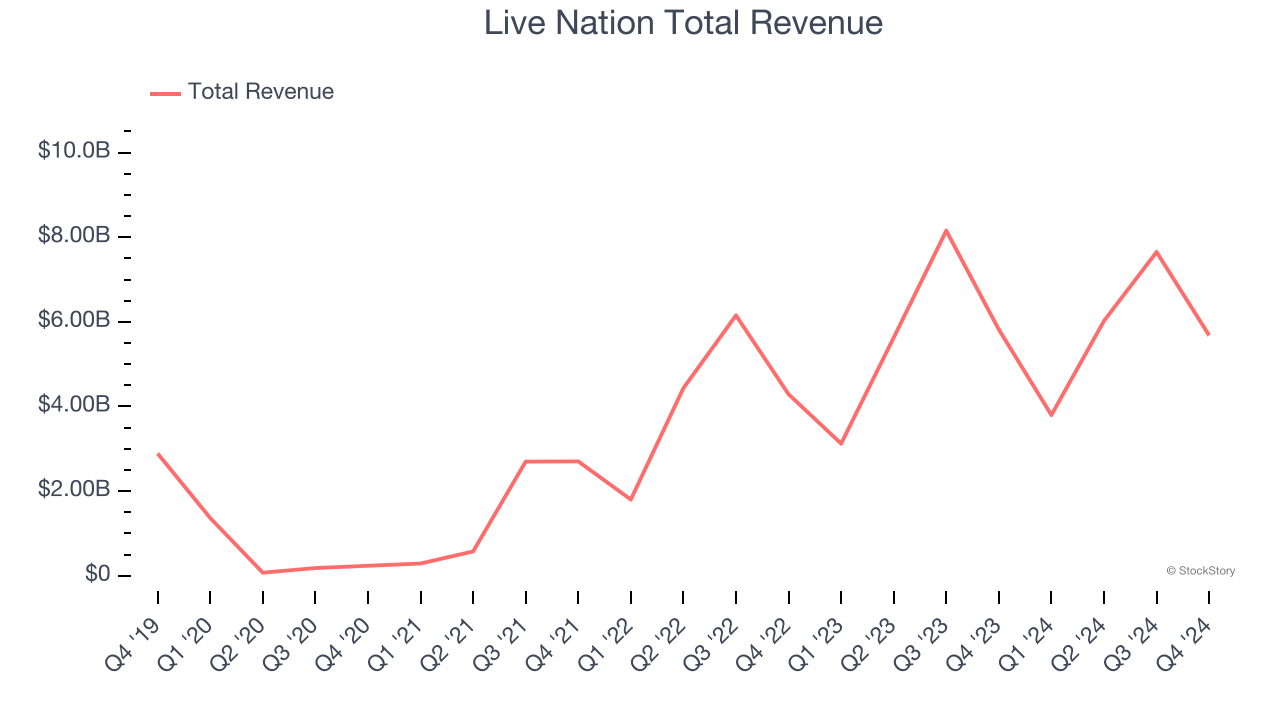

Best Q4: Live Nation (NYSE: LYV)

Owner of Ticketmaster and operator of music festival EDC, Live Nation (NYSE: LYV) is a company specializing in live event promotion, venue management, and ticketing services for concerts and shows.

Live Nation reported revenues of $5.68 billion, down 2.4% year on year, outperforming analysts’ expectations by 1.4%. The business had an exceptional quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 17% since reporting. It currently trades at $126.37.

Is now the time to buy Live Nation? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Xponential Fitness (NYSE: XPOF)

Owner of CycleBar, Rumble, and Club Pilates, Xponential Fitness (NYSE: XPOF) is a boutique fitness brand offering diverse and specialized exercise experiences.

Xponential Fitness reported revenues of $83.22 million, down 6.8% year on year, exceeding analysts’ expectations by 3.1%. Still, it was a softer quarter as it posted full-year revenue guidance missing analysts’ expectations.

Xponential Fitness delivered the weakest full-year guidance update in the group. As expected, the stock is down 35% since the results and currently trades at $7.92.

Read our full analysis of Xponential Fitness’s results here.

AMC Entertainment (NYSE: AMC)

With a profile that was raised due to meme stock mania beginning in 2021, AMC Entertainment (NYSE: AMC) operates movie theaters primarily in the US and Europe.

AMC Entertainment reported revenues of $1.31 billion, up 18.3% year on year. This number beat analysts’ expectations by 1.6%. Aside from that, it was a slower quarter as it logged a significant miss of analysts’ adjusted operating income and EPS estimates.

The stock is down 7.3% since reporting and currently trades at $3.04.

Read our full, actionable report on AMC Entertainment here, it’s free.

Topgolf Callaway (NYSE: MODG)

Formed between the merger of Callaway and Topgolf, Topgolf Callaway (NYSE: MODG) sells golf equipment and operates technology-driven golf entertainment venues.

Topgolf Callaway reported revenues of $924.4 million, up 3% year on year. This print surpassed analysts’ expectations by 4.5%. Zooming out, it was a slower quarter as it recorded full-year EBITDA guidance missing analysts’ expectations.

The stock is up 3.1% since reporting and currently trades at $6.90.

Read our full, actionable report on Topgolf Callaway here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.