Sea has had an impressive run over the past six months. While the S&P 500 has been flat, the stock has returned 38.6% and now trades at $130.68. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Following the strength, is SE a buy right now? Or is the market overestimating its value? Find out in our full research report, it’s free.

Why Are We Positive On SE?

Founded in 2009 and a publicly traded company since 2017, Sea (NYSE: SE) started as a gaming platform and has since expanded to offer a variety of services such as e-commerce, digital payments, and financial services across Southeast Asia.

1. Eye-Popping Growth in Customer Spending

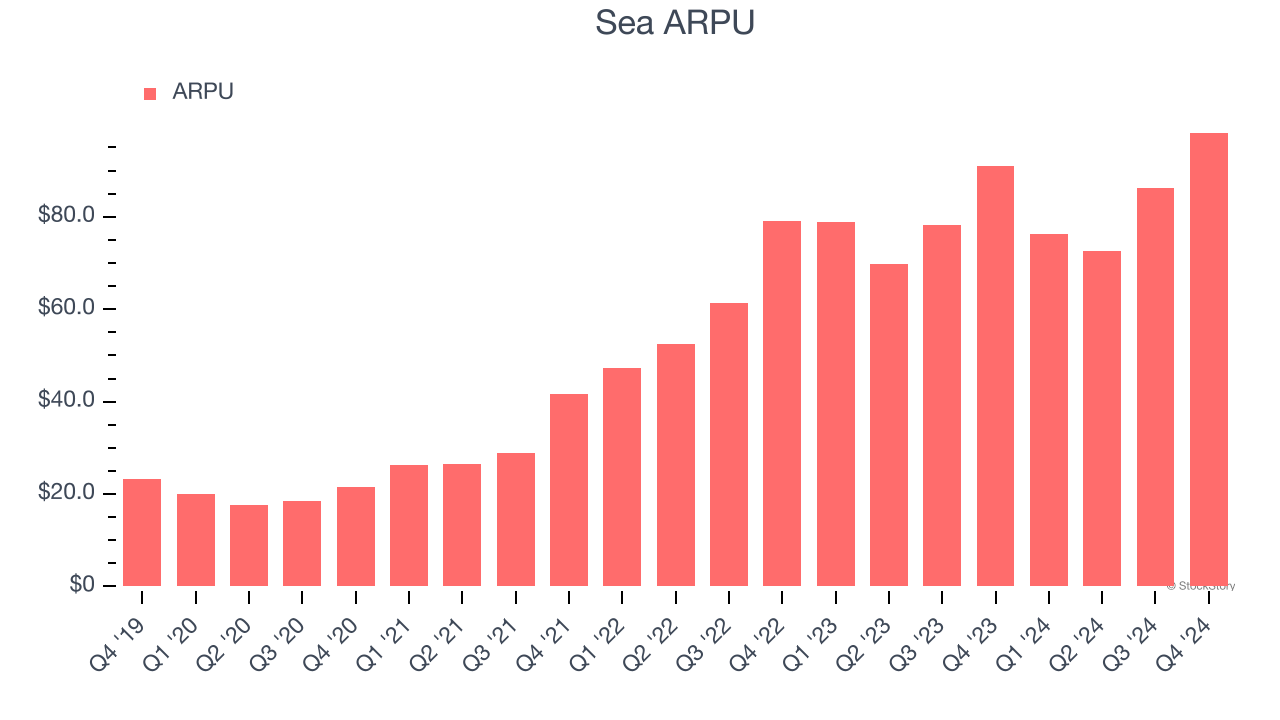

Average revenue per user (ARPU) is a critical metric to track because it measures how much the company earns in transaction fees from each user. ARPU also gives us unique insights into a user’s average order size and Sea’s take rate, or "cut", on each order.

Sea’s ARPU growth has been exceptional over the last two years, averaging 20.2%. Its ability to increase monetization while growing its paying users demonstrates its platform’s value, as its users are spending significantly more than last year.

2. Outstanding Long-Term EPS Growth

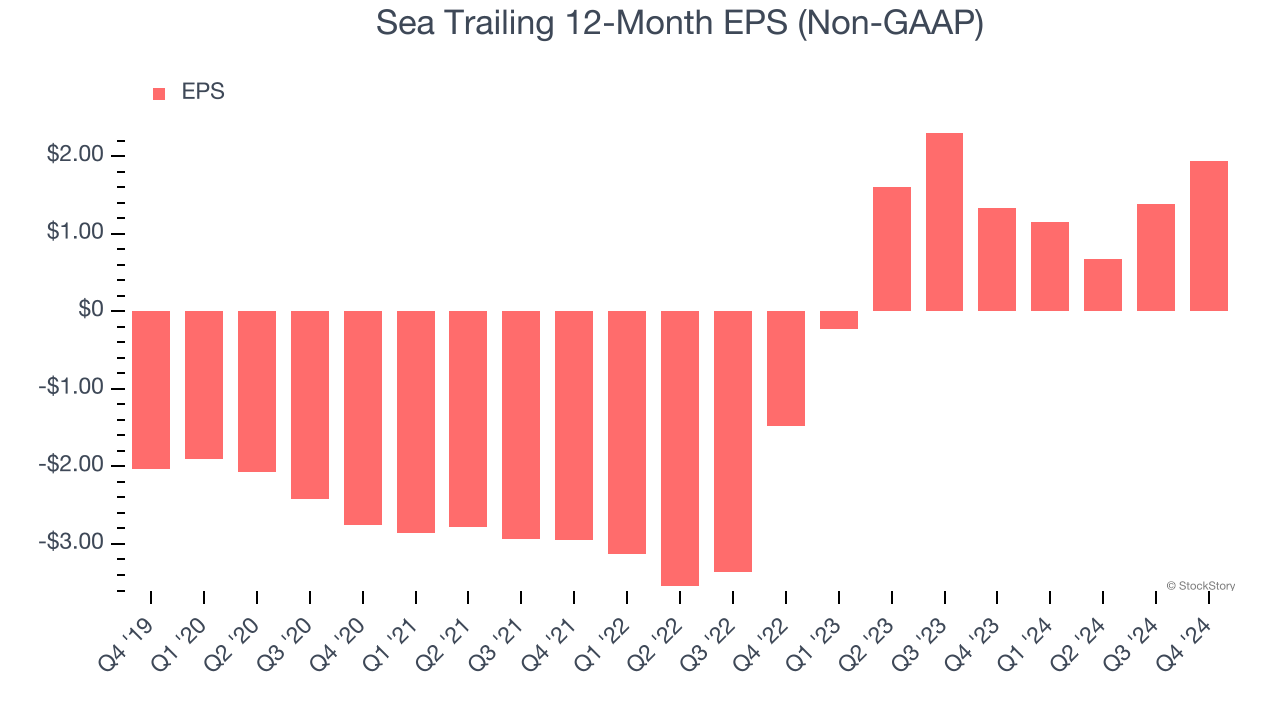

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sea’s full-year EPS flipped from negative to positive over the last three years. This is a good sign and shows it’s at an inflection point.

3. Increasing Free Cash Flow Margin Juices Financials

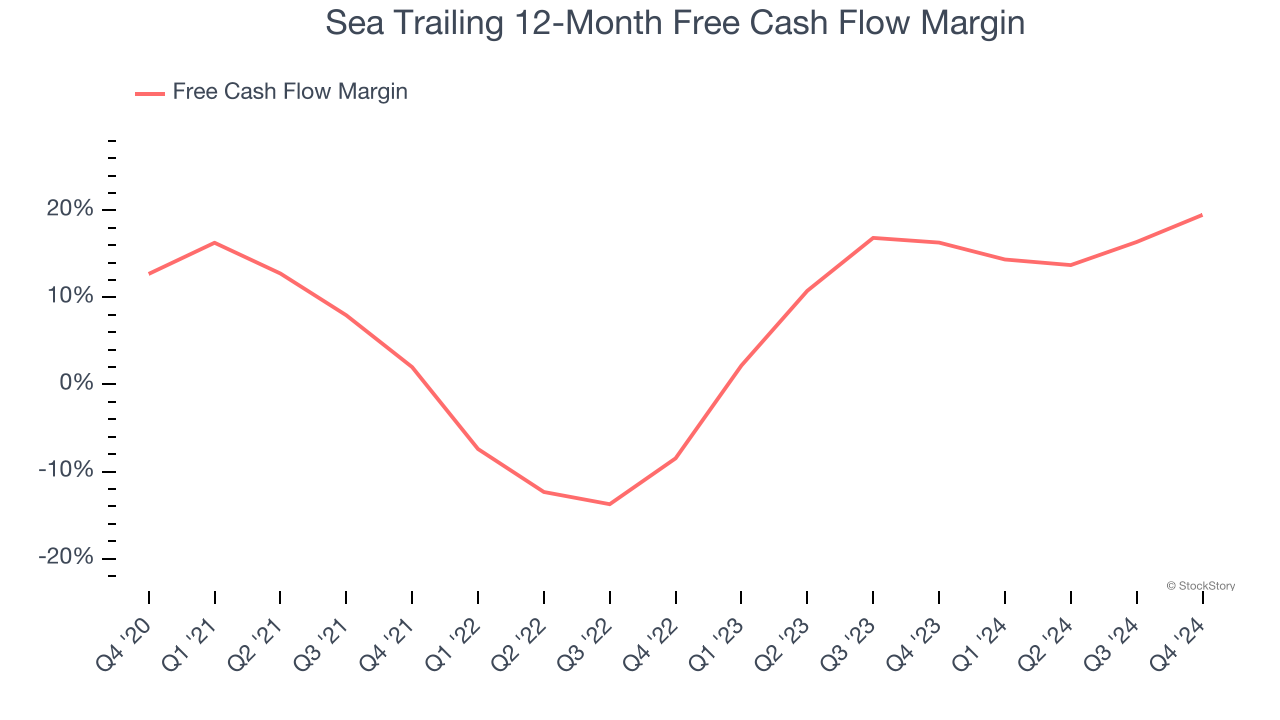

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Sea’s margin expanded by 17.5 percentage points over the last few years. This is encouraging because it gives the company more optionality. Sea’s free cash flow margin for the trailing 12 months was 19.5%.

Final Judgment

These are just a few reasons why we think Sea is a high-quality business, and with its shares beating the market recently, the stock trades at 24.1× forward EV-to-EBITDA (or $130.68 per share). Is now a good time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Sea

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.