Since September 2024, Richardson Electronics has been in a holding pattern, posting a small loss of 4.4% while floating around $11.86.

Is now the time to buy Richardson Electronics, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

We're sitting this one out for now. Here are three reasons why RELL doesn't excite us and a stock we'd rather own.

Why Do We Think Richardson Electronics Will Underperform?

Founded in 1947, Richardson Electronics (NASDAQ: RELL) is a distributor of power grid and microwave tubes as well as consumables related to those products.

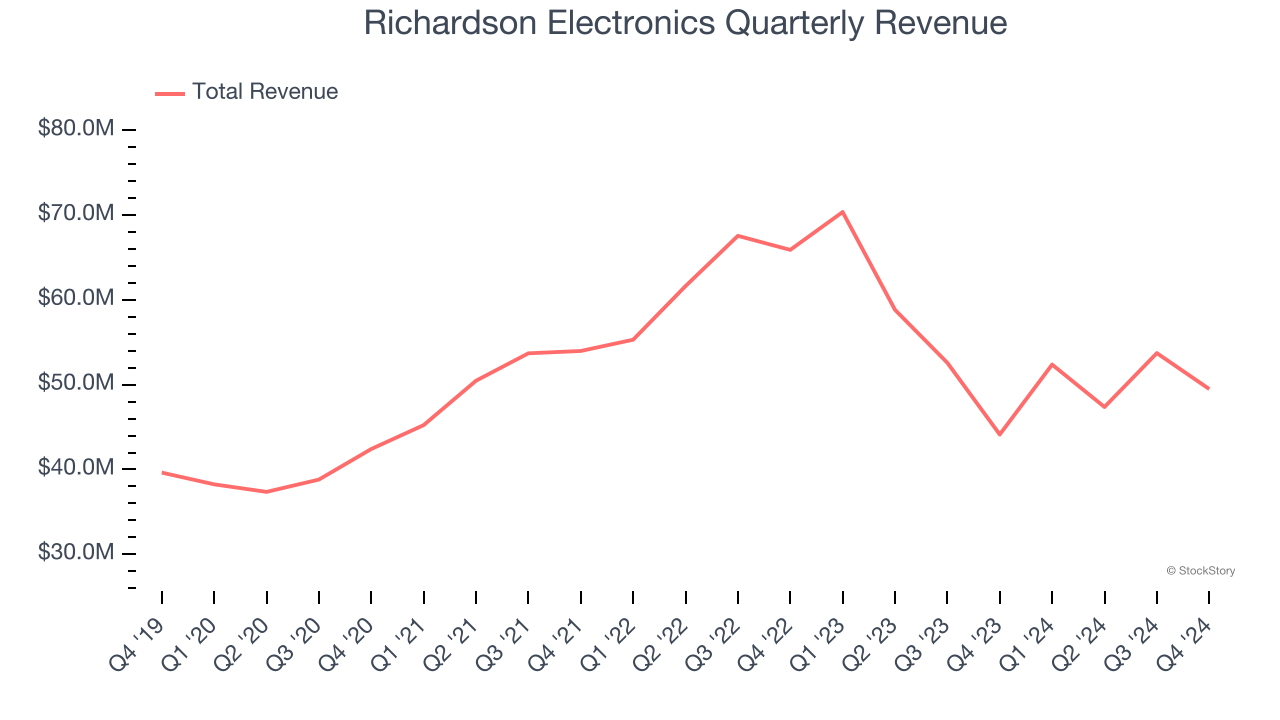

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Richardson Electronics’s 4.7% annualized revenue growth over the last five years was tepid. This fell short of our benchmark for the industrials sector.

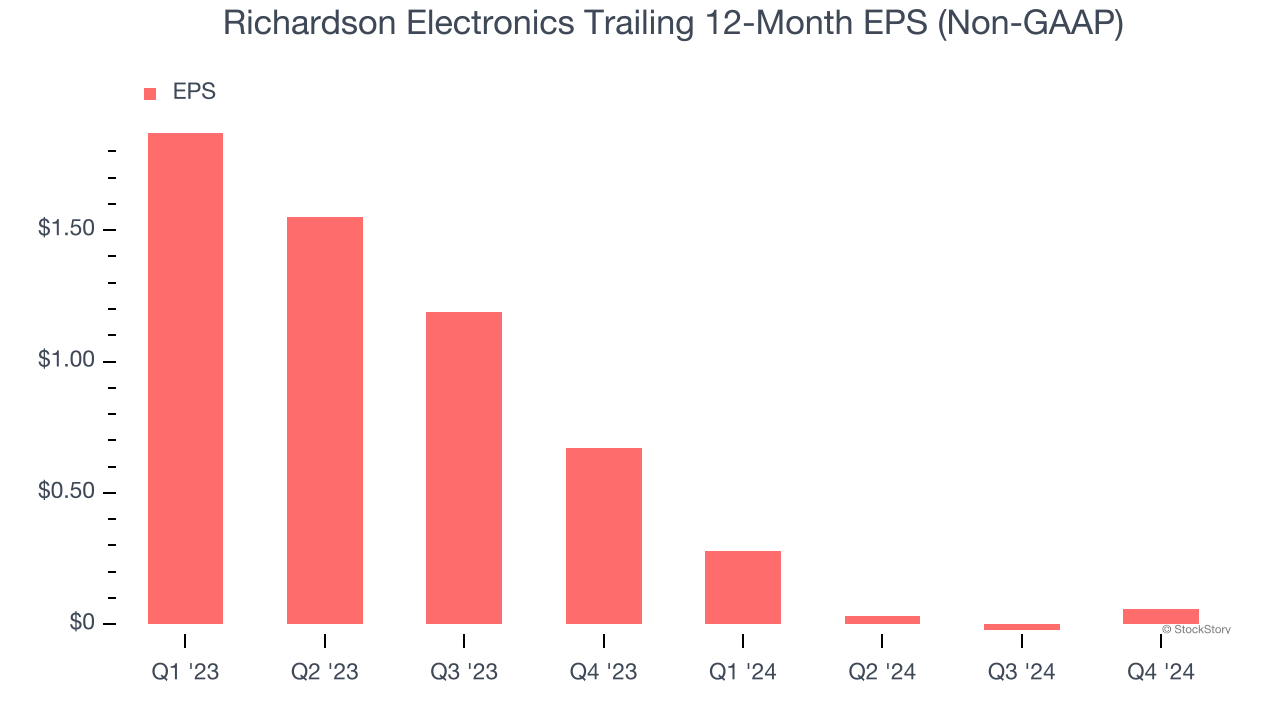

2. EPS Trending Down

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Richardson Electronics’s full-year EPS dropped significantly over the last two years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Richardson Electronics’s low margin of safety could leave its stock price susceptible to large downswings.

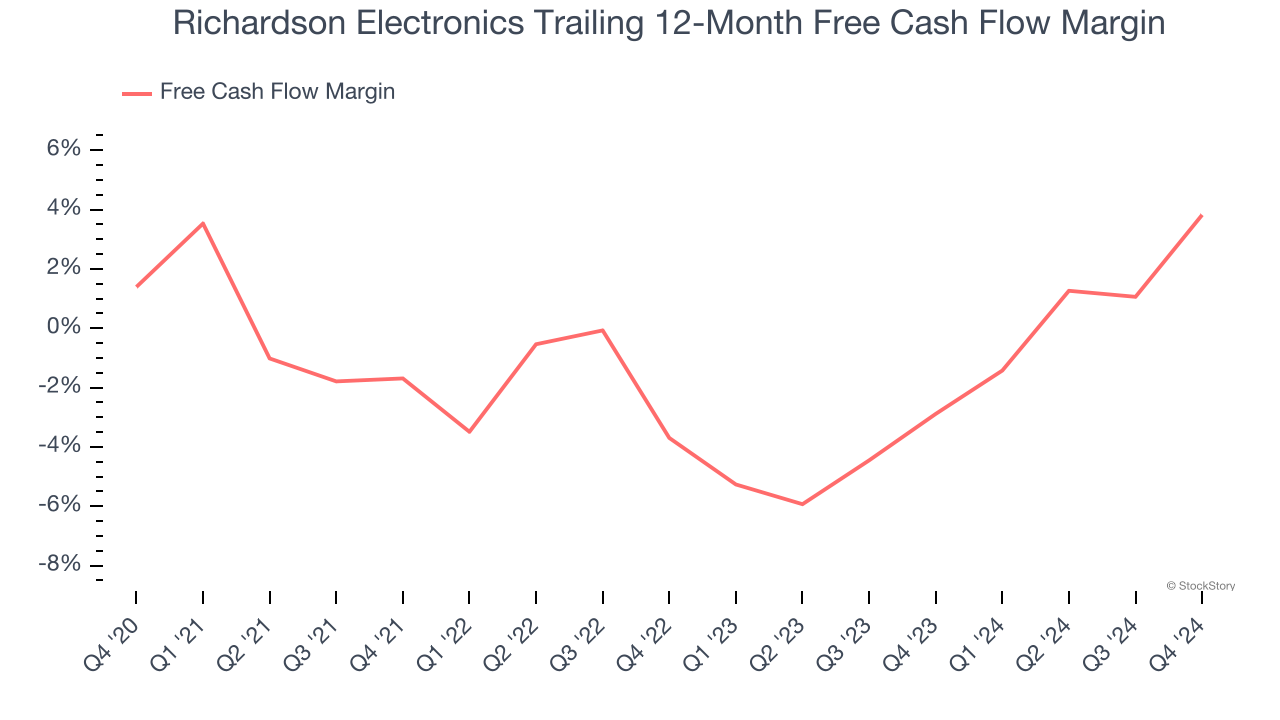

3. Breakeven Free Cash Flow Limits Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Richardson Electronics broke even from a free cash flow perspective over the last five years, giving the company limited opportunities to return capital to shareholders.

Final Judgment

We cheer for all companies making their customers lives easier, but in the case of Richardson Electronics, we’ll be cheering from the sidelines. That said, the stock currently trades at 15.9× forward price-to-earnings (or $11.86 per share). This valuation tells us a lot of optimism is priced in - we think there are better stocks to buy right now. We’d recommend looking at the Amazon and PayPal of Latin America.

Stocks We Like More Than Richardson Electronics

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.