Over the past six months, Flowers Foods’s shares (currently trading at $18.67) have posted a disappointing 19.7% loss while the S&P 500 was flat. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Flowers Foods, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Even with the cheaper entry price, we're cautious about Flowers Foods. Here are three reasons why there are better opportunities than FLO and a stock we'd rather own.

Why Is Flowers Foods Not Exciting?

With Wonder Bread as its premier brand, Flower Foods (NYSE: FLO) is a packaged foods company that focuses on bakery products such as breads, buns, and cakes.

1. Demand Slipping as Sales Volumes Decline

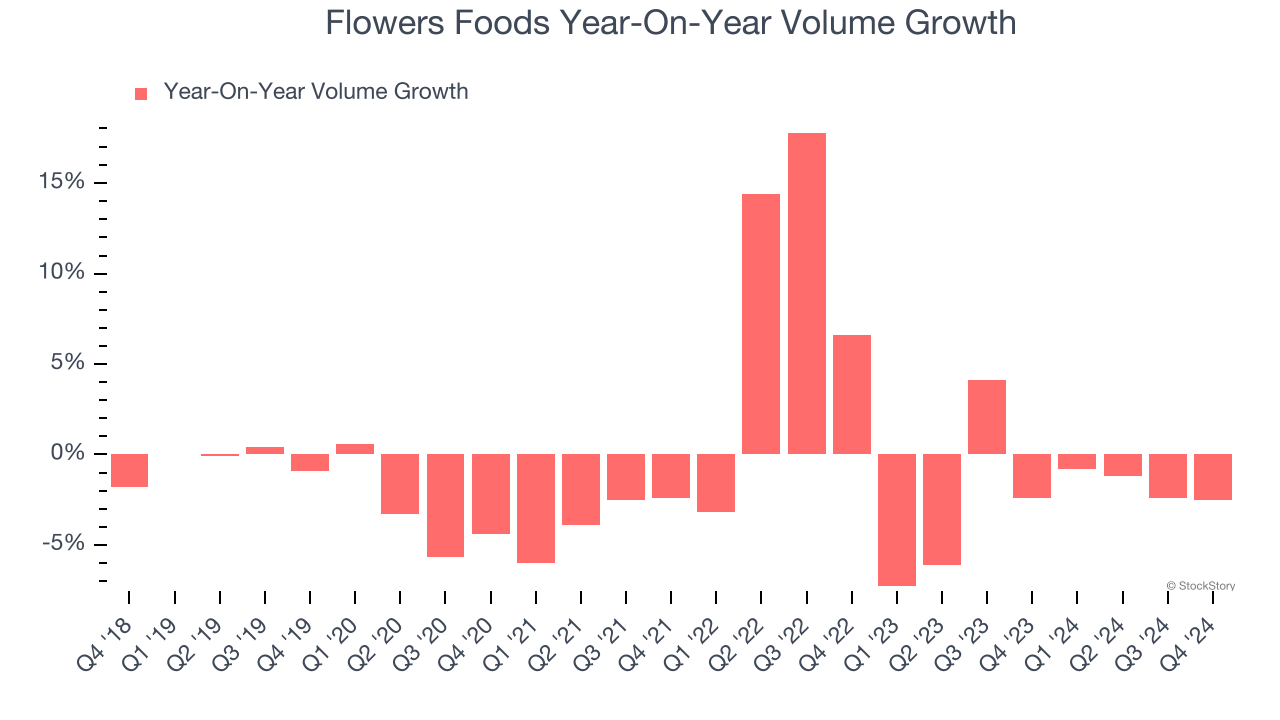

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

Flowers Foods’s average quarterly sales volumes have shrunk by 2.3% over the last two years. This decrease isn’t ideal because the quantity demanded for consumer staples products is typically stable.

2. Core Business Falling Behind as Demand Plateaus

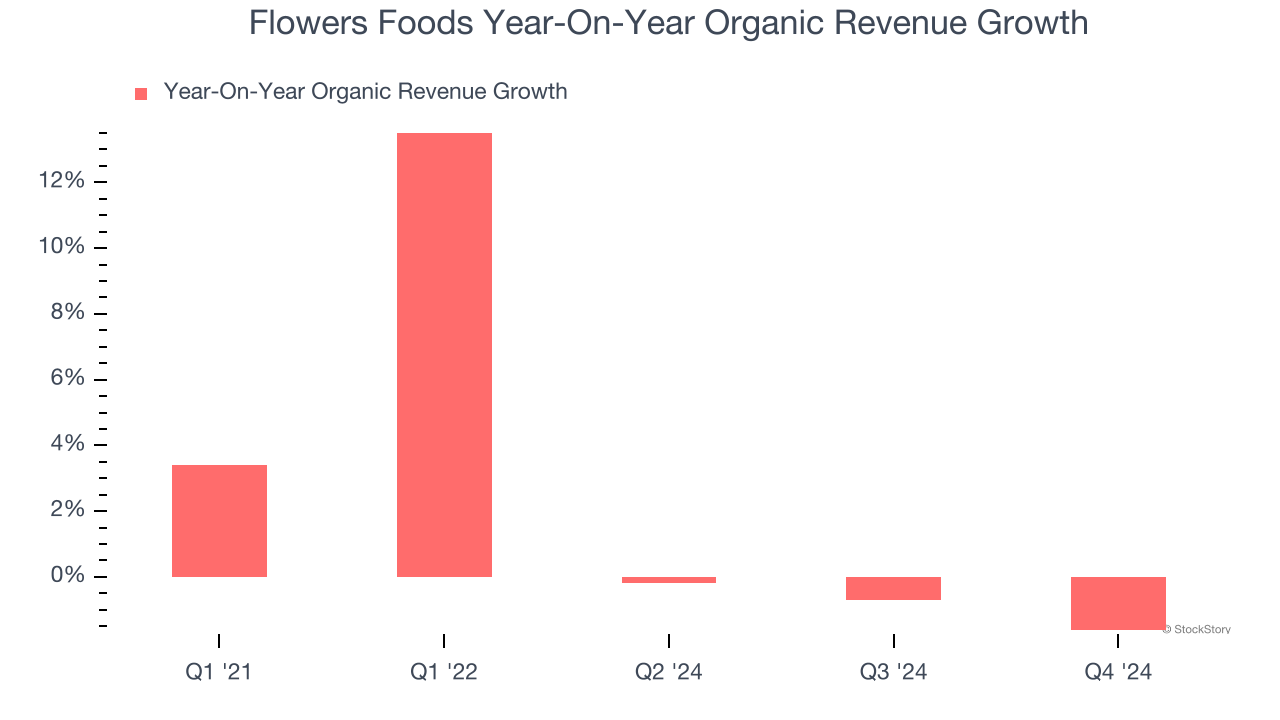

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business’s performance excluding one-time events such as mergers, acquisitions, and divestitures as well as foreign currency fluctuations.

The demand for Flowers Foods’s products has barely risen over the last eight quarters. On average, the company’s organic sales have been flat.

3. EPS Barely Growing

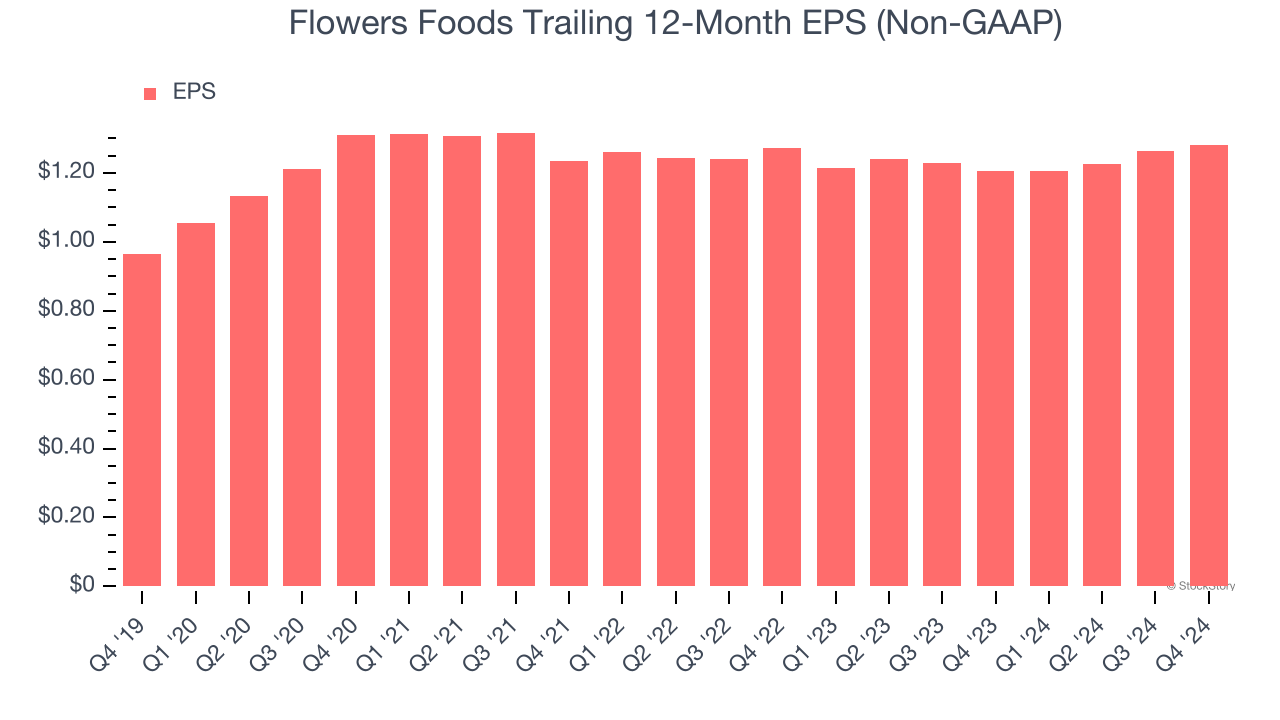

Analyzing the change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Flowers Foods’s EPS grew at an unimpressive 1.2% compounded annual growth rate over the last three years, lower than its 5.6% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

Flowers Foods isn’t a terrible business, but it doesn’t pass our quality test. Following the recent decline, the stock trades at 14.1× forward price-to-earnings (or $18.67 per share). Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're pretty confident there are more exciting stocks to buy at the moment. Let us point you toward an all-weather company that owns household favorite Taco Bell.

Stocks We Like More Than Flowers Foods

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.