What a fantastic six months it’s been for The RealReal. Shares of the company have skyrocketed 86.5%, hitting $6.06. This performance may have investors wondering how to approach the situation.

Is now the time to buy The RealReal, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Despite the momentum, we don't have much confidence in The RealReal. Here are three reasons why REAL doesn't excite us and a stock we'd rather own.

Why Is The RealReal Not Exciting?

Founded by consignment store aficionado Julie Wainwright, The RealReal (NASDAQ: REAL) is an online marketplace for buying and selling secondhand luxury goods.

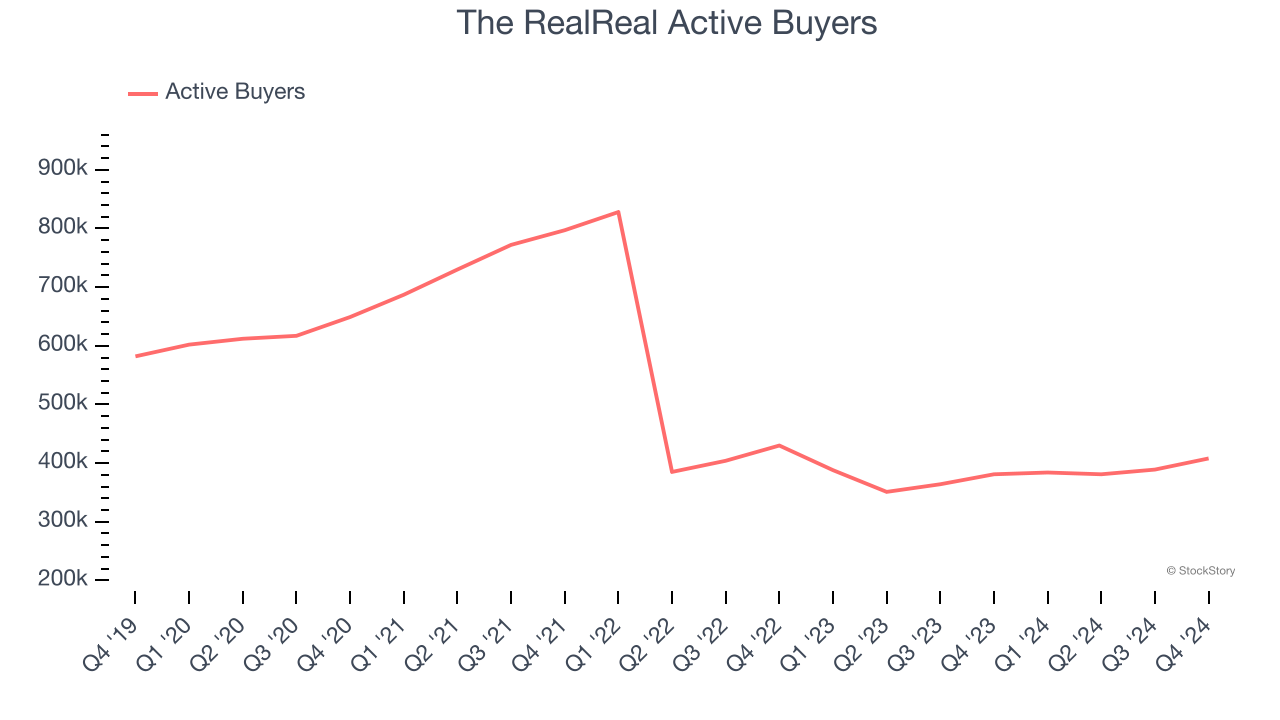

1. Declining Active Buyers Reflect Product Weakness

As an online marketplace, The RealReal generates revenue growth by increasing both the number of users on its platform and the average order size in dollars.

The RealReal struggled with new customer acquisition over the last two years as its active buyers have declined by 7.7% annually to 408,000 in the latest quarter. This performance isn't ideal because internet usage is secular, meaning there are typically unaddressed market opportunities. If The RealReal wants to accelerate growth, it likely needs to enhance the appeal of its current offerings or innovate with new products.

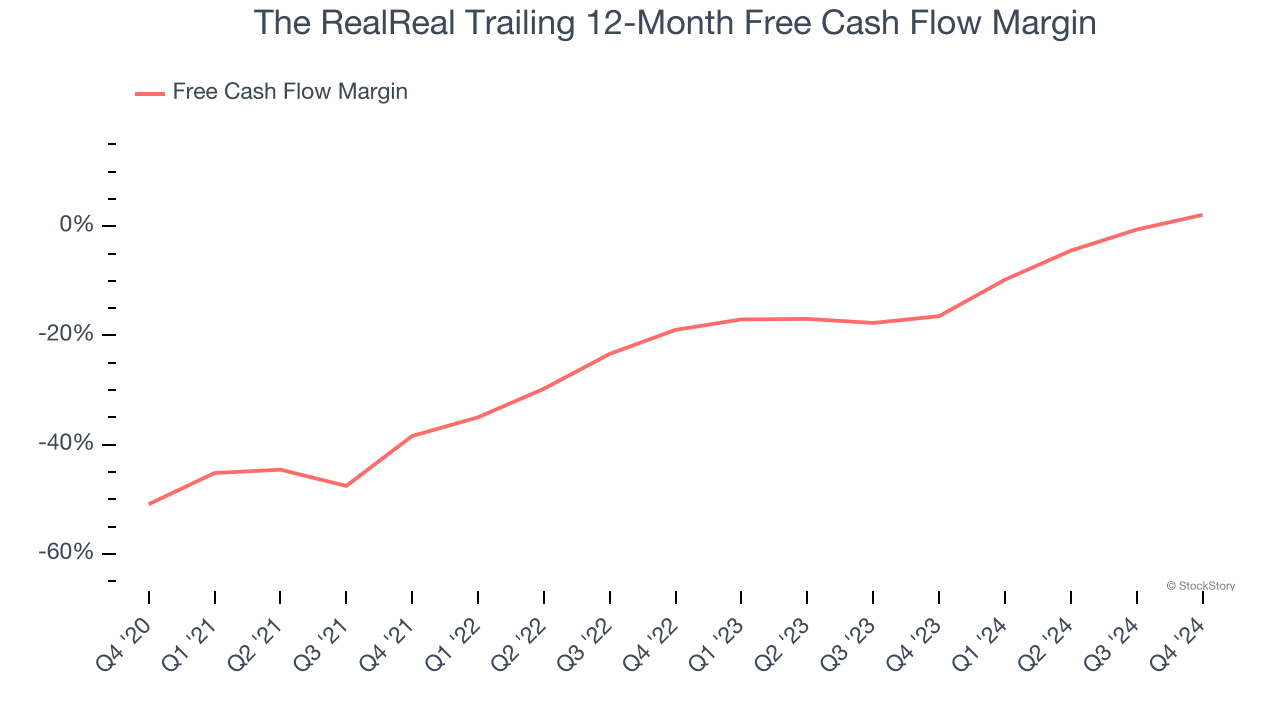

2. Cash Burn Ignites Concerns

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

While The RealReal posted positive free cash flow this quarter, the broader story hasn’t been so clean. The RealReal’s demanding reinvestments have consumed many resources over the last two years, contributing to an average free cash flow margin of negative 6.8%. This means it lit $6.77 of cash on fire for every $100 in revenue.

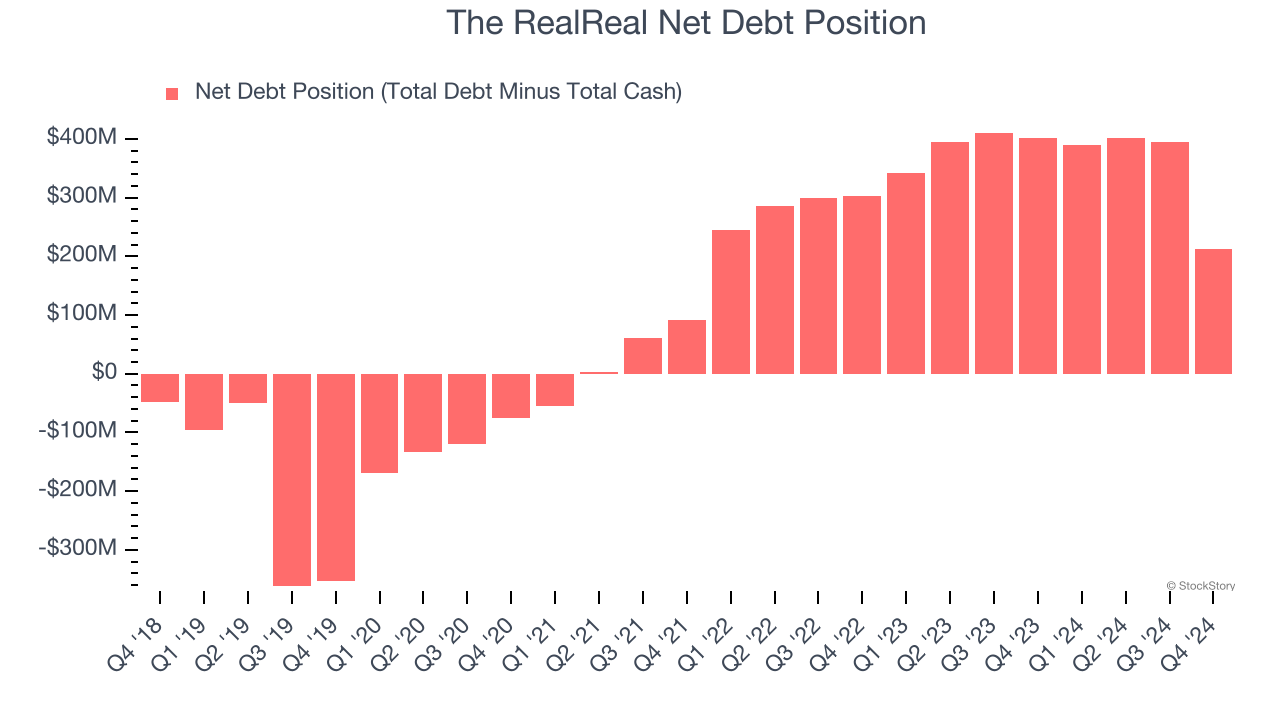

3. High Debt Levels Increase Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

The RealReal’s $385.4 million of debt exceeds the $172.2 million of cash on its balance sheet. Furthermore, its 23× net-debt-to-EBITDA ratio (based on its EBITDA of $9.31 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. The RealReal could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope The RealReal can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

Final Judgment

The RealReal isn’t a terrible business, but it doesn’t pass our bar. After the recent surge, the stock trades at 23.8× forward EV-to-EBITDA (or $6.06 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're pretty confident there are superior stocks to buy right now. We’d recommend looking at an all-weather company that owns household favorite Taco Bell.

Stocks We Would Buy Instead of The RealReal

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.