Over the past six months, Landstar’s stock price fell to $151.87. Shareholders have lost 18.8% of their capital, disappointing when considering the S&P 500 was flat. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is now the time to buy Landstar, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Despite the more favorable entry price, we're sitting this one out for now. Here are three reasons why there are better opportunities than LSTR and a stock we'd rather own.

Why Do We Think Landstar Will Underperform?

Covering billions of miles throughout North America, Landstar (NASDAQ: LSTR) is a transportation company specializing in freight and last-mile delivery services.

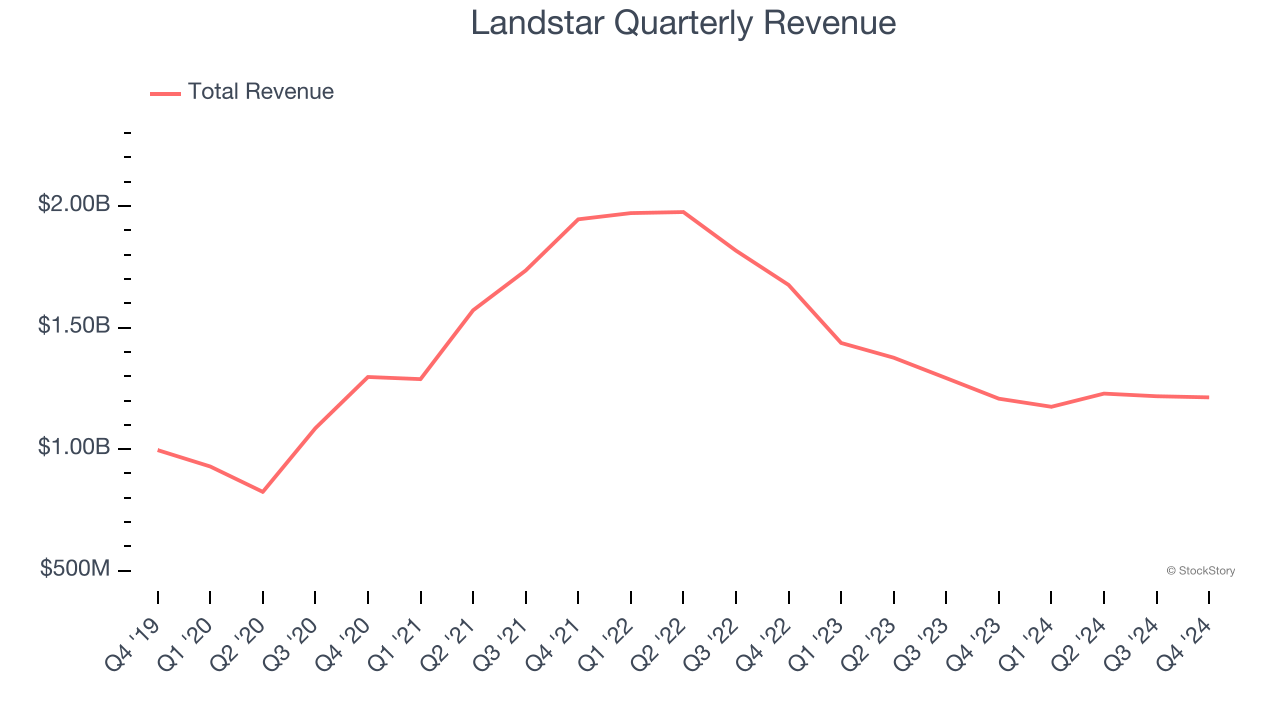

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Landstar’s sales grew at a sluggish 3.4% compounded annual growth rate over the last five years. This fell short of our benchmark for the industrials sector.

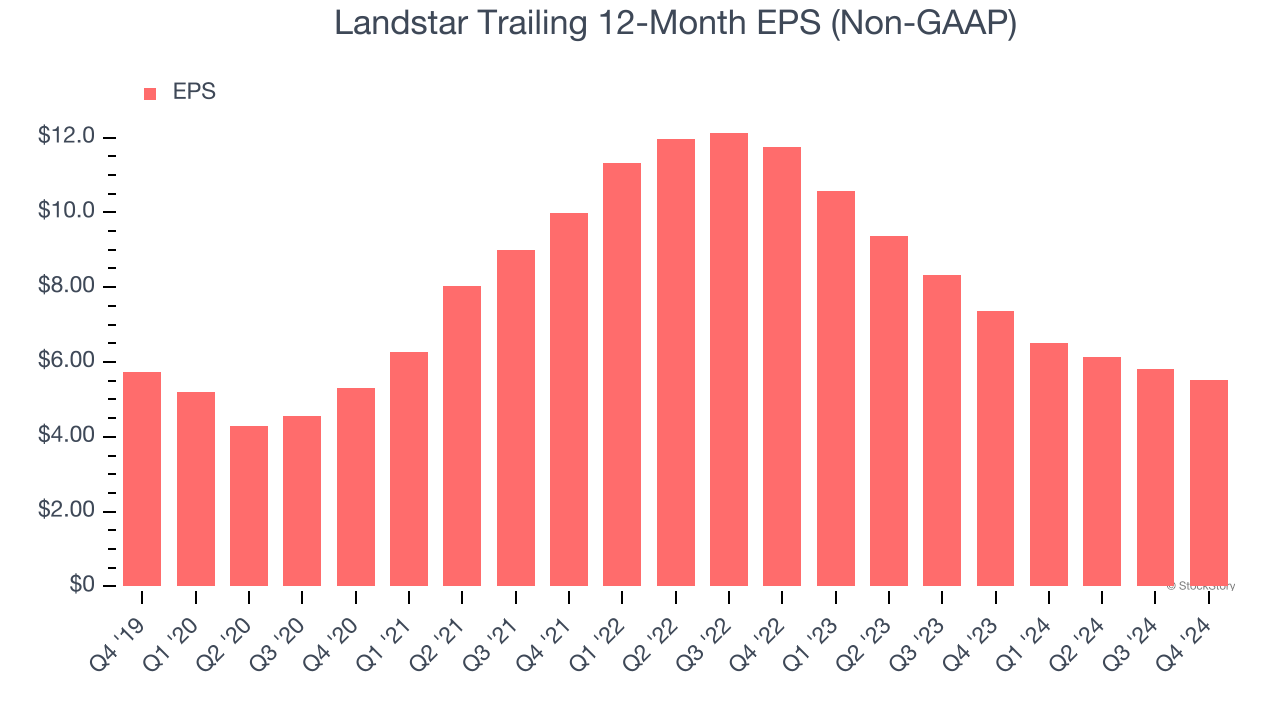

2. EPS Growth Has Stalled

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Landstar’s flat EPS over the last five years was below its 3.4% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

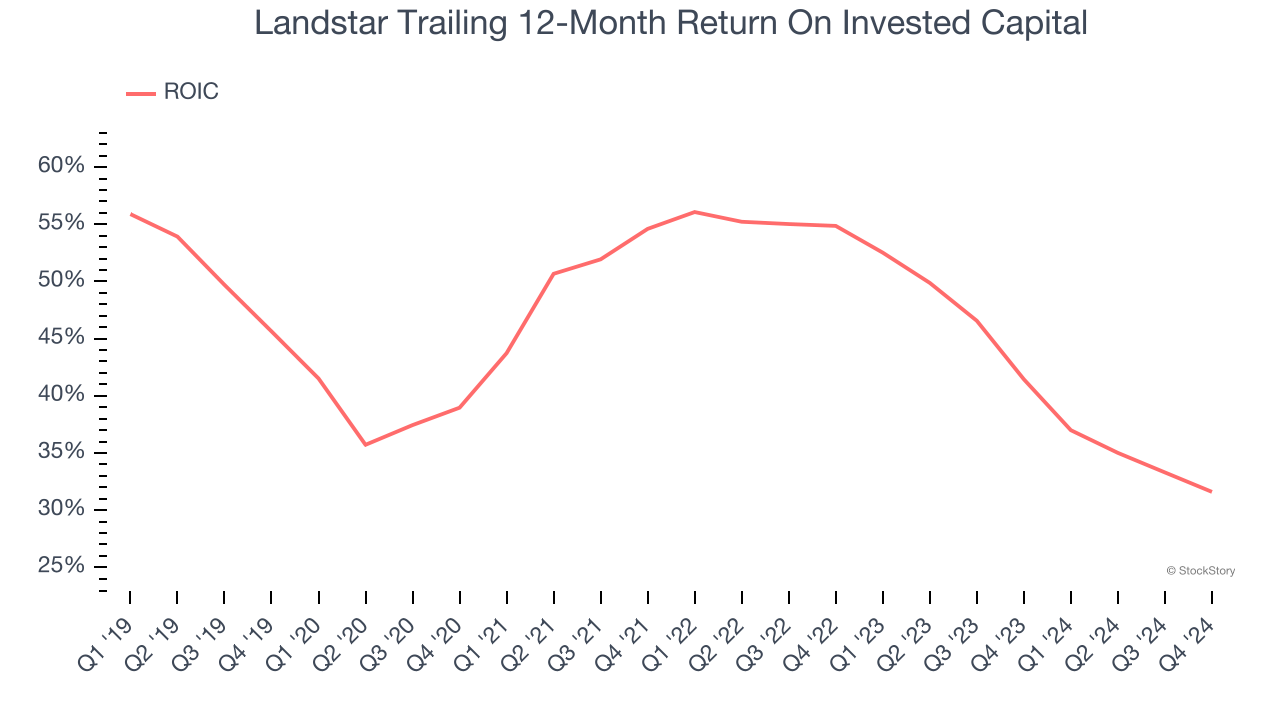

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Landstar’s ROIC has unfortunately decreased significantly. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

We see the value of companies helping their customers, but in the case of Landstar, we’re out. After the recent drawdown, the stock trades at 23.3× forward price-to-earnings (or $151.87 per share). This multiple tells us a lot of good news is priced in - we think there are better stocks to buy right now. Let us point you toward a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Would Buy Instead of Landstar

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.