Wrapping up Q4 earnings, we look at the numbers and key takeaways for the commercial building products stocks, including AZZ (NYSE: AZZ) and its peers.

Commercial building products companies, which often serve more complicated projects, can supplement their core business with higher-margin installation and consulting services revenues. More recently, advances to address labor availability and job site productivity have spurred innovation. Additionally, companies in the space that can produce more energy-efficient materials have opportunities to take share. However, these companies are at the whim of commercial construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of commercial building products companies.

The 5 commercial building products stocks we track reported a very strong Q4. As a group, revenues beat analysts’ consensus estimates by 8.4%.

While some commercial building products stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 1.9% since the latest earnings results.

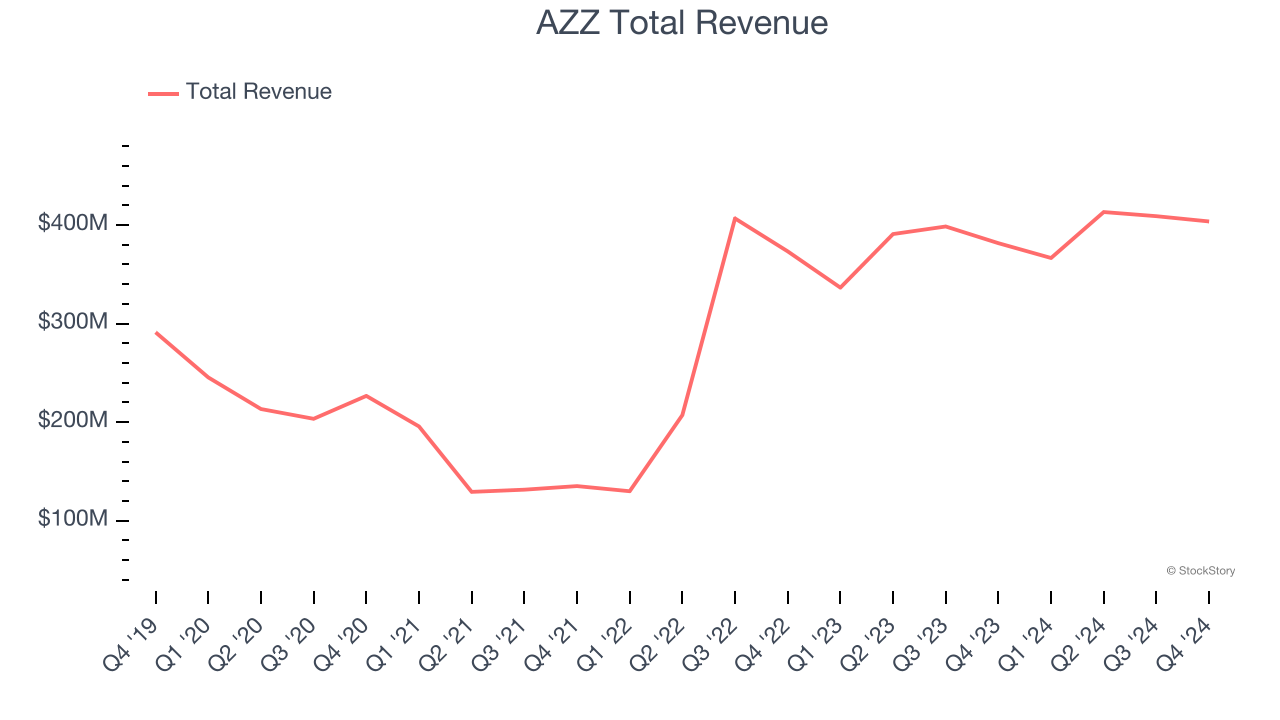

Weakest Q4: AZZ (NYSE: AZZ)

Responsible for projects like nuclear facilities, AZZ (NYSE: AZZ) is a provider of metal coating and power infrastructure solutions.

AZZ reported revenues of $403.7 million, up 5.8% year on year. This print exceeded analysts’ expectations by 1.8%. Overall, it was a satisfactory quarter for the company with a solid beat of analysts’ EBITDA estimates but full-year revenue guidance missing analysts’ expectations.

Tom Ferguson, President, and Chief Executive Officer of AZZ, commented, "Third quarter results exceeded expectations as third quarter sales grew to $403.7 million, up 5.8% over the prior year, with Adjusted EPS of $1.39. Consolidated Adjusted EBITDA grew to $90.7 million, or 22.5% of sales, primarily driven by higher volume for hot-dip galvanized steel and coil-coated materials and operational productivity over the prior year. Metal Coatings benefited from lower zinc costs and improved zinc utilization and delivered an Adjusted EBITDA margin of 31.5%. Precoat Metals' Adjusted EBITDA margin improved to 19.1%, primarily due to sales growth, favorable mix and improved operational performance.

AZZ delivered the weakest performance against analyst estimates and weakest full-year guidance update of the whole group. The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $85.50.

Is now the time to buy AZZ? Access our full analysis of the earnings results here, it’s free.

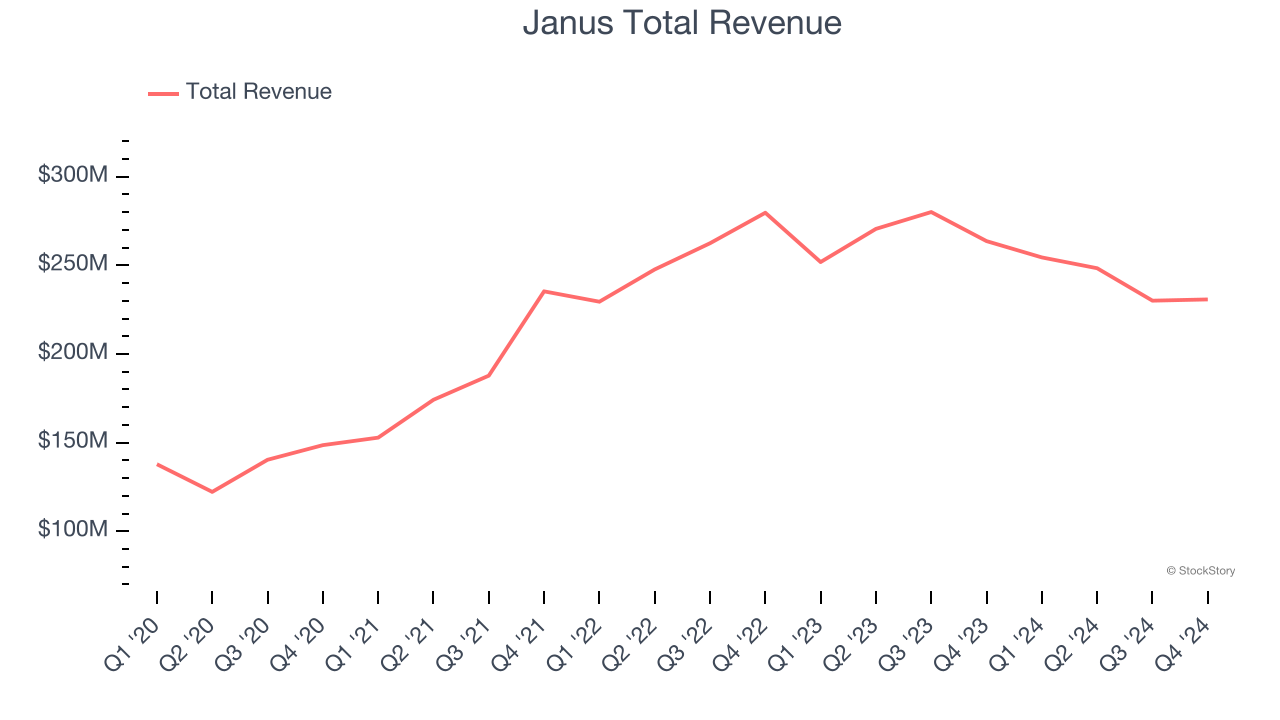

Best Q4: Janus (NYSE: JBI)

Standing out with its digital keyless entry into self-storage room technology, Janus (NYSE: JBI) is a provider of easily accessible self-storage solutions.

Janus reported revenues of $230.8 million, down 12.5% year on year, outperforming analysts’ expectations by 24.1%. The business had an incredible quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

Janus scored the biggest analyst estimates beat and highest full-year guidance raise among its peers. However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $8.01.

Is now the time to buy Janus? Access our full analysis of the earnings results here, it’s free.

Apogee (NASDAQ: APOG)

Involved in the design of the Apple Store on Fifth Avenue in New York City, Apogee (NASDAQ: APOG) sells architectural products and services such as high-performance glass for commercial buildings.

Apogee reported revenues of $341.3 million, flat year on year, exceeding analysts’ expectations by 2.8%. It may have had the worst quarter among its peers, but its results were still good as it also locked in a solid beat of analysts’ EBITDA estimates and a decent beat of analysts’ EPS estimates.

As expected, the stock is down 32.7% since the results and currently trades at $47.87.

Read our full analysis of Apogee’s results here.

Johnson Controls (NYSE: JCI)

Founded after patenting the electric room thermostat, Johnson Controls (NYSE: JCI) specializes in building products and technology solutions, including HVAC systems, fire and security systems, and energy storage.

Johnson Controls reported revenues of $5.43 billion, up 4.2% year on year. This result topped analysts’ expectations by 2.7%. It was an exceptional quarter as it also logged an impressive beat of analysts’ organic revenue and adjusted operating income estimates.

The stock is up 8.6% since reporting and currently trades at $83.87.

Read our full, actionable report on Johnson Controls here, it’s free.

Insteel (NYSE: IIIN)

Growing from a small wire manufacturer to one of the largest in the U.S., Insteel (NYSE: IIIN) provides steel wire reinforcing products for concrete.

Insteel reported revenues of $129.7 million, up 6.6% year on year. This number beat analysts’ expectations by 10.4%. It was a very strong quarter as it also produced a solid beat of analysts’ EBITDA estimates.

Insteel scored the fastest revenue growth among its peers. The stock is up 14.4% since reporting and currently trades at $28.40.

Read our full, actionable report on Insteel here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.