The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Waste Management (NYSE: WM) and the rest of the waste management stocks fared in Q4.

Waste management companies can possess licenses permitting them to handle hazardous materials. Furthermore, many services are performed through contracts and statutorily mandated, non-discretionary, or recurring, leading to more predictable revenue streams. However, regulation can be a headwind, rendering existing services obsolete or forcing companies to invest precious capital to comply with new, more environmentally-friendly rules. Lastly, waste management companies are at the whim of economic cycles. Interest rates, for example, can greatly impact industrial production or commercial projects that create waste and byproducts.

The 9 waste management stocks we track reported a slower Q4. As a group, revenues missed analysts’ consensus estimates by 1.2%.

While some waste management stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 4.8% since the latest earnings results.

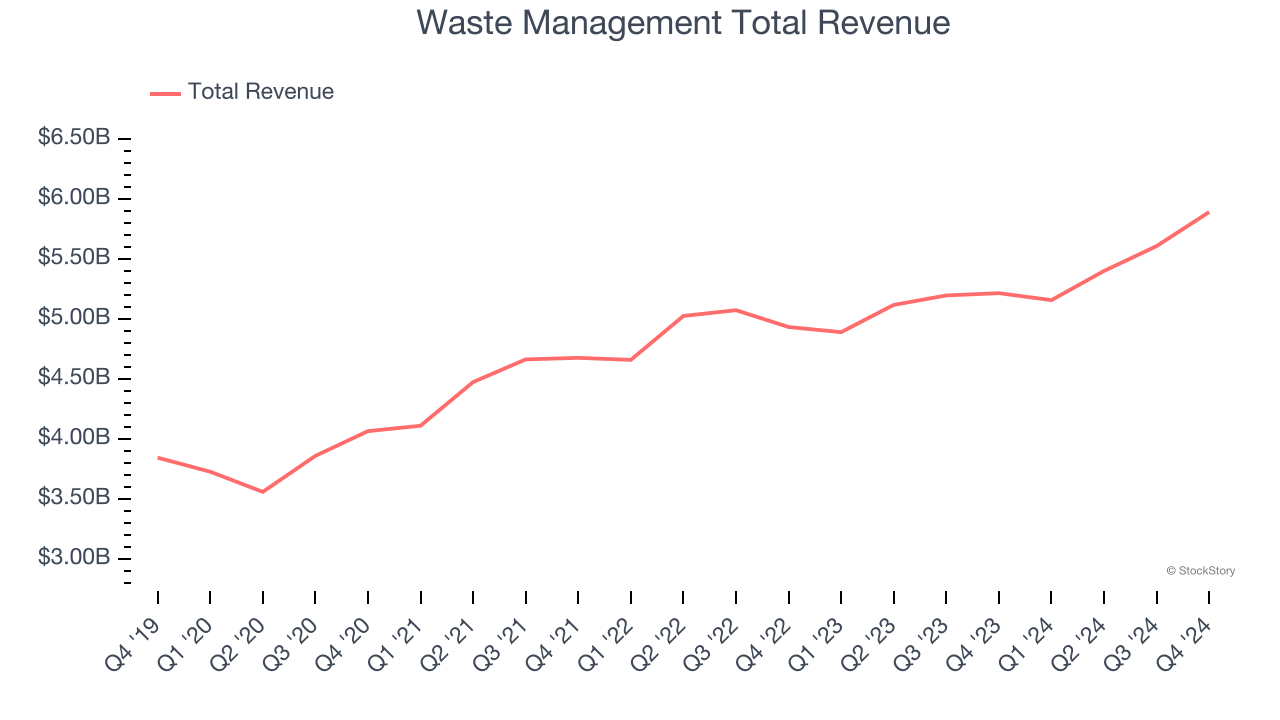

Waste Management (NYSE: WM)

Headquartered in Houston, Waste Management (NYSE: WM) is a provider of comprehensive waste management services in North America.

Waste Management reported revenues of $5.89 billion, up 13% year on year. This print exceeded analysts’ expectations by 0.9%. Despite the top-line beat, it was still a slower quarter for the company with a significant miss of analysts’ adjusted operating income and EPS estimates.

“The WM team achieved another year of exceptional results by continuously improving our core business, expanding our sustainability platforms, and adding medical waste and secure information destruction solutions for our customers,” said Jim Fish, WM’s President and CEO.

The stock is up 8.4% since reporting and currently trades at $227.39.

Is now the time to buy Waste Management? Access our full analysis of the earnings results here, it’s free.

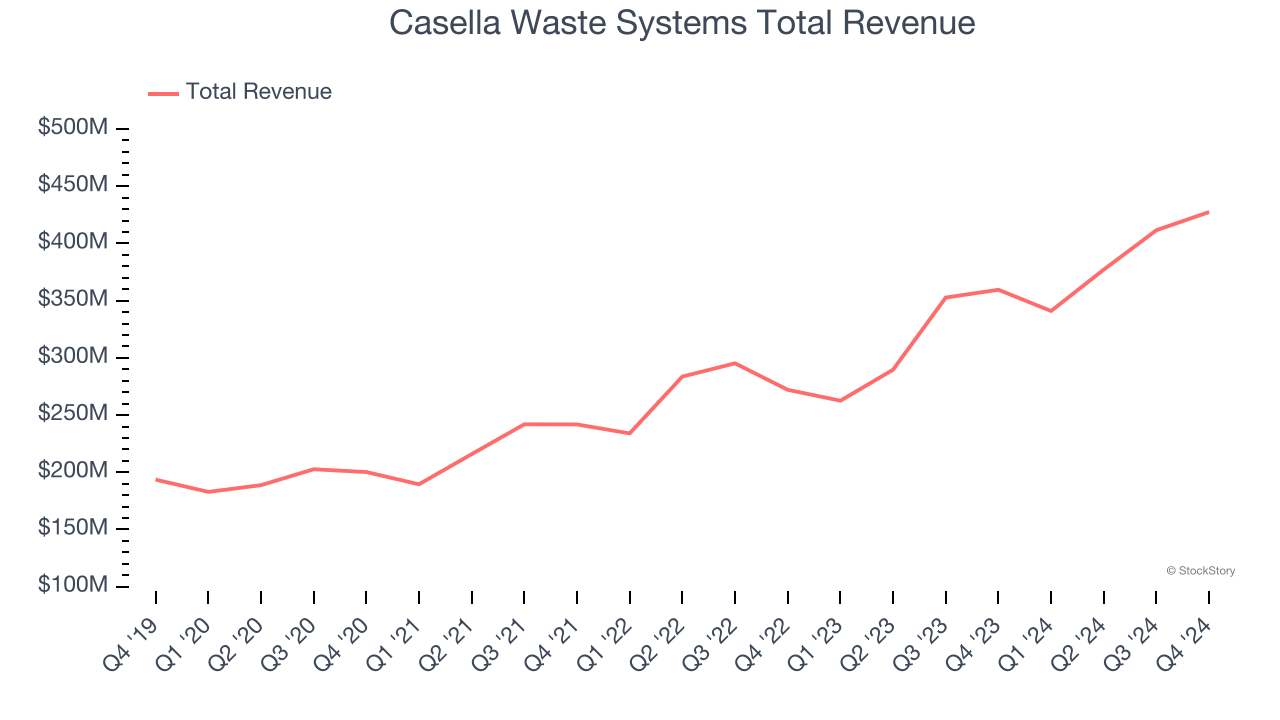

Best Q4: Casella Waste Systems (NASDAQ: CWST)

Starting with the founder picking up garbage with a pickup truck he purchased using savings from high school, Casella (NASDAQ: CWST) offers waste management services for businesses, residents, and the government.

Casella Waste Systems reported revenues of $427.5 million, up 18.9% year on year, outperforming analysts’ expectations by 2.3%. The business had an exceptional quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Casella Waste Systems scored the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise among its peers. The market seems content with the results as the stock is up 3.8% since reporting. It currently trades at $110.82.

Is now the time to buy Casella Waste Systems? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Quest Resource (NASDAQ: QRHC)

Recycling corporate waste to help companies be more sustainable, Quest Resource (NASDAQ: QRHC) is a provider of waste and recycling services.

Quest Resource reported revenues of $69.97 million, flat year on year, falling short of analysts’ expectations by 5%. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA and EPS estimates.

As expected, the stock is down 25.1% since the results and currently trades at $2.90.

Read our full analysis of Quest Resource’s results here.

Waste Connections (NYSE: WCN)

Operating a network of municipal solid waste landfills in the U.S. and Canada, Waste Connections (NYSE: WCN) is North America's third-largest waste management company providing collection, disposal, and recycling services.

Waste Connections reported revenues of $2.26 billion, up 11% year on year. This result surpassed analysts’ expectations by 0.8%. Zooming out, it was a slower quarter as it recorded a significant miss of analysts’ EBITDA estimates and a miss of analysts’ EPS estimates.

The stock is up 1% since reporting and currently trades at $191.70.

Read our full, actionable report on Waste Connections here, it’s free.

Enviri (NYSE: NVRI)

Cooling America’s first indoor ice rink in the 19th century, Enviri (NYSE: NVRI) offers steel and waste handling services.

Enviri reported revenues of $558.7 million, up 5.7% year on year. This number lagged analysts' expectations by 3.5%. It was a softer quarter as it also logged full-year EBITDA guidance missing analysts’ expectations and EBITDA guidance for next quarter missing analysts’ expectations significantly.

The stock is down 16.9% since reporting and currently trades at $7.26.

Read our full, actionable report on Enviri here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.