Over the past six months, Werner’s stock price fell to $30.06. Shareholders have lost 19.8% of their capital, disappointing when considering the S&P 500 was flat. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in Werner, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Even with the cheaper entry price, we're sitting this one out for now. Here are three reasons why there are better opportunities than WERN and a stock we'd rather own.

Why Do We Think Werner Will Underperform?

Conducting business in over a 100 countries, Werner (NASDAQ: WERN) offers full-truckload, less-than-truckload, and intermodal delivery services.

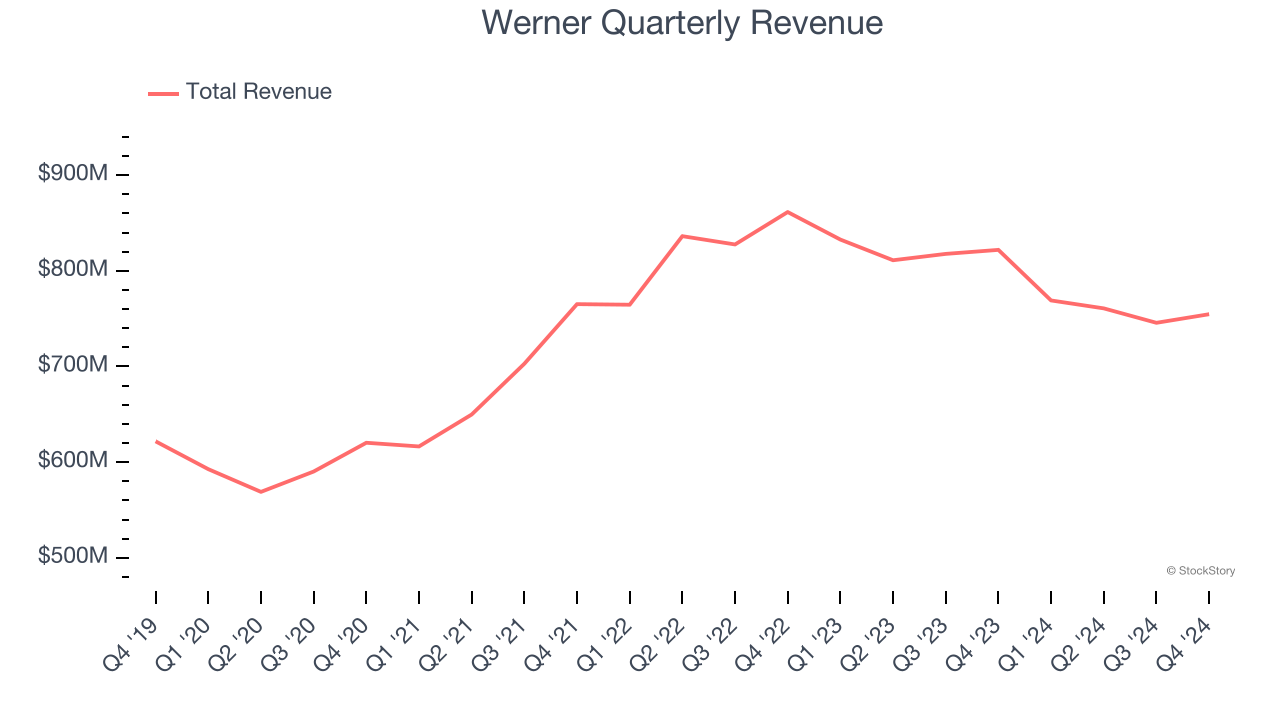

1. Long-Term Revenue Growth Disappoints

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Werner’s 4.2% annualized revenue growth over the last five years was sluggish. This was below our standard for the industrials sector.

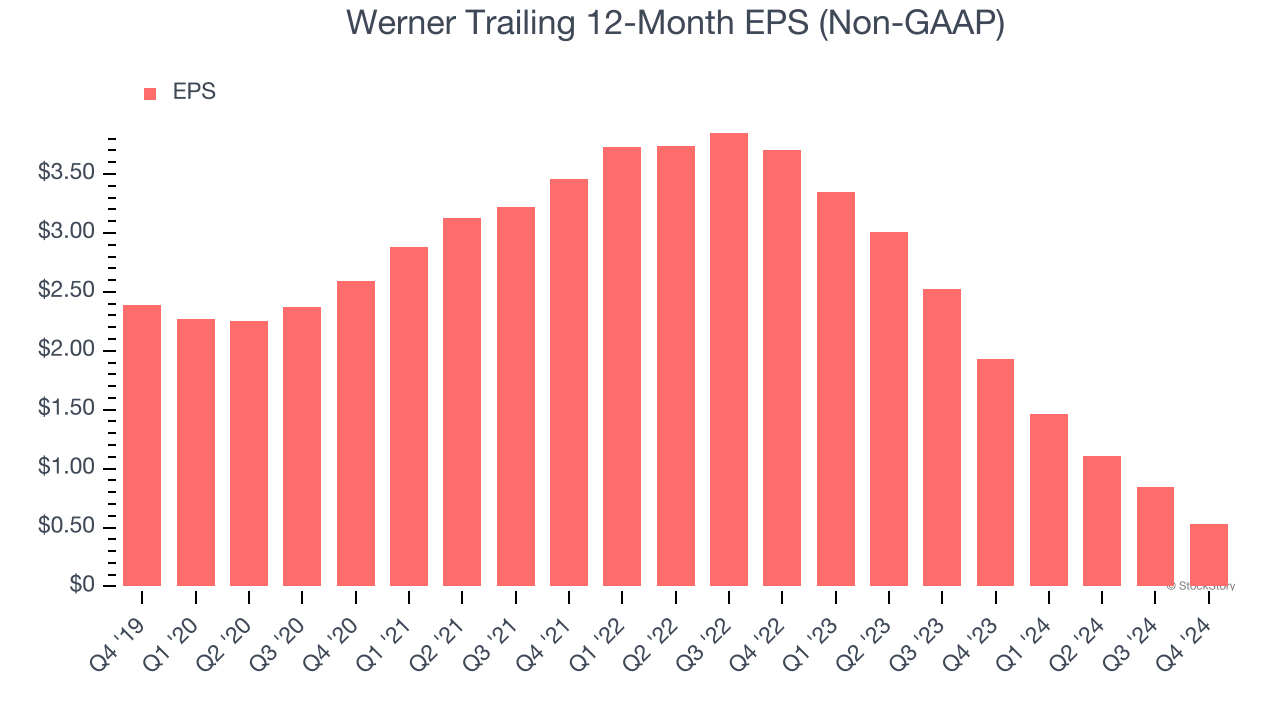

2. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Werner, its EPS declined by 26% annually over the last five years while its revenue grew by 4.2%. This tells us the company became less profitable on a per-share basis as it expanded.

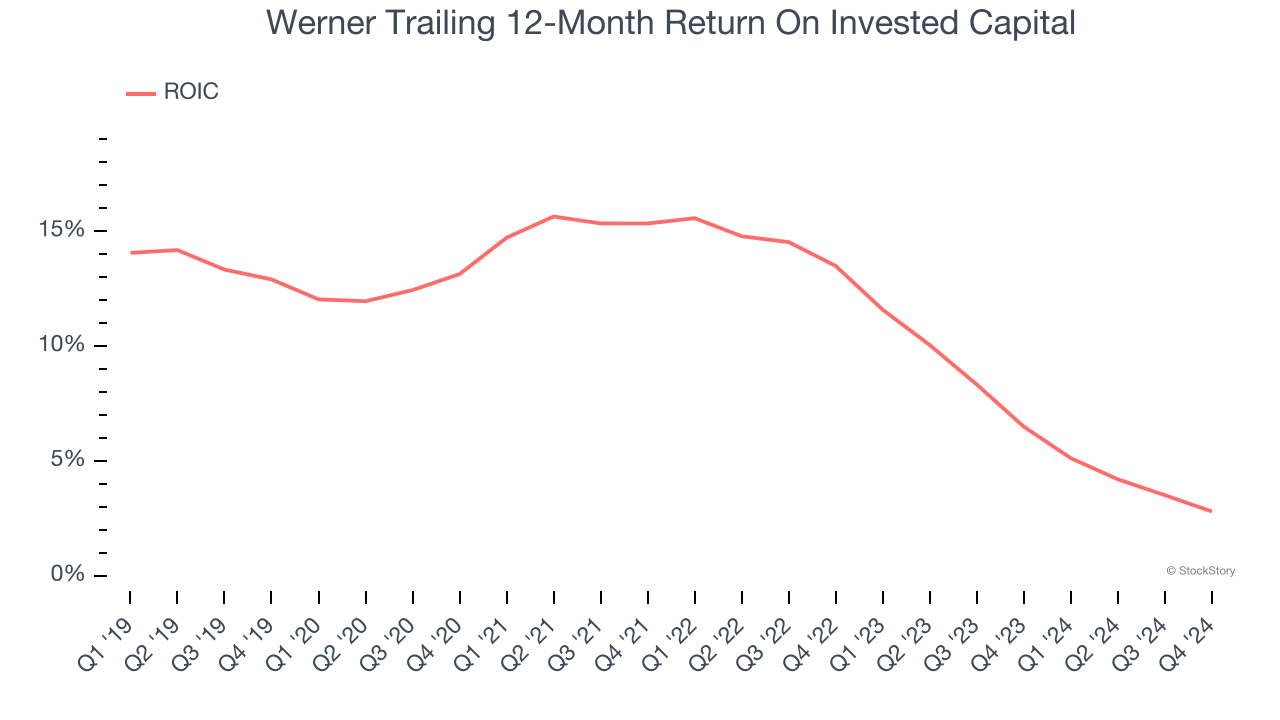

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Werner’s ROIC has unfortunately decreased. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

We cheer for all companies making their customers lives easier, but in the case of Werner, we’ll be cheering from the sidelines. After the recent drawdown, the stock trades at 24.3× forward price-to-earnings (or $30.06 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better opportunities elsewhere. Let us point you toward one of our top software and edge computing picks.

Stocks We Would Buy Instead of Werner

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.