As the Q4 earnings season wraps, let’s dig into this quarter’s best and worst performers in the government & technical consulting industry, including Amentum (NYSE: AMTM) and its peers.

The sector has historically benefitted from steady government spending on defense, infrastructure, and regulatory compliance, providing firms long-term contract stability. However, the Trump administration is showing more willingness than previous administrations to upend government spending and bloat. Whether or not defense budgets get cut, the rising demand for cybersecurity, AI-driven defense solutions, and sustainability consulting should benefit the sector for years, as agencies and enterprises seek expertise in navigating complex technology and regulations. Additionally, industrial automation and digital engineering are driving efficiency gains in infrastructure and technical consulting projects, which could help profit margins.

The 7 government & technical consulting stocks we track reported a very strong Q4. As a group, revenues beat analysts’ consensus estimates by 2.5% while next quarter’s revenue guidance was 7.7% above.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 6.7% since the latest earnings results.

Amentum (NYSE: AMTM)

With operations spanning approximately 80 countries and a workforce of specialized engineers and technical experts, Amentum Holdings (NYSE: AMTM) provides advanced engineering and technology solutions to U.S. government agencies, allied governments, and commercial enterprises across defense, energy, and space sectors.

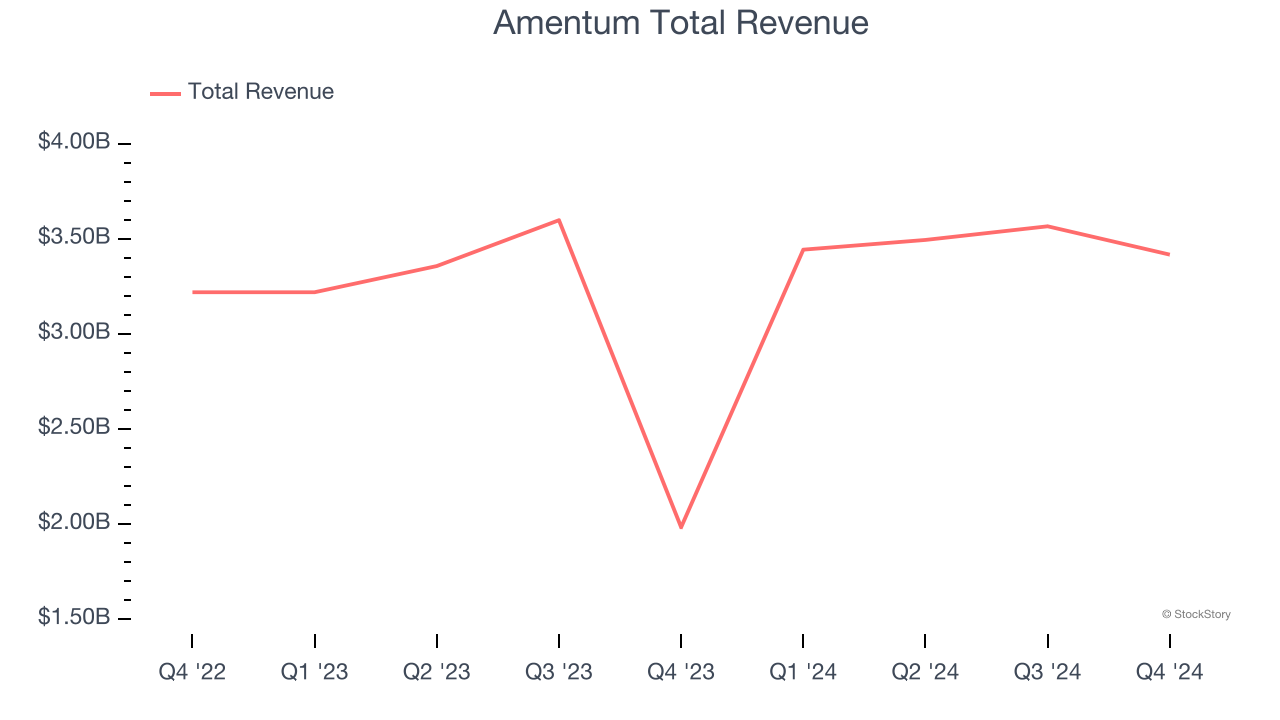

Amentum reported revenues of $3.42 billion, up 72.3% year on year. This print exceeded analysts’ expectations by 2.1%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ EPS estimates.

Amentum scored the fastest revenue growth but had the weakest full-year guidance update of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 10.6% since reporting and currently trades at $18.33.

We think Amentum is a good business, but is it a buy today? Read our full report here, it’s free.

Best Q4: UL Solutions (NYSE: ULS)

Founded in 1894 as a response to the growing dangers of electricity in American homes and businesses, UL Solutions (NYSE: ULS) provides testing, inspection, and certification services that help companies ensure their products meet safety, security, and sustainability standards.

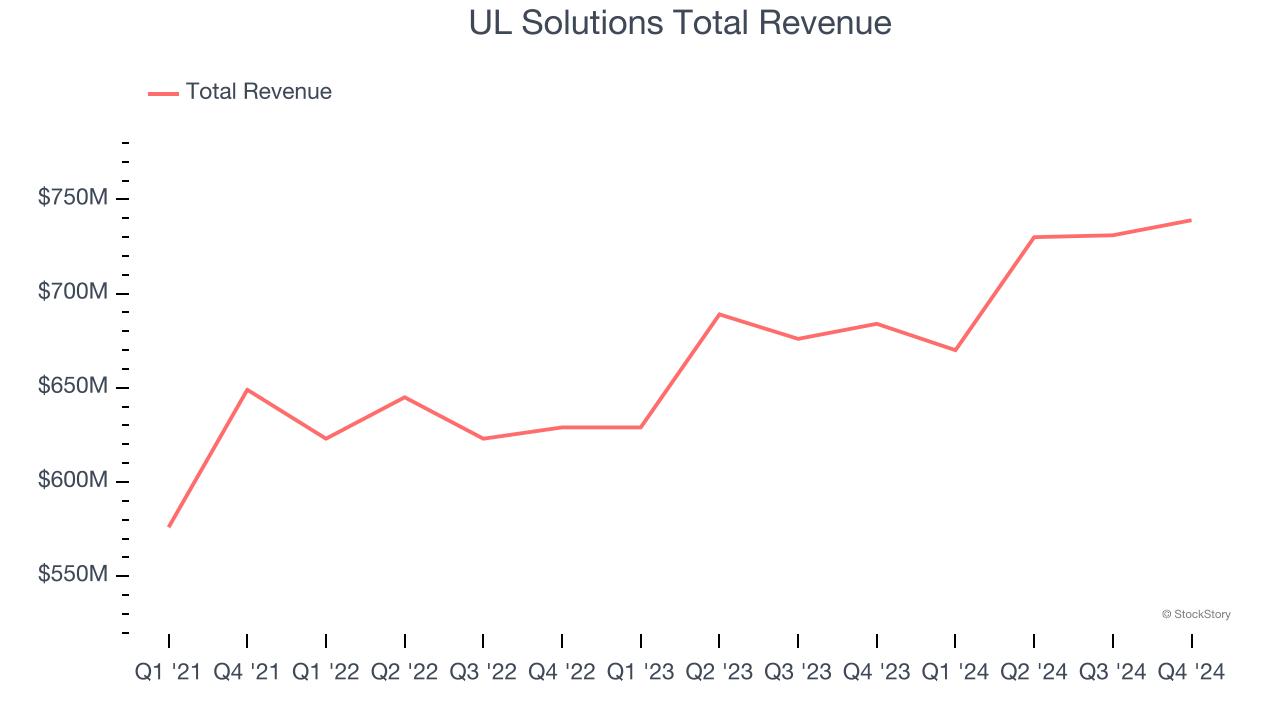

UL Solutions reported revenues of $739 million, up 8% year on year, outperforming analysts’ expectations by 1.9%. The business had an exceptional quarter with an impressive beat of analysts’ EPS estimates.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 1.4% since reporting. It currently trades at $54.78.

Is now the time to buy UL Solutions? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Booz Allen Hamilton (NYSE: BAH)

With roots dating back to 1914 and deep ties to nearly all U.S. cabinet-level departments, Booz Allen Hamilton (NYSE: BAH) provides management consulting, technology services, and cybersecurity solutions primarily to U.S. government agencies and military branches.

Booz Allen Hamilton reported revenues of $2.92 billion, up 13.5% year on year, exceeding analysts’ expectations by 1.7%. It may have had the worst quarter among its peers, but its results were still good as it also locked in a solid beat of analysts’ organic revenue estimates and a decent beat of analysts’ EPS estimates.

As expected, the stock is down 19.2% since the results and currently trades at $104.17.

Read our full analysis of Booz Allen Hamilton’s results here.

NV5 Global (NASDAQ: NVEE)

Operating from over 100 locations across the U.S. and internationally, NV5 Global (NASDAQ: NVEE) provides engineering, environmental, geospatial, and technical consulting services to public and private sector clients for infrastructure and building projects.

NV5 Global reported revenues of $246.5 million, up 14.7% year on year. This result topped analysts’ expectations by 1.6%. It was a very strong quarter with full-year revenue guidance exceeding analysts’ expectations.

NV5 Global pulled off the highest full-year guidance raise among its peers. The stock is up 8.9% since reporting and currently trades at $18.98.

Read our full, actionable report on NV5 Global here, it’s free.

Maximus (NYSE: MMS)

With nearly 50 years of experience translating public policy into operational programs that serve millions of citizens, Maximus (NYSE: MMS) provides operational services, clinical assessments, and technology solutions to government agencies in the U.S. and internationally.

Maximus reported revenues of $1.40 billion, up 5.7% year on year. This print beat analysts’ expectations by 8.8%. Overall, it was a very strong quarter as it also logged a solid beat of analysts’ EPS estimates and full-year revenue guidance meeting analysts’ expectations.

Maximus scored the biggest analyst estimates beat among its peers. The stock is down 11% since reporting and currently trades at $67.66.

Read our full, actionable report on Maximus here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.