Wrapping up Q4 earnings, we look at the numbers and key takeaways for the home construction materials stocks, including Quanex (NYSE: NX) and its peers.

Traditionally, home construction materials companies have built economic moats with expertise in specialized areas, brand recognition, and strong relationships with contractors. More recently, advances to address labor availability and job site productivity have spurred innovation that is driving incremental demand. However, these companies are at the whim of residential construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of home construction materials companies.

The 12 home construction materials stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 1.5%.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 8.4% since the latest earnings results.

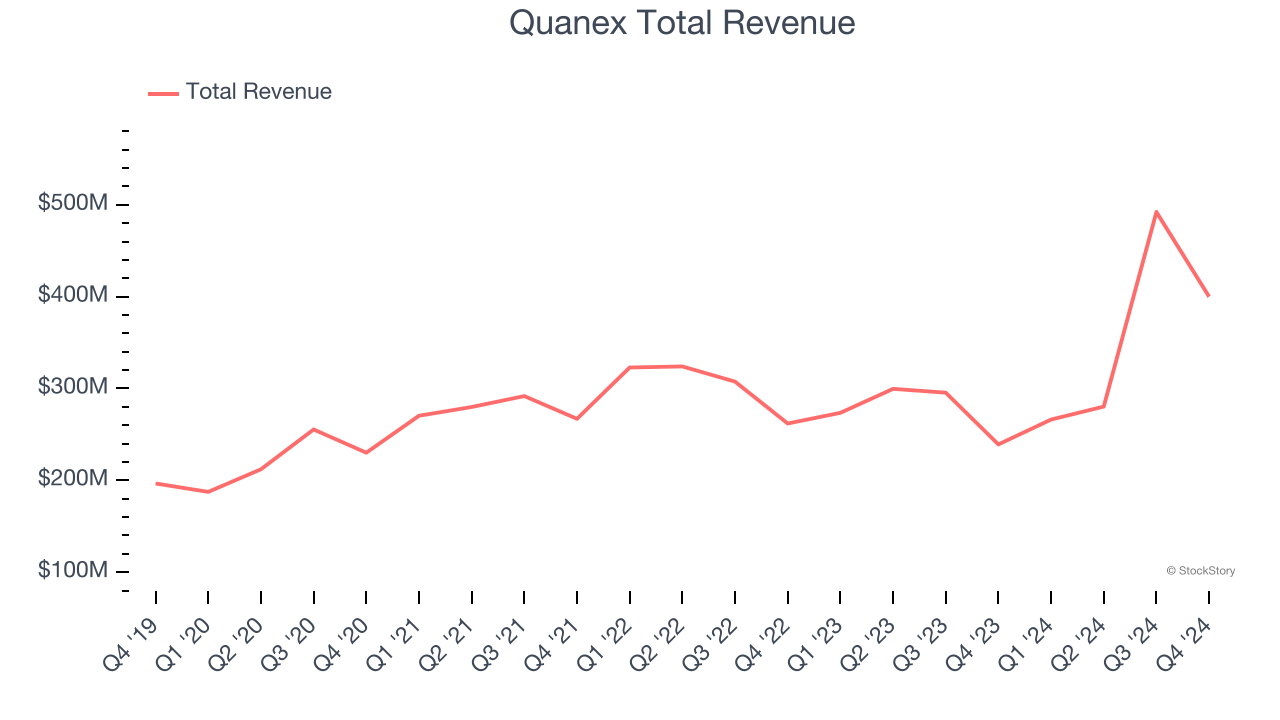

Quanex (NYSE: NX)

Starting in the seamless tube industry, Quanex (NYSE: NX) manufactures building products like window, door, kitchen, and bath cabinet components.

Quanex reported revenues of $400 million, up 67.3% year on year. This print exceeded analysts’ expectations by 4.6%. Overall, it was an exceptional quarter for the company with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

George Wilson, Chairman, President and Chief Executive Officer, stated, “The first quarter of 2025 was a very busy time for Quanex internally and I would like to thank all my Quanex teammates for their continuous efforts as we navigate through the process of integrating legacy Quanex with legacy Tyman."

Quanex achieved the fastest revenue growth of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 2.5% since reporting and currently trades at $19.92.

Is now the time to buy Quanex? Access our full analysis of the earnings results here, it’s free.

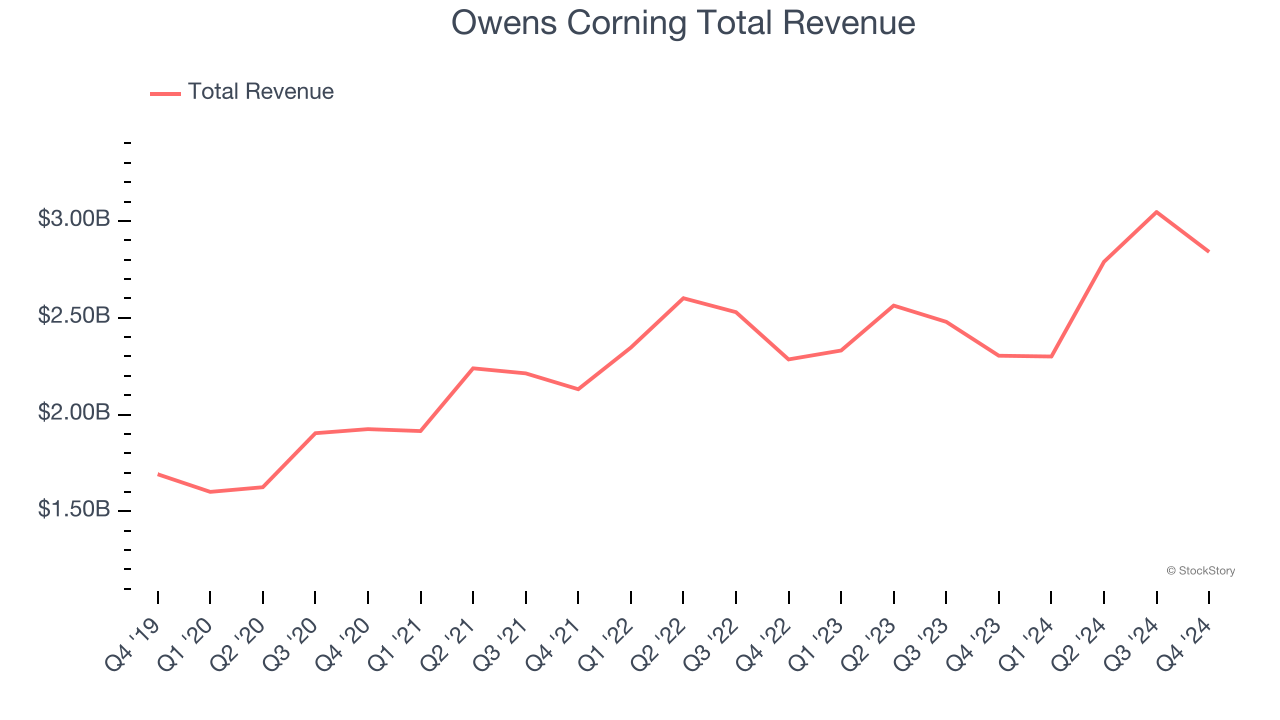

Best Q4: Owens Corning (NYSE: OC)

Credited with the discovery of fiberglass, Owens Corning (NYSE: OC) supplies building and construction materials to the United States and international markets.

Owens Corning reported revenues of $2.84 billion, up 23.3% year on year, outperforming analysts’ expectations by 2.7%. The business had a stunning quarter with a solid beat of analysts’ organic revenue and EBITDA estimates.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 12% since reporting. It currently trades at $145.74.

Is now the time to buy Owens Corning? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: American Woodmark (NASDAQ: AMWD)

Starting as a small millwork shop, American Woodmark (NASDAQ: AMWD) is a cabinet manufacturing company that helps customers from inspiration to installation.

American Woodmark reported revenues of $397.6 million, down 5.8% year on year, falling short of analysts’ expectations by 3.3%. It was a disappointing quarter as it posted full-year EBITDA guidance missing analysts’ expectations.

As expected, the stock is down 17% since the results and currently trades at $59.08.

Read our full analysis of American Woodmark’s results here.

Simpson (NYSE: SSD)

Aiming to build safer and stronger buildings, Simpson (NYSE: SSD) designs and manufactures structural connectors, anchors, and other construction products.

Simpson reported revenues of $517.4 million, up 3.1% year on year. This print surpassed analysts’ expectations by 4.3%. It was an exceptional quarter as it also recorded an impressive beat of analysts’ EBITDA estimates and a decent beat of analysts’ EPS estimates.

The stock is down 6% since reporting and currently trades at $156.92.

Read our full, actionable report on Simpson here, it’s free.

Gibraltar (NASDAQ: ROCK)

Gibraltar (NASDAQ: ROCK) makes renewable energy, agriculture technology and infrastructure products. Its mission statement is to make everyday living more sustainable.

Gibraltar reported revenues of $302.1 million, down 8.1% year on year. This number came in 1.9% below analysts' expectations. Aside from that, it was a very strong quarter as it logged full-year EPS guidance exceeding analysts’ expectations and an impressive beat of analysts’ EBITDA estimates.

Gibraltar achieved the highest full-year guidance raise among its peers. The stock is up 5.5% since reporting and currently trades at $61.20.

Read our full, actionable report on Gibraltar here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.