Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at UFP Industries (NASDAQ: UFPI) and the best and worst performers in the building materials industry.

Traditionally, building materials companies have built competitive advantages with economies of scale, brand recognition, and strong relationships with builders and contractors. More recently, advances to address labor availability and job site productivity have spurred innovation. Additionally, companies in the space that can produce more energy-efficient materials have opportunities to take share. However, these companies are at the whim of construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of building materials companies.

The 9 building materials stocks we track reported a strong Q4. As a group, revenues beat analysts’ consensus estimates by 2% while next quarter’s revenue guidance was 1.8% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 7.6% since the latest earnings results.

UFP Industries (NASDAQ: UFPI)

Beginning as a lumber supplier in the 1950s, UFP Industries (NASDAQ: UFPI) is a holding company making building materials for the construction, retail, and industrial sectors.

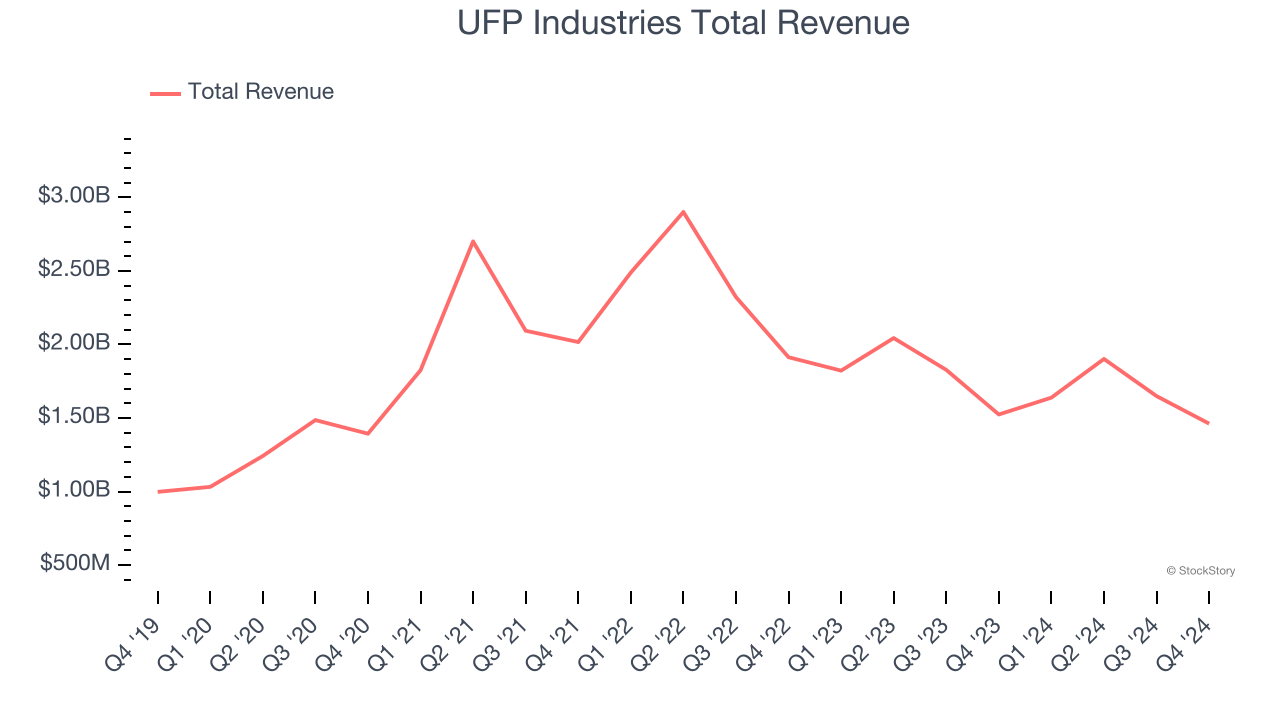

UFP Industries reported revenues of $1.46 billion, down 4.1% year on year. This print exceeded analysts’ expectations by 2.7%. Overall, it was a satisfactory quarter for the company with an impressive beat of analysts’ sales volume estimates but a significant miss of analysts’ adjusted operating income estimates.

“I feel honored to step into the role as CEO at UFP Industries and help build on the company’s incredibly rich history,” said Will Schwartz.

UFP Industries delivered the slowest revenue growth of the whole group. The stock is down 7.3% since reporting and currently trades at $107.84.

Is now the time to buy UFP Industries? Access our full analysis of the earnings results here, it’s free.

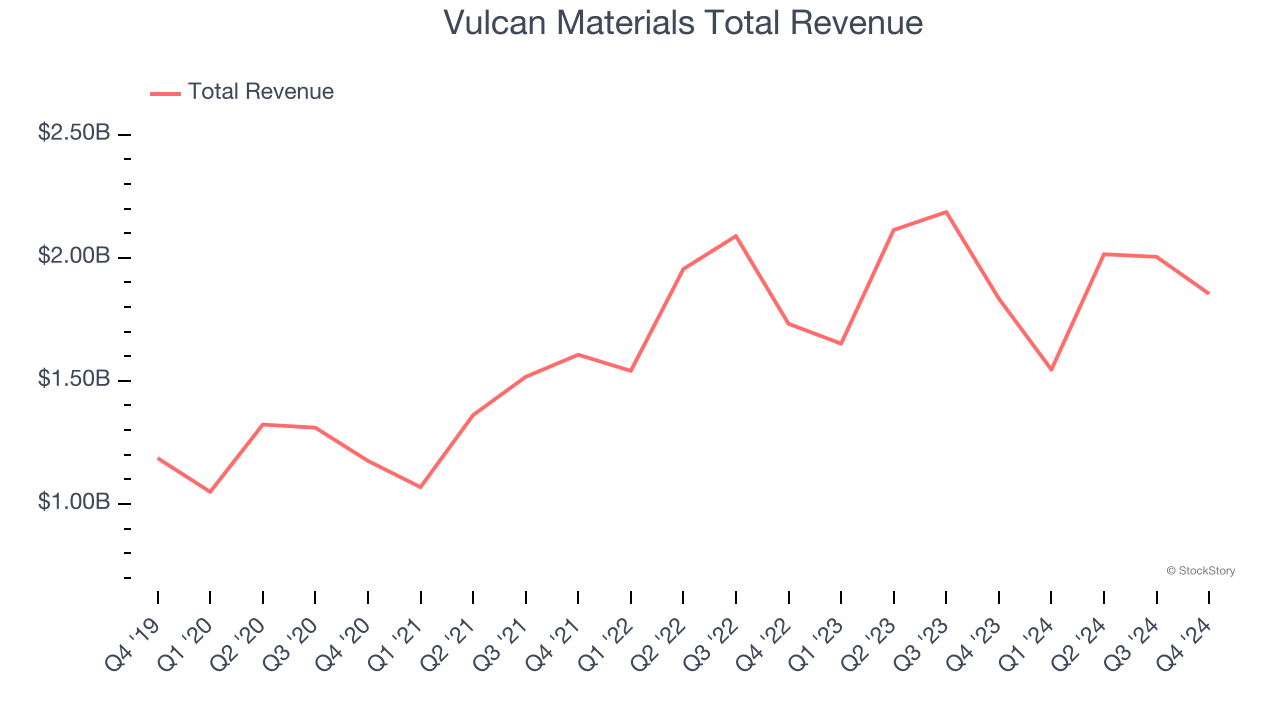

Best Q4: Vulcan Materials (NYSE: VMC)

Founded in 1909, Vulcan Materials (NYSE: VMC) is a producer of construction aggregates, primarily crushed stone, sand, and gravel.

Vulcan Materials reported revenues of $1.85 billion, up 1.1% year on year, outperforming analysts’ expectations by 2.1%. The business had a stunning quarter with a solid beat of analysts’ EBITDA estimates.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 11.9% since reporting. It currently trades at $238.22.

Is now the time to buy Vulcan Materials? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Carlisle (NYSE: CSL)

Originally founded as Carlisle Tire and Rubber Company, Carlisle Companies (NYSE: CSL) is a multi-industry product manufacturer focusing on construction materials and weatherproofing technologies.

Carlisle reported revenues of $1.12 billion, flat year on year, falling short of analysts’ expectations by 1.9%. It was a slower quarter as it posted a miss of analysts’ EBITDA and organic revenue estimates.

Carlisle delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 10.3% since the results and currently trades at $337.30.

Read our full analysis of Carlisle’s results here.

AZEK (NYSE: AZEK)

With a significant portion of its products made from recycled materials, AZEK (NYSE: AZEK) designs and manufactures goods for outdoor living spaces.

AZEK reported revenues of $285.4 million, up 18.7% year on year. This result beat analysts’ expectations by 7.9%. Overall, it was a very strong quarter as it also logged an impressive beat of analysts’ organic revenue estimates and a solid beat of analysts’ EPS estimates.

AZEK delivered the biggest analyst estimates beat among its peers. The stock is down 16.4% since reporting and currently trades at $42.05.

Read our full, actionable report on AZEK here, it’s free.

Tecnoglass (NYSE: TGLS)

The first-ever Colombian company to trade on the NASDAQ, Tecnoglass (NYSE: TGLS) is a manufacturer of architectural glass, windows, and aluminum products.

Tecnoglass reported revenues of $239.6 million, up 23.1% year on year. This number met analysts’ expectations. Aside from that, it was a mixed quarter as it also produced a narrow beat of analysts’ adjusted operating income estimates.

Tecnoglass achieved the fastest revenue growth among its peers. The stock is up 3.4% since reporting and currently trades at $72.26.

Read our full, actionable report on Tecnoglass here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.