Earnings results often indicate what direction a company will take in the months ahead. With Q4 behind us, let’s have a look at Option Care Health (NASDAQ: OPCH) and its peers.

The senior health, home care, and hospice care industries provide essential services to aging populations and patients with chronic or terminal conditions. These companies benefit from stable, recurring revenue driven by relationships with patients and families that can extend many months or even years. However, the labor-intensive nature of the business makes it vulnerable to rising labor costs and staffing shortages, while profitability is constrained by reimbursement rates from Medicare, Medicaid, and private insurers. Looking ahead, the industry is positioned for tailwinds from an aging population, increasing chronic disease prevalence, and a growing preference for personalized in-home care. Advancements in remote monitoring and telehealth are expected to enhance efficiency and care delivery. However, headwinds such as labor shortages, wage inflation, and regulatory uncertainty around reimbursement could pose challenges. Investments in digitization and technology-driven care will be critical for long-term success.

The 7 senior health, home health & hospice stocks we track reported a strong Q4. As a group, revenues beat analysts’ consensus estimates by 2%.

In light of this news, share prices of the companies have held steady as they are up 3.5% on average since the latest earnings results.

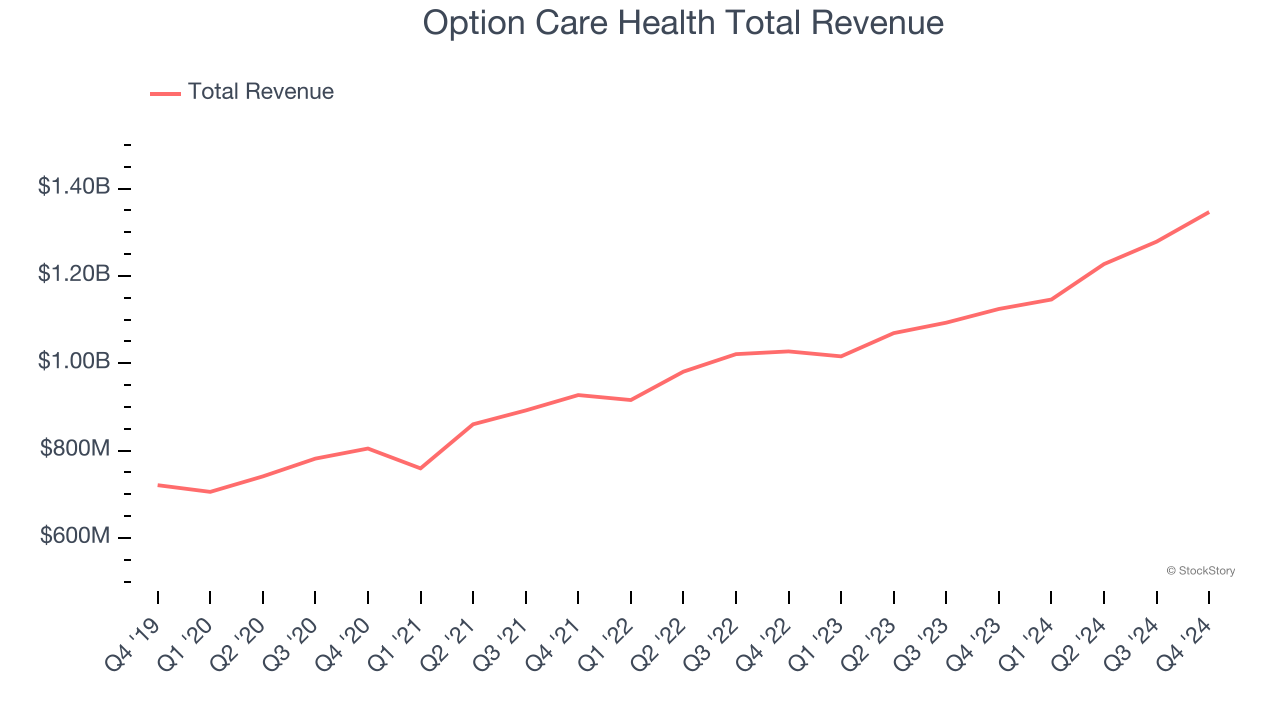

Best Q4: Option Care Health (NASDAQ: OPCH)

With a nationwide network of 177 locations serving 43 states and a team of over 4,500 clinicians, Option Care Health (NASDAQ: OPCH) is the largest independent provider of home and alternate site infusion services, delivering medications and clinical support to patients across the United States.

Option Care Health reported revenues of $1.35 billion, up 19.7% year on year. This print exceeded analysts’ expectations by 4.9%. Overall, it was an exceptional quarter for the company with an impressive beat of analysts’ full-year EPS guidance estimates and a solid beat of analysts’ EPS estimates.

John C. Rademacher, Chief Executive Officer, commented, “The Option Care Health team’s execution produced solid financial results in the fourth quarter and full year 2024, demonstrating resilience in a dynamic and challenging period, while continuing to place the patient at the center of everything that we do. I am excited about the road ahead and the opportunity to leverage our capabilities to provide more patients high quality, affordable care, in a setting in which they wish to receive it.”

Option Care Health scored the biggest analyst estimates beat and highest full-year guidance raise of the whole group. Unsurprisingly, the stock is up 5.8% since reporting and currently trades at $34.53.

Is now the time to buy Option Care Health? Access our full analysis of the earnings results here, it’s free.

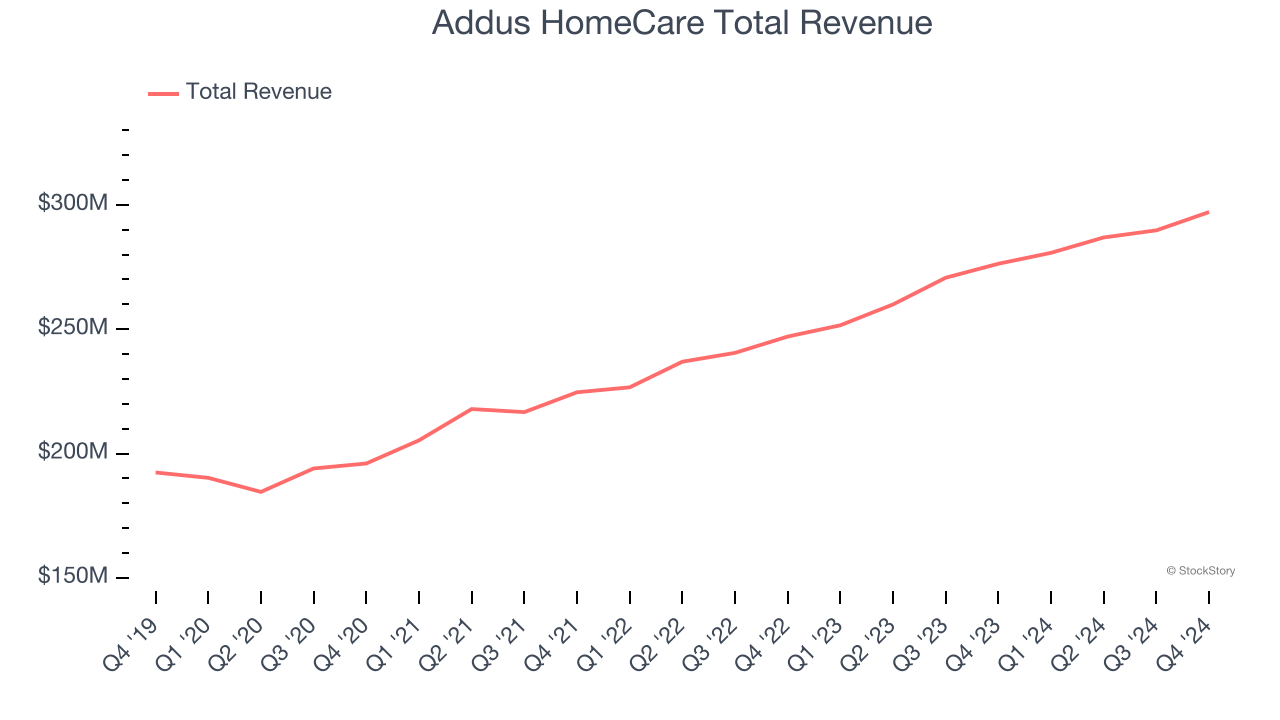

Addus HomeCare (NASDAQ: ADUS)

Serving approximately 66,000 clients across 22 states with a focus on "dual eligible" Medicare and Medicaid beneficiaries, Addus HomeCare (NASDAQ: ADUS) provides in-home personal care, hospice, and home health services to elderly, chronically ill, and disabled individuals.

Addus HomeCare reported revenues of $297.1 million, up 7.5% year on year, outperforming analysts’ expectations by 2.7%. The business had a very strong quarter with a solid beat of analysts’ sales volume estimates and a decent beat of analysts’ EPS estimates.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 16.1% since reporting. It currently trades at $91.24.

Is now the time to buy Addus HomeCare? Access our full analysis of the earnings results here, it’s free.

Slowest Q4: Brookdale (NYSE: BKD)

With a network of over 650 communities serving approximately 59,000 residents across 41 states, Brookdale Senior Living (NYSE: BKD) operates senior living communities across the United States, offering independent living, assisted living, memory care, and continuing care retirement communities.

Brookdale reported revenues of $780.9 million, up 3.5% year on year, in line with analysts’ expectations. It was a slower quarter as it posted a significant miss of analysts’ EPS estimates.

Brookdale delivered the weakest performance against analyst estimates in the group. Interestingly, the stock is up 18.5% since the results and currently trades at $6.29.

Read our full analysis of Brookdale’s results here.

The Pennant Group (NASDAQ: PNTG)

Spun off from The Ensign Group in 2019 to focus on non-skilled nursing healthcare services, Pennant Group (NASDAQ: PNTG) operates home health, hospice, and senior living facilities across 13 western and midwestern states, serving patients of all ages including seniors.

The Pennant Group reported revenues of $188.9 million, up 29.4% year on year. This number surpassed analysts’ expectations by 1.4%. Overall, it was a strong quarter as it also produced a solid beat of analysts’ sales volume estimates and full-year revenue guidance beating analysts’ expectations.

The Pennant Group delivered the fastest revenue growth among its peers. The stock is down 5.3% since reporting and currently trades at $24.18.

Read our full, actionable report on The Pennant Group here, it’s free.

AdaptHealth (NASDAQ: AHCO)

With a network of approximately 680 locations serving patients across all 50 states, AdaptHealth (NASDAQ: AHCO) provides home medical equipment, supplies, and related services to patients with chronic conditions like sleep apnea, diabetes, and respiratory disorders.

AdaptHealth reported revenues of $856.6 million, flat year on year. This print beat analysts’ expectations by 3.3%. It was a strong quarter as it also logged a solid beat of analysts’ EPS estimates and full-year EBITDA guidance slightly topping analysts’ expectations.

AdaptHealth had the slowest revenue growth and weakest full-year guidance update among its peers. The stock is up 11.8% since reporting and currently trades at $9.56.

Read our full, actionable report on AdaptHealth here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.