As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q4. Today, we are looking at semiconductors stocks, starting with Seagate Technology (NASDAQ: STX).

The semiconductor industry is driven by cyclical demand for advanced electronic products like smartphones, PCs, servers, and data storage. While analog chips serve as the building blocks of most electronic goods and equipment, processors (CPUs) and graphics chips serve as their brains. The growth of data and technologies like artificial intelligence, 5G, the Internet of Things, and smart cars are creating the next wave of secular growth for the industry.

The 40 semiconductors stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 1.7% while next quarter’s revenue guidance was 2,618% above.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 7.3% since the latest earnings results.

Seagate Technology (NASDAQ: STX)

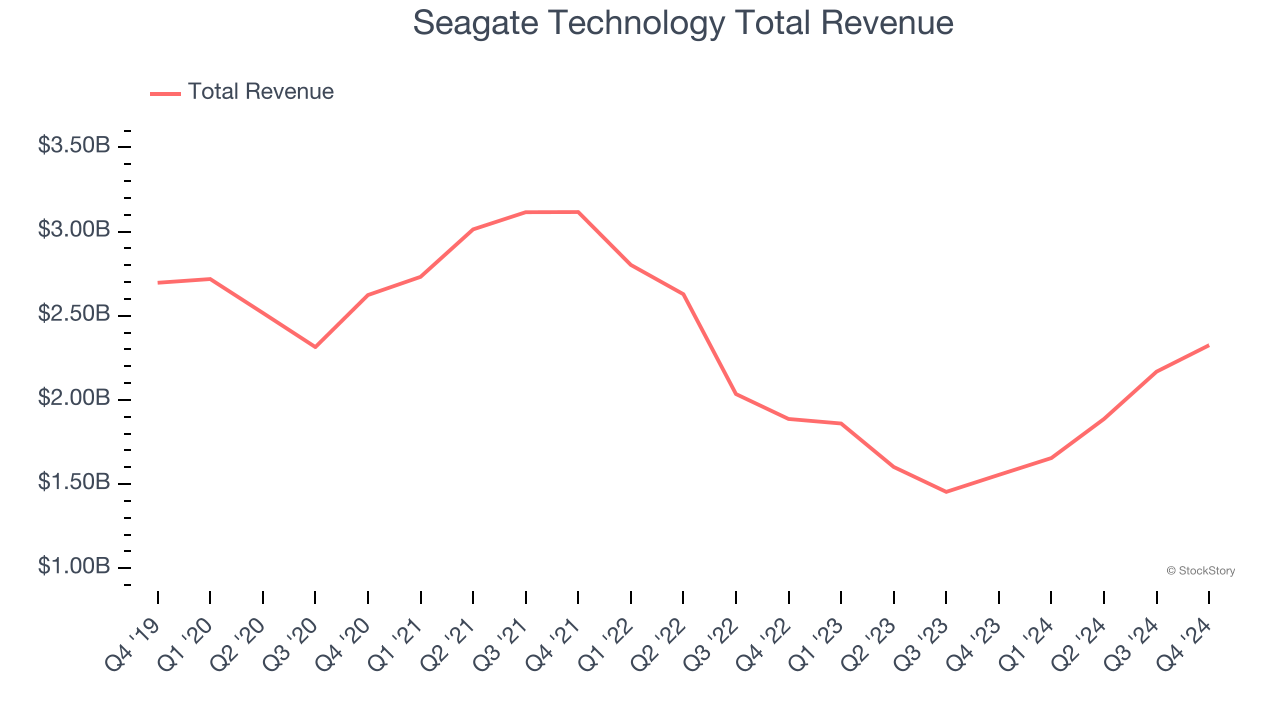

The developer of the original 5.25inch hard disk drive, Seagate (NASDAQ: STX) is a leading producer of data storage solutions, including hard drives and Solid State Drives (SSDs) used in PCs and data centers.

Seagate Technology reported revenues of $2.33 billion, up 49.5% year on year. This print was in line with analysts’ expectations, and overall, it was a satisfactory quarter for the company with a solid beat of analysts’ EPS estimates but revenue guidance for next quarter missing analysts’ expectations.

"Seagate ended calendar 2024 on a strong note as we grew revenue, gross margin and non-GAAP EPS successively in each quarter of the year. Our results demonstrate structural improvements in the business and our focus on value capture in an improving demand environment, highlighted by decade-high gross margin performance exiting the December quarter," said Dave Mosley, Seagate’s chief executive officer.

The stock is down 12.2% since reporting and currently trades at $88.93.

Is now the time to buy Seagate Technology? Access our full analysis of the earnings results here, it’s free.

Best Q4: Himax (NASDAQ: HIMX)

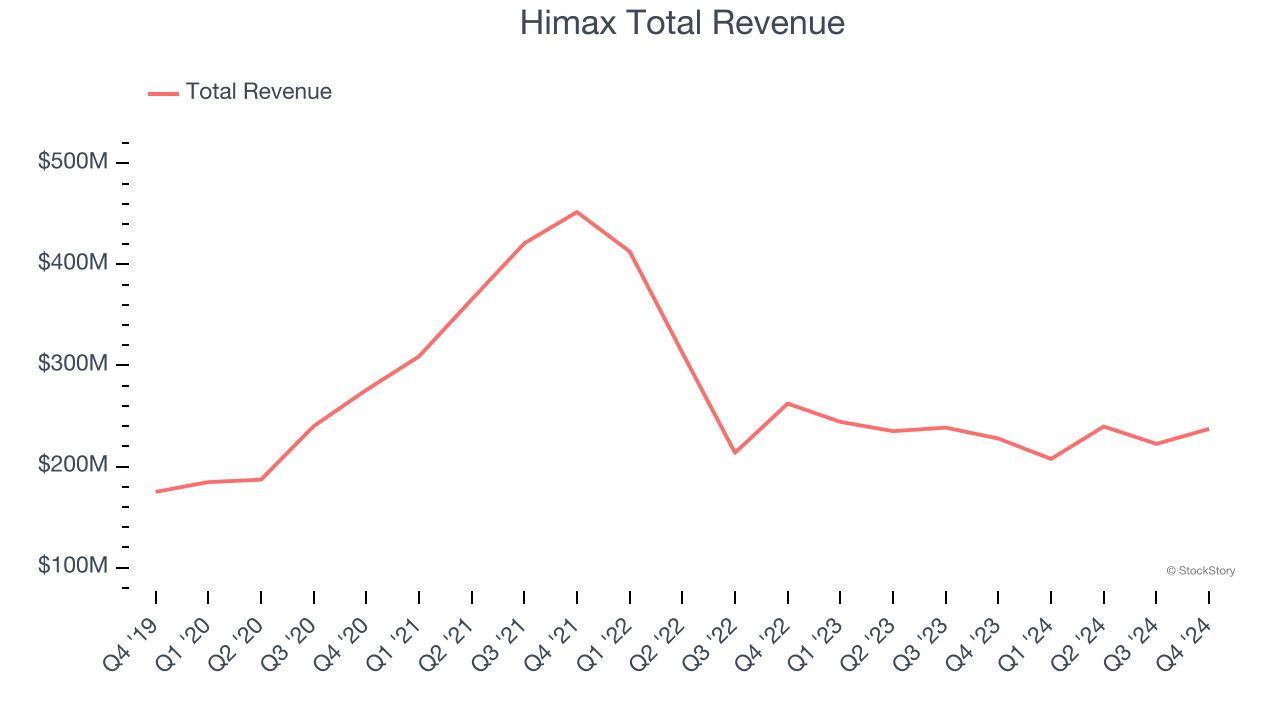

Taiwan-based Himax Technologies (NASDAQ: HIMX) is a leading manufacturer of display driver chips and timing controllers used in TVs, laptops, and mobile phones.

Himax reported revenues of $237.2 million, up 4.2% year on year, outperforming analysts’ expectations by 7.3%. The business had a stunning quarter with a significant improvement in its inventory levels and an impressive beat of analysts’ EPS estimates.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 4.1% since reporting. It currently trades at $8.75.

Is now the time to buy Himax? Access our full analysis of the earnings results here, it’s free.

Slowest Q4: Vishay Intertechnology (NYSE: VSH)

Named after the founder's ancestral village in present-day Lithuania, Vishay Intertechnology (NYSE: VSH) manufactures simple chips and electronic components that are building blocks of virtually all types of electronic devices.

Vishay Intertechnology reported revenues of $714.7 million, down 9% year on year, falling short of analysts’ expectations by 1.1%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income and EPS estimates.

Interestingly, the stock is up 3.3% since the results and currently trades at $17.15.

Read our full analysis of Vishay Intertechnology’s results here.

Skyworks Solutions (NASDAQ: SWKS)

Result of a merger of Alpha Industries and the wireless communications division of Conexant, Skyworks Solutions (NASDAQ: SWKS) is a designer and manufacturer of chips used in smartphones, autos, and industrial applications to amplify, filter, and process wireless signals.

Skyworks Solutions reported revenues of $1.07 billion, down 11.1% year on year. This result met analysts’ expectations. Overall, it was a very strong quarter as it also put up a significant improvement in its inventory levels and revenue guidance for next quarter exceeding analysts’ expectations.

The stock is down 21.6% since reporting and currently trades at $68.37.

Read our full, actionable report on Skyworks Solutions here, it’s free.

Nova (NASDAQ: NVMI)

Headquartered in Israel, Nova (NASDAQ: NVMI) is a provider of quality control systems used in semiconductor manufacturing.

Nova reported revenues of $194.8 million, up 45.1% year on year. This print surpassed analysts’ expectations by 2.3%. It was a very strong quarter as it also logged a significant improvement in its inventory levels and an impressive beat of analysts’ adjusted operating income estimates.

The stock is down 19% since reporting and currently trades at $199.01.

Read our full, actionable report on Nova here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.