Over the last six months, United Rentals’s shares have sunk to $629.21, producing a disappointing 19.7% loss while the S&P 500 was flat. This might have investors contemplating their next move.

Given the weaker price action, is now an opportune time to buy URI? Find out in our full research report, it’s free.

Why Is United Rentals a Good Business?

Owning the largest rental fleet in the world, United Rentals (NYSE: URI) provides equipment rental and related services to construction, industrial, and infrastructure industries.

1. Core Business Firing on All Cylinders

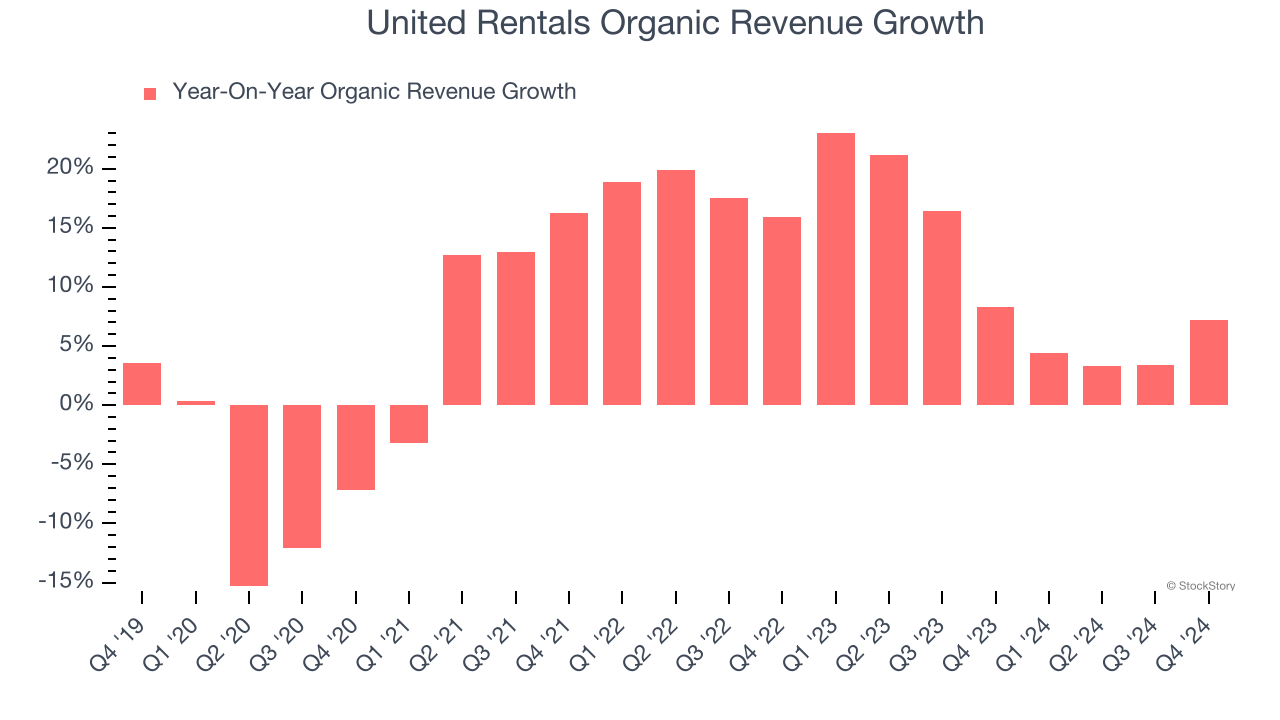

Investors interested in Specialty Equipment Distributors companies should track organic revenue in addition to reported revenue. This metric gives visibility into United Rentals’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, United Rentals’s organic revenue averaged 10.9% year-on-year growth. This performance was impressive and shows it can expand quickly without relying on expensive (and risky) acquisitions.

2. Operating Margin Reveals a Well-Run Organization

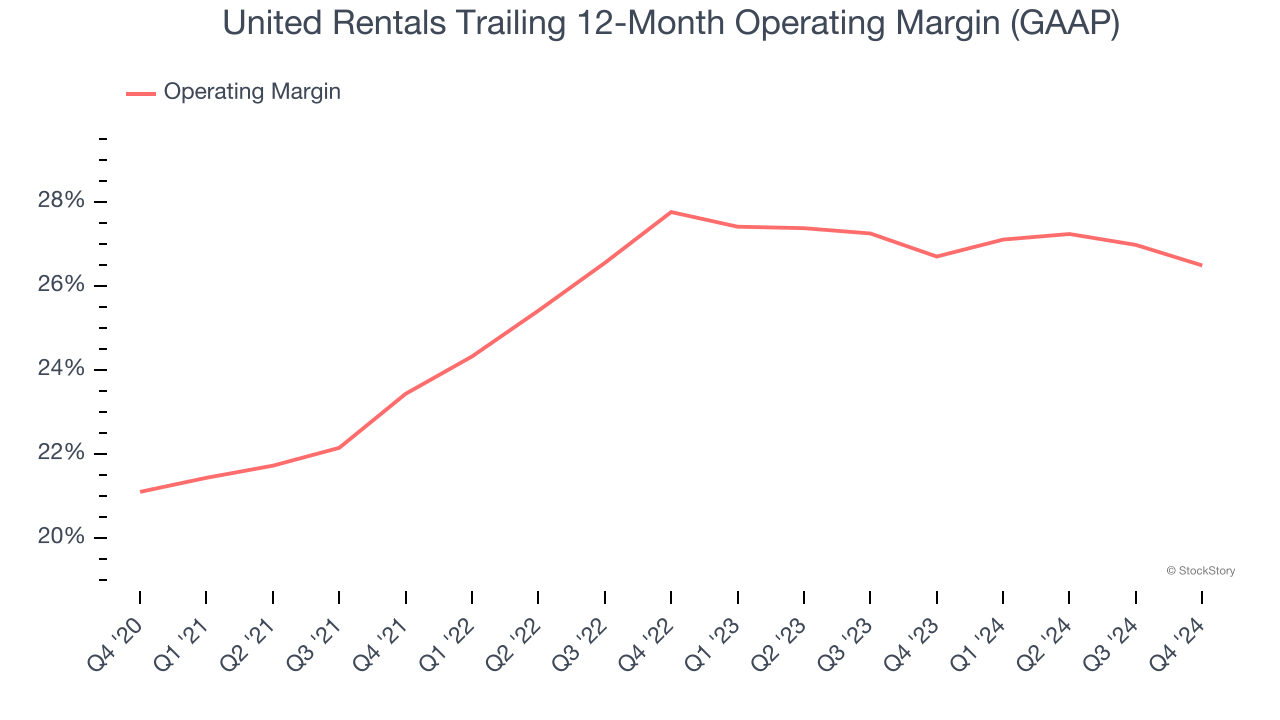

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

United Rentals has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 25.5%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

3. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

United Rentals has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 16.9% over the last five years.

Final Judgment

These are just a few reasons why United Rentals ranks highly on our list. After the recent drawdown, the stock trades at 13.7× forward price-to-earnings (or $629.21 per share). Is now a good time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than United Rentals

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.