Earth imaging satellite company Planet Labs (NYSE: PL) fell short of the market’s revenue expectations in Q4 CY2024 as sales rose 4.6% year on year to $61.55 million. Next quarter’s revenue guidance of $62 million underwhelmed, coming in 5.1% below analysts’ estimates. Its non-GAAP loss of $0.08 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Planet Labs? Find out by accessing our full research report, it’s free.

Planet Labs (PL) Q4 CY2024 Highlights:

- Revenue: $61.55 million vs analyst estimates of $62.28 million (4.6% year-on-year growth, 1.2% miss)

- Adjusted EPS: -$0.08 vs analyst estimates of -$0.02 (significant miss)

- Adjusted EBITDA: $2.38 million vs analyst estimates of $994,690 (3.9% margin, significant beat)

- Management’s revenue guidance for the upcoming financial year 2026 is $270 million at the midpoint, missing analyst estimates by 1.4% and implying 10.5% growth (vs 10.9% in FY2025)

- EBITDA guidance for the upcoming financial year 2026 is -$10 million at the midpoint, below analyst estimates of $14.47 million

- Operating Margin: -31.5%, up from -57.6% in the same quarter last year

- Backlog: $498.5 million at quarter end

- Market Capitalization: $1.29 billion

“Last year was an exciting and transitional year for Planet. We introduced a new industry-aligned go-to-market structure and began to shift towards selling AI-enabled solutions. We took a major step forward in the satellite services market and signed a $230 million contract with our long-term partner in Japan, JSAT. We launched over 70 satellites, including our first Tanager hyperspectral satellite and our second Pelican high resolution satellite, both of which are performing well in orbit,” said Will Marshall, Planet’s Co-Founder, Chief Executive Officer and Chairperson.

Company Overview

Pioneering the concept of "agile aerospace" with hundreds of small but powerful satellites, Planet Labs (NYSE: PL) operates the world's largest fleet of Earth observation satellites, capturing daily images of our planet to provide insights on deforestation, agriculture, and climate change.

Data & Business Process Services

A combination of increasing reliance on data and analytics across various industries and the desire for cost efficiency through outsourcing could mean that companies in this space gain. As functions such as payroll, HR, and credit risk assessment rely on more digitization, key players in the data & business process services industry could be increased demand. On the other hand, the sector faces headwinds from growing regulatory scrutiny on data privacy and security, with laws like GDPR and evolving U.S. regulations potentially limiting data collection and monetization strategies. Additionally, rising cyber threats pose risks to firms handling sensitive personal and financial information, creating outsized headline risk when things go wrong in this area.

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $244.4 million in revenue over the past 12 months, Planet Labs is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

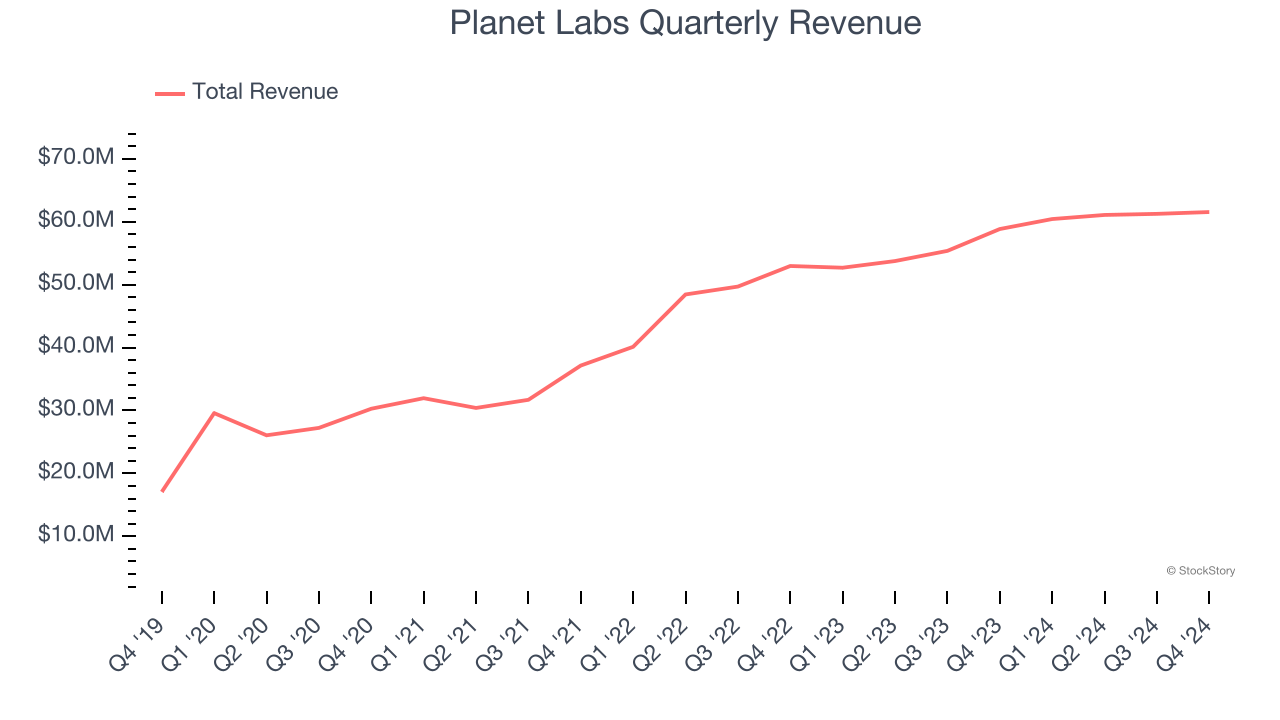

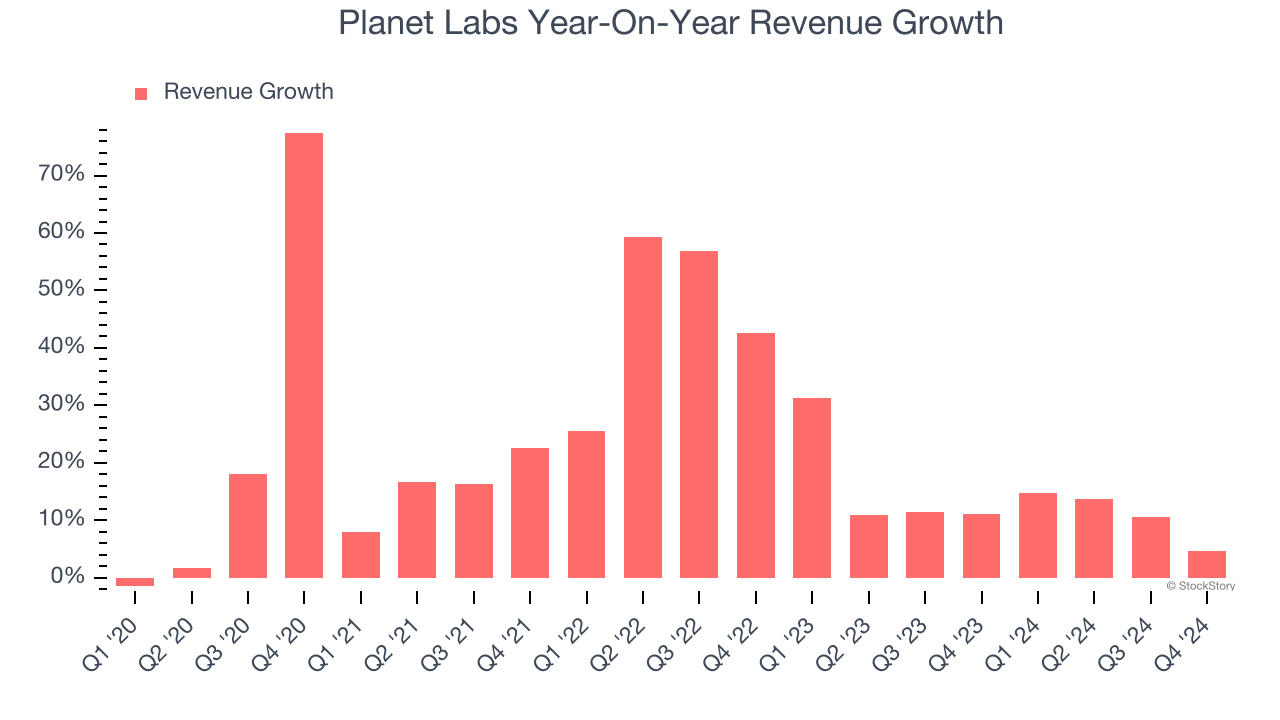

As you can see below, Planet Labs grew its sales at an incredible 20.6% compounded annual growth rate over the last five years. This is a great starting point for our analysis because it shows Planet Labs’s demand was higher than many business services companies.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Planet Labs’s annualized revenue growth of 13% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Planet Labs’s revenue grew by 4.6% year on year to $61.55 million, falling short of Wall Street’s estimates. Company management is currently guiding for a 2.6% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 13.2% over the next 12 months, similar to its two-year rate. This projection is commendable and indicates the market sees success for its products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

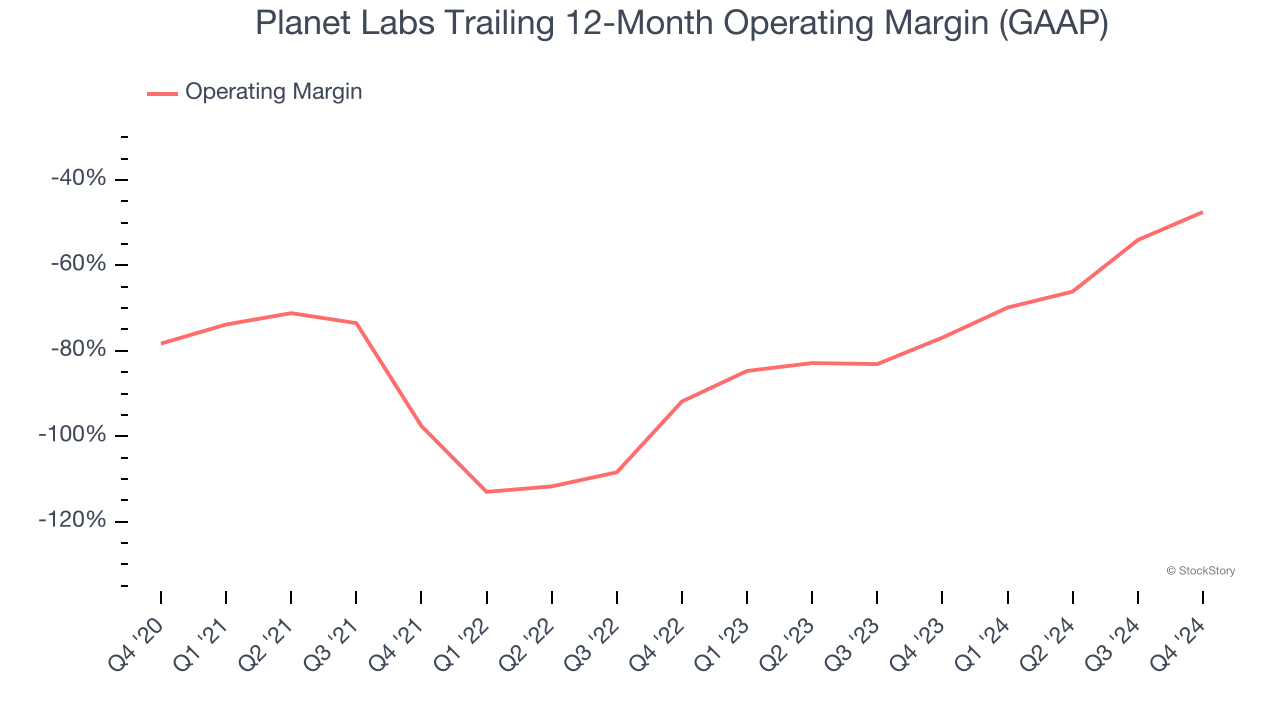

Planet Labs’s high expenses have contributed to an average operating margin of negative 75.3% over the last five years. Unprofitable business services companies require extra attention because they could get caught swimming naked when the tide goes out.

On the plus side, Planet Labs’s operating margin rose by 30.8 percentage points over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to reach long-term profitability.

Planet Labs’s operating margin was negative 31.5% this quarter.

Earnings Per Share

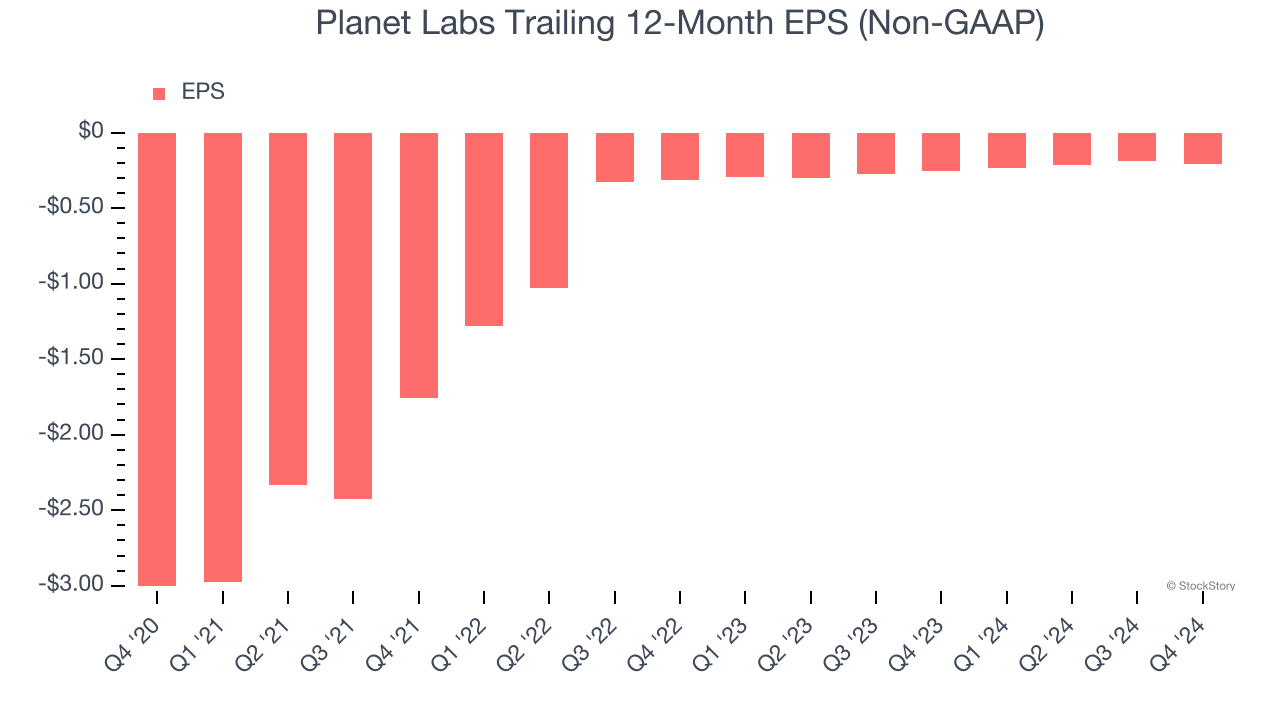

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Although Planet Labs’s full-year earnings are still negative, it reduced its losses and improved its EPS by 48.7% annually over the last four years. The next few quarters will be critical for assessing its long-term profitability. We hope to see an inflection point soon.

In Q4, Planet Labs reported EPS at negative $0.08, down from negative $0.06 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Planet Labs’s full-year EPS of negative $0.21 will reach break even.

Key Takeaways from Planet Labs’s Q4 Results

We struggled to find many positives in these results. Its full-year revenue and EBITDA guidance missed significantly along with this quarter's revenue and EPS. Overall, this quarter could have been better. The stock traded down 8% to $3.90 immediately following the results.

Planet Labs didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.