Let’s dig into the relative performance of Diebold Nixdorf (NYSE: DBD) and its peers as we unravel the now-completed Q4 hardware & infrastructure earnings season.

The Hardware & Infrastructure sector will be buoyed by demand related to AI adoption, cloud computing expansion, and the need for more efficient data storage and processing solutions. Companies with tech offerings such as servers, switches, and storage solutions are well-positioned in our new hybrid working and IT world. On the other hand, headwinds include ongoing supply chain disruptions, rising component costs, and intensifying competition from cloud-native and hyperscale providers reducing reliance on traditional hardware. Additionally, regulatory scrutiny over data sovereignty, cybersecurity standards, and environmental sustainability in hardware manufacturing could increase compliance costs.

The 9 hardware & infrastructure stocks we track reported a slower Q4. As a group, revenues beat analysts’ consensus estimates by 1.5% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 15.5% since the latest earnings results.

Diebold Nixdorf (NYSE: DBD)

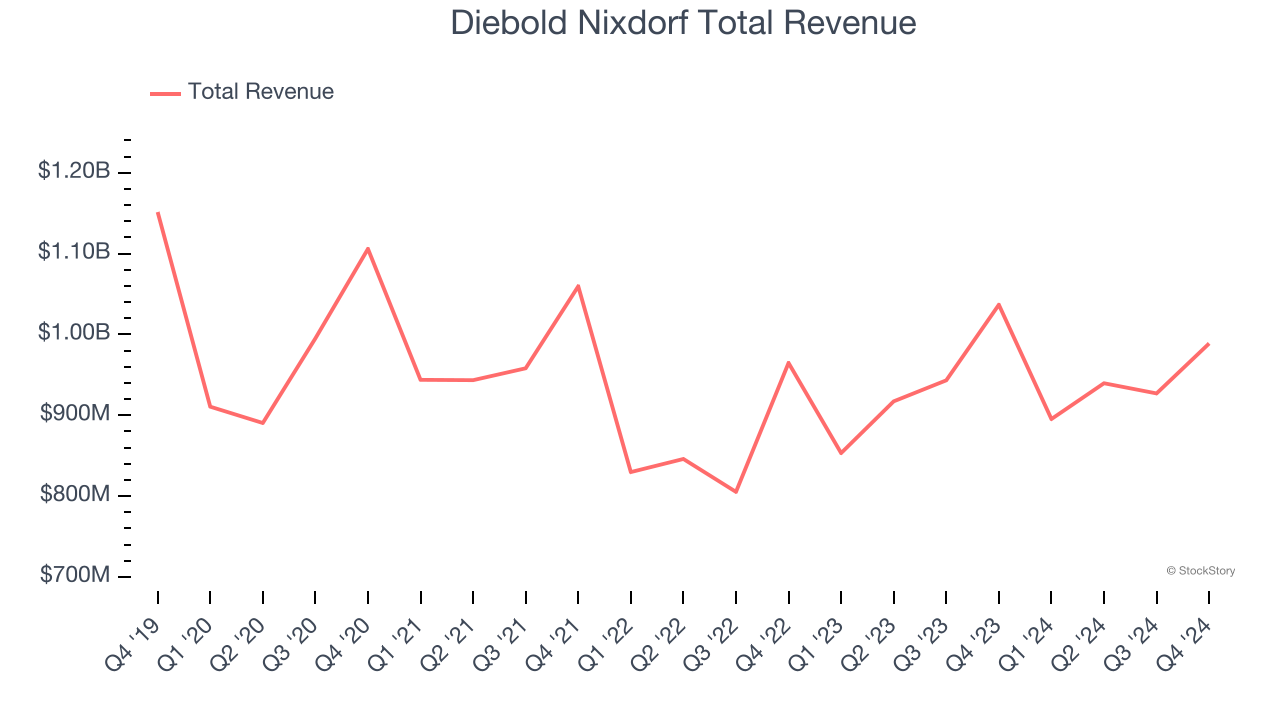

With roots dating back to 1859 and a presence in over 100 countries, Diebold Nixdorf (NYSE: DBD) provides automated self-service technology, software, and services that help banks and retailers digitize their customer transactions.

Diebold Nixdorf reported revenues of $988.9 million, down 4.6% year on year. This print was in line with analysts’ expectations, but overall, it was a softer quarter for the company with a significant miss of analysts’ EPS estimates.

The stock is down 1.5% since reporting and currently trades at $43.30.

Read our full report on Diebold Nixdorf here, it’s free.

Best Q4: Pure Storage (NYSE: PSTG)

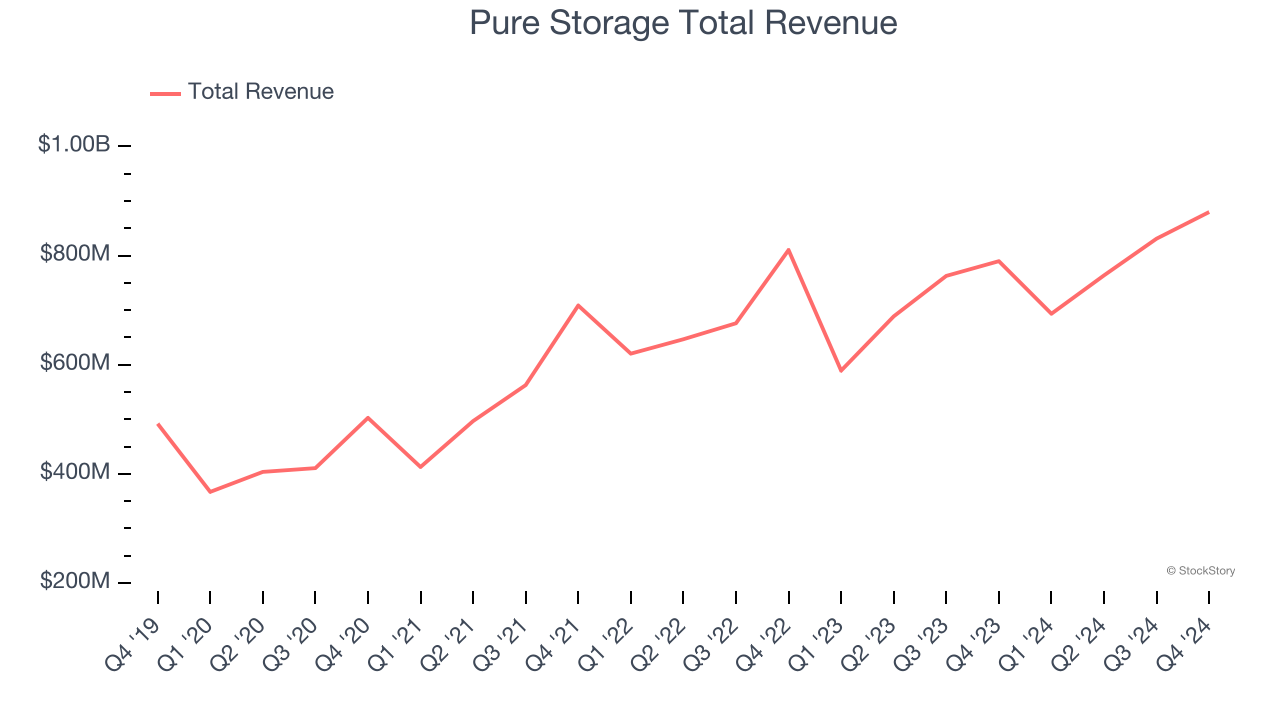

Founded in 2009 as a pioneer in enterprise all-flash storage technology, Pure Storage (NYSE: PSTG) provides all-flash data storage hardware and software that helps organizations manage their data more efficiently across on-premises and cloud environments.

Pure Storage reported revenues of $879.8 million, up 11.4% year on year, outperforming analysts’ expectations by 1.2%. The business had a satisfactory quarter with an impressive beat of analysts’ EPS estimates but billings in line with analysts’ estimates.

Pure Storage scored the highest full-year guidance raise among its peers. Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 16.7% since reporting. It currently trades at $52.

Is now the time to buy Pure Storage? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: CompoSecure (NASDAQ: CMPO)

Pioneer of the luxury metal credit card that's in the wallets of affluent consumers worldwide, CompoSecure (NASDAQ: CMPO) designs and manufactures premium metal payment cards and secure authentication solutions for financial institutions and digital asset storage.

CompoSecure reported revenues of $100.9 million, flat year on year, falling short of analysts’ expectations by 1.6%. It was a disappointing quarter as it posted a significant miss of analysts’ EPS estimates.

As expected, the stock is down 8.3% since the results and currently trades at $11.01.

Read our full analysis of CompoSecure’s results here.

IonQ (NYSE: IONQ)

Founded by quantum physics pioneers from the University of Maryland and Duke University in 2015, IonQ (NYSE: IONQ) develops quantum computers that process information using trapped ions to solve complex computational problems beyond the capabilities of traditional computers.

IonQ reported revenues of $11.71 million, up 91.8% year on year. This result topped analysts’ expectations by 15.9%. However, it was a slower quarter as it recorded a significant miss of analysts’ EPS estimates.

IonQ pulled off the biggest analyst estimates beat and fastest revenue growth among its peers. The stock is down 21% since reporting and currently trades at $23.65.

Read our full, actionable report on IonQ here, it’s free.

HP (NYSE: HPQ)

Born from the legendary Silicon Valley garage startup founded by Bill Hewlett and Dave Packard in 1939, HP (NYSE: HPQ) designs and sells personal computers, printers, and related technology products and services to consumers, businesses, and enterprises worldwide.

HP reported revenues of $13.5 billion, up 2.4% year on year. This number surpassed analysts’ expectations by 1.1%. Zooming out, it was a slower quarter as it logged a slight miss of analysts’ EPS estimates.

The stock is down 13.3% since reporting and currently trades at $28.76.

Read our full, actionable report on HP here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.