Bumble’s stock price has taken a beating over the past six months, shedding 23% of its value and falling to $4.69 per share. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is now the time to buy Bumble, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

Even with the cheaper entry price, we're cautious about Bumble. Here are three reasons why there are better opportunities than BMBL and a stock we'd rather own.

Why Is Bumble Not Exciting?

Started by the co-founder of Tinder, Whitney Wolfe Herd, Bumble (NASDAQ: BMBL) is a leading dating app built with women at the center.

1. Customer Spending Decreases, Engagement Falling?

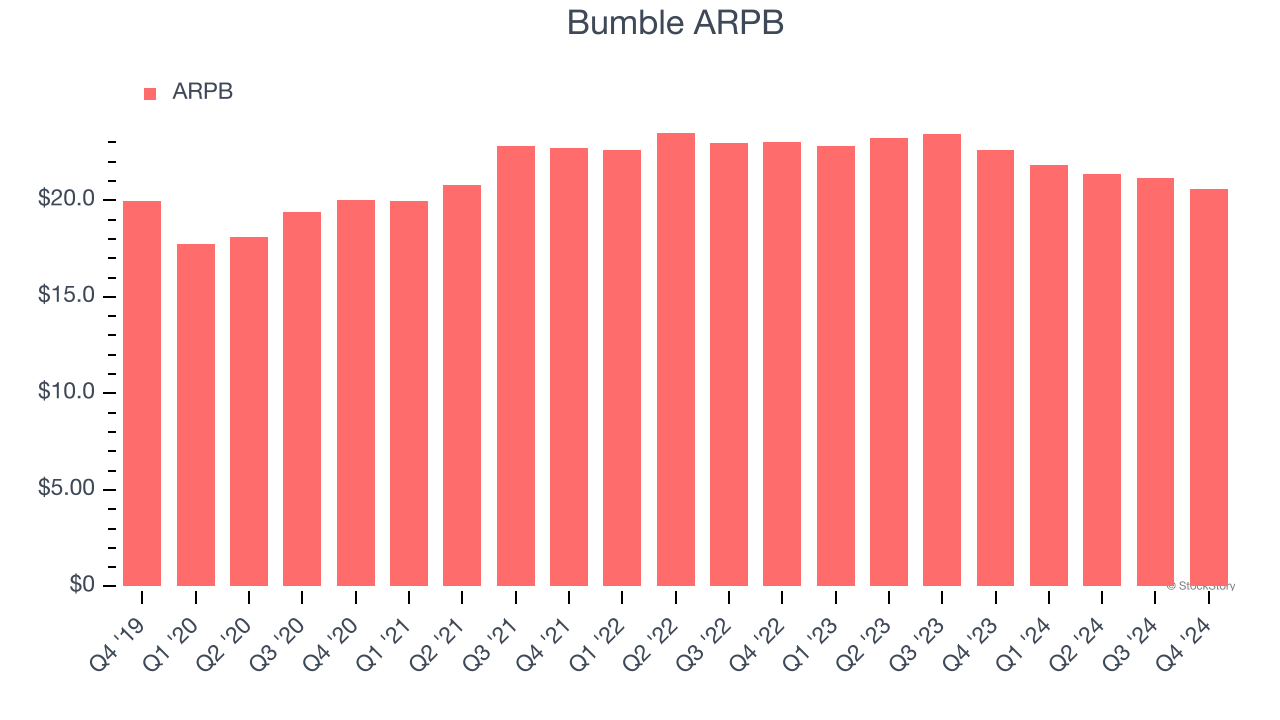

Average revenue per buyer (ARPB) is a critical metric to track because it measures how much the average buyer spends. ARPB is also a key indicator of how valuable its buyers are (and can be over time).

Bumble’s ARPB fell over the last two years, averaging 3.9% annual declines. This isn’t great, but the increase in paying users is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Bumble tries boosting ARPB by taking a more aggressive approach to monetization, it’s unclear whether buyers can continue growing at the current pace.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Bumble’s revenue to drop by 8.3%, a decrease from its 12.1% annualized growth for the past three years. This projection is underwhelming and implies its products and services will see some demand headwinds.

3. EPS Barely Growing

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Bumble’s EPS grew at a weak 3.6% compounded annual growth rate over the last three years, lower than its 12.1% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

Bumble isn’t a terrible business, but it isn’t one of our picks. Following the recent decline, the stock trades at 1.8× forward EV-to-EBITDA (or $4.69 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. We're pretty confident there are more exciting stocks to buy at the moment. We’d recommend looking at a safe-and-steady industrials business benefiting from an upgrade cycle.

Stocks We Would Buy Instead of Bumble

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.