Since March 2020, the S&P 500 has delivered a total return of 149%. But one standout stock has doubled the market - over the past five years, RBC Bearings has surged 299% to $338.42 per share. Its momentum hasn’t stopped as it’s also gained 14.5% in the last six months, beating the S&P by 14.3%.

Is now still a good time to buy RBC? Or are investors being too optimistic? Find out in our full research report, it’s free.

Why Does RBC Bearings Spark Debate?

With a Guinness World Record for engineering the largest spherical plain bearing, RBC Bearings (NYSE: RBC) is a manufacturer of bearings and related components for the aerospace & defense, industrial, and transportation industries.

Two Positive Attributes:

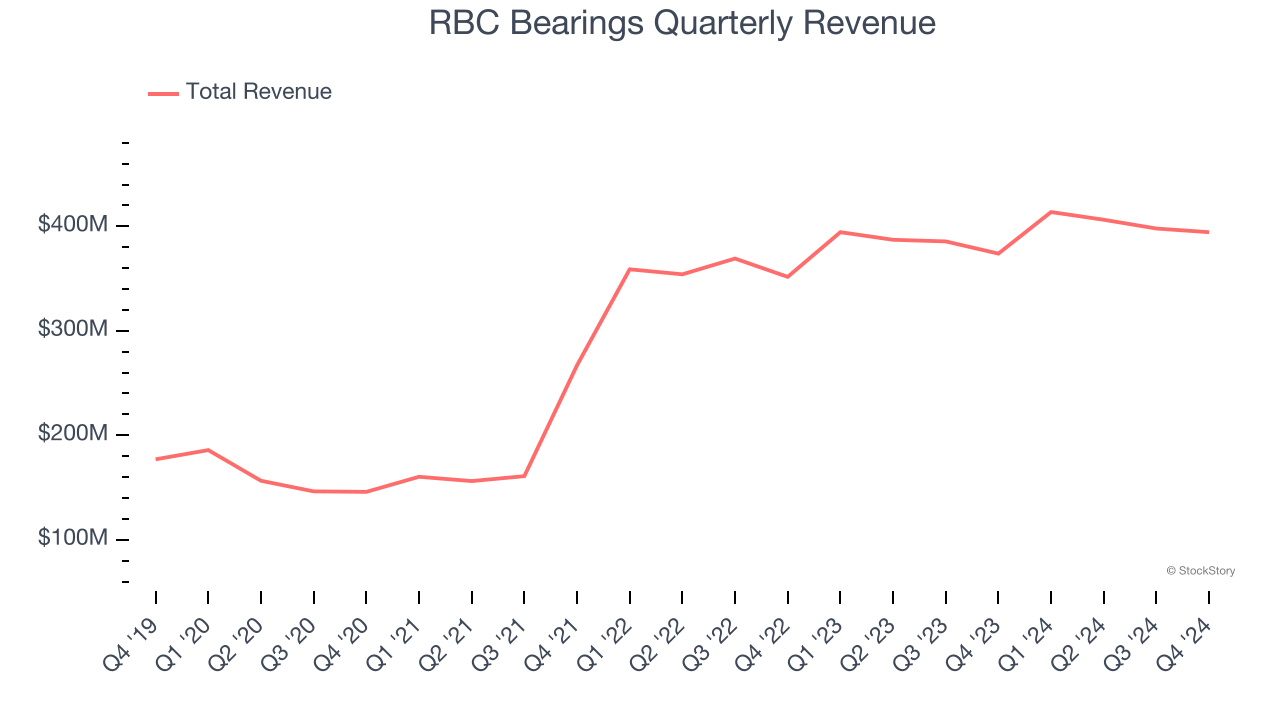

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, RBC Bearings’s sales grew at an incredible 17.4% compounded annual growth rate over the last five years. Its growth surpassed the average industrials company and shows its offerings resonate with customers.

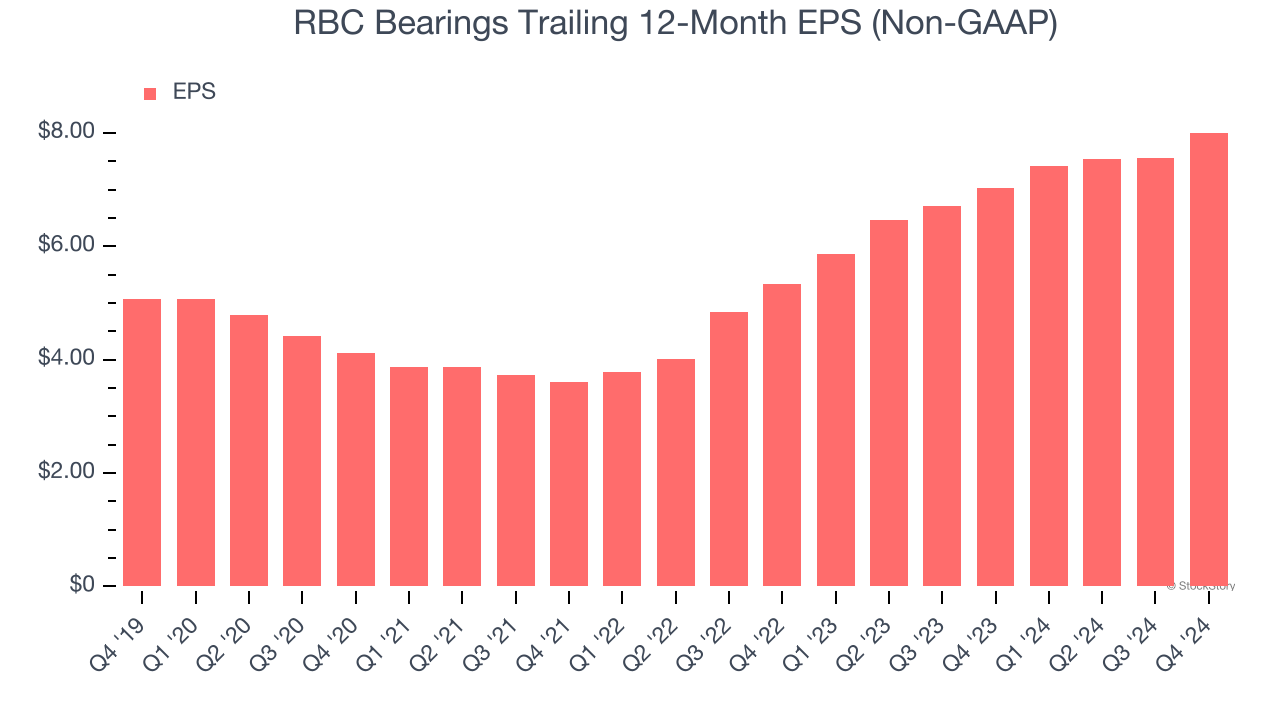

2. EPS Moving Up Steadily

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

RBC Bearings’s EPS grew at a decent 9.5% compounded annual growth rate over the last five years. This performance was better than most industrials businesses.

One Reason to be Careful:

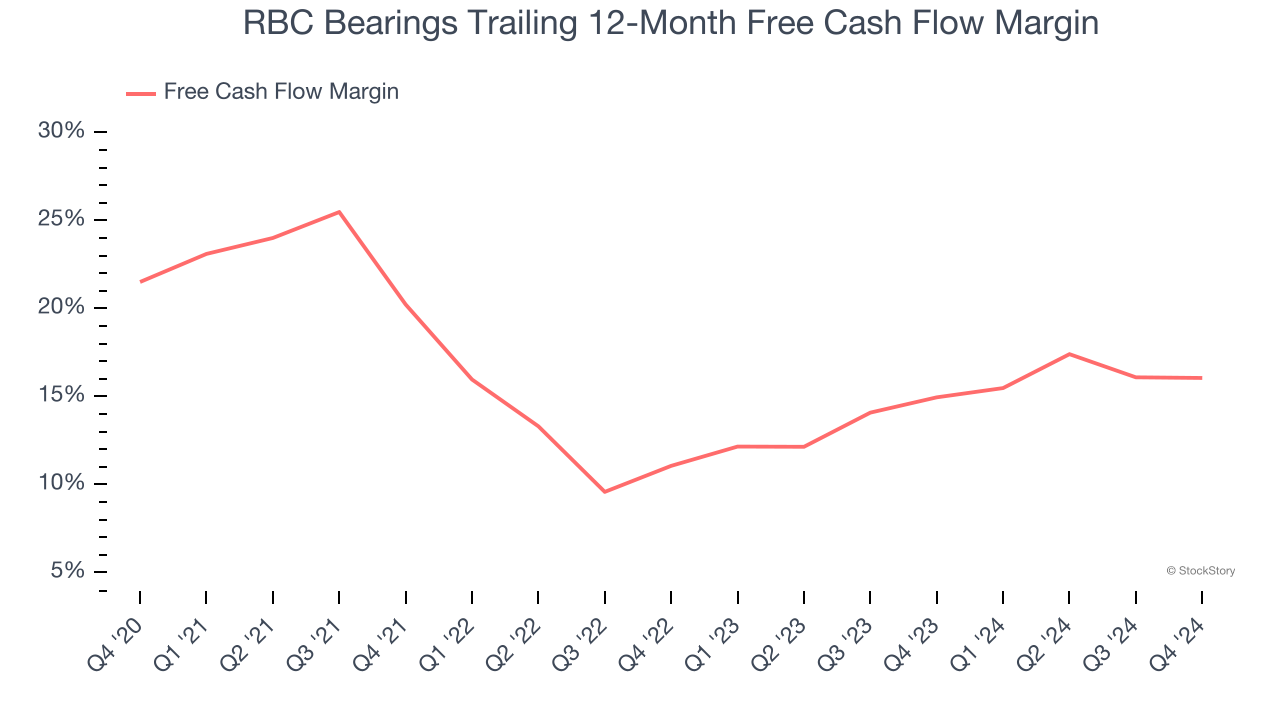

Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, RBC Bearings’s margin dropped by 5.5 percentage points over the last five years. If its declines continue, it could signal increasing investment needs and capital intensity. RBC Bearings’s free cash flow margin for the trailing 12 months was 16.1%.

Final Judgment

RBC Bearings’s merits more than compensate for its flaws, and with its shares topping the market in recent months, the stock trades at 32.3× forward price-to-earnings (or $338.42 per share). Is now a good time to buy? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than RBC Bearings

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.