The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how American Airlines (NASDAQ: AAL) and the rest of the travel and vacation providers stocks fared in Q4.

Airlines, hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional airlines, hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

The 18 travel and vacation providers stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 2% while next quarter’s revenue guidance was 6.1% above.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 17.1% since the latest earnings results.

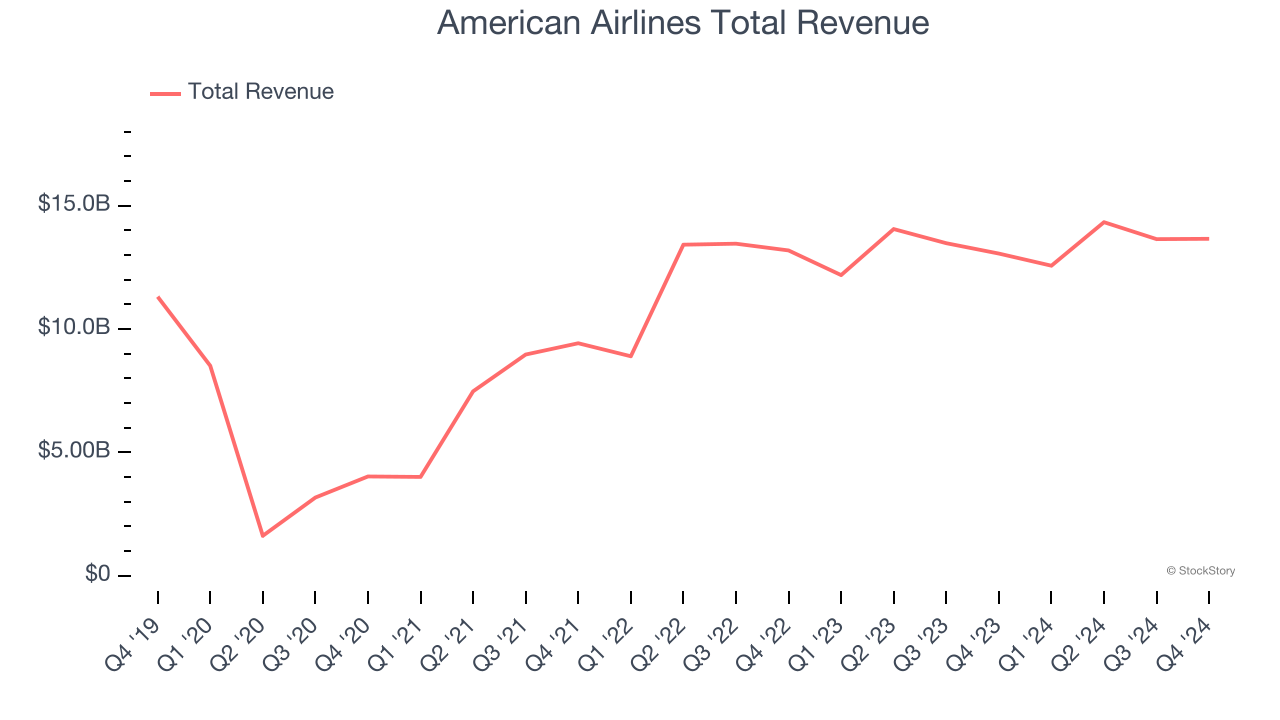

American Airlines (NASDAQ: AAL)

One of the ‘Big Four’ airlines in the US, American Airlines (NASDAQ: AAL) is a major global air carrier that serves both business and leisure travelers through its domestic and international flights.

American Airlines reported revenues of $13.66 billion, up 4.6% year on year. This print exceeded analysts’ expectations by 2%. Despite the top-line beat, it was still a slower quarter for the company with full-year EPS guidance missing analysts’ expectations.

“The American Airlines team achieved a number of important objectives in 2024,” said American’s CEO Robert Isom.

The stock is down 40.4% since reporting and currently trades at $11.13.

Read our full report on American Airlines here, it’s free.

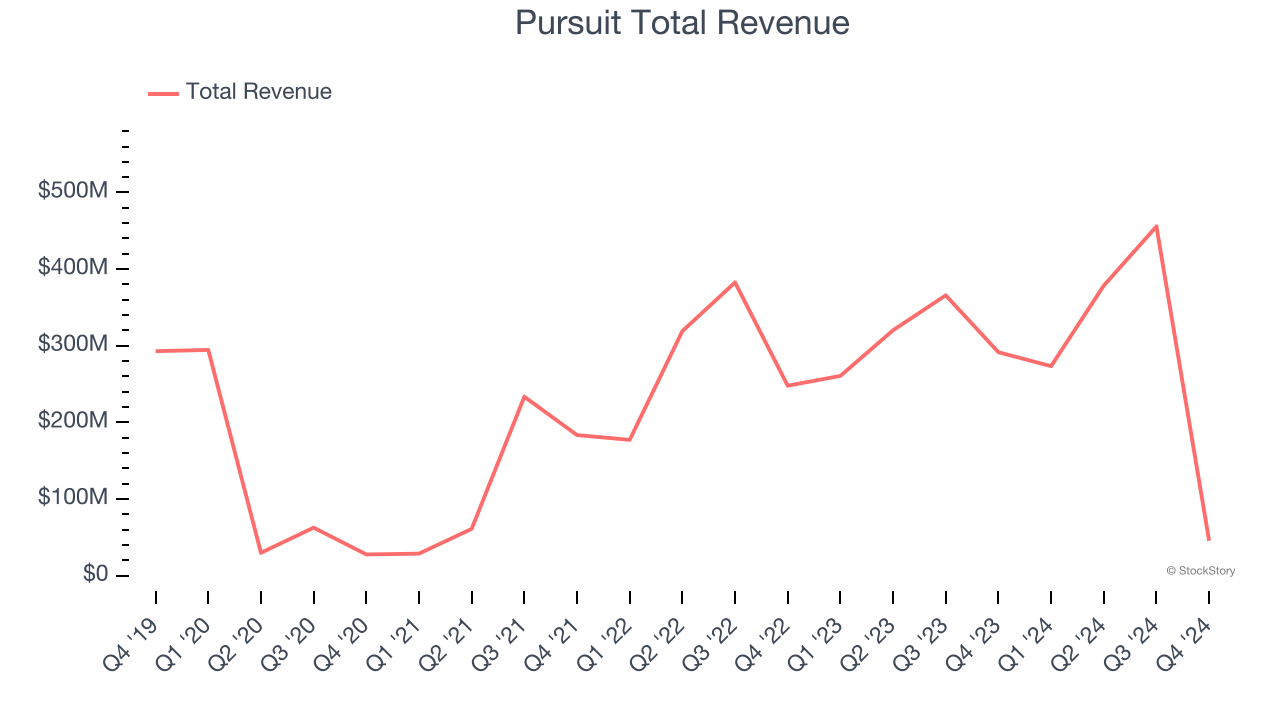

Best Q4: Pursuit (NYSE: PRSU)

With attractions ranging from glacier tours in the Canadian Rockies to an oceanfront geothermal lagoon in Iceland, Pursuit Attractions and Hospitality (NYSE: PRSU) operates iconic travel experiences, experiential marketing services, and exhibition management across North America and Europe.

Pursuit reported revenues of $45.8 million, down 84.3% year on year, outperforming analysts’ expectations by 8.8%. The business had a stunning quarter with a solid beat of analysts’ EPS estimates and full-year EBITDA guidance exceeding analysts’ expectations.

However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $36.95.

Is now the time to buy Pursuit? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Hyatt Hotels (NYSE: H)

Founded in 1957, Hyatt Hotels (NYSE: H) is a global hospitality company with a portfolio of 20 premier brands and over 950 properties across 65 countries.

Hyatt Hotels reported revenues of $1.60 billion, down 3.5% year on year, falling short of analysts’ expectations by 3.1%. It was a softer quarter as it posted a significant miss of analysts’ adjusted operating income and EPS estimates.

Hyatt Hotels delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 24.4% since the results and currently trades at $122.71.

Read our full analysis of Hyatt Hotels’s results here.

Lindblad Expeditions (NASDAQ: LIND)

Founded by explorer Sven-Olof Lindblad in 1979, Lindblad Expeditions (NASDAQ: LIND) offers cruising experiences to remote destinations in partnership with National Geographic.

Lindblad Expeditions reported revenues of $148.6 million, up 18.5% year on year. This print surpassed analysts’ expectations by 10.2%. Aside from that, it was a mixed quarter as it also produced full-year revenue guidance exceeding analysts’ expectations but a significant miss of analysts’ adjusted operating income estimates.

Lindblad Expeditions delivered the biggest analyst estimates beat among its peers. The stock is down 8.4% since reporting and currently trades at $10.19.

Read our full, actionable report on Lindblad Expeditions here, it’s free.

Marriott Vacations (NYSE: VAC)

Spun off from Marriott International in 1984, Marriott Vacations (NYSE: VAC) is a vacation company providing leisure experiences for travelers around the world.

Marriott Vacations reported revenues of $1.33 billion, up 11.1% year on year. This result topped analysts’ expectations by 6.7%. More broadly, it was a mixed quarter as it also logged a decent beat of analysts’ EPS estimates but a miss of analysts’ adjusted operating income estimates.

The stock is down 22.6% since reporting and currently trades at $66.22.

Read our full, actionable report on Marriott Vacations here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.