Let’s dig into the relative performance of Vertex Pharmaceuticals (NASDAQ: VRTX) and its peers as we unravel the now-completed Q4 therapeutics earnings season.

Over the next few years, therapeutic companies, which develop a wide variety of treatments for diseases and disorders, face strong tailwinds from advancements in precision medicine (including the use of AI to improve hit rates) and growing demand for treatments targeting rare diseases. However, headwinds such as rising scrutiny over drug pricing, regulatory unknowns, and competition from larger, more resourced pharmaceutical companies could weigh on growth.

The 10 therapeutics stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 2.6%.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

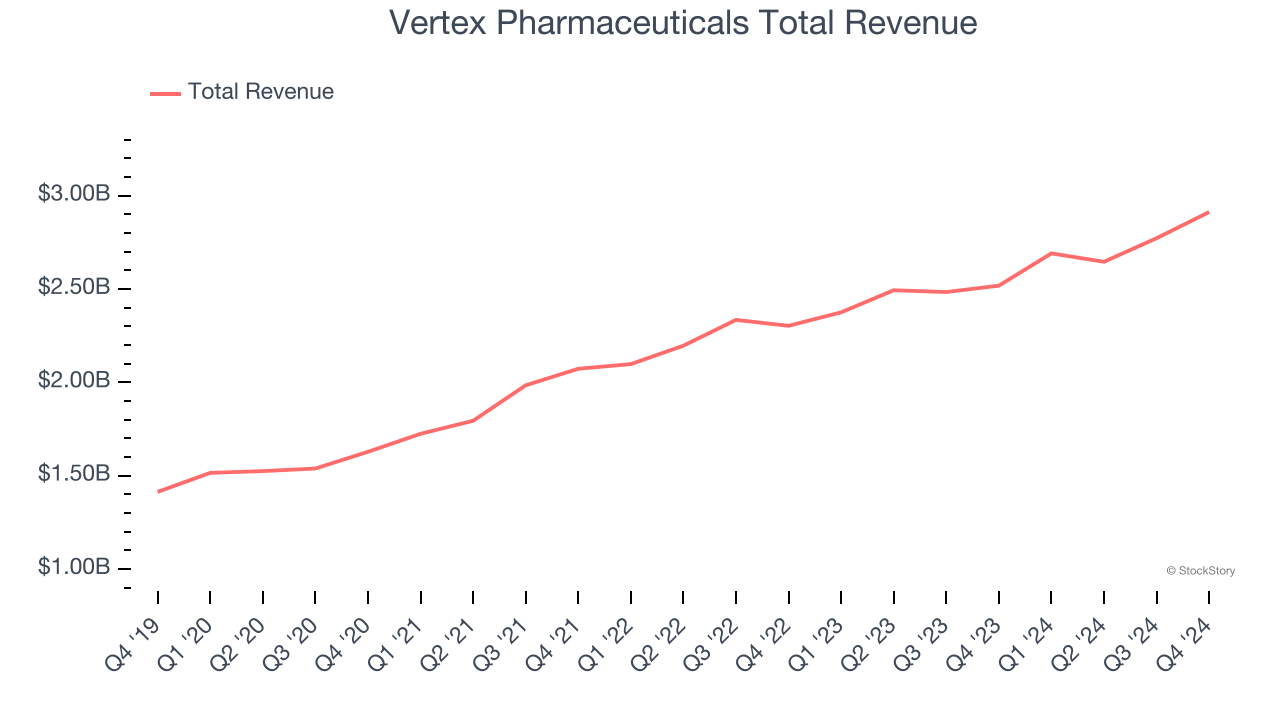

Vertex Pharmaceuticals (NASDAQ: VRTX)

Founded in 1989 with a mission to create medicines that treat the underlying causes of disease rather than just symptoms, Vertex Pharmaceuticals (NASDAQ: VRTX) develops and markets transformative medicines for serious diseases, with a focus on cystic fibrosis, sickle cell disease, and pain management.

Vertex Pharmaceuticals reported revenues of $2.91 billion, up 15.7% year on year. This print exceeded analysts’ expectations by 4.9%. Overall, it was a strong quarter for the company with full-year revenue guidance meeting analysts’ expectations.

“2024 marked a year of tremendous growth for Vertex and we anticipate 2025 will be another important year with the landmark JOURNAVX approval and launch for moderate-to-severe acute pain; the launch of our fifth CF medicine, ALYFTREK; the continuing global launch of CASGEVY; and multiple ongoing pivotal trials. We are excited to drive diversification of the revenue base, disease areas of focus, R&D pipeline, and geographies to continue to deliver long-term value to both patients and shareholders,” said Reshma Kewalramani, M.D., Chief Executive Officer and President of Vertex.

The stock is up 8.6% since reporting and currently trades at $510.02.

Is now the time to buy Vertex Pharmaceuticals? Access our full analysis of the earnings results here, it’s free.

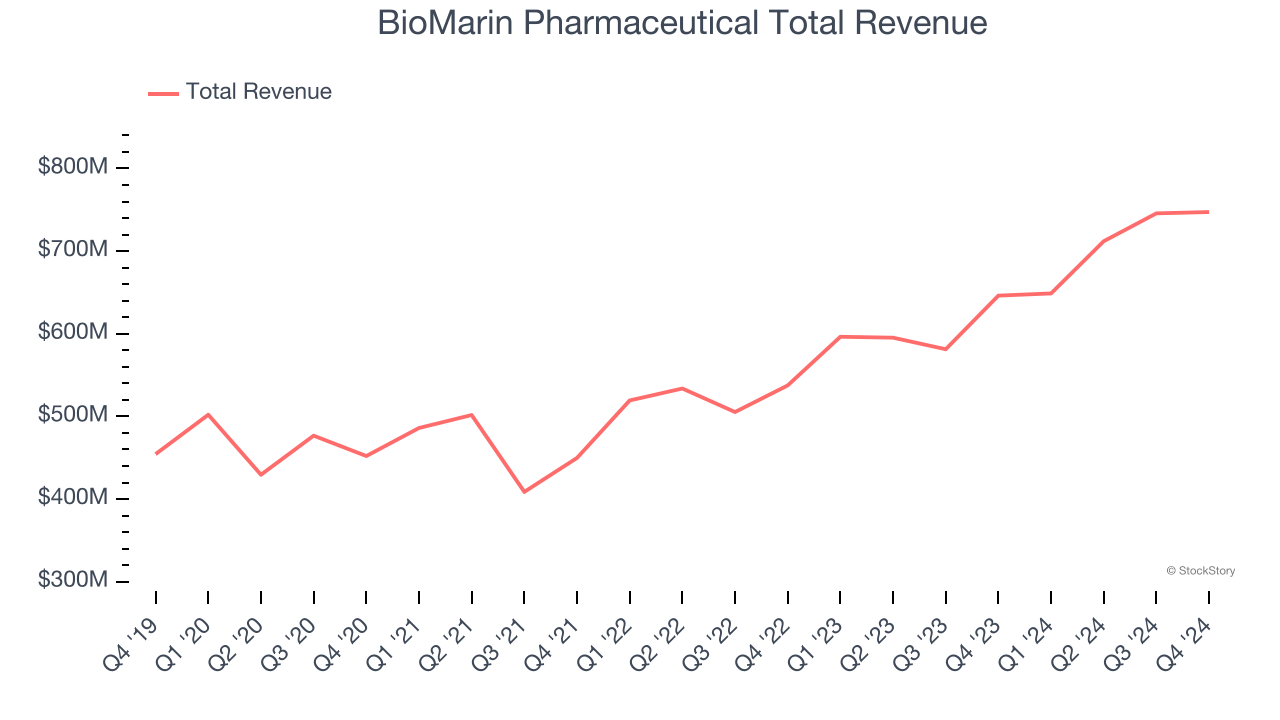

Best Q4: BioMarin Pharmaceutical (NASDAQ: BMRN)

Pioneering treatments for conditions that often had no previous therapeutic options, BioMarin Pharmaceutical (NASDAQ: BMRN) develops and commercializes therapies that address the root causes of rare genetic disorders, particularly those affecting children.

BioMarin Pharmaceutical reported revenues of $747.3 million, up 15.6% year on year, outperforming analysts’ expectations by 4.8%. The business had a stunning quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ full-year EPS guidance estimates.

BioMarin Pharmaceutical delivered the highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 7.7% since reporting. It currently trades at $70.71.

Is now the time to buy BioMarin Pharmaceutical? Access our full analysis of the earnings results here, it’s free.

Slowest Q4: Moderna (NASDAQ: MRNA)

Rising to global prominence during the COVID-19 pandemic with one of the first effective vaccines, Moderna (NASDAQ: MRNA) develops messenger RNA (mRNA) medicines that direct the body's cells to produce proteins with therapeutic or preventive benefits for various diseases.

Moderna reported revenues of $966 million, down 65.6% year on year, in line with analysts’ expectations. It was a slower quarter as it posted full-year revenue guidance missing analysts’ expectations.

Moderna delivered the slowest revenue growth and weakest full-year guidance update in the group. Interestingly, the stock is up 5.4% since the results and currently trades at $33.66.

Read our full analysis of Moderna’s results here.

Gilead Sciences (NASDAQ: GILD)

From its groundbreaking work in developing the first single-tablet regimens for HIV treatment, Gilead Sciences (NASDAQ: GILD) develops and markets innovative medicines for life-threatening diseases including HIV, viral hepatitis, COVID-19, and cancer.

Gilead Sciences reported revenues of $7.57 billion, up 6.4% year on year. This print beat analysts’ expectations by 6.3%. It was a very strong quarter as it also logged a solid beat of analysts’ full-year EPS guidance estimates and an impressive beat of analysts’ EPS estimates.

Gilead Sciences scored the biggest analyst estimates beat among its peers. The stock is up 11.4% since reporting and currently trades at $107.07.

Read our full, actionable report on Gilead Sciences here, it’s free.

Myriad Genetics (NASDAQ: MYGN)

Founded in 1991 as one of the pioneers in translating genetic discoveries into clinical applications, Myriad Genetics (NASDAQ: MYGN) develops genetic tests that assess disease risk, guide treatment decisions, and provide insights across oncology, women's health, and mental health.

Myriad Genetics reported revenues of $210.6 million, up 7.1% year on year. This result came in 0.6% below analysts' expectations. More broadly, it was a mixed quarter as it also produced an impressive beat of analysts’ full-year EPS guidance estimates but full-year revenue guidance missing analysts’ expectations.

Myriad Genetics had the weakest performance against analyst estimates among its peers. The stock is down 24.7% since reporting and currently trades at $10.35.

Read our full, actionable report on Myriad Genetics here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.