Shareholders of Apogee would probably like to forget the past six months even happened. The stock dropped 32.8% and now trades at $46.73. This might have investors contemplating their next move.

Is now the time to buy Apogee, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Despite the more favorable entry price, we don't have much confidence in Apogee. Here are three reasons why there are better opportunities than APOG and a stock we'd rather own.

Why Is Apogee Not Exciting?

Involved in the design of the Apple Store on Fifth Avenue in New York City, Apogee (NASDAQ: APOG) sells architectural products and services such as high-performance glass for commercial buildings.

1. Long-Term Revenue Growth Flatter Than a Pancake

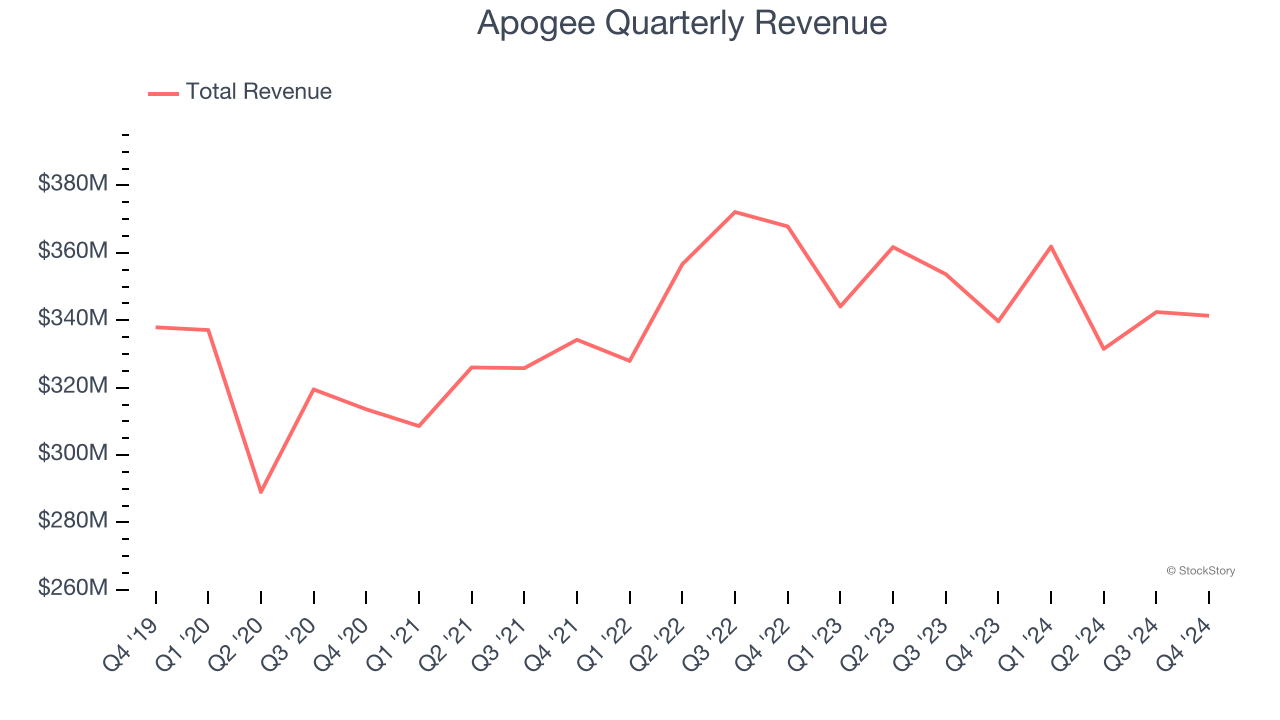

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Apogee struggled to consistently increase demand as its $1.38 billion of sales for the trailing 12 months was close to its revenue five years ago. This was below our standards and is a sign of lacking business quality.

2. Low Gross Margin Reveals Weak Structural Profitability

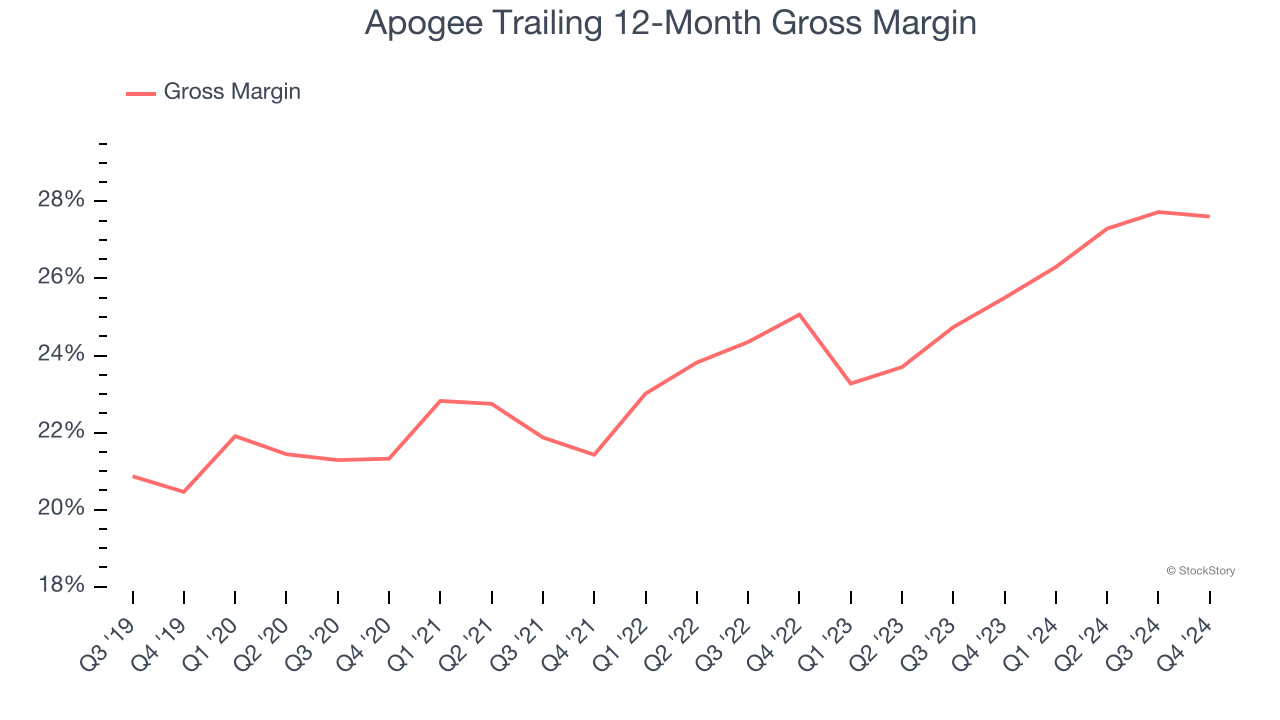

All else equal, we prefer higher gross margins because they usually indicate that a company sells more differentiated products and commands stronger pricing power.

Apogee has bad unit economics for an industrials company, giving it less room to reinvest and develop new offerings. As you can see below, it averaged a 24.3% gross margin over the last five years. That means Apogee paid its suppliers a lot of money ($75.72 for every $100 in revenue) to run its business.

3. Free Cash Flow Margin Dropping

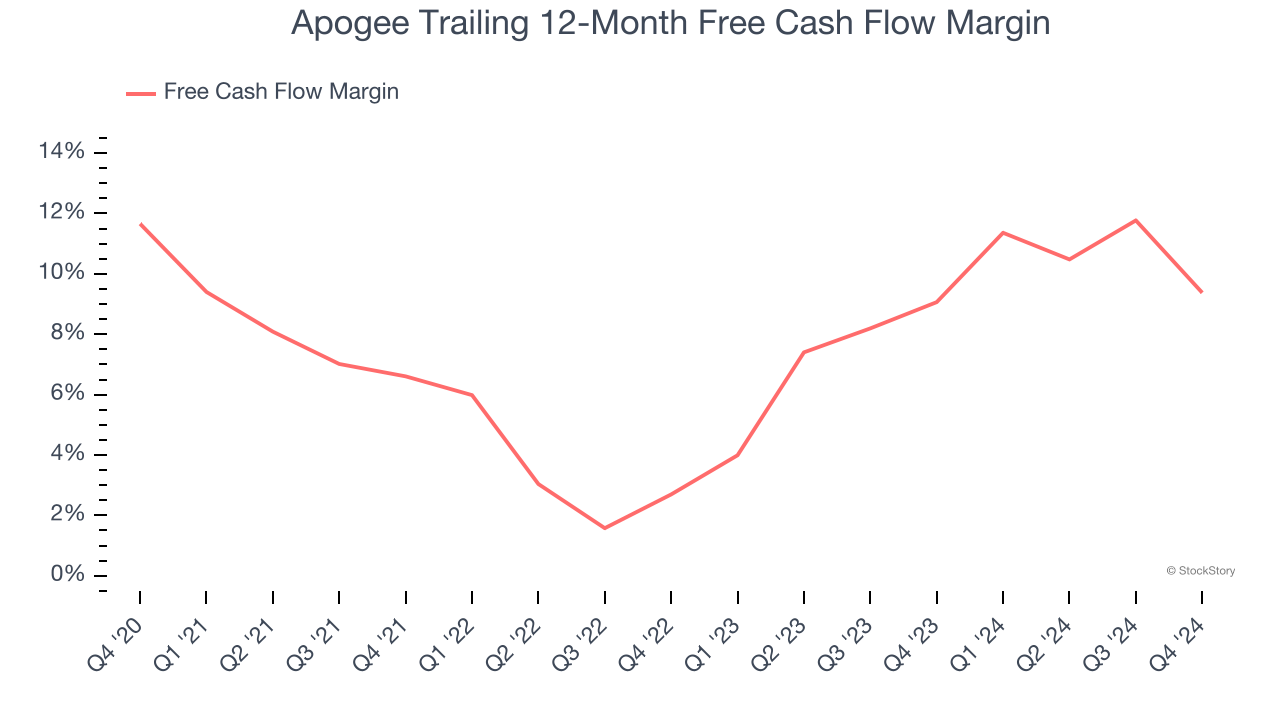

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Apogee’s margin dropped by 2.3 percentage points over the last five years. If its declines continue, it could signal increasing investment needs and capital intensity. Apogee’s free cash flow margin for the trailing 12 months was 9.4%.

Final Judgment

Apogee’s business quality ultimately falls short of our standards. After the recent drawdown, the stock trades at 9.5× forward price-to-earnings (or $46.73 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're pretty confident there are more exciting stocks to buy at the moment. We’d suggest looking at an all-weather company that owns household favorite Taco Bell.

Stocks We Would Buy Instead of Apogee

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.