Over the past six months, U.S. Cellular has been a great trade. While the S&P 500 was flat, the stock price has climbed by 13.9% to $64.40 per share. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is there a buying opportunity in U.S. Cellular, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.

Despite the momentum, we don't have much confidence in U.S. Cellular. Here are three reasons why there are better opportunities than USM and a stock we'd rather own.

Why Do We Think U.S. Cellular Will Underperform?

Operating as a majority-owned subsidiary of Telephone and Data Systems since its founding in 1983, US Cellular (NYSE: USM) is a regional wireless telecommunications provider serving 4.6 million customers across 21 states with mobile phone, internet, and IoT services.

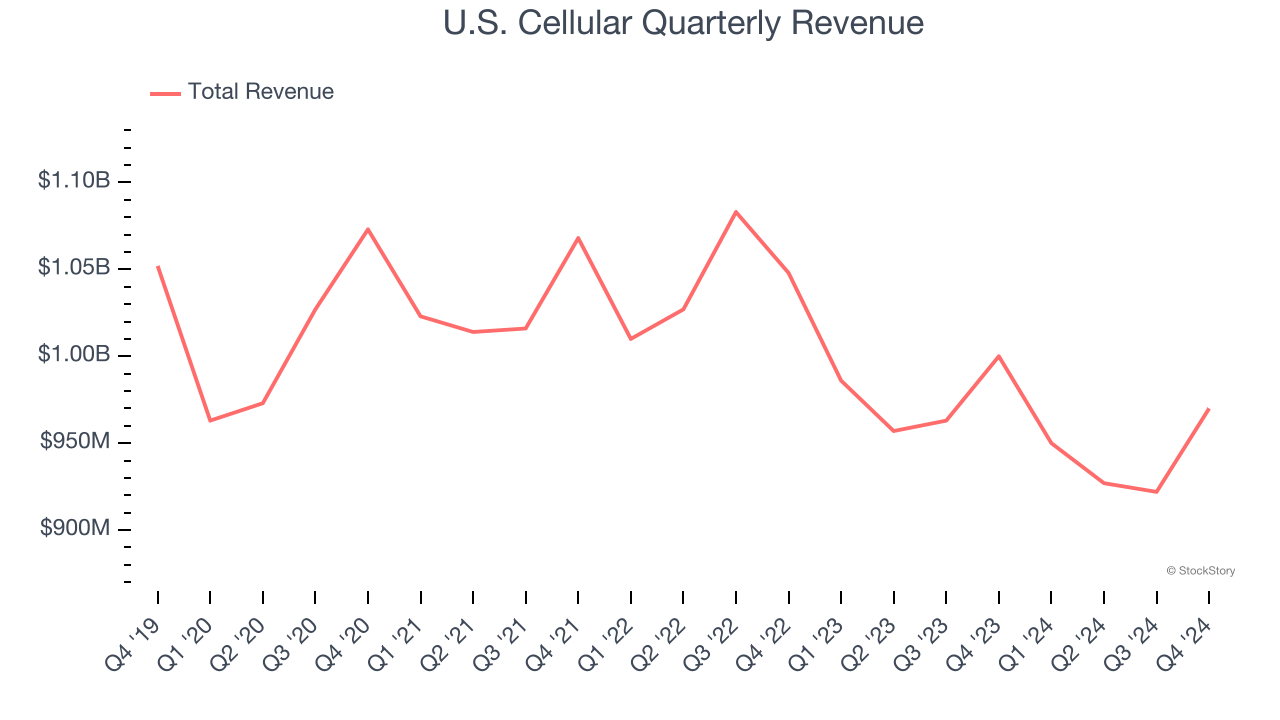

1. Revenue Spiraling Downwards

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. U.S. Cellular’s demand was weak over the last five years as its sales fell at a 1.3% annual rate. This wasn’t a great result and is a sign of poor business quality.

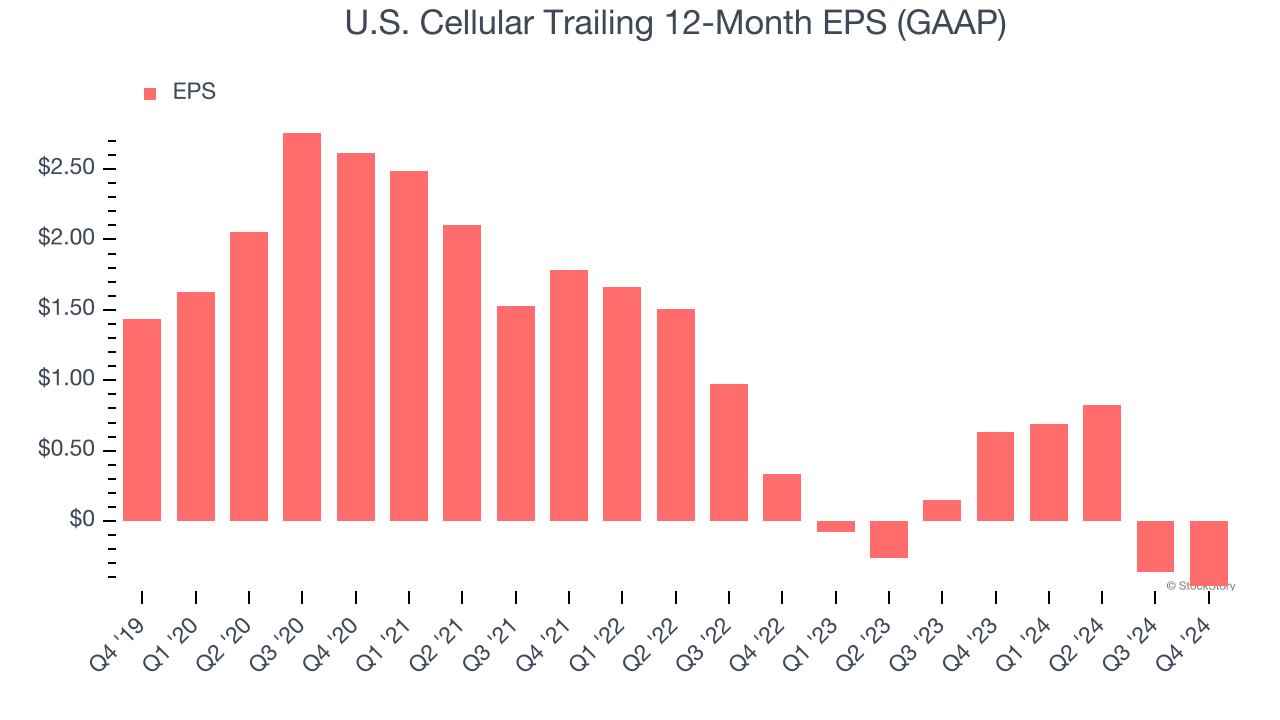

2. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for U.S. Cellular, its EPS declined by 18.4% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

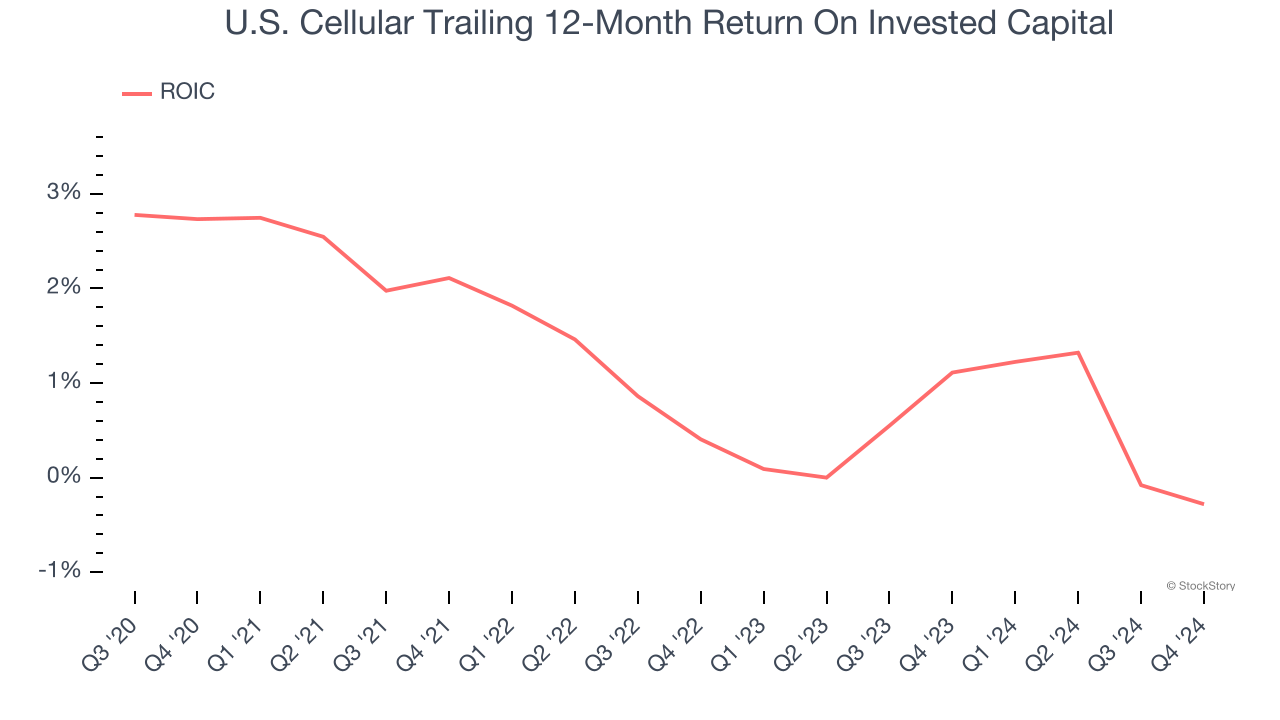

3. Previous Growth Initiatives Haven’t Impressed

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

U.S. Cellular historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 1.2%, lower than the typical cost of capital (how much it costs to raise money) for business services companies.

Final Judgment

We see the value of companies helping consumers, but in the case of U.S. Cellular, we’re out. With its shares topping the market in recent months, the stock trades at 5.7× forward EV-to-EBITDA (or $64.40 per share). At this valuation, there’s a lot of good news priced in - you can find better investment opportunities elsewhere. Let us point you toward one of our top digital advertising picks.

Stocks We Like More Than U.S. Cellular

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.