Over the last six months, CSX’s shares have sunk to $30.02, producing a disappointing 11.9% loss while the S&P 500 was flat. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is now the time to buy CSX, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Even with the cheaper entry price, we don't have much confidence in CSX. Here are three reasons why there are better opportunities than CSX and a stock we'd rather own.

Why Do We Think CSX Will Underperform?

Established as part of the Chessie System and Seaboard Coast Line Industries merger, CSX (NASDAQ: CSX) is a transportation company specializing in freight rail services.

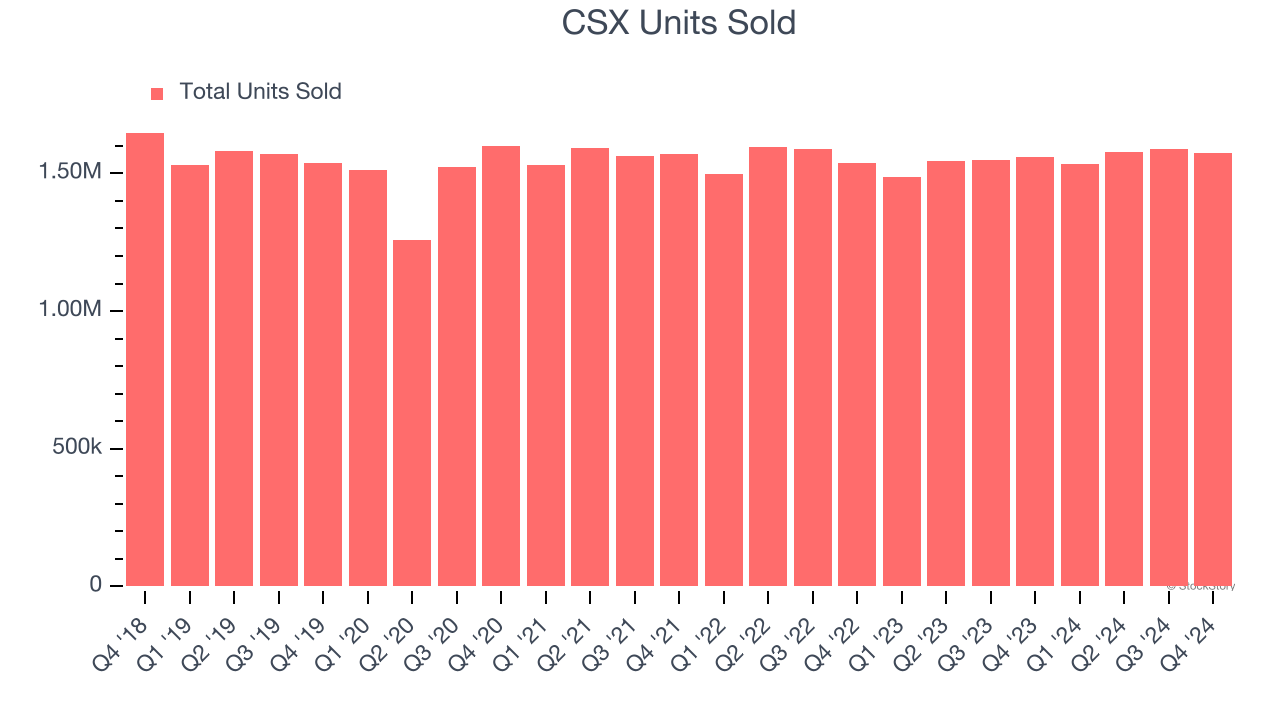

1. Sales Volumes Stall, Demand Waning

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful Rail Transportation company because there’s a ceiling to what customers will pay.

Over the last two years, CSX failed to grow its units sold, which came in at 1.58 million in the latest quarter. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests CSX might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

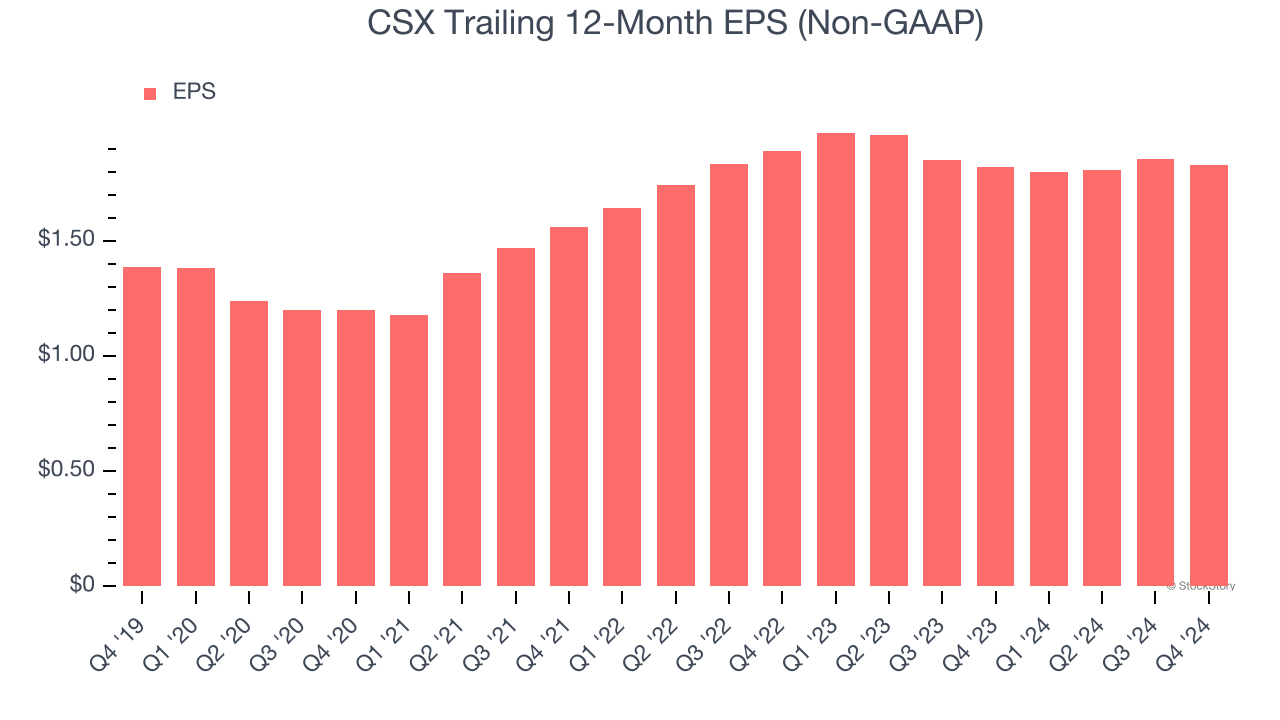

2. EPS Barely Growing

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

CSX’s EPS grew at an unimpressive 5.7% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 4% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

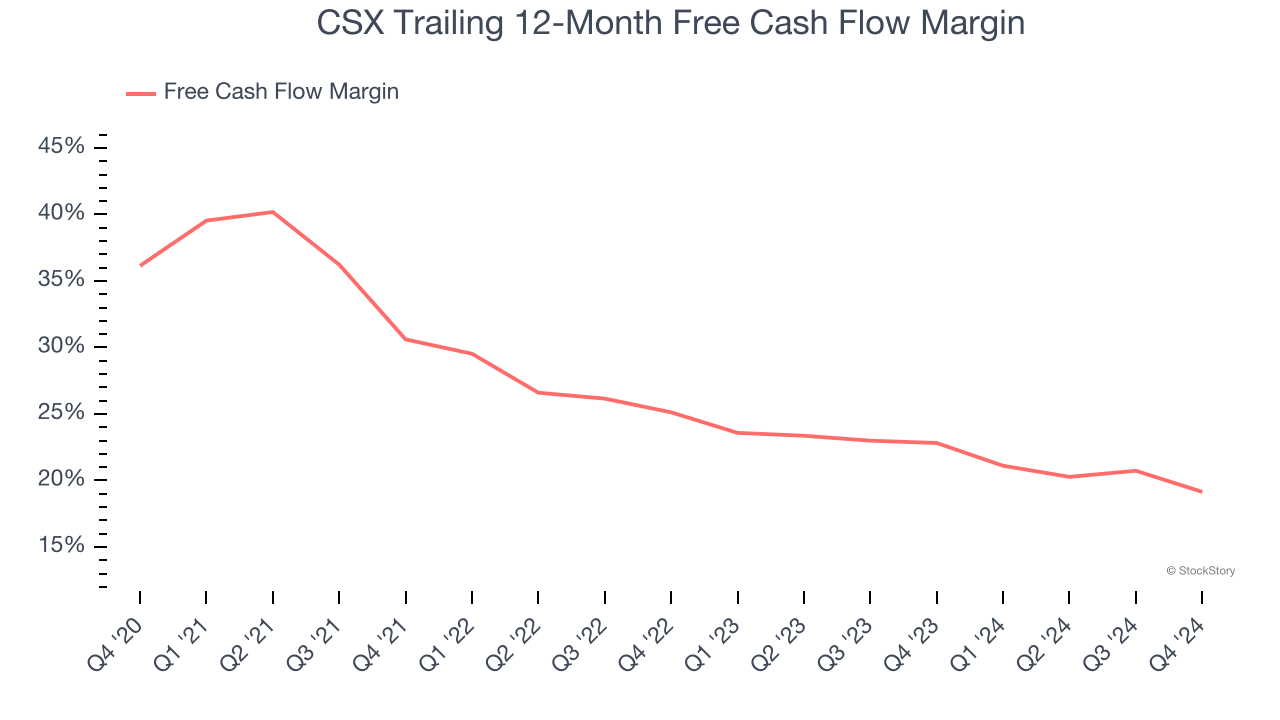

3. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, CSX’s margin dropped by 17 percentage points over the last five years. If its declines continue, it could signal increasing investment needs and capital intensity. CSX’s free cash flow margin for the trailing 12 months was 19.1%.

Final Judgment

We see the value of companies helping their customers, but in the case of CSX, we’re out. Following the recent decline, the stock trades at 15.5× forward price-to-earnings (or $30.02 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. There are superior stocks to buy right now. We’d suggest looking at one of Charlie Munger’s all-time favorite businesses.

Stocks We Like More Than CSX

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.