Young adult apparel retailer American Eagle Outfitters (NYSE: AEO) met Wall Street’s revenue expectations in Q4 CY2024, but sales fell by 4.4% year on year to $1.6 billion. On the other hand, next quarter’s revenue guidance of $1.09 billion was less impressive, coming in 6.7% below analysts’ estimates. Its non-GAAP profit of $0.54 per share was 6.3% above analysts’ consensus estimates.

Is now the time to buy American Eagle? Find out by accessing our full research report, it’s free.

American Eagle (AEO) Q4 CY2024 Highlights:

- Revenue: $1.6 billion vs analyst estimates of $1.6 billion (4.4% year-on-year decline, in line)

- Adjusted EPS: $0.54 vs analyst estimates of $0.51 (6.3% beat)

- Revenue Guidance for Q1 CY2025 is $1.09 billion at the midpoint, below analyst estimates of $1.16 billion

- Operating Margin: 8.9%, up from 0.6% in the same quarter last year

- Locations: 1,172 at quarter end, down from 1,182 in the same quarter last year

- Same-Store Sales rose 3% year on year (8% in the same quarter last year)

- Market Capitalization: $2.21 billion

“2024 demonstrated significant progress on our Powering Profitable Growth Plan. The team delivered strong operating profit growth with positive momentum across our brands and channels as well as disciplined expense management and operating efficiencies,” commented Jay Schottenstein, AEO’s Executive Chairman of the Board and Chief Executive Officer.

Company Overview

With a heavy focus on denim, American Eagle Outfitters (NYSE: AEO) is a specialty retailer offering an assortment of apparel and accessories to young adults.

Apparel Retailer

Apparel sales are not driven so much by personal needs but by seasons, trends, and innovation, and over the last few decades, the category has shifted meaningfully online. Retailers that once only had brick-and-mortar stores are responding with omnichannel presences. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stall, so the evolution of clothing sellers marches on.

Sales Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $5.33 billion in revenue over the past 12 months, American Eagle is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

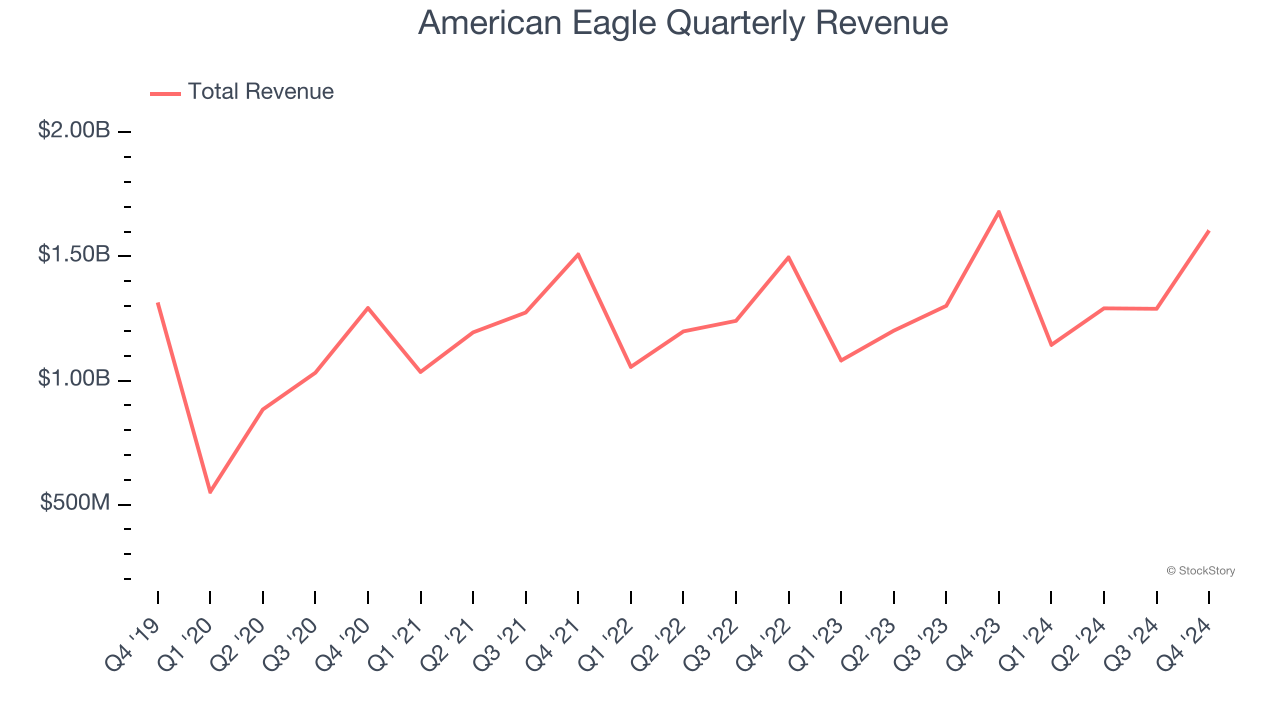

As you can see below, American Eagle’s 4.3% annualized revenue growth over the last five years (we compare to 2019 to normalize for COVID-19 impacts) was sluggish as its store footprint remained unchanged.

This quarter, American Eagle reported a rather uninspiring 4.4% year-on-year revenue decline to $1.6 billion of revenue, in line with Wall Street’s estimates. Company management is currently guiding for a 5% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 3% over the next 12 months, similar to its five-year rate. This projection doesn't excite us and implies its products will face some demand challenges.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Store Performance

Number of Stores

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

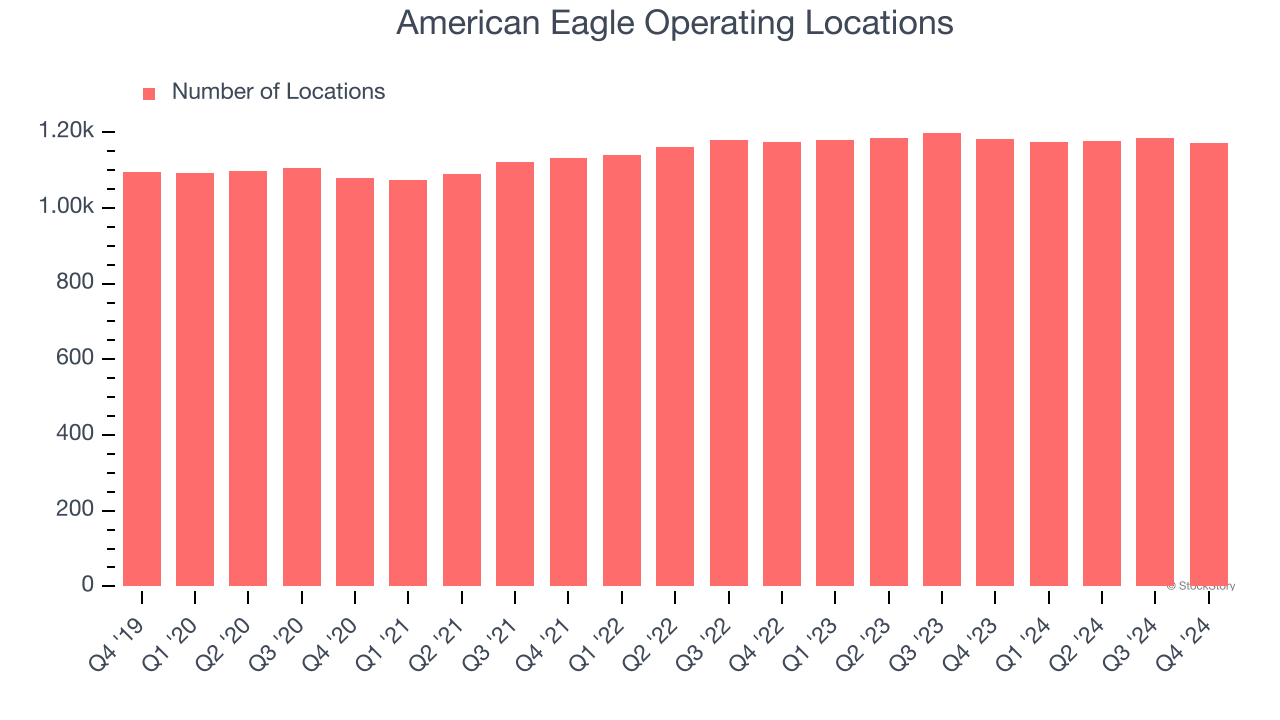

American Eagle operated 1,172 locations in the latest quarter, and over the last two years, has kept its store count flat while other consumer retail businesses have opted for growth.

When a retailer keeps its store footprint steady, it usually means demand is stable and it’s focusing on operational efficiency to increase profitability.

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

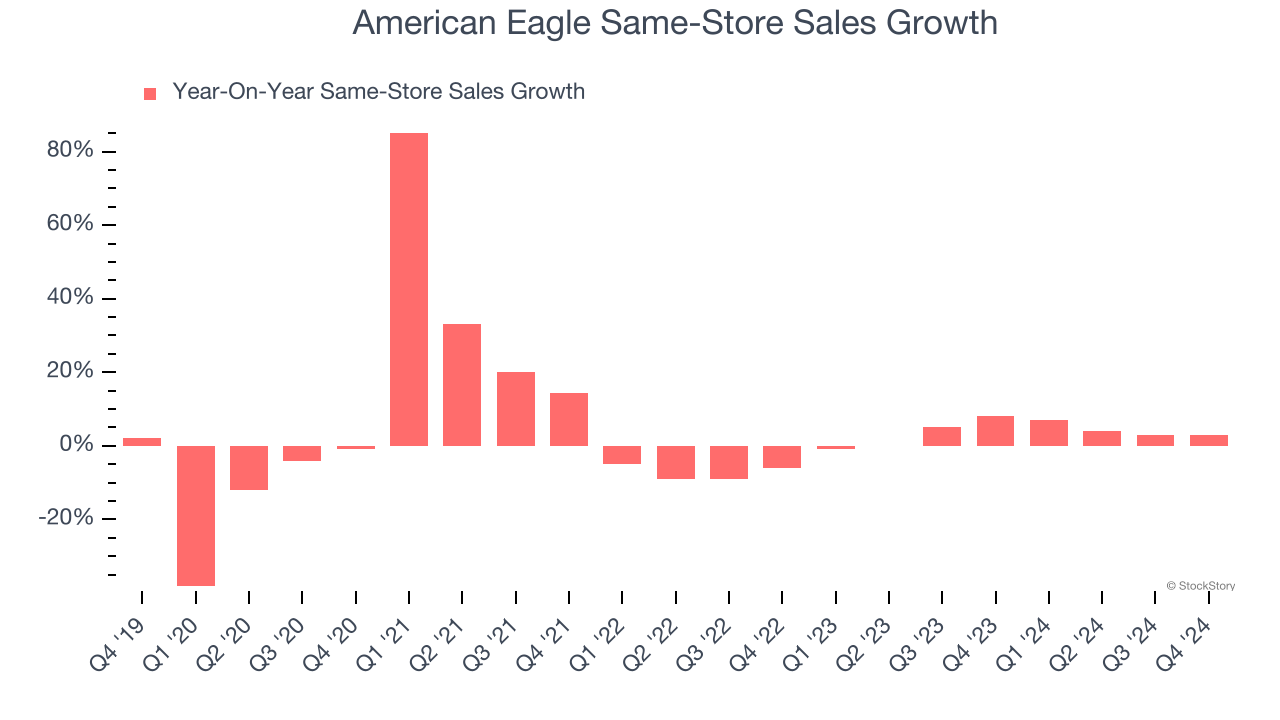

American Eagle’s demand has been spectacular for a retailer over the last two years. On average, the company has increased its same-store sales by an impressive 3.6% per year. Given its flat store base over the same period, this performance stems from not only increased foot traffic at existing locations but also higher e-commerce sales as demand shifts from in-store to online.

In the latest quarter, American Eagle’s same-store sales rose 3% year on year. This performance was more or less in line with its historical levels.

Key Takeaways from American Eagle’s Q4 Results

It was encouraging to see American Eagle beat analysts’ gross margin expectations this quarter. We were also happy its EPS outperformed Wall Street’s estimates. On the other hand, its revenue guidance for next quarter missed significantly, making this a weaker quarter. The stock traded down 5.6% to $10.85 immediately after reporting.

American Eagle didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.