Financial advisory firm Perella Weinberg Partners (NASDAQ: PWP) fell short of the markets revenue expectations in Q3 CY2025, with sales falling 40.8% year on year to $164.6 million. Its non-GAAP profit of $0.13 per share was 10.3% below analysts’ consensus estimates.

Is now the time to buy Perella Weinberg? Find out by accessing our full research report, it’s free for active Edge members.

Perella Weinberg (PWP) Q3 CY2025 Highlights:

“Our strategic investments this year — adding 25 senior bankers and closing the Devon Park acquisition — position us well in an increasingly active transaction environment and demonstrate our commitment to build scale. We’ve hired in some of the most attractive sectors in our markets, with a singular focus on providing the best strategic and financial advice to our clients,” stated Andrew Bednar, Chief Executive Officer.

Company Overview

Founded in 2006 by veteran investment bankers Joseph Perella and Peter Weinberg during a wave of boutique advisory firm launches, Perella Weinberg Partners (NASDAQ: PWP) is a global independent advisory firm that provides strategic and financial advice to corporations, financial sponsors, and government institutions.

Revenue Growth

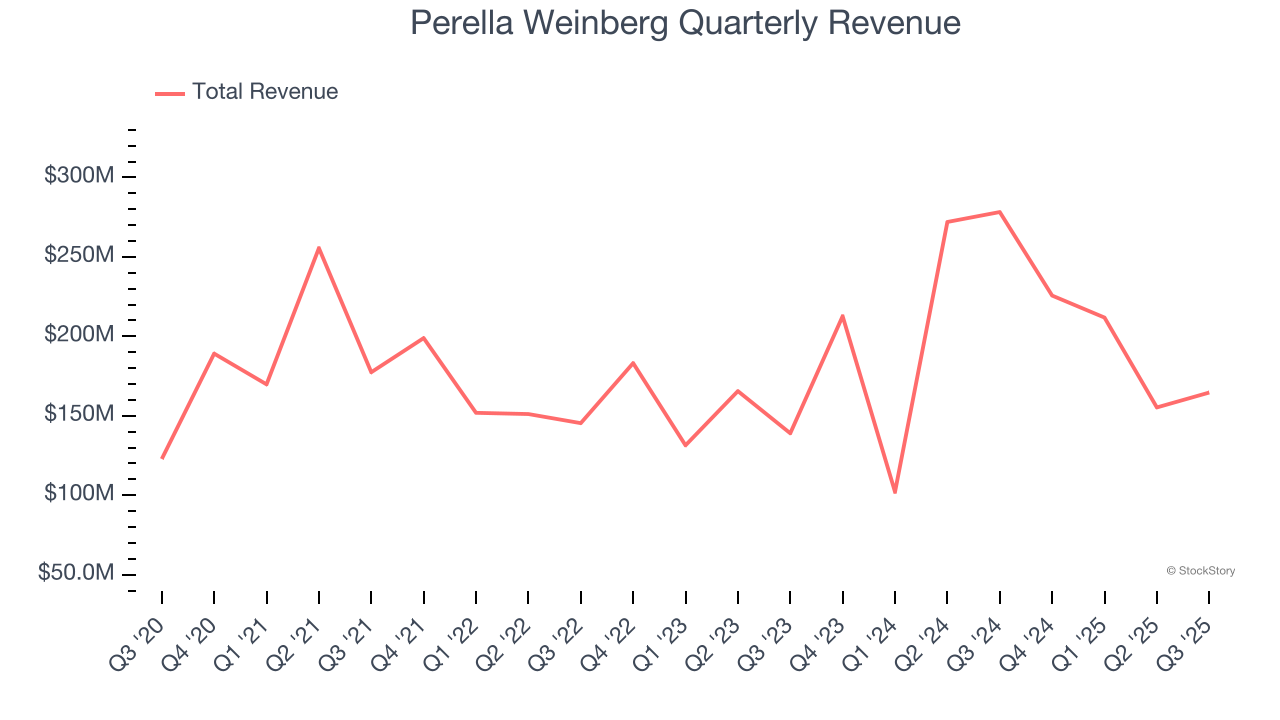

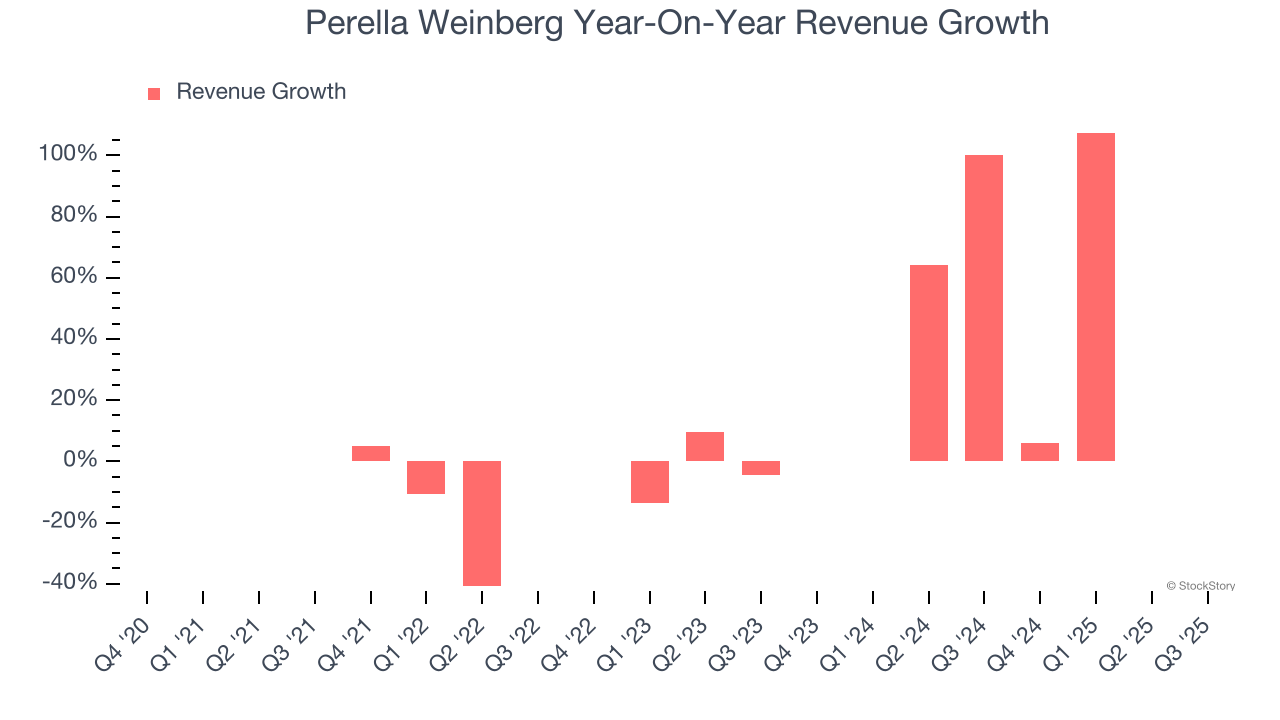

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, Perella Weinberg’s 8.6% annualized revenue growth over the last five years was decent. Its growth was slightly above the average financials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Perella Weinberg’s annualized revenue growth of 10.6% over the last two years is above its five-year trend, suggesting some bright spots.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Perella Weinberg missed Wall Street’s estimates and reported a rather uninspiring 40.8% year-on-year revenue decline, generating $164.6 million of revenue.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Key Takeaways from Perella Weinberg’s Q3 Results

We struggled to find many positives in these results. Its revenue missed and its EPS fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $18.85 immediately after reporting.

The latest quarter from Perella Weinberg’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.