Fertility benefits company Progyny (NASDAQ: PGNY) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 9.3% year on year to $313.3 million. Revenue guidance for the full year exceeded analysts’ estimates, but next quarter’s guidance of $300.2 million was less impressive, coming in 0.7% below expectations. Its non-GAAP profit of $0.45 per share was 15.4% above analysts’ consensus estimates.

Is now the time to buy Progyny? Find out by accessing our full research report, it’s free for active Edge members.

Progyny (PGNY) Q3 CY2025 Highlights:

- Revenue: $313.3 million vs analyst estimates of $299.3 million (9.3% year-on-year growth, 4.7% beat)

- Adjusted EPS: $0.45 vs analyst estimates of $0.39 (15.4% beat)

- Adjusted EBITDA: $54.97 million vs analyst estimates of $47.11 million (17.5% margin, 16.7% beat)

- Revenue Guidance for Q4 CY2025 is $300.2 million at the midpoint, below analyst estimates of $302.2 million

- Management raised its full-year Adjusted EPS guidance to $1.81 at the midpoint, a 3.7% increase

- EBITDA guidance for Q4 CY2025 is $47.3 million at the midpoint, above analyst estimates of $46.78 million

- Operating Margin: 6.9%, up from 4.3% in the same quarter last year

- Free Cash Flow Margin: 14.7%, similar to the same quarter last year

- Sales Volumes fell 99.9% year on year (-0.6% in the same quarter last year)

- Market Capitalization: $1.62 billion

“Our strong results this quarter reflect that members have continued to pursue the care and services they need in order to best address both their family building goals and their overall health, and did so at levels that exceeded our expectations,” said Pete Anevski, Chief Executive Officer of Progyny.

Company Overview

Pioneering a data-driven approach to family building that has achieved an industry-leading patient satisfaction score of +80, Progyny (NASDAQ: PGNY) provides comprehensive fertility and family building benefits solutions to employers, helping employees access quality fertility treatments and support services.

Revenue Growth

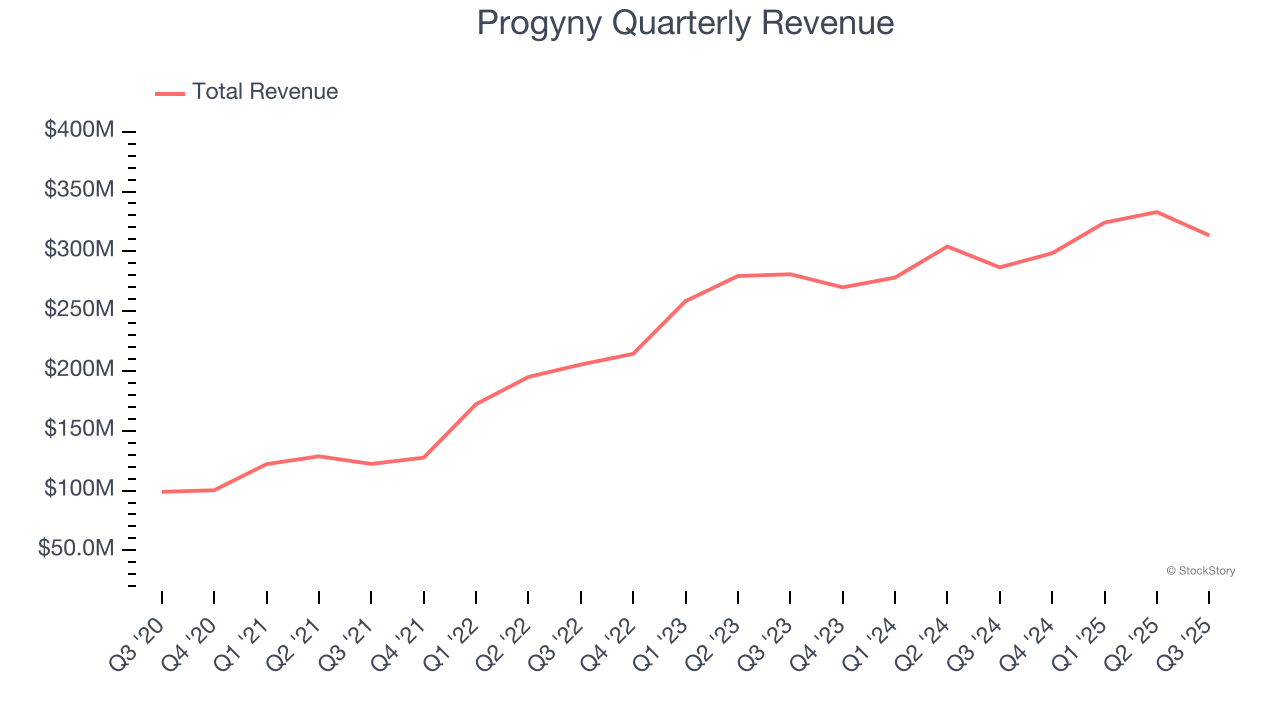

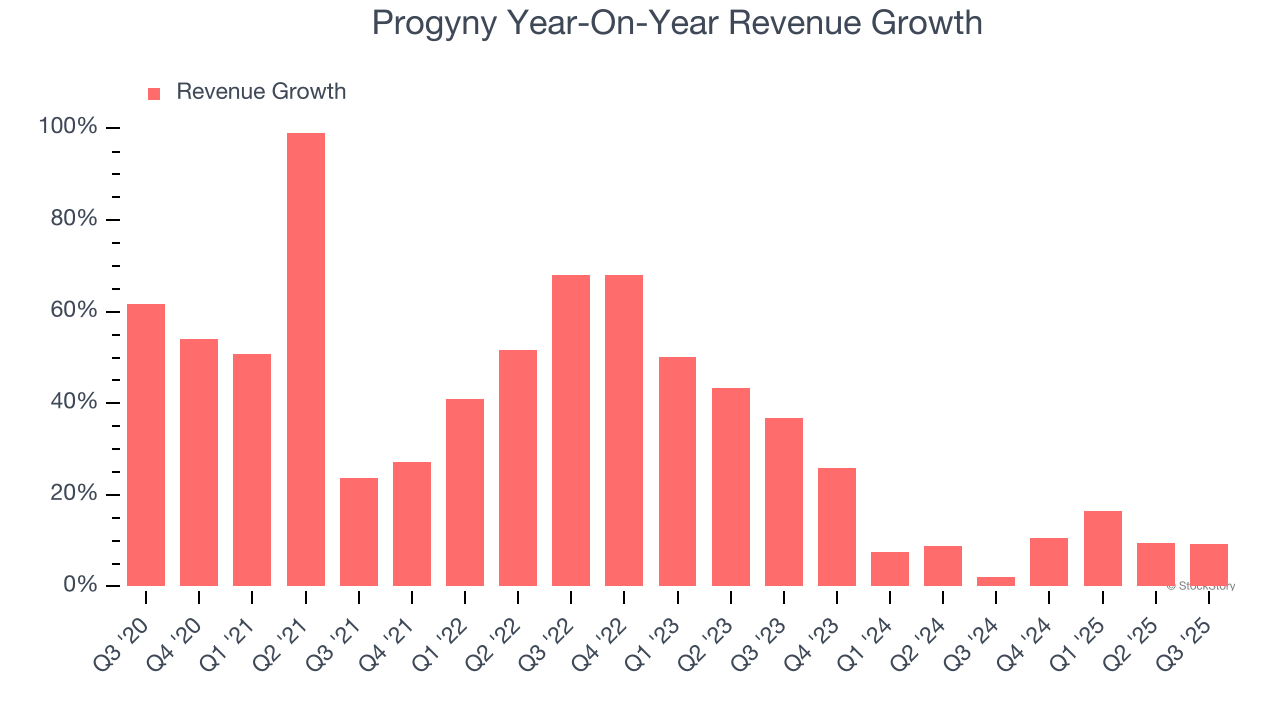

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, Progyny’s sales grew at an incredible 32.6% compounded annual growth rate over the last five years. Its growth beat the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Progyny’s annualized revenue growth of 10.8% over the last two years is below its five-year trend, but we still think the results were respectable.

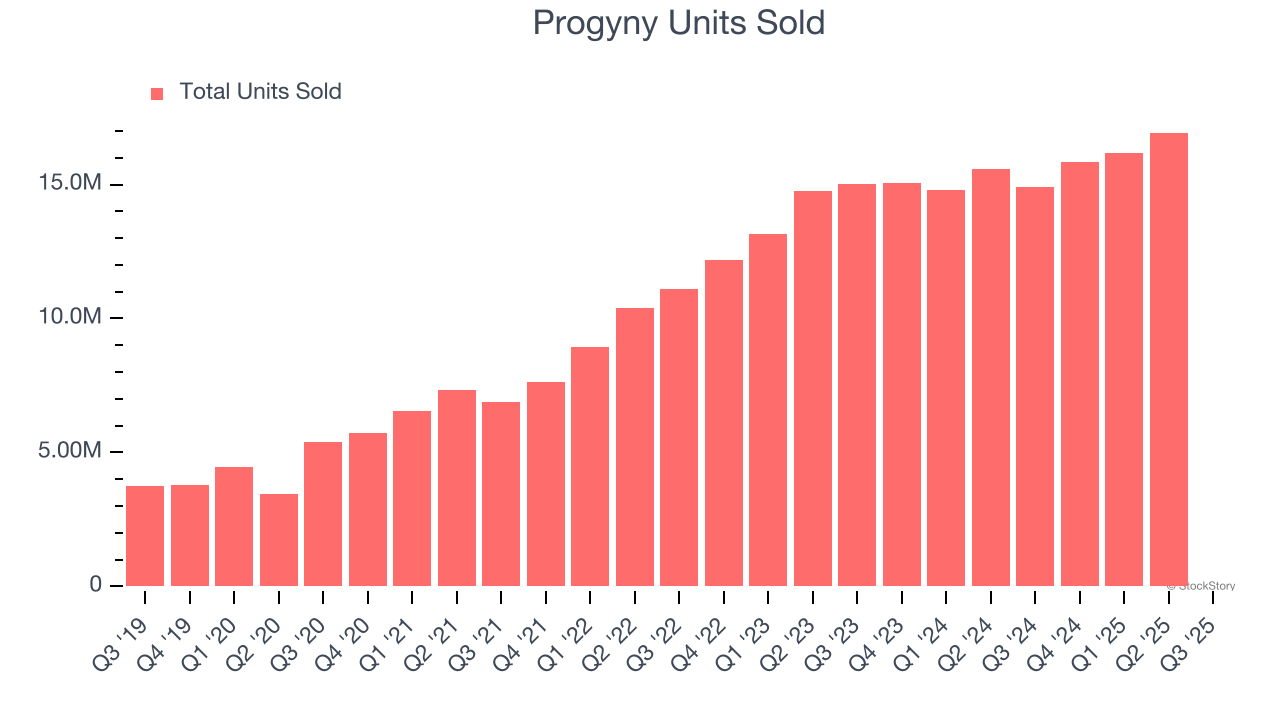

We can better understand the company’s revenue dynamics by analyzing its number of units sold, which reached 15,981 in the latest quarter. Over the last two years, Progyny’s units sold averaged 4.5% year-on-year declines. Because this number is lower than its revenue growth, we can see the company benefited from price increases.

This quarter, Progyny reported year-on-year revenue growth of 9.3%, and its $313.3 million of revenue exceeded Wall Street’s estimates by 4.7%. Company management is currently guiding for flat sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 5.5% over the next 12 months, a deceleration versus the last two years. Still, this projection is above average for the sector and suggests the market is baking in some success for its newer products and services.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

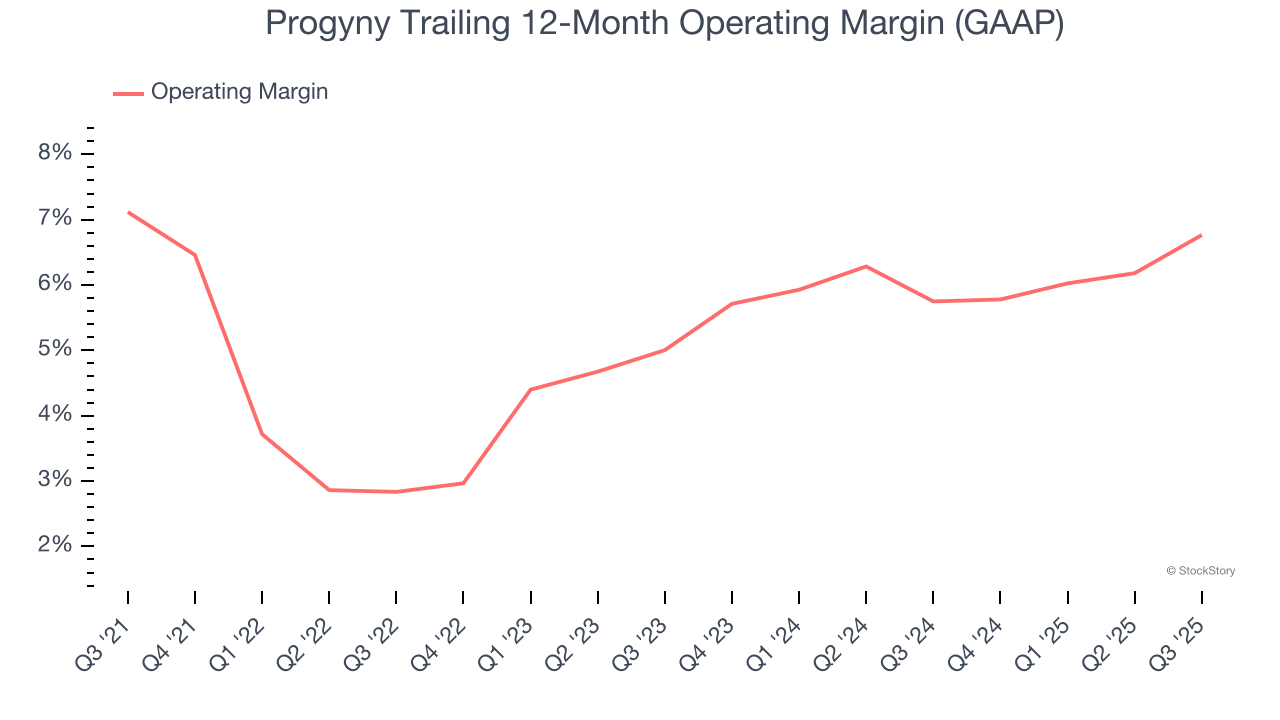

Operating Margin

Progyny’s operating margin has been trending up over the last 12 months and averaged 5.6% over the last five years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports paltry profitability for a healthcare business.

Analyzing the trend in its profitability, Progyny’s operating margin of 6.8% for the trailing 12 months may be around the same as five years ago, but it has increased by 1.8 percentage points over the last two years.

In Q3, Progyny generated an operating margin profit margin of 6.9%, up 2.5 percentage points year on year. This increase was a welcome development and shows it was more efficient.

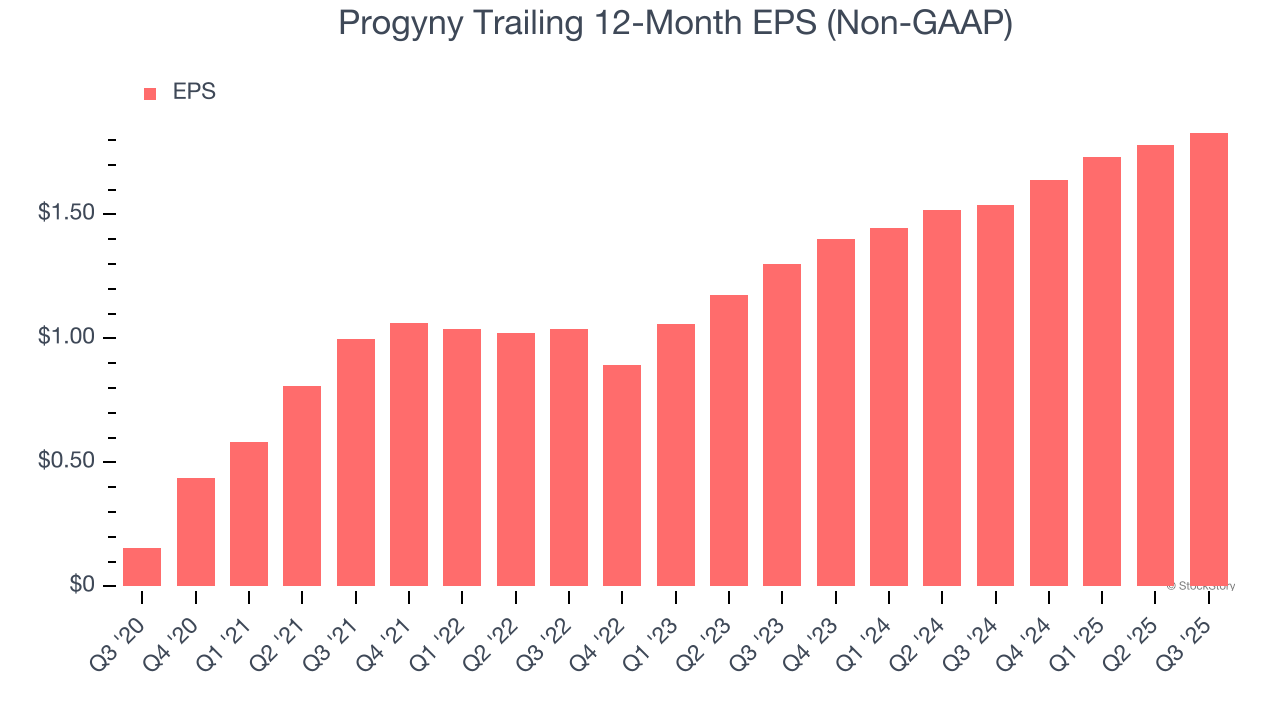

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

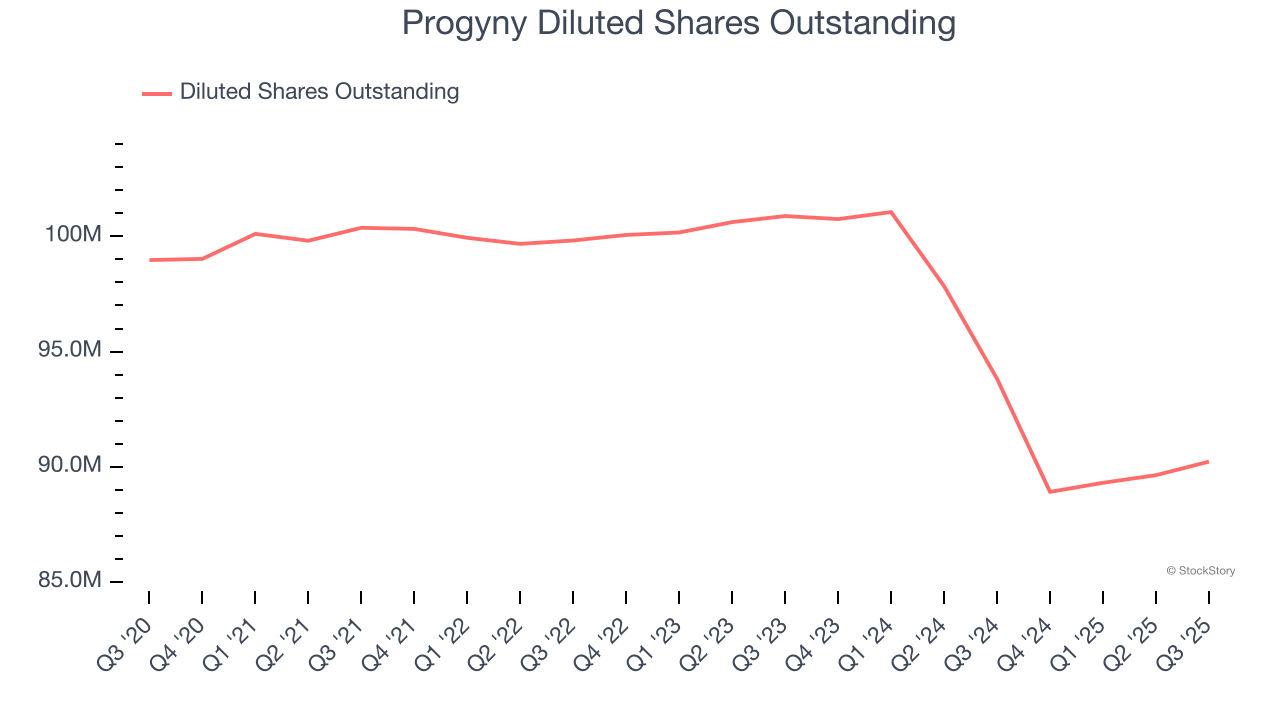

Progyny’s EPS grew at an astounding 64.1% compounded annual growth rate over the last five years, higher than its 32.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Progyny’s earnings to better understand the drivers of its performance. A five-year view shows that Progyny has repurchased its stock, shrinking its share count by 8.8%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q3, Progyny reported adjusted EPS of $0.45, up from $0.40 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Progyny’s full-year EPS of $1.83 to shrink by 1.5%.

Key Takeaways from Progyny’s Q3 Results

We enjoyed seeing Progyny beat analysts’ revenue expectations this quarter. We were also glad its full-year EPS guidance outperformed Wall Street’s estimates. On the other hand, its revenue guidance for next quarter slightly missed. Overall, we think this was still a solid quarter with some key areas of upside. The stock traded up 5.5% to $19.01 immediately following the results.

Progyny put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.