Medical tech company Masimo (NASDAQ: MASI) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 8.2% year on year to $371.5 million. The company expects the full year’s revenue to be around $1.52 billion, close to analysts’ estimates. Its non-GAAP profit of $1.32 per share was 9.9% above analysts’ consensus estimates.

Is now the time to buy Masimo? Find out by accessing our full research report, it’s free for active Edge members.

Masimo (MASI) Q3 CY2025 Highlights:

- Revenue: $371.5 million vs analyst estimates of $366.5 million (8.2% year-on-year growth, 1.4% beat)

- Adjusted EPS: $1.32 vs analyst estimates of $1.20 (9.9% beat)

- Adjusted EBITDA: $101.1 million vs analyst estimates of $111.4 million (27.2% margin, 9.3% miss)

- The company reconfirmed its revenue guidance for the full year of $1.52 billion at the midpoint

- Management raised its full-year Adjusted EPS guidance to $5.71 at the midpoint, a 7.1% increase

- Operating Margin: 22.5%, up from 8.8% in the same quarter last year

- Free Cash Flow Margin: 13.7%, up from 5.7% in the same quarter last year

- Constant Currency Revenue rose 7.6% year on year (5.4% in the same quarter last year)

- Market Capitalization: $7.87 billion

Katie Szyman, Chief Executive Officer of Masimo, said, “In the third quarter, we saw continued positive momentum across our core healthcare business, driven by the power of our innovative products. Revenues grew 8%, operating margin improved by 450 basis points, and EPS grew by 38%, all driven by sales growth and our successful operating efficiency initiatives. During the quarter, we closed the sale of Sound United to Harman and used the net proceeds to repurchase common stock. We also announced the expansion of our strategic partnership with Philips. We continue to invest in our core healthcare business to position for strong, sustainable long-term growth, and look forward to sharing more details on our strategy and innovations at our upcoming Investor Day on December 3rd.”

Company Overview

Founded in 1989 to solve the "unsolvable problem" of accurate pulse oximetry during patient movement, Masimo (NASDAQ: MASI) develops and manufactures noninvasive patient monitoring technologies, including its breakthrough pulse oximetry systems that accurately measure blood oxygen levels even during patient movement.

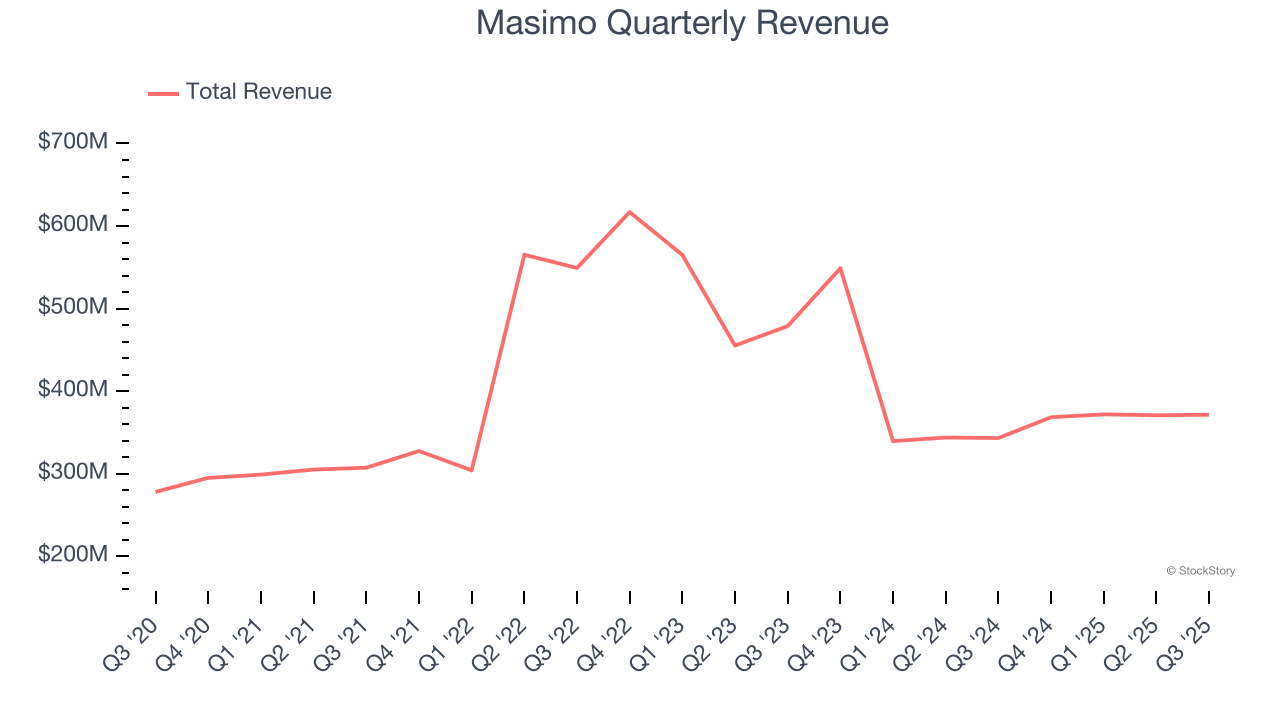

Revenue Growth

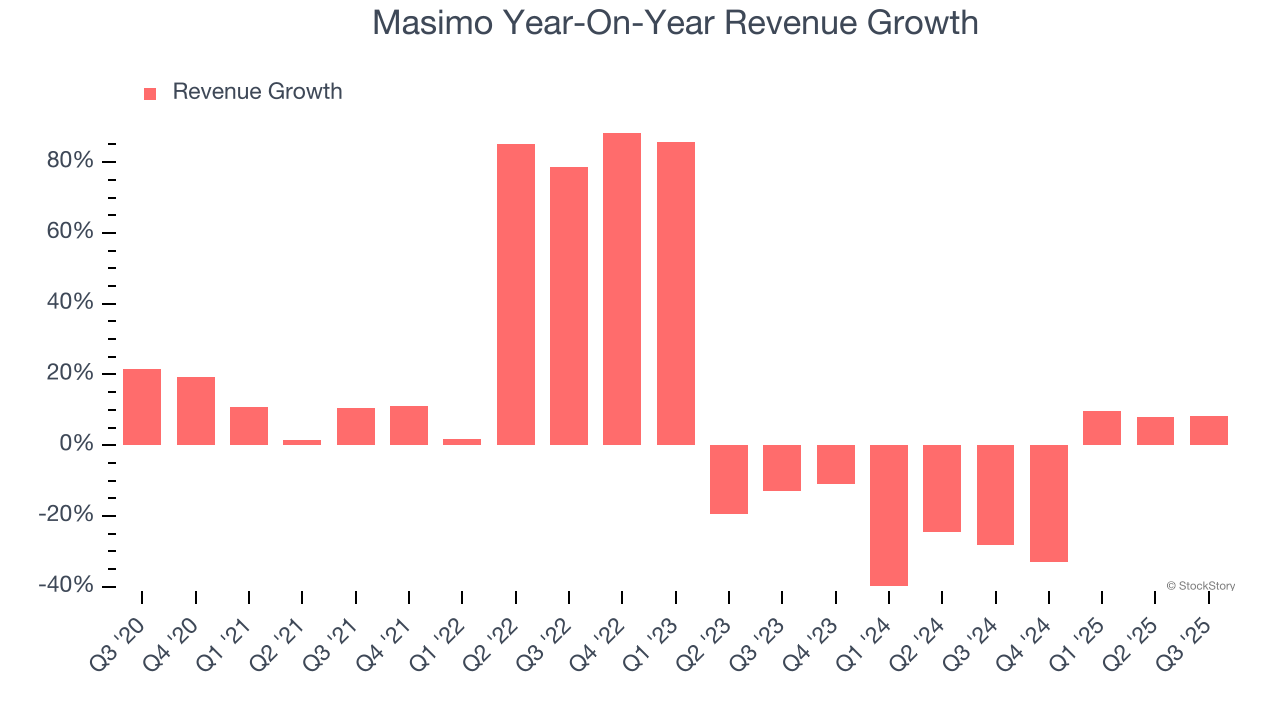

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Masimo’s 6.2% annualized revenue growth over the last five years was mediocre. This fell short of our benchmark for the healthcare sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Masimo’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 16.3% annually.

We can better understand the company’s sales dynamics by analyzing its constant currency revenue, which excludes currency movements that are outside their control and not indicative of demand. Over the last two years, its constant currency sales averaged 3.3% year-on-year growth. Because this number is better than its normal revenue growth, we can see that foreign exchange rates have been a headwind for Masimo.

This quarter, Masimo reported year-on-year revenue growth of 8.2%, and its $371.5 million of revenue exceeded Wall Street’s estimates by 1.4%.

Looking ahead, sell-side analysts expect revenue to grow 8.6% over the next 12 months, an improvement versus the last two years. This projection is admirable and indicates its newer products and services will fuel better top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

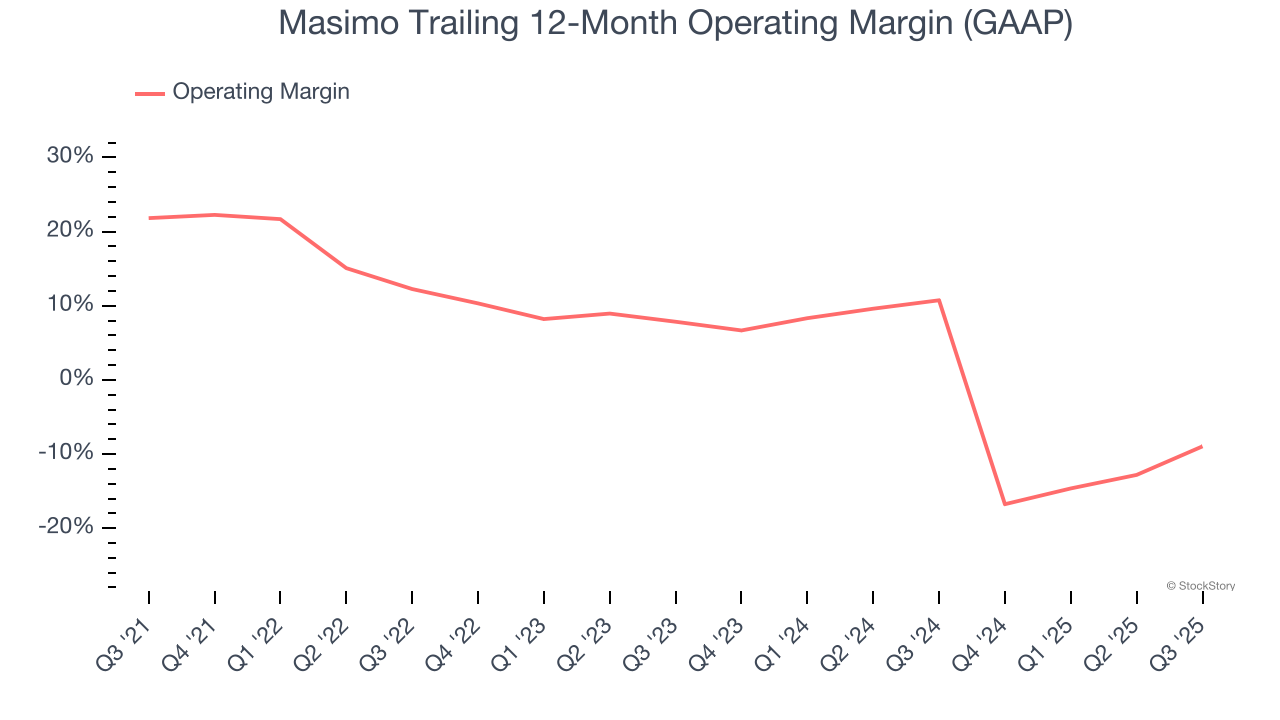

Operating Margin

Masimo was profitable over the last five years but held back by its large cost base. Its average operating margin of 8.4% was weak for a healthcare business.

Analyzing the trend in its profitability, Masimo’s operating margin decreased by 30.8 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 16.8 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Masimo generated an operating margin profit margin of 22.5%, up 13.7 percentage points year on year. This increase was a welcome development and shows it was more efficient.

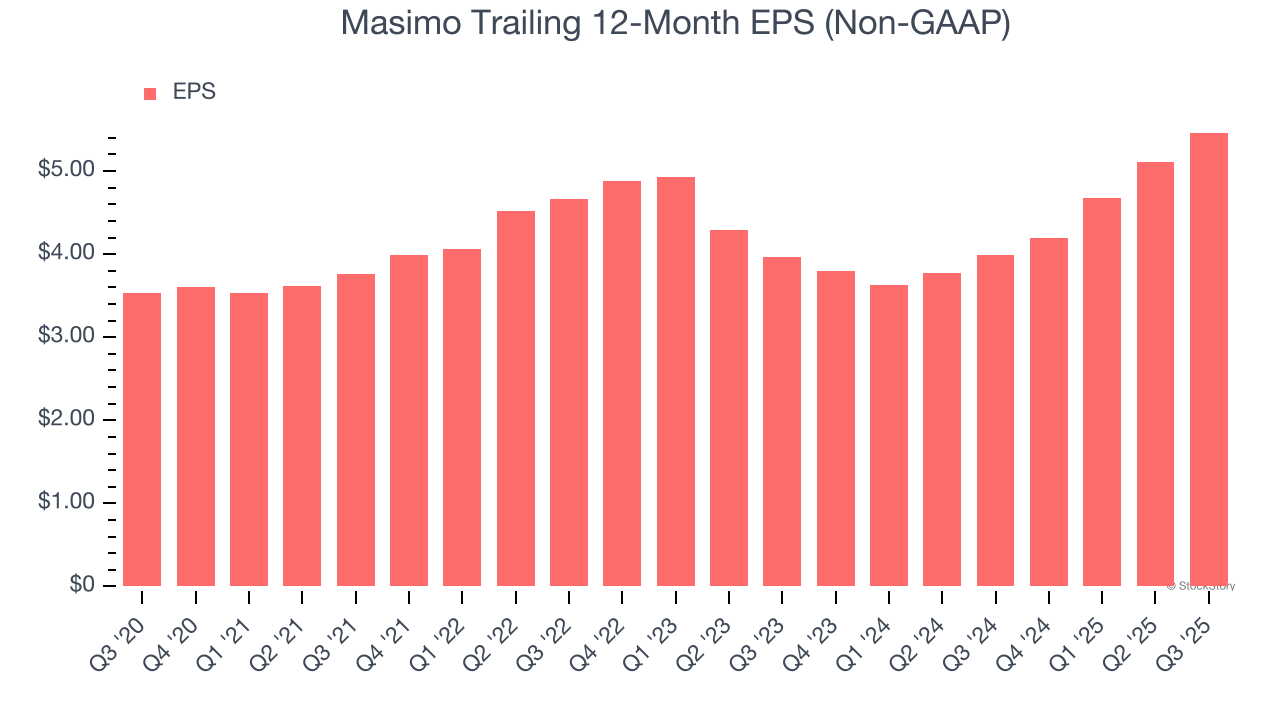

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Masimo’s EPS grew at a remarkable 9.1% compounded annual growth rate over the last five years, higher than its 6.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

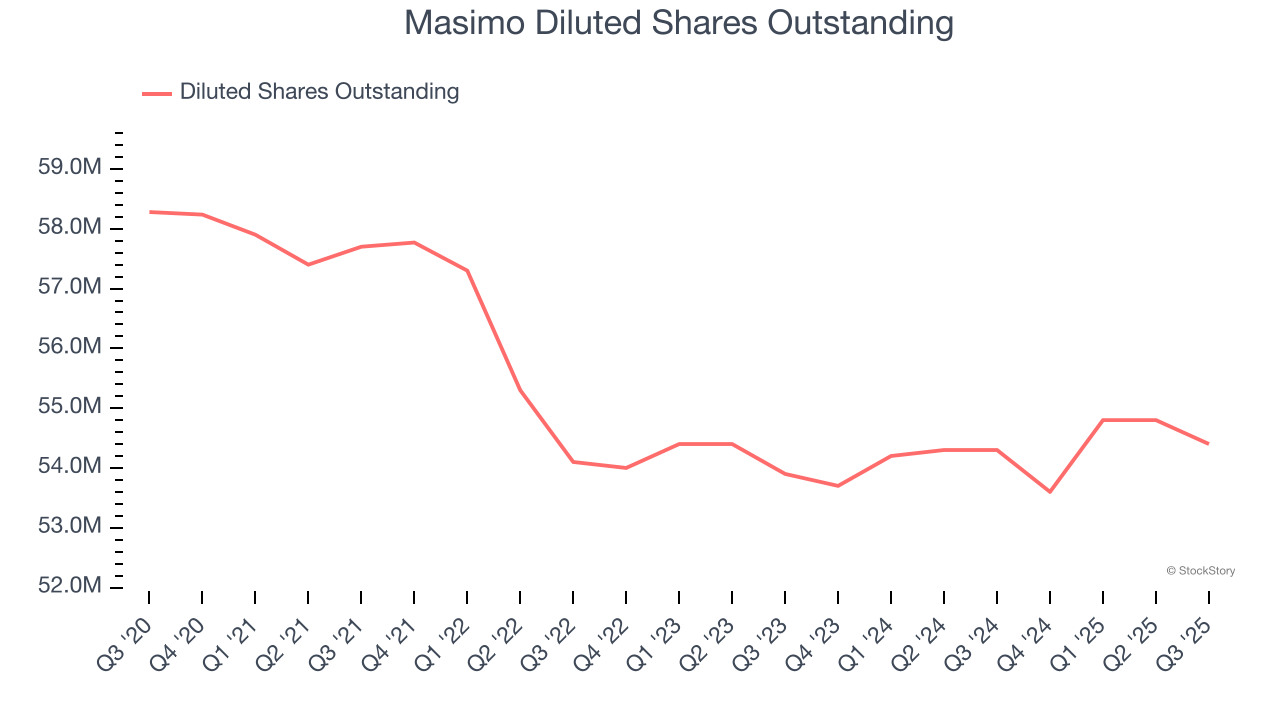

We can take a deeper look into Masimo’s earnings to better understand the drivers of its performance. A five-year view shows that Masimo has repurchased its stock, shrinking its share count by 6.7%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q3, Masimo reported adjusted EPS of $1.32, up from $0.96 in the same quarter last year. This print beat analysts’ estimates by 9.9%. Over the next 12 months, Wall Street expects Masimo’s full-year EPS of $5.46 to grow 3.3%.

Key Takeaways from Masimo’s Q3 Results

We were impressed by how significantly Masimo blew past analysts’ full-year EPS guidance expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 1.2% to $150.70 immediately after reporting.

Masimo had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.