Fast-food company Restaurant Brands (NYSE: QSR) announced better-than-expected revenue in Q3 CY2025, with sales up 6.9% year on year to $2.45 billion. Its non-GAAP profit of $1.03 per share was 2.9% above analysts’ consensus estimates.

Is now the time to buy Restaurant Brands? Find out by accessing our full research report, it’s free for active Edge members.

Restaurant Brands (QSR) Q3 CY2025 Highlights:

- Revenue: $2.45 billion vs analyst estimates of $2.39 billion (6.9% year-on-year growth, 2.4% beat)

- Adjusted EPS: $1.03 vs analyst estimates of $1.00 (2.9% beat)

- Operating Margin: 27.1%, up from 25.2% in the same quarter last year

- Free Cash Flow Margin: 21.7%, similar to the same quarter last year

- Locations: 32,423 at quarter end, up from 31,525 in the same quarter last year

- Same-Store Sales rose 4% year on year (0.3% in the same quarter last year)

- Market Capitalization: $21.64 billion

MIAMI, Oct. 30, 2025 /PRNewswire/ - Restaurant Brands International Inc. ("RBI") (NYSE: QSR) (TSX: QSR) (TSX: QSP) today reported financial results for the third quarter ended September 30, 2025.

Company Overview

Formed through a strategic merger, Restaurant Brands International (NYSE: QSR) is a multinational corporation that owns three iconic fast-food chains: Burger King, Tim Hortons, and Popeyes.

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $9.26 billion in revenue over the past 12 months, Restaurant Brands is one of the most widely recognized restaurant chains and benefits from customer loyalty, a luxury many don’t have. Its scale also gives it negotiating leverage with suppliers, enabling it to source its ingredients at a lower cost.

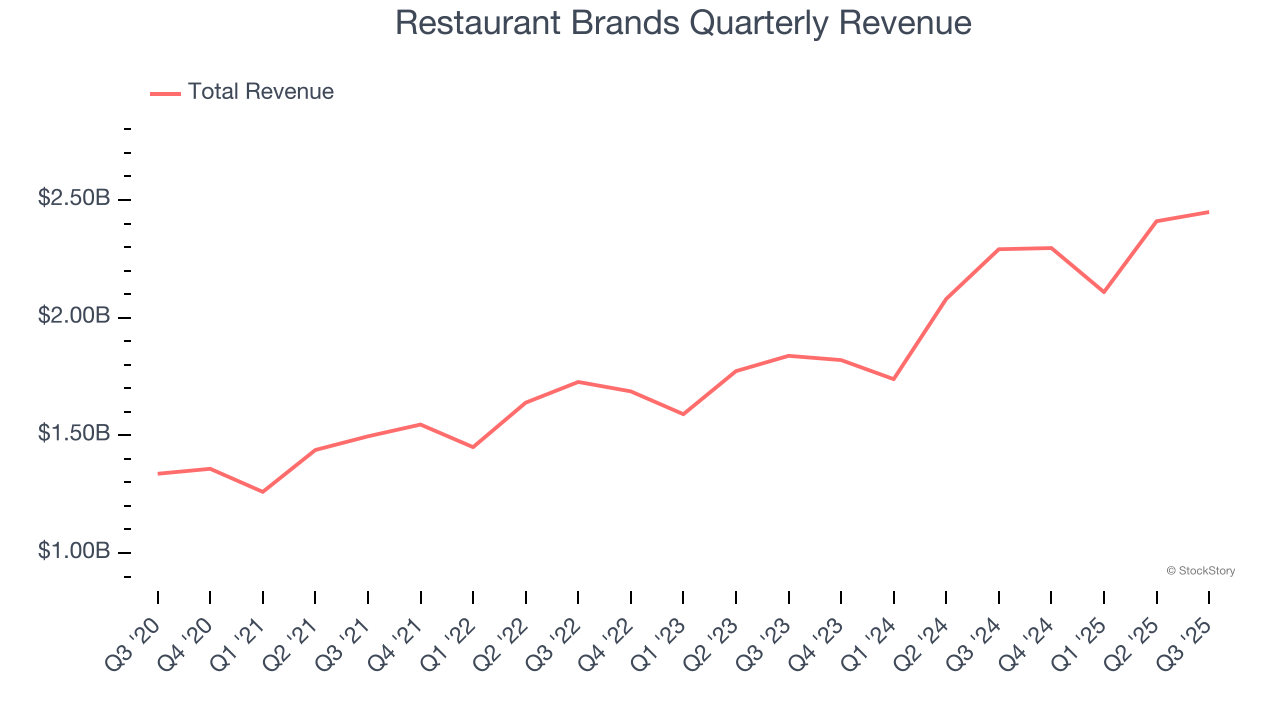

As you can see below, Restaurant Brands grew its sales at a decent 9% compounded annual growth rate over the last six years (we compare to 2019 to normalize for COVID-19 impacts) as it opened new restaurants and increased sales at existing, established dining locations.

This quarter, Restaurant Brands reported year-on-year revenue growth of 6.9%, and its $2.45 billion of revenue exceeded Wall Street’s estimates by 2.4%.

Looking ahead, sell-side analysts expect revenue to grow 3.3% over the next 12 months, a deceleration versus the last six years. This projection doesn't excite us and indicates its menu offerings will face some demand challenges.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Restaurant Performance

Number of Restaurants

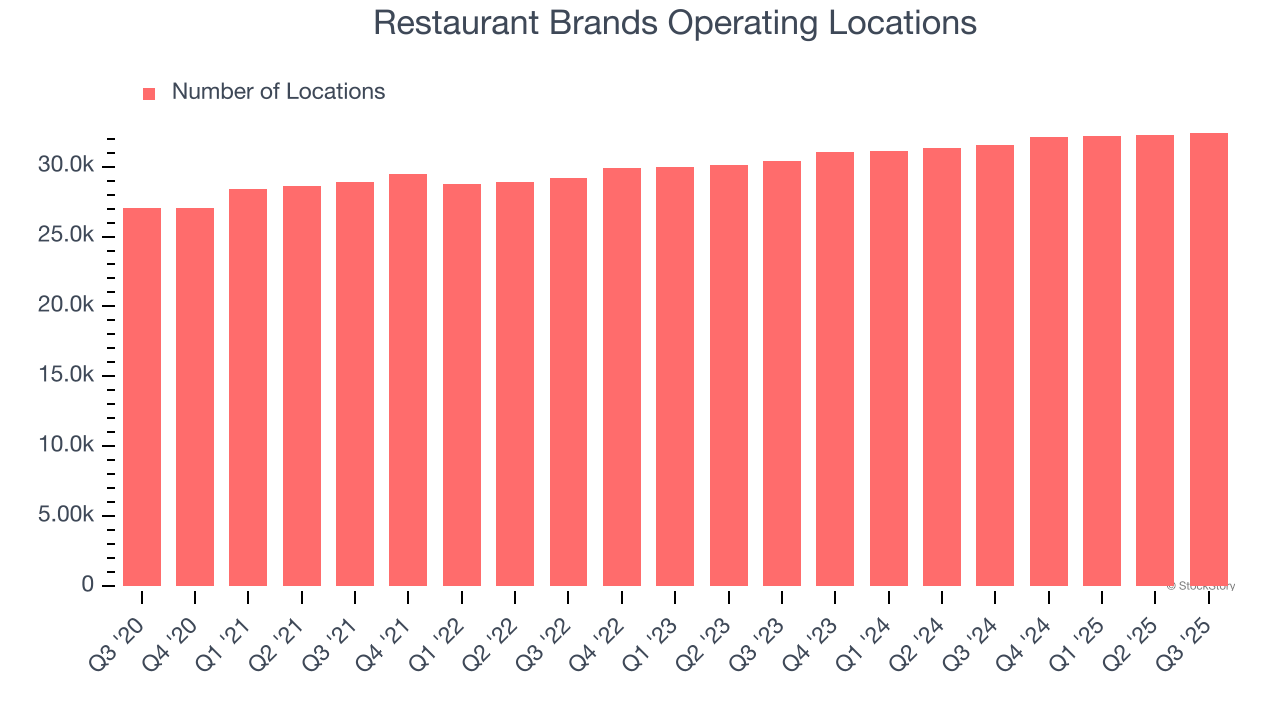

A restaurant chain’s total number of dining locations influences how much it can sell and how quickly revenue can grow.

Restaurant Brands operated 32,423 locations in the latest quarter. It has opened new restaurants quickly over the last two years, averaging 3.5% annual growth, faster than the broader restaurant sector. Furthermore, one dynamic making expansion more seamless is the company’s franchise model, where franchisees are primarily responsible for opening new restaurants while Restaurant Brands provides support.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

Same-Store Sales

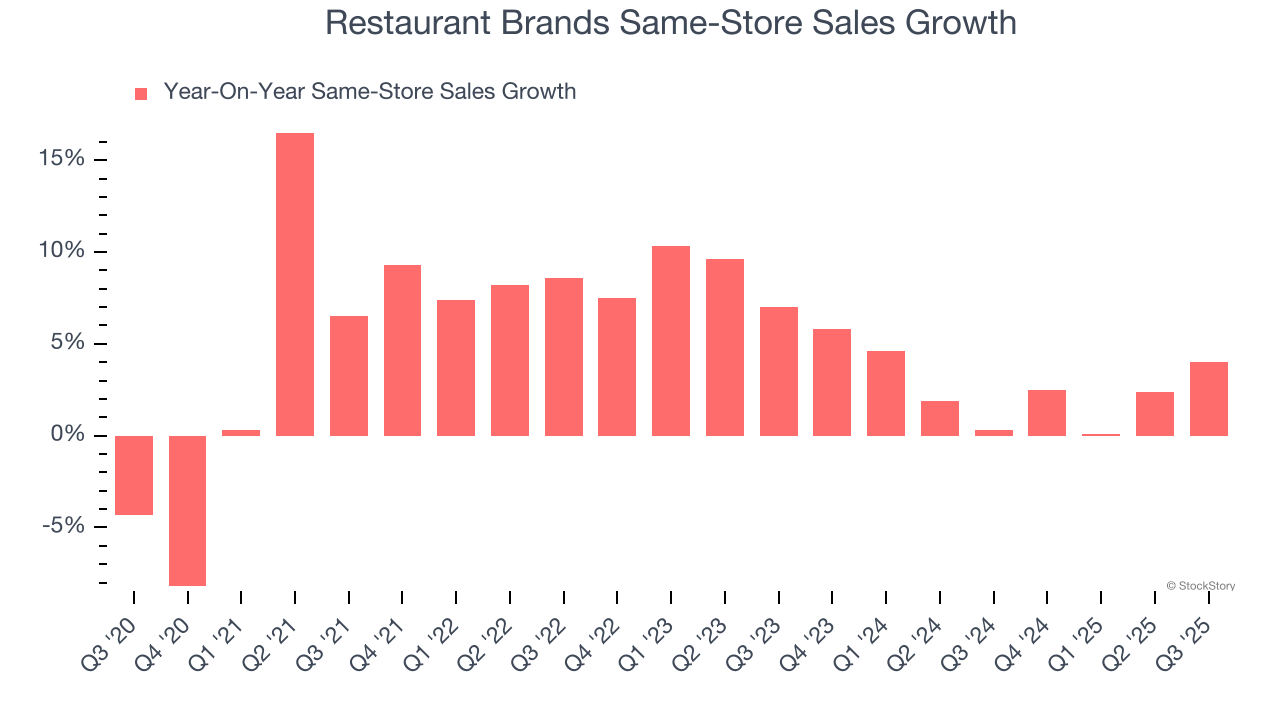

The change in a company's restaurant base only tells one side of the story. The other is the performance of its existing locations, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales gives us insight into this topic because it measures organic growth at restaurants open for at least a year.

Restaurant Brands’s demand has been healthy for a restaurant chain over the last two years. On average, the company has grown its same-store sales by a robust 2.7% per year. This performance suggests its rollout of new restaurants could be beneficial for shareholders. When a chain has demand, more locations should help it reach more customers and boost revenue growth.

In the latest quarter, Restaurant Brands’s same-store sales rose 4% year on year. This growth was an acceleration from its historical levels, which is always an encouraging sign.

Key Takeaways from Restaurant Brands’s Q3 Results

We enjoyed seeing Restaurant Brands beat analysts’ revenue expectations this quarter. We were also glad its same-store sales outperformed Wall Street’s estimates. This ultimately led to an EPS beat. Overall, we think this was still a solid quarter with some key areas of upside. The stock traded up 4% to $68.65 immediately after reporting.

Restaurant Brands had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.