Upscale restaurant company The One Group Hospitality (NASDAQ: STKS) fell short of the market’s revenue expectations in Q3 CY2024, but sales rose 152% year on year to $194 million. The company’s full-year revenue guidance of $670 million at the midpoint came in 6% below analysts’ estimates. Its non-GAAP loss of $0.30 per share was also below analysts’ consensus estimates.

Is now the time to buy The ONE Group? Find out by accessing our full research report, it’s free.

The ONE Group (STKS) Q3 CY2024 Highlights:

- Revenue: $194 million vs analyst estimates of $215.6 million (10% miss)

- Adjusted EPS: -$0.30 vs analyst estimates of $0.01 (-$0.31 miss)

- EBITDA: $14.8 million vs analyst estimates of $25.8 million (42.6% miss)

- The company dropped its revenue guidance for the full year to $670 million at the midpoint from $720 million, a 6.9% decrease

- Gross Margin (GAAP): 14.7%, down from 16% in the same quarter last year

- Operating Margin: -1.6%, in line with the same quarter last year

- EBITDA Margin: 7.6%, in line with the same quarter last year

- Same-Store Sales rose 8.8% year on year (-3% in the same quarter last year)

- Market Capitalization: $114.6 million

“With the addition of Benihana and RA Sushi, we increased our revenue $117 million to a record $194 million as we continue to grow a scalable platform with exciting VIBE and entertainment centric dining brands. During the quarter, I was encouraged by our team’s ability to manage costs effectively. Operating profit growth exceeded revenue growth as we improved year-over-year margins at Benihana through supply chain synergies, benefitted from their higher margin contribution, and exhibited tight cost management within our preexisting business. Within the last sixty days we opened three Company-owned locations, all of which are off to terrific starts,” said Emanuel “Manny” Hilario, President and Chief Executive Officer.

Company Overview

Doubling as a hospitality services provider for hotels and resorts, The One Group Hospitality (NASDAQ: STKS) is an upscale restaurant company that operates STK Steakhouse and Kona Grill.

Sit-Down Dining

Sit-down restaurants offer a complete dining experience with table service. These establishments span various cuisines and are renowned for their warm hospitality and welcoming ambiance, making them perfect for family gatherings, special occasions, or simply unwinding. Their extensive menus range from appetizers to indulgent desserts and wines and cocktails. This space is extremely fragmented and competition includes everything from publicly-traded companies owning multiple chains to single-location mom-and-pop restaurants.

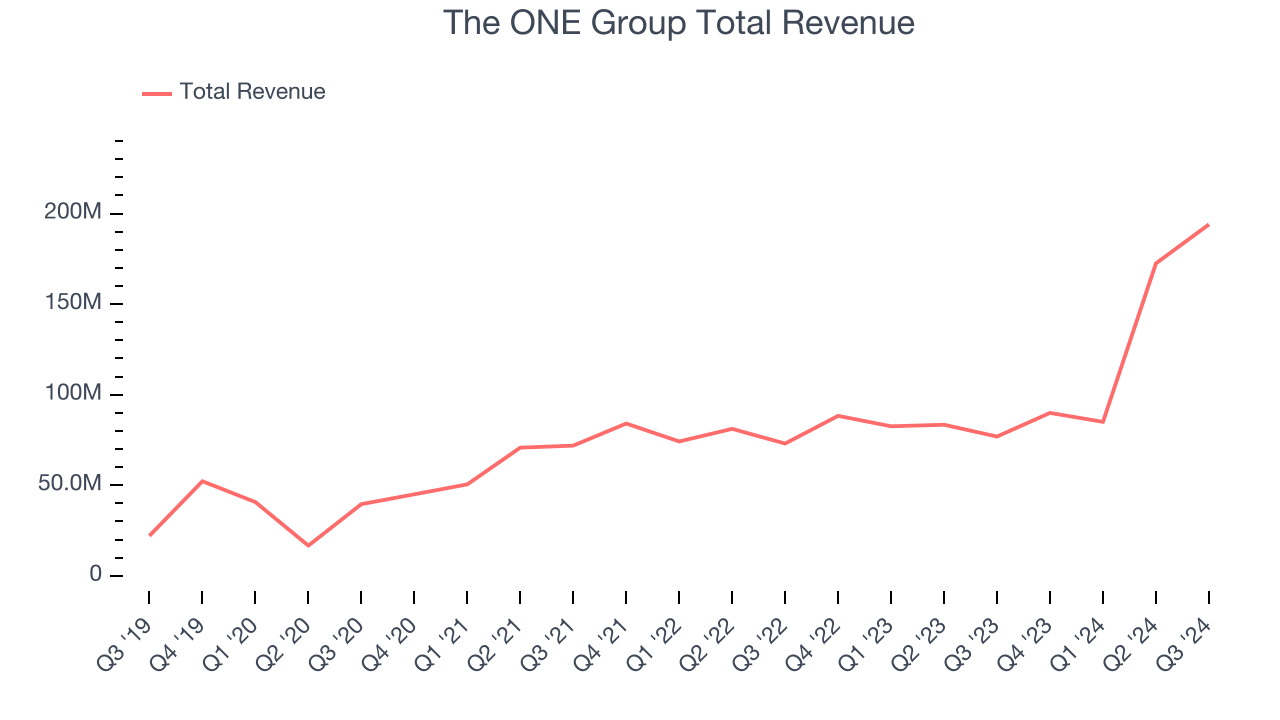

Sales Growth

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

The ONE Group is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale. On the other hand, it can grow faster because it’s working from a smaller revenue base and has more white space to build new restaurants.

As you can see below, The ONE Group’s 41.8% annualized revenue growth over the last five years (we compare to 2019 to normalize for COVID-19 impacts) was incredible as it opened new restaurants and expanded its reach.

This quarter, The ONE Group achieved a magnificent 152% year-on-year revenue growth rate, but its $194 million of revenue fell short of Wall Street’s lofty estimates.

Looking ahead, sell-side analysts expect revenue to grow 73.7% over the next 12 months, an acceleration versus the last five years. This projection is admirable and illustrates the market believes its newer offerings will fuel higher growth rates.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Restaurant Performance

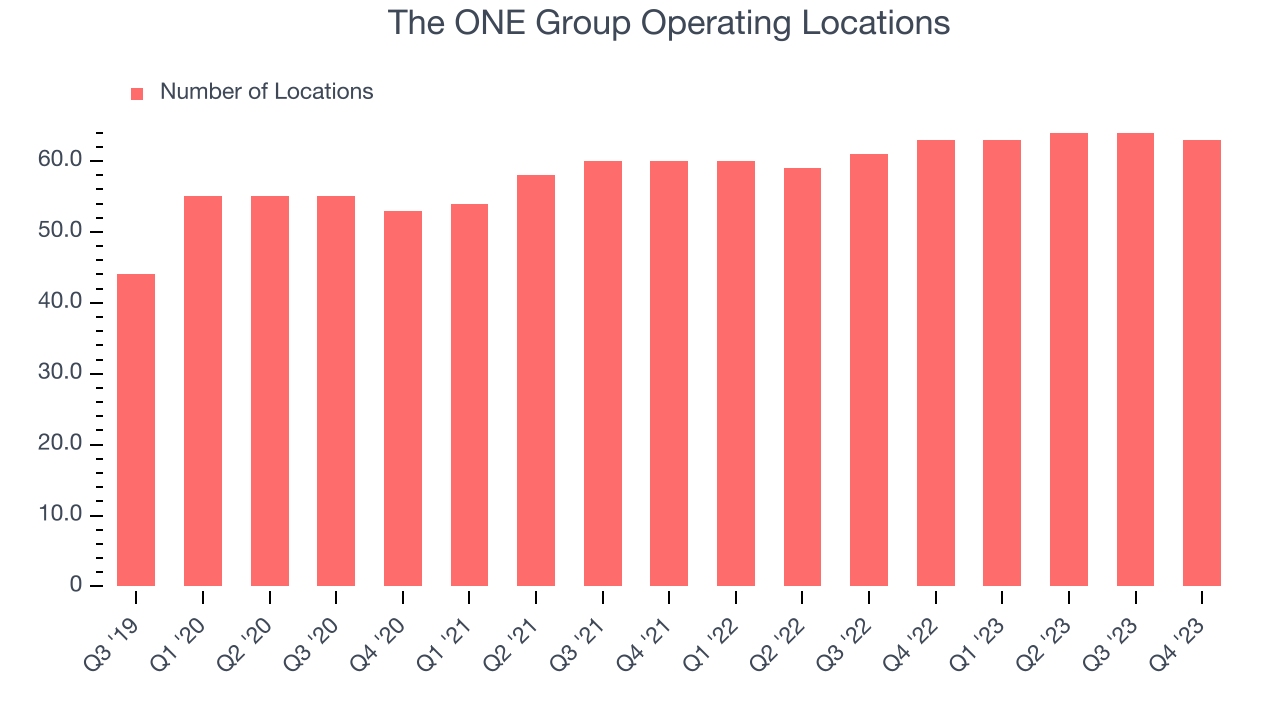

Number of Restaurants

The ONE Group opened new restaurants at a rapid clip over the last two years and averaged 4.7% annual growth, much faster than the broader restaurant sector. This gives it a chance to scale into a mid-sized business over time.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where the concept has few or no locations.

Note that The ONE Group reports its restaurant count intermittently, so some data points are missing in the chart below.

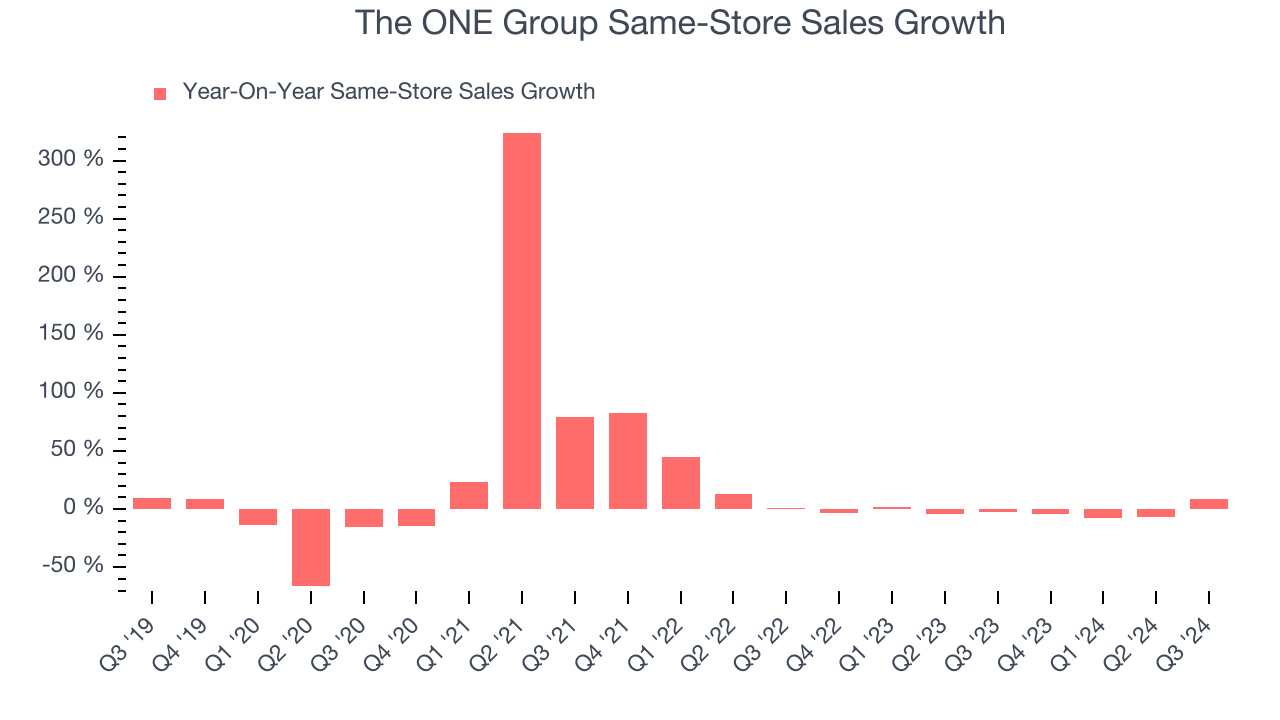

Same-Store Sales

The change in a company's restaurant base only tells one side of the story. The other is the performance of its existing locations, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales gives us insight into this topic because it measures organic growth for restaurants open for at least a year.

The ONE Group’s demand has been shrinking over the last two years as its same-store sales have averaged 2.4% annual declines. This performance is concerning - it shows The ONE Group artificially boosts its revenue by building new restaurants. We’d like to see a company’s same-store sales rise before it takes on the costly, capital-intensive endeavor of expanding its restaurant base.

In the latest quarter, The ONE Group’s same-store sales rose 8.8% annually. This growth was a well-appreciated turnaround from the 3% year-on-year decline it posted 12 months ago, showing the business is regaining momentum.

Key Takeaways from The ONE Group’s Q3 Results

We struggled to find many strong positives in these results. It lowered its full-year revenue guidance and missed Wall Street's revenue, EPS, and EBITDA estimates. Overall, this quarter could have been better. The stock traded down 19.7% to $3.15 immediately after reporting.

The ONE Group’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.