Clothing company Hanesbrands (NYSE: HBI) met Wall Street’s revenue expectations in Q3 CY2024, but sales fell 2.5% year on year to $937.1 million. The company expects next quarter’s revenue to be around $900 million, close to analysts’ estimates. Its non-GAAP profit of $0.15 per share was 26% above analysts’ consensus estimates.

Is now the time to buy Hanesbrands? Find out by accessing our full research report, it’s free.

Hanesbrands (HBI) Q3 CY2024 Highlights:

- Revenue: $937.1 million vs analyst estimates of $935.7 million (in line)

- Adjusted EPS: $0.15 vs analyst estimates of $0.12 (26% beat)

- Revenue Guidance for Q4 CY2024 is $900 million at the midpoint, roughly in line with what analysts were expecting

- Management raised its full-year Adjusted EPS guidance to $0.39 at the midpoint, a 14.7% increase

- Gross Margin (GAAP): 41.7%, up from -3.3% in the same quarter last year

- Operating Margin: 11%, up from 8.4% in the same quarter last year

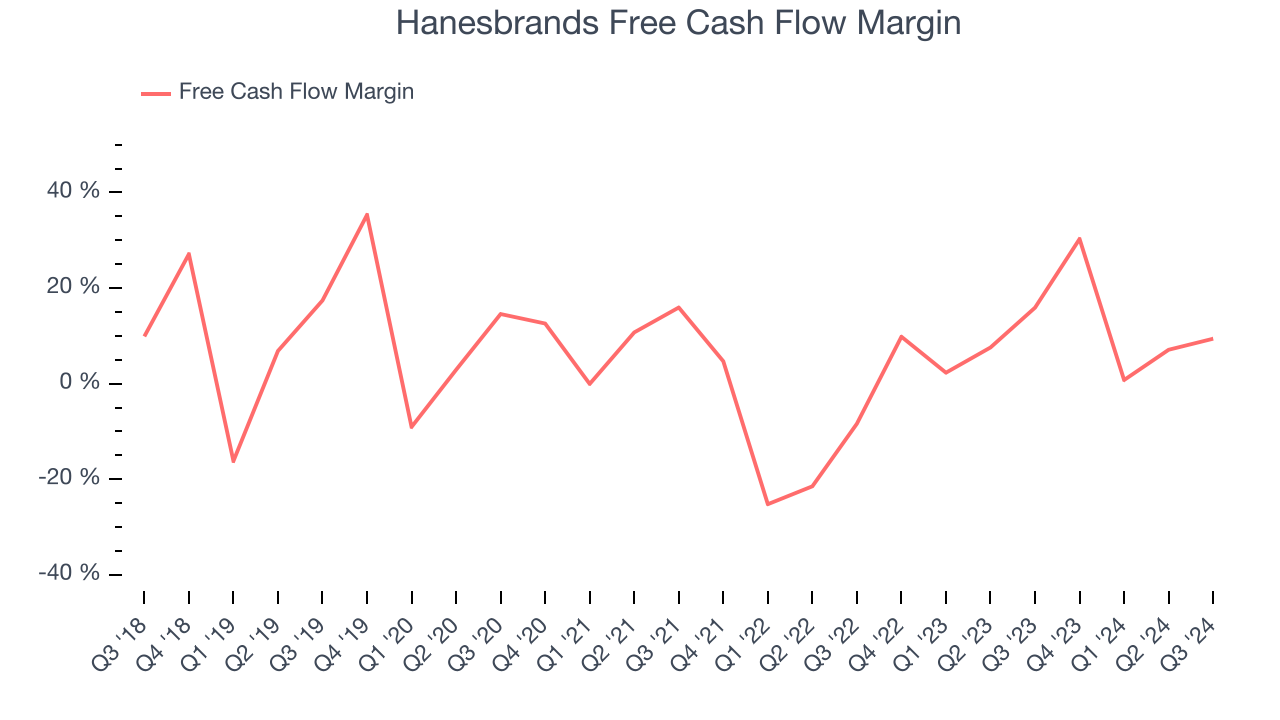

- Free Cash Flow Margin: 9.4%, down from 15.9% in the same quarter last year

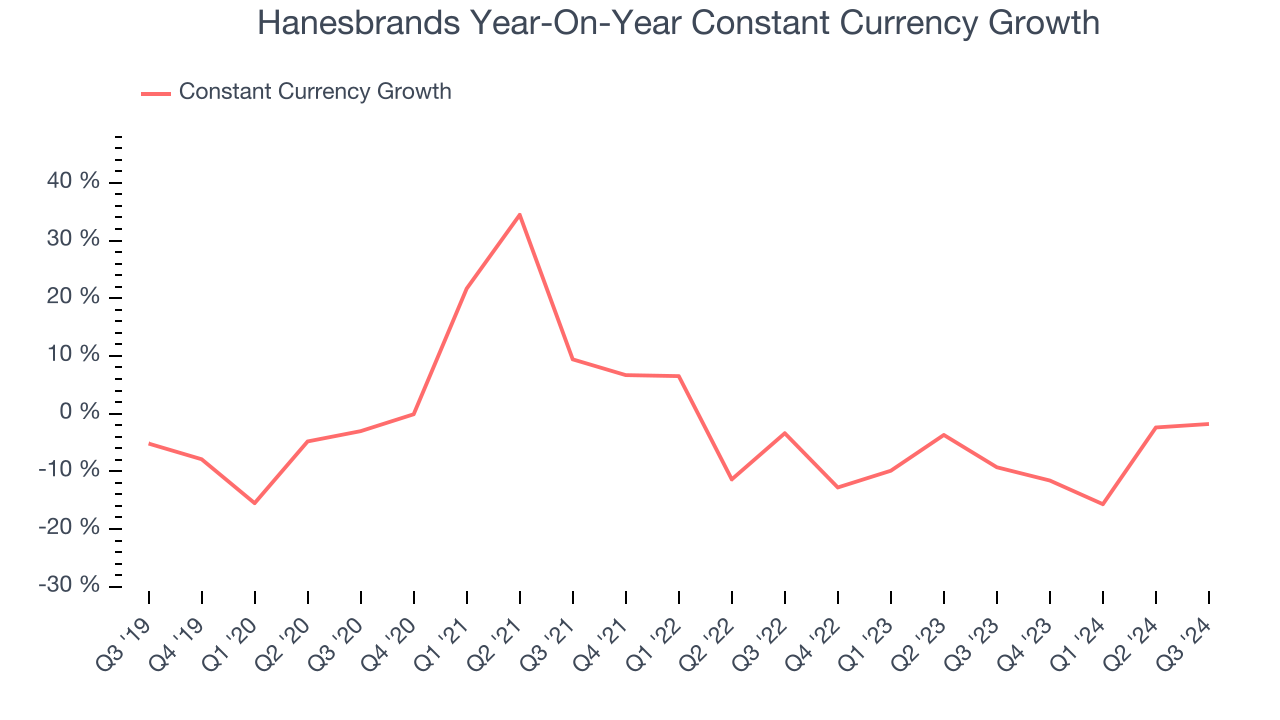

- Constant Currency Revenue fell 1.8% year on year (-9.3% in the same quarter last year)

- Market Capitalization: $2.50 billion

“We delivered another strong quarter with operating profit, earnings per share, and cash flow results that exceeded our expectations. In addition, we have further reduced our leverage, expect a return to revenue growth in the fourth quarter, and raised our full-year outlook for profit and cash flow,” said Steve Bratspies, CEO.

Company Overview

A classic American staple founded in 1901, Hanesbrands (NYSE: HBI) is a clothing company known for its array of basic apparel including innerwear and activewear.

Apparel, Accessories and Luxury Goods

Within apparel and accessories, not only do styles change more frequently today than decades past as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel, accessories, and luxury goods companies have made concerted efforts to adapt while those who are slower to move may fall behind.

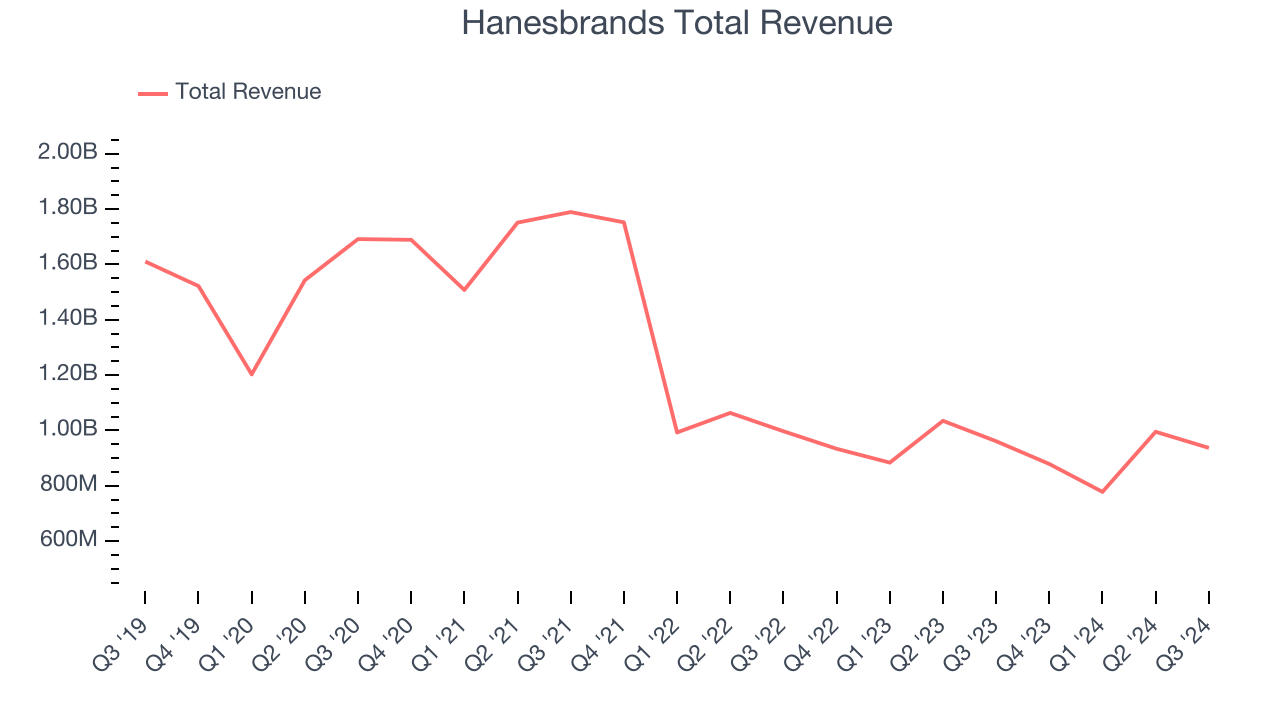

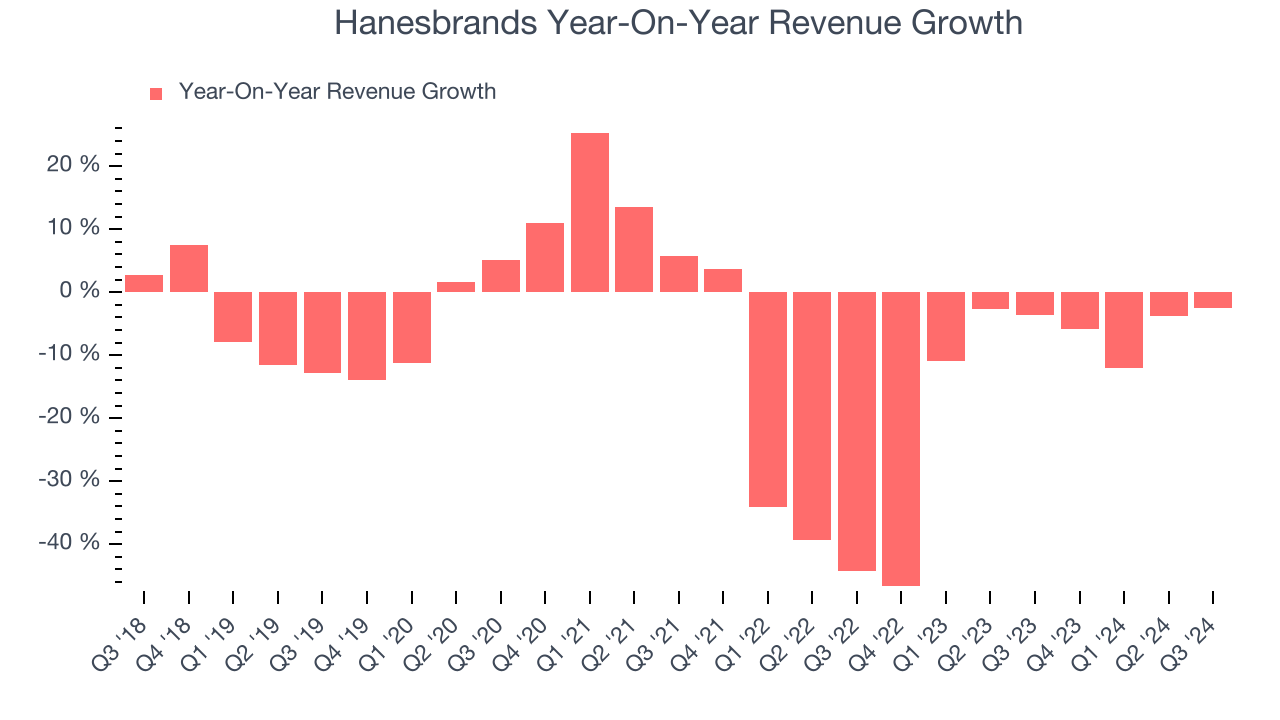

Sales Growth

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Over the last five years, Hanesbrands’s revenue declined by 10.5% per year. This shows demand was weak, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or emerging trend. Hanesbrands’s recent history shows its demand has stayed suppressed as its revenue has declined by 13.6% annually over the last two years.

Hanesbrands also reports sales performance excluding currency movements, which are outside the company’s control and not indicative of demand. Over the last two years, its constant currency sales averaged 8.4% year-on-year declines. Because this number is better than its normal revenue growth, we can see that foreign exchange rates have been a headwind for Hanesbrands.

This quarter, Hanesbrands reported a rather uninspiring 2.5% year-on-year revenue decline to $937.1 million of revenue, in line with Wall Street’s estimates. Management is currently guiding for a 2.4% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to remain flat over the next 12 months, an improvement versus the last two years. While this projection illustrates the market believes its newer products and services will fuel better performance, it is still below average for the sector.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Hanesbrands has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 10.5% over the last two years, slightly better than the broader consumer discretionary sector.

Hanesbrands’s free cash flow clocked in at $88.13 million in Q3, equivalent to a 9.4% margin. The company’s cash profitability regressed as it was 6.5 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Key Takeaways from Hanesbrands’s Q3 Results

We were impressed by Hanesbrands’s optimistic EPS forecast for next quarter, which blew past analysts’ expectations. We were also glad its full-year EPS guidance exceeded Wall Street’s estimates. On the other hand, its constant currency revenue missed. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 3.5% to $7.35 immediately following the results.

Hanesbrands had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.