Transportation company Schneider (NYSE: SNDR) fell short of the market’s revenue expectations in Q3 CY2024, with sales falling 2.7% year on year to $1.32 billion. Its non-GAAP profit of $0.18 per share was also 20.7% below analysts’ consensus estimates.

Is now the time to buy Schneider National? Find out by accessing our full research report, it’s free.

Schneider National (SNDR) Q3 CY2024 Highlights:

- Revenue: $1.32 billion vs analyst estimates of $1.33 billion (1.1% miss)

- Adjusted EPS: $0.18 vs analyst expectations of $0.23 (20.7% miss)

- EBITDA: $143.8 million vs analyst estimates of $158.9 million (9.5% miss)

- Management lowered its full-year Adjusted EPS guidance to $0.69 at the midpoint, a 18.8% decrease

- Gross Margin (GAAP): 16.2%, in line with the same quarter last year

- Operating Margin: 3.3%, in line with the same quarter last year

- EBITDA Margin: 10.9%, in line with the same quarter last year

- Free Cash Flow Margin: 8.6%, up from 2.8% in the same quarter last year

- Market Capitalization: $5.10 billion

“In the third quarter, our Dedicated and Intermodal businesses demonstrated their resilience, and Logistics maintained its profitable operations,” said Mark Rourke, President and Chief Executive Officer of Schneider.

Company Overview

Employing thousands of drivers across the country to make deliveries, Schneider (NYSE: SNDR) makes full truckload and intermodal deliveries regionally and across borders.

Ground Transportation

The growth of e-commerce and global trade continues to drive demand for shipping services, especially last-mile delivery, presenting opportunities for ground transportation companies. The industry continues to invest in data, analytics, and autonomous fleets to optimize efficiency and find the most cost-effective routes. Despite the essential services this industry provides, ground transportation companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins.

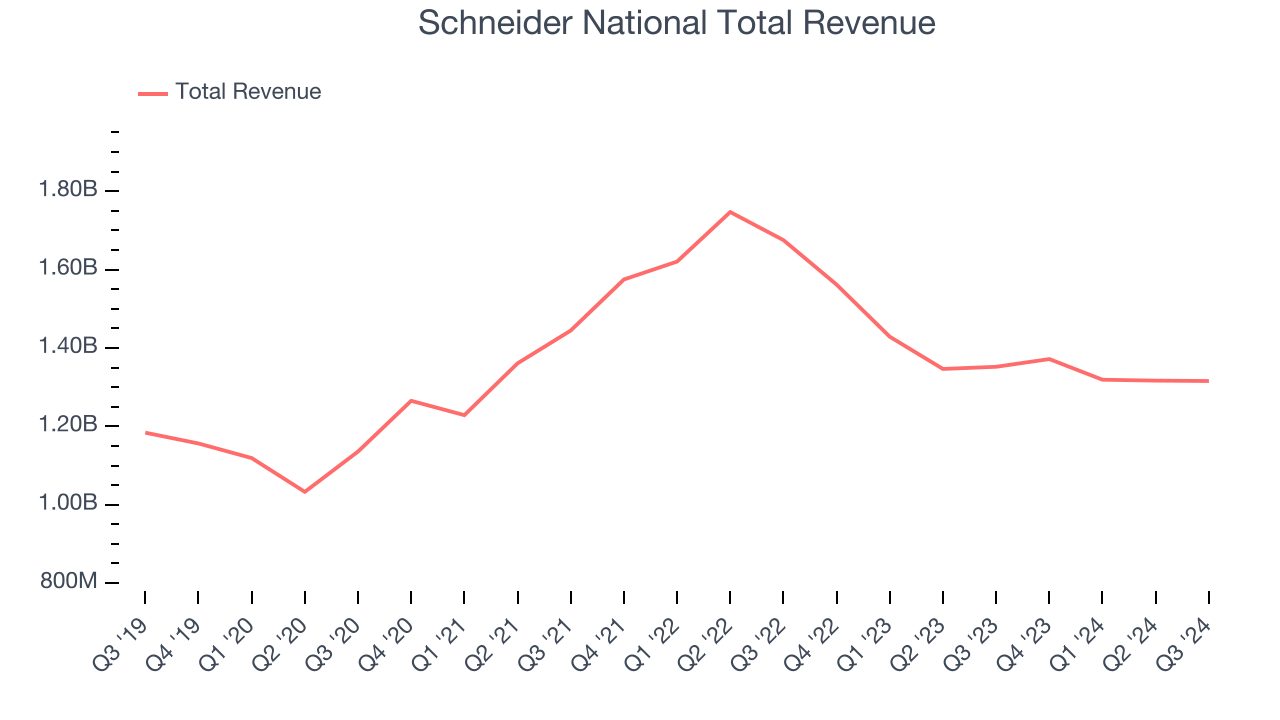

Sales Growth

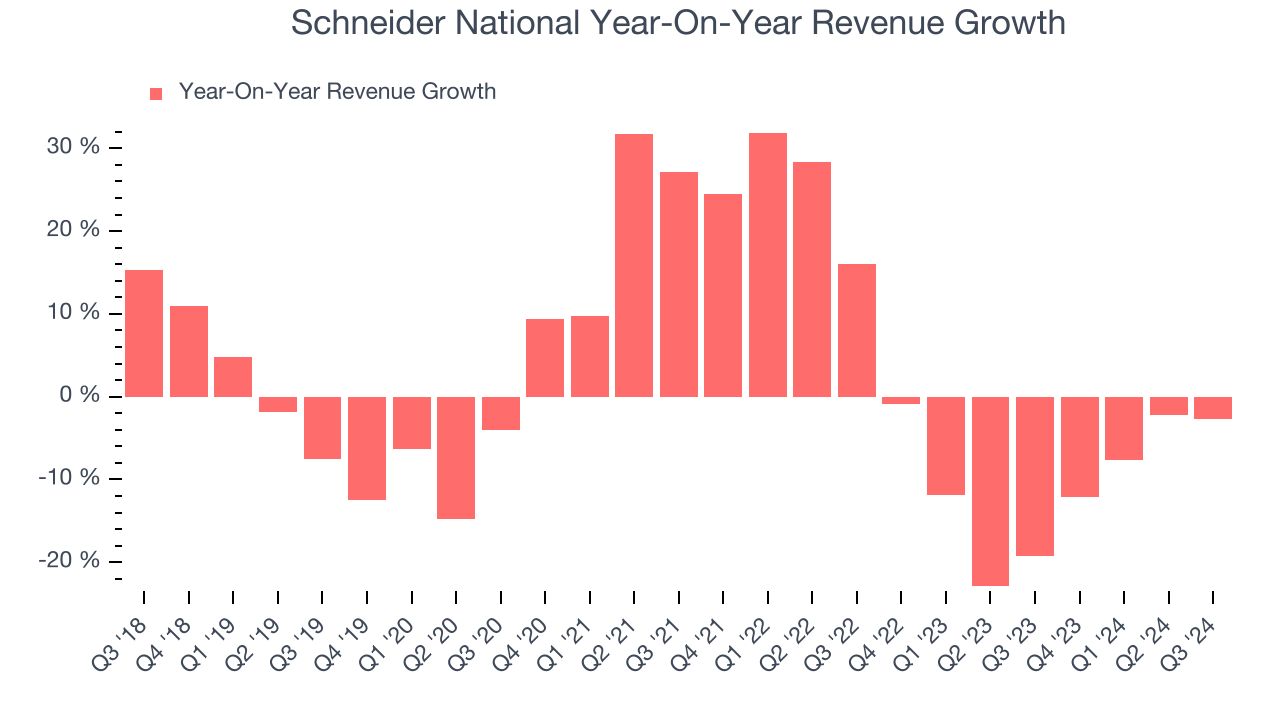

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, Schneider National’s sales grew at a sluggish 1.6% compounded annual growth rate over the last five years. This shows it failed to expand in any major way, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Schneider National’s history shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 10.3% annually. Schneider National isn’t alone in its struggles as the Ground Transportation industry experienced a cyclical downturn, with many similar businesses seeing lower sales at this time.

Schneider National also breaks out the revenue for its most important segments, Truckload and Logistics, which are 40.4% and 23.8% of revenue. Over the last two years, Schneider National’s Truckload revenue (road freight) averaged 1.1% year-on-year declines while its Logistics revenue (supply chain, warehousing) averaged 20.2% declines.

This quarter, Schneider National missed Wall Street’s estimates and reported a rather uninspiring 2.7% year-on-year revenue decline, generating $1.32 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 4.5% over the next 12 months, an improvement versus the last two years. While this projection illustrates the market believes its newer products and services will fuel better performance, it is still below average for the sector.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

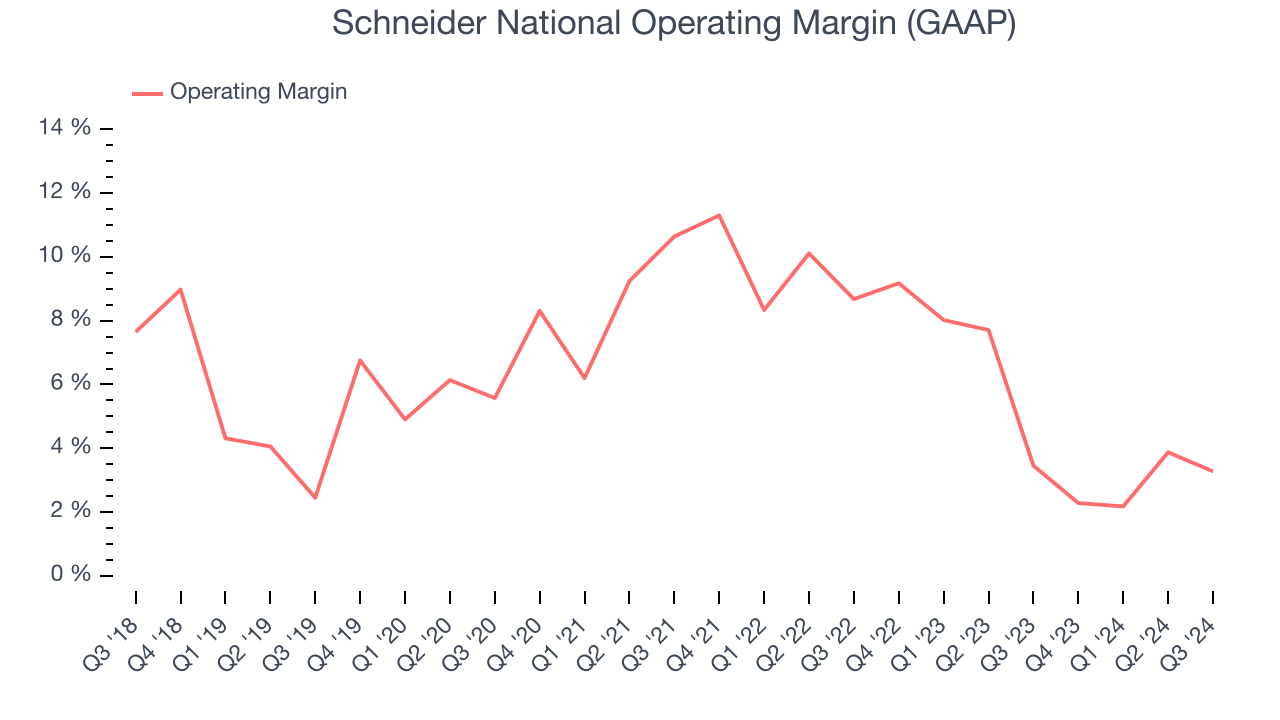

Operating Margin

Schneider National was profitable over the last five years but held back by its large cost base. Its average operating margin of 7% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Looking at the trend in its profitability, Schneider National’s annual operating margin decreased by 2.9 percentage points over the last five years. The company’s performance was poor no matter how you look at it. It shows operating expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Schneider National generated an operating profit margin of 3.3%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

Earnings Per Share

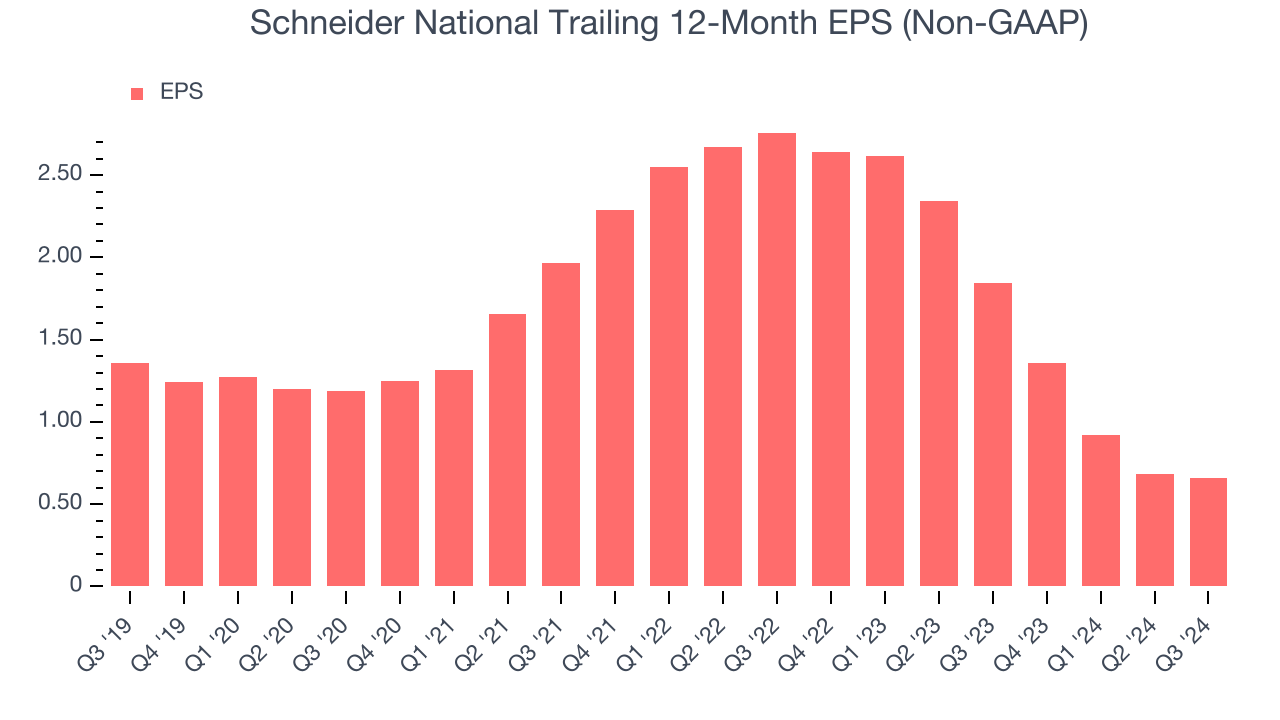

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth was profitable.

Sadly for Schneider National, its EPS declined by 13.5% annually over the last five years while its revenue grew by 1.6%. This tells us the company became less profitable on a per-share basis as it expanded.

Diving into the nuances of Schneider National’s earnings can give us a better understanding of its performance. As we mentioned earlier, Schneider National’s operating margin was flat this quarter but declined by 2.9 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can give insight into an emerging theme or development for the business.

Schneider National’s two-year annual EPS declines of 51.2% were bad and lower than its two-year revenue performance.In Q3, Schneider National reported EPS at $0.18, down from $0.20 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Schneider National’s full-year EPS of $0.66 to grow by 86.4%.

Key Takeaways from Schneider National’s Q3 Results

We struggled to find many strong positives in these results. Its EPS forecast for the full year missed and its EBITDA fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 7.2% to $27 immediately after reporting.

Schneider National underperformed this quarter, but does that create an opportunity to invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.