Industrials 3M (NYSE: MMM), Honeywell (NASDAQ: HON) and General Electric (NYSE: GE) are all trading higher following recent earnings reports.

Industrials 3M (NYSE: MMM), Honeywell (NASDAQ: HON) and General Electric (NYSE: GE) are all trading higher following recent earnings reports.One truism about the industrial sector: These companies’ businesses are intricately tied to economic cycles. We maybe familiar with the consumer products offered by these companies, such as 3M’s Post-It notes, Honeywell’s air purifiers and humidifiers, and GE’s light bulbs.

However, all these companies also have large exposure to business and enterprise customers. That means they feel the effects of cyclical demand as the economy rises and falls, and businesses and manufacturers expand and contract their buying.

Despite widespread worries about recession, the broader industrial sector, as tracked by the Industrial Select Sector SPDR ETF (NYSEARCA: XLI), is down 8.49% year-to-date, but it’s participated in the recent broad market rally, showing a one-month gain of 9.30%.

The most heavily weighted components within the sector, and their one-month returns are:

- United Parcel Service (NYSE: UPS): +5.77%

- Union Pacific (NYSE: UNP): +8.66%

- Raytheon Technologies (NYSE: RTX): -4.12%

3M, which constitutes 3.08% of sector weighting, reported quarterly results on July 26, and the stock has been on a tear since then. Earnings came in at $2.48 per share, a 10% year-over-year decrease. Revenue was $8.7 billion, a decrease of 3%. That marked the second quarter in a row of declining earnings. On the revenue side, 3M saw zero revenue growth in the two previous quarters.

The stock has returned a whopping 15.35% in the past month.

So what’s the upside here? Why is the stock on the rise?

The company announced a spinoff of its health care technology business focused on wound care, oral care, healthcare IT, and biopharma filtration. It expects the tax-free transaction expected to be completed by year-end 2023. It previously announced a split-off transaction of its food safety business, with a targeted closing date of September 1, 2022.

Spinoffs can create shareholder value by allowing two different companies to focus on their core businesses. In this case, the new 3M expects to retain a stake of 19.9% in Health Care, which it says will be monetized over time.

Meanwhile, Honeywell reported earnings of $2.10 per share on July 28, topping views by $0.07 per share. Revenue came in at $8.95 billion, also ahead of views, according to MarketBeat earnings data.

The company topped earnings expectations in every quarter since October 2017, when it met views.

Honeywell’s aerospace sales rose, as airline travel bounced back. In addition, its business unit serving the oil-and-gas industry also saw strong revenue.

MarketBeat analyst data reveal that Wall Street has a “moderate buy” rating on Honeywell, with a price target of $210.08, an 8.09% upside.

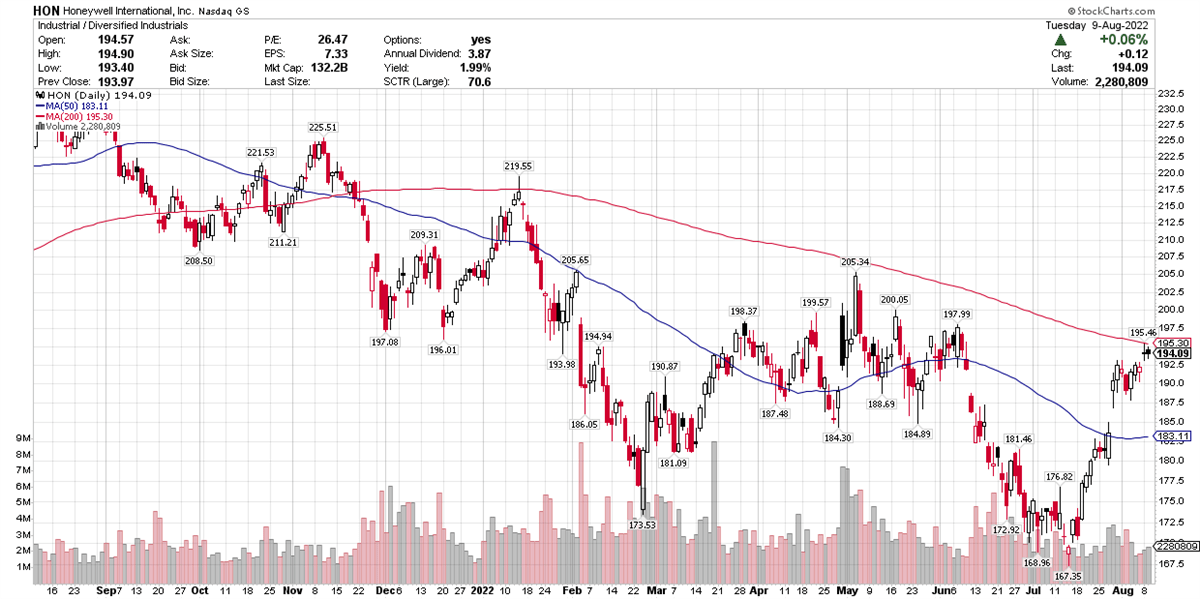

In the past month, Honeywell shares are up 11.90%. The stock remains below its 200-day moving average, but above its 50-day line. When the longer-term average is above the shorter term, it can signal that an uptrend may weaken and fail. However, at some point trends reverse. There’s a slight move higher in the 50-day line which might possibly indicate a more sustained rally, although it’s way too soon to know that for sure.

General Electric, which constitutes 3.02% of the industrials sector, reported quarterly results on July 26, and the stock has been trading higher. It boasts a one-month gain of 18.86%.

That was ahead of views by $0.40 per share. Revenue was $18.65 billion, well ahead of views calling for $17.90 billion, according to MarketBeat data.

The big news for GE is an imminent split-up into three separate companies: GE HealthCare, GE Aerospace and GE Vernova.

GE HealthCare will be listed on the Nasdaq under the ticker GEHC. It’s expected to begin trading in early 2023.

GE Aerospace include company’s aviation business unit. The plan is to expand beyond the engines it’s known for. That spinoff is expected to be completed in 2024, and this company is expected to retain the traditional GE ticker.

GE Vernova will consist of the company’s portfolio of energy businesses. The company has not revealed the ticker for this business unit.

Should you buy a stock ahead of a split-up that’s already been announced? While some analysts see attractive upside in the trio of companies, seven analysts have slashed their price targets on GE since the end of April, MarketBeat analyst data reveal.