- Buy Now, Pay Later (BNPL) surpasses checks to become fourth most accepted customer payment method, cryptocurrency gains favorability among merchants.

- Small businesses are more satisfied with payment processing costs as a higher proportion use zero-fee payment processing and pass on surcharges to customers.

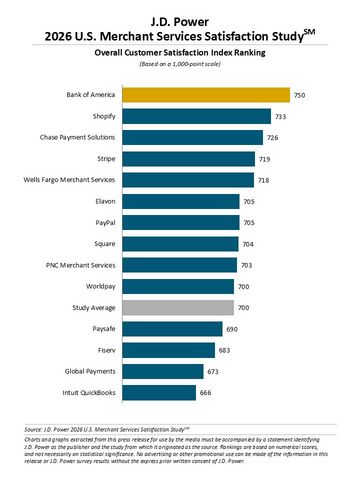

- Bank of America ranks highest in merchant services customer satisfaction.

Rising consumer interest in digital wallets, debit and credit cards, BNPL and even cryptocurrency has small business owners accepting more forms of payment than ever before, which puts third-party merchant services providers at the center of their livelihoods. According to the J.D. Power 2026 U.S. Merchant Services Satisfaction Study,SM released today, the manner and speed with which transactions are processed, as well as the ability to manage costs and avoid software and hardware glitches, have become critical drivers of satisfaction with merchant services providers.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20260113620962/en/

J.D. Power 2026 U.S. Merchant Services Satisfaction Study

“Merchant services providers have become a vital link in the way small businesses manage payments and are a critical customer touchpoint, which can create opportunities and challenges for the companies providing the necessary technology services and hardware,” said John Cabell, managing director of payments intelligence at J.D. Power. “The data in this year’s study spotlights a rising tension between business owners’ growing pressure to offer multiple payment options and their increased desire to pass processing costs onto retail customers, a shift that can negatively affect the customer experience.”

Following are key findings of the 2026 study:

- Banks and specialists deliver on satisfaction: Large U.S. banks lead specialists and processors in overall merchant satisfaction, often integrating these payment processing services with existing banking relationships. In contrast, newer, software-driven specialist processors close the satisfaction gap to banks among startup small businesses. These specialist providers perform well among startups for their rewards programs and technology-driven guidance that helps businesses operate more efficiently.

- Digital payments continue to gain acceptance: Overall, 92% of merchants in the U.S. now accept payments via digital wallets, an increase of 4 percentage points since 2024. Likewise, BNPL is now accepted by 58% of U.S. small businesses, up from 54% in 2024. BNPL is now the fourth most accepted form of payment behind debit or credit cards (96%), digital wallets (92%), and cash (78%). Personal checks are now accepted by just 57% of U.S. small businesses, down from 63% in 2024.

- Is crypto next? Cryptocurrency adoption among U.S. small businesses stands at 19% this year, up 4 percentage points from 2025. In addition, sentiment is improving: 37% of merchants say they have a favorable view of cryptocurrency, and 33% of non-accepting merchants say they would likely accept crypto payments if their merchant services provider enabled the option.

- Surcharges create tough balancing act for business owners: Slightly more than one-third of small businesses (35%) now include surcharges for customers who use credit cards. New small businesses and those in the restaurant industry show the largest increases in this practice. However, the clear downside is that nearly one-third (32%) of merchants say their retail customers occasionally or frequently cancel a purchase and walk away when a surcharge is added to their transaction.

- Tip, donation and surcharge screens disrupt sales process: Nationwide, 61% of merchants use at least one default screen—such as tip, donation, or surcharge prompts—on their point-of-sale hardware. While these screens make it easier to apply extra charges, they also contribute to higher transaction abandonment rates by customers due to growing software and hardware issues. In general, only about half of customers (51%, down from 55% in 2025) never encounter a system problem.

Study Ranking

Bank of America ranks highest in merchant services satisfaction with a score of 750 (on a 1,000-point scale). Shopify (733) ranks second and Chase Payment Solutions (726) ranks third.

The U.S. Merchant Services Satisfaction Study evaluates merchant services providers in the United States with the largest market shares. Overall satisfaction results reflect overall corporate results, meaning they can include the results of various sub-brands or alternate brand names that operate under the respective corporate brand names. In some cases, brands profiled also currently have or recently have formed joint partnerships to provide merchant services to small business clients.

The 2026 study is based on responses from 4,407 small business customers of merchant services providers and measures satisfaction across six dimensions (in alphabetical order): advice and guidance on running your business; cost of processing payments; data security and protection; managing my account; payment processing; and quality of technology. The study was fielded from August through October 2025.

For more information about the U.S. Merchant Services Satisfaction Study, visit https://www.jdpower.com/business/merchant-services-satisfaction-study.

To view the online press release, please visit http://www.jdpower.com/pr-id/2026002.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services, and data and analytics. A pioneer in the use of big data, artificial intelligence (AI), and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 55 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe, and Asia Pacific. To learn more about the company's business offerings, visit JDPower.com/business. The J.D. Power auto-shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

View source version on businesswire.com: https://www.businesswire.com/news/home/20260113620962/en/

Contacts

Media Relations Contacts

Joe LaMuraglia, J.D. Power; East Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com