The Number of Women Who Own Investments Increased Nearly 20% Compared to 2023

Gen Z Women Continue to Lead the Way in Getting Started Early with Investing and Building Their Financial Knowledge

Arianna Huffington and Shelley Zalis Join Fidelity’s Women Talk Money Fall Event Series

More women are taking control of their finances and investing than ever before, according to new research from Fidelity Investments®. Fidelity’s 2024 Women & Investing Study finds 7-in-10 women own investments in the stock market, an 18% increase compared to 2023. While younger generations continue to invest in higher numbers, the percentage of Gen X and Boomer women who invest in the stock market jumped the most year-over-year, increasing 18% and 23% respectively. This trend also holds true among Fidelity customers – the number of women retail customers has grown more than 20% over the past two years.1

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20241003297758/en/

Source: Fidelity Investments 2024 Women & Investing Study

“It’s encouraging to see the number of women taking control of their finances swell over the past three years,” said Sangeeta Moorjani, Head of Tax Exempt Market and Lifetime Engagement for Fidelity Investments. “We know there is still work to be done – the financial confidence gap continues to persist, and women continue to report higher levels of financial stress than men – but we’ve made considerable strides. Fidelity is committed to continuing that momentum by providing access to tools, support, and education tailored to the unique financial needs of women.”

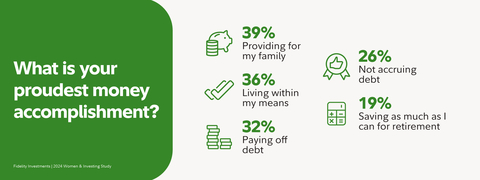

Investing for the Future and Building Generational Wealth Among the Top Goals for Women

Seventy-one percent of women agree that investing is a way to build generational wealth, so it’s no surprise the leading factors motivating women to invest include ensuring a certain quality of life for their children, making as much money as possible, and being able to afford goals like retirement and large purchases. The focus on building generational wealth is the top motivator for Millennial women, whereas older generations are more motivated by being able to afford future goals. The leading motivators are also reflected in women’s top money accomplishments, which include providing for their families, living within their means and paying off debt.

While women continue to make progress, they’re still feeling the impact of financial stressors. More than half of women surveyed admit their financial situation keeps them up at night at least monthly, and those numbers are higher for Gen Z (72%) and Millennial women (68%).

Gen Z Women Are Seeking Out Financial Education and Making Strides

As in previous years, Fidelity’s research shows Gen Z women continue to lead the way in embracing investing and taking control of their finances. Seventy-seven percent of Gen Z women own investments in the stock market today, up six percentage points compared to 2023; this group is also most likely among women to say they consider themselves an investor2. With 38% of Gen Z women investing outside of retirement (compared to 28% of women overall), they lead the way not only in the rate at which they invest, but also in how much, allocating an average of 10.4% of their paycheck to those investments compared to 9.5% among women investing outside of retirement overall.

While social media is predictably one of their main sources of investing ideas (46%), Gen Z women prefer to rely on family and friends (52%) and their own research (47%) for guidance. Of note, only 11% of Gen Z women said they consider social media the most trustworthy source when it comes to investing guidance, with family and friends yet again taking the top spot (28%). This aligns with Gen Z’s preference to describe themselves as “researchers” when it comes to their investing habits – they want to know what they own and build their investing knowledge and skills through multiple sources. That said, Gen Z women still see value in trusted resources – 89% have already gotten or plan to get help from a financial professional to better manage and grow their money.

Despite Progress, Women Still Lack Confidence When It Comes to Investing

Even with the considerable progress women have made in taking control of their finances, Fidelity’s research suggests a financial confidence gap persists. In fact, women are nearly two times more likely than men to describe their level of investing knowledge as “non-existent.”3

Women are also more likely than men to indicate they're overwhelmed and intimidated by investing and managing their day-to-day finances.

“Although women are more likely to say they don’t have as much investing knowledge as they would like, it’s inspiring to see in our research that they actually are taking the right steps when it comes to their finances,” said Lorna Kapusta, Head of Women and Engagement at Fidelity. “Our goal is to continue to arm women with the education and resources they need to feel confident in their ability to achieve their financial goals. We’ve made great progress – let’s keep the momentum going.”

Fidelity Offers Resources to Help Women Build Confidence and Take Next Steps

While women have made significant strides with investing, one-third said their biggest money regret involved not having an investment strategy earlier. In fact, more than 7-in-10 women wish they started investing their extra savings earlier on. Women would be more likely to invest if they had clear steps on how to do so (68%).

With this in mind, Fidelity offers free and accessible resources and education to help women grow their financial confidence and make the most of their money, no matter where they are on their financial journeys—including its signature fall event.

- Women Talk Money Fall Event Series: Fidelity brings together celebrity guests and Fidelity leaders for a free, month-long event series focused on concrete steps women can take to invest in their future. The series will feature special guests Shelley Zalis, founder and CEO of The Female Quotient; Arianna Huffington, founder and CEO of Thrive Global; and women across Fidelity. Conversations will focus on how to make the most of your peak earning years, optimizing your savings for retirement, and how to cultivate a successful career and build your finances.

- Women Talk Money: Fidelity’s Women Talk Money community offers a forum for real talk about money, investing, careers, and other topics top of mind for women, through live events, on demand content, and other actionable resources to help members take their next best steps with their finances. It’s free to join for everyone.

- Learning Series for Teen Girls and their Parents: Women Talk Money: Teen Girl Learning Series is a free digital, self-paced learning series designed to help parents and teen girls build positive money habits.

- Year-Round Support Built for Women: Fidelity’s tailored website experience provides insights on the unique factors women often need to plan for, when to save and invest based on your individual situation, which accounts make the most sense for your goals, and clear next steps to move forward.

- 24/7 Access to Live Help: Need more help? Fidelity offers free 1:1 consultations with financial professionals who are specifically trained to discuss and help plan for the unique money factors that women often face. This guidance is available 24/7 at 1-800-FIDELITY, or online at Fidelity.com.

About Fidelity’s Women & Investing Study

This study presents the findings of a national online survey, among 3,012 adults, 18 years of age and older, with a gender breakdown of 1,533 women and 1,463 men. Interviewing was conducted July 18-25, 2024, by Big Village, which is not affiliated with Fidelity Investments. The results of this survey may not be representative of all adults meeting the same criteria as those surveyed for this study. The theoretical sampling error for all respondents is +/- 1.8 percentage points at the 95% confidence level. Smaller subgroups will have larger error margins. Fidelity was not identified as the sponsor of this study.

The generations are defined as: Boomers (born 1946 - 1964), Gen X (born 1965 - 1980), Millennials (born 1981 - 1996), and Gen Z (born 1997-2012; only those ages 18+ were considered for this study).

About Fidelity Investments

Fidelity’s mission is to strengthen the financial well-being of our customers and deliver better outcomes for the clients and businesses we serve. Fidelity’s strength comes from the scale of our diversified, market-leading financial services businesses that serve individuals, families, employers, wealth management firms, and institutions. With assets under administration of $14.1 trillion, including discretionary assets of $5.5 trillion as of June 30, 2024, we focus on meeting the unique needs of a broad and growing customer base. Privately held for 78 years, Fidelity employs more than 75,000 associates across the United States, Ireland, and India. For more information about Fidelity Investments, visit https://www.fidelity.com/about-fidelity/our-company.

Fidelity Investments and Fidelity are registered service marks of FMR LLC.

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

Views expressed are as of the date indicated, based on the information available at that time, and may change based on market or other conditions. Unless otherwise noted, the opinions provided are those of the speaker or author and not necessarily those of Fidelity Investments or its affiliates. Fidelity does not assume any duty to update any of the information.

# # #

Fidelity Brokerage Services LLC, Member NYSE, SIPC

900 Salem Street, Smithfield, RI 02917

Fidelity Distributors Company LLC

900 Salem Street, Smithfield, RI 02917

National Financial Services LLC, Member NYSE, SIPC

245 Summer Street, Boston, MA 0211

1167269.1.0

© 2024 FMR LLC. All rights reserved.

1 Fidelity internal data, January 1, 2022-August 31, 2024

2 49% of Gen Z women say they consider themselves an investor, compared to 35% of women overall

3 32% vs. 18%

View source version on businesswire.com: https://www.businesswire.com/news/home/20241003297758/en/

Contacts

Fidelity Media Relations

FidelityMediaRelations@fmr.com

Ellie Flanagan

Ellie.Flanagan@fmr.com

(617) 563-4169

Follow us on X @FidelityNews

Visit About Fidelity and our online newsroom