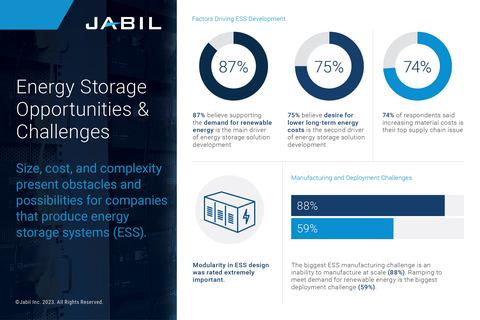

- Participants cite demands for renewable energy (87%), lower energy costs (75%), and increased grid resiliency (56%) as top drivers for developing energy storage systems

- 88% of those polled struggle to scale production to meet market demand while 74% face supply chain constraints amid increasing material costs

- 62% report that modularity is extremely important in designing energy storage systems to streamline manufacturing and product technology updates

Jabil Inc. (NYSE: JBL) today announced the findings of its 2023 global survey of energy storage and battery solution providers. The results reveal steady expansion in the production of energy storage systems (ESS) to ensure consistent energy supply while increasing power grid stability. Amid intensifying global energy demands, 88% of the survey participants are struggling to scale production of their ESS portfolios to keep pace with rapid industry growth.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230627078282/en/

Jabil’s global survey on energy storage trends reveals major industry drivers and manufacturing challenges facing producers of energy storage systems (ESS). (Photo: Business Wire)

“Technology advances are fueling innovations in batteries, charging equipment, and solutions for making energy storage more accessible to households, businesses, industries, and utility grids,” said Bill Mitchell, senior business unit director for power and storage, Jabil. “This latest survey reinforces top industry trends while pinpointing some of the toughest manufacturing challenges facing companies as energy storage solutions grow in size and complexity.”

Jabil commissioned SIS International Research to conduct the 2023 Energy Storage Trends Survey, with participation from 204 energy storage and battery solutions stakeholders worldwide. Respondents were asked questions designed to offer a better understanding of the types of solutions currently being produced, along with evolving market opportunities and manufacturing obstacles. The majority of the participants (88%) are producing solutions for commercial and industrial applications while 61% are considering expanding into the residential and commercial/industrial markets. More than half (58%) plan to enter a new energy storage market within three to five years, while 14% of the survey respondents plan to enter a new market in one to two years.

Other key findings include:

- Demand for renewable energy is the top driver of ESS development according to 87% of those polled, followed by a desire for lower long-term energy costs (75%), and increased grid resiliency (56%)

- 66% of the survey respondents are interested in developing energy storage solutions with energy capacities of 200 kWh to 1 MWh, while 62% are focused on 20 kWh to 199 kWh capacities

- Participants expect the highest ESS deployments in the next three to five years to take place in North America (70%) and Europe (67%)

Prioritizing Battery Technology and Management

Energy storage systems companies already are — or are considering — producing batteries within their own facilities, according to 87% of those surveyed. Additionally, companies are using cells to build modules to their exact specifications while avoiding persistent supply chain challenges. Unsurprisingly, 90% of the participants use lithium-ion (Li-ion) batteries in existing energy storage solutions; 75% plan continued use of Li-ion batteries in the next five to 10 years. Other technologies are being used currently to a much lesser extent, including lead-acid batteries (21%) and flow batteries (19%). Rising interest in non-battery technologies, however, is poised to help increase energy resiliency, with participants planning to explore hydrogen fuel cells (20%), thermal storage (19%), and super capacitors (13%) within the next decade.

Respondents were split on the need for safer battery chemistry, with less than half (45%) reporting current efforts in this area. Interestingly, 75% believe in reusing energy storage system batteries that have reached end-of-life in new ESS solutions, yet only 39% plan to integrate second-life batteries into their own energy storage solutions. Nearly half of the participants (46%) indicated that lower battery prices could speed ESS deployments by one to two years.

Reducing Manufacturing & Supply Chain Obstacles

Myriad challenges can stymy or stall ESS providers’ efforts to meet escalating market demands. Among those surveyed, 88% reported an inability to scale production capacity, while 78% felt they could not build their own modules and storage systems cost effectively. Additionally, 73% reported they are not set up in the right geography to address market requirements while 61% lacked much-needed expertise to build modules and storage systems. More than 59% of those polled also reported that meeting demand for renewable energy remains their biggest ESS deployment challenge.

Persistent supply chain issues also continue to impact the energy-storage market. Ever-increasing material costs, particularly for the steel needed to produce storage system frames, were reported by 74% of the participants. Respondents ranked additional constraints, including shortage of battery cell modules (60%), shortage of semiconductors (47%), and sourcing far from end markets, which ultimately impacted supply chain costs (44%).

To alleviate these obstacles, ESS providers are favoring modular design, or modularity, to streamline and simplify manufacturing workflows and product technology updates. As a result, 62% of the survey participants cited modularity as “extremely important” in their overall product design strategy.

Jabil’s Power & Storage Solutions

Jabil engineers, builds, and ramps production of some of the most innovative and complex energy storage systems available today. A blend of advanced power engineering, global supply chain intelligence, state-of-the-art manufacturing, and high-level assembly (HLA) empowers Jabil’s customers to speed and simplify ESS development and deployment for a more sustainable future.

About Jabil:

Jabil (NYSE: JBL) is a manufacturing solutions provider with over 250,000 employees across 100 locations in 30 countries. The world's leading brands rely on Jabil's unmatched breadth and depth of end-market experience, technical and design capabilities, manufacturing know-how, supply chain insights, and global product management expertise. Driven by a common purpose, Jabil and its people are committed to making a positive impact on their local community and the environment. Visit www.jabil.com to learn more.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230627078282/en/

Contacts

Michael Kovacs

Senior Director, Marketing, Jabil

1.408.427.1191

michael_kovacs@jabil.com