Oklo (OKLO) shares soared as much as 20% on Jan. 9 after hyperscaler Meta Platforms (META) agreed to support development of a 1.2-gigawatt nuclear power campus in Pike County, Ohio.

This advanced nuclear campus will power META’s data centers, including its artificial intelligence (AI) supercluster broadly known as the “Prometheus” in New Albany, Ohio.

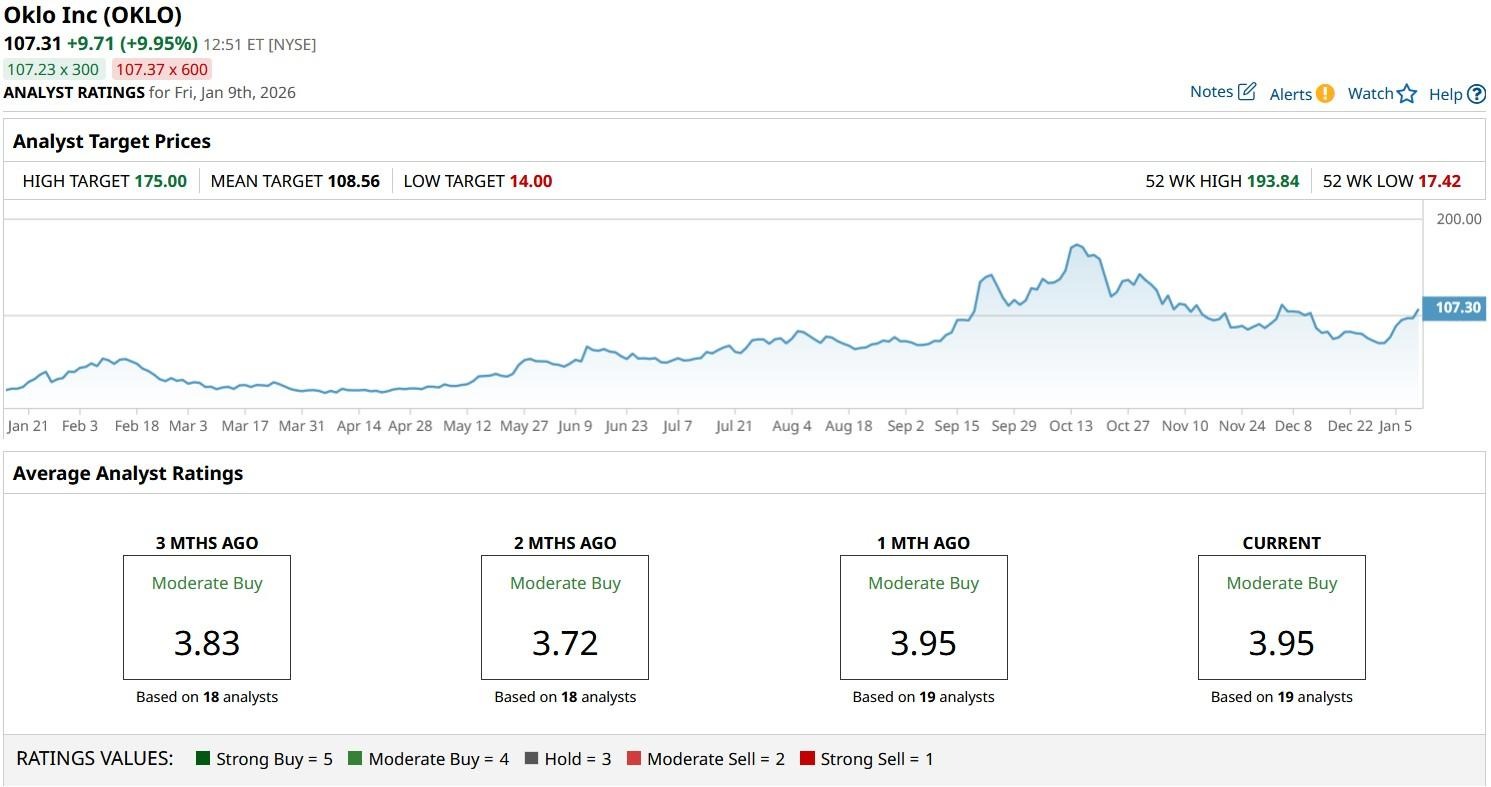

Despite today’s rally, however, OKLO stock remains down nearly 40% versus its 52-week high.

Significance of Meta News for OKLO Stock

OKLO shares rallied this morning primarily because Meta’s announcement validates its advanced reactor technology at an unprecedented scale.

A vote of confidence from one of the world’s largest tech companies could translate into long-term demand for clean, reliable power for AI infrastructure.

Effectively, this partnership elevates OKLO from a speculative nuclear startup to a credible energy supplier for mission-critical operations.

Investors see this as a major de-risking event: better revenue visibility, potential replication across other hyperscaler campuses, and alignment with the booming AI sector – all catalysts for sustained stock appreciation.

Wedbush Reiterates $150 Price Target on Oklo Shares

Wedbush’s senior analyst Dan Ives dubbed Meta news a “Buy” signal for long-term Oklo investors in a research note on Friday.

According to him, the announcement “reaffirms hyperscalers’ commitment to start leveraging new energy sources to fuel the AI revolution with power being the biggest headwind to the industry.”

Ives maintained his $150 price target on OKLO stock today, indicating potential upside of roughly 33% from current levels.

Options traders seem to agree with his bullish view on the Santa Clara-headquartered nuclear-tech firm as well. Derivatives contracts expiring mid-April currently have the upper price set at about $146.

Note that Oklo was previously picked to participate in DOE initiatives to advance small modular reactor (SMR) technology.

Wall Street Remains Bullish on Oklo

While OKLO isn’t an inexpensive stock to own in 2026, Wall Street analysts more broadly believe its premium multiple is justified.

According to Barchart, the consensus rating on Oklo shares sits at “Moderate Buy” currently with price targets going as high as $175 indicating potential upside of another 70% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Nvidia CEO Jensen Huang Warns Investors That the AI Market Is Bigger Than They Realize With Over ‘One and a Half Million AI Models in the World’

- Novo Nordisk Is Getting a Major Boost from Amazon for Its New Wegovy Pill. Does That Make NVO Stock a Buy Here?

- A $200 Billion Reason to Buy Opendoor Stock Today

- Oklo Declares a ‘Major Step in Moving Advanced Nuclear Forward’ Following Meta Deal. Should You Buy OKLO Stock Today?