Last year was not a particularly pleasant year for Tesla (TSLA) stock, with the shares turning red at one point and briefly ranking as the worst performer in the “Magnificent Seven.” There has also been the challenge of falling deliveries and the real prospect of a second straight year of volume decline. Mounting doubts about demand have grown as Tesla cedes market share in key regions.

Europe has been especially tough, with November registrations sliding in major markets like France and Sweden despite a refreshed Model Y lineup. Intensifying competition and an aging model range have weighed heavily on sales.

However, the debate over what comes next is only getting louder and more polarized. Baird has reiterated its bullish stance on Tesla and attached a $548 price target heading into 2026, effectively arguing that 2025’s reset is a setup for a stronger payoff rather than the start of a long fade.

So after such a bruising year, is Tesla really setting up for a 2026 comeback, or is the optimism still running ahead of reality? Let's dive in.

Tesla’s 2025 Numbers Still Look Like a “Core Holding”

Tesla, headquartered in Austin, Texas, with a market cap of nearly $1.53 trillion, designs and manufactures electric vehicles, energy storage systems, and related software.

TSLA stock closed around $454.43 on Dec. 30, up about 12.53% year-to-date (YTD) and currently sits about 11% up over the past 52 weeks.

Its valuation implies a trailing P/E of roughly 327.72x versus a sector median near 16.41x and a P/S of 16.18x versus a sector median of around 0.97x, signaling that investors are still willing to pay a hefty premium.

It reported its most recent quarterly EPS of $0.50 on Oct. 22. Their sales stood at about $28.1 billion for that period, with revenue growth of roughly 24.89%, showing that top‑line momentum remains solid even after a more challenging year.

Its net income figure of roughly $1.37 billion, growing about 17.15%, indicates that profitability is still moving in the right direction, even as pricing and competitive pressures have intensified.

The operating cash flow of approximately $10.93 billion, up about 132.84%, highlights how much more cash the business is now generating from its core operations versus a year ago. That strength flows through to the net cash flow of roughly $2.55 billion, with a staggering 943.38% increase. This improvement culminated in free cash flow jumping to nearly $4B, a record for the company.

Tesla’s 2026 Growth Levers

Tesla is making a direct push into the U.K. energy market, beyond selling vehicles and batteries. The company is bidding to supply electricity to British households and businesses across the U.K.

Tesla submitted a formal bid for an electricity license to Ofgem after a notice was posted on a government website. If regulators approve the application, Tesla could start competing with the major electricity suppliers as soon as 2026.

Another catalyst sits in energy storage. Tesla reportedly reached a multi‑billion supply agreement with Samsung SDI valued at more than 3 trillion won, or about $2.1B.

The deal would run for roughly three years and focus on battery cells for Tesla’s Energy Storage System business, not its EV lineup. Those cells are intended for Megapack and potentially Powerwall, which keeps the emphasis on grid and residential storage demand.

Wall Street’s Numbers Say “Messy Now, Better Later”

Tesla’s next real checkpoint for this narrative is its upcoming earnings release, scheduled for Feb. 2, where the Street’s expectations already tell a nuanced story. The current quarter (12/2025) carries an average EPS estimate of $0.34 versus $0.66 a year ago, implying a steep 48.48% year-over-year (YoY) decline as 2025’s margin pressure shows up cleanly in the bottom line.

Its next quarter (03/2026) has estimates at $0.33 versus just $0.15 in the prior year, pointing to a sharp 120% YoY rebound if Tesla can execute.

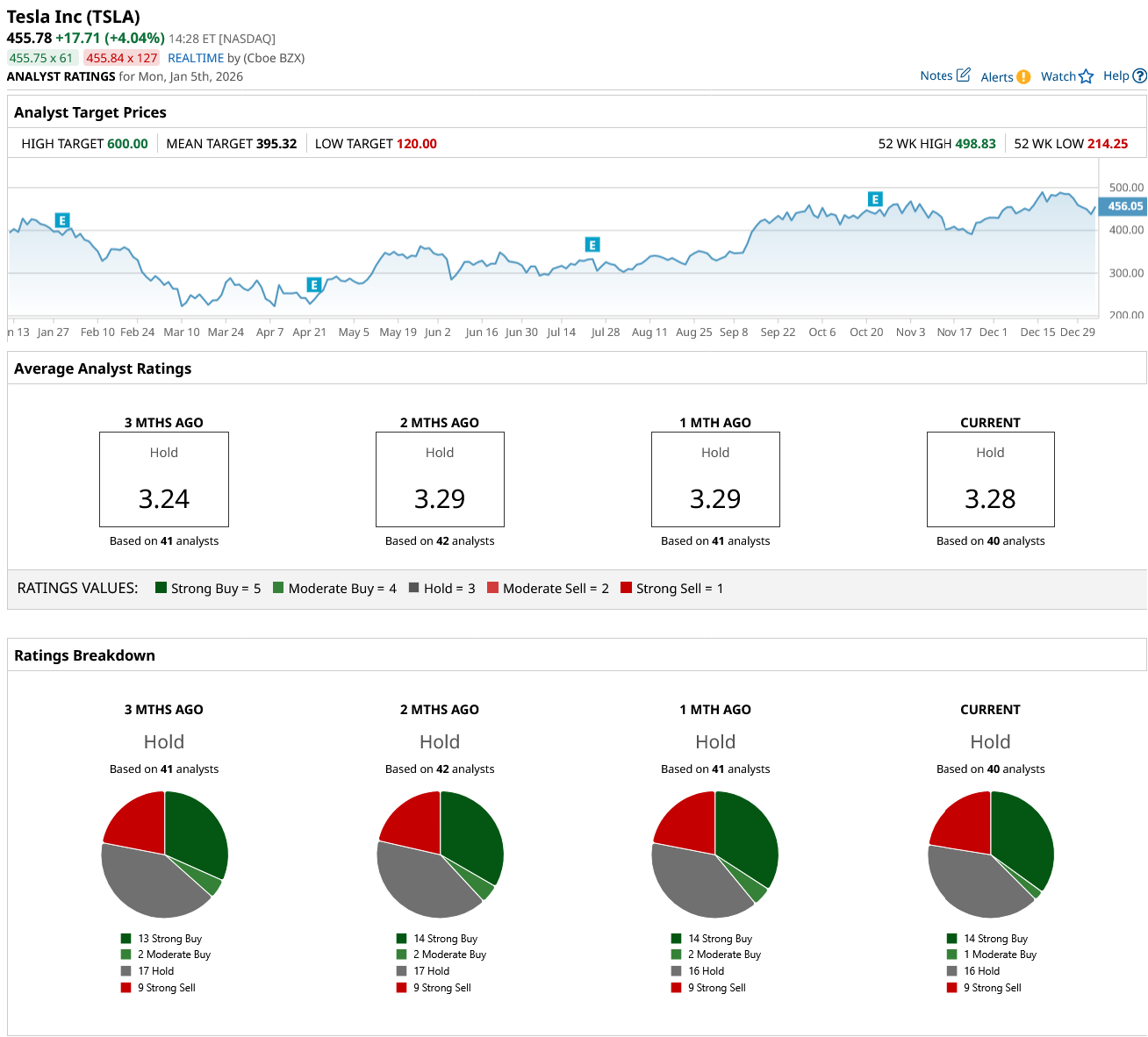

That brings the conversation naturally to how the Street is framing the stock right now, as 40 analysts surveyed on TSLA land on a consensus “Hold” rating. The average price target across that group is $395.32, which is actually below its current price and implies roughly 13% downside from here, not upside.

Conclusion

Tesla’s 2025 feels like a stress test that never quite ended, but the numbers and narrative don’t point to a broken story. With earnings reset lower, free cash flow ramping hard, and energy and AI acting as the next growth legs, the setup into 2026 looks more like a “prove‑it” phase than a last stand.

In the near term, the stock probably chops around current levels or even gives back some ground as the market waits for cleaner evidence that margins and earnings can catch up to the valuation.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Halliburton Stock Just Pushed into Overbought Territory Amid Venezuela Tumult. Is There Still Time to Buy HAL?

- 2025 Wasn’t an Easy Year for Tesla Stock, but Baird Says It’s a ‘Core Holding’ for 2026 Anyways

- Why ConocoPhillips Is One of the Top Oil Stocks to Buy After Venezuela

- Chevron, ConocoPhillips, and Gold: Your Critical Watchlist After the U.S.–Venezuela Oil Market Shock