In the last few years, Nvidia (NVDA) stock has been among the biggest value creators from the technology space. As investments related to artificial intelligence (AI) have swelled, value creation has been backed by significant upside in revenue, margins, and cash flows. Currently, Nvidia commands a market valuation of $4.6 trillion.

Looking forward, there seems to be no dearth of catalysts. Goldman Sachs estimates that global AI-related infrastructure spending is likely to reach $3 trillion to $4 trillion by 2030. While trade frictions have been a concern, recent news also suggests that Chinese regulators have granted "in-principle approval” for Alibaba (BABA), Tencent (TCEHY), and ByteDance to prepare for Nvidia H200 orders. The report further suggests that Alibaba and ByteDance are looking to order over 200,000 units each.

Earlier this month, Nvidia CEO Jensen Huang indicated that “demand for the H200 chips was strong among Chinese customers.” Therefore, as the purchase orders start flowing, it’s likely to support overall growth.

About Nvidia Stock

Headquartered in Santa Clara, California, Nvidia identifies itself as a global leader in accelerated computing. The company specializes in products and platforms for markets that include gaming, data center, automotive, and professional visualization.

Nvidia has a critical role in the growth of AI with the company engineering the most advanced chips, systems, and software for AI factories. For Q3 fiscal 2026, Nvidia reported revenue of $57 billion, which was higher by 62% on a year-over-year (YOY) basis. For the same period, GAAP margin was robust at 73.4%.

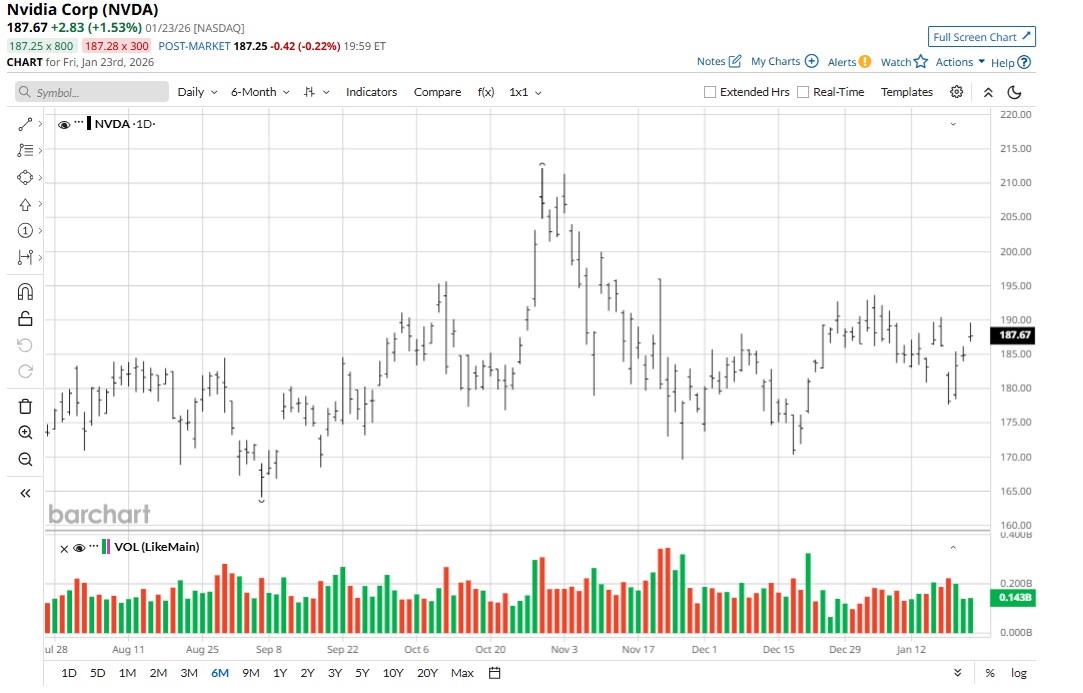

In the last six months, NVDA stock has trended higher by 7%. The uptrend has been relatively subdued and seems like an opportunity to accumulate.

Sustained Growth Visibility

For Nvidia, the growth momentum is not cyclical, but structural. To put things into perspective, Nvidia expects accelerated computing, powerful AI models, and agentic applications to drive demand in the coming years. Founder and CEO Jensen Huang has also pointed to the beginning of a “virtuous cycle of AI.”

This positive view is backed by the fact that Nvidia has partnered with companies like Alphabet (GOOGL), Microsoft (MSFT), Oracle (ORCL), and xAI to build out AI infrastructure in the United States. Nvidia has also collaborated with Intel (INTC) to develop multiple generations of custom data center and PC products.

There is also ample scope for growth in sectors likr robotics, life sciences, and automotive, among others. Earlier this month, BNP Paribas opined that robotics will likely be a key market in the technology sector.

As Nvidia spreads its wings, the implications are significant from the perspective of shareholder value creation. For Q3, Nvidia reported free cash flow (FCF) of $22.1 billion. Considering the growth trajectory, it may not be long before annual FCF surpasses $100 billion. Robust financial flexibility will help fuel R&D-driven growth and aggressive share repurchases.

What Analysts Say About NVDA Stock

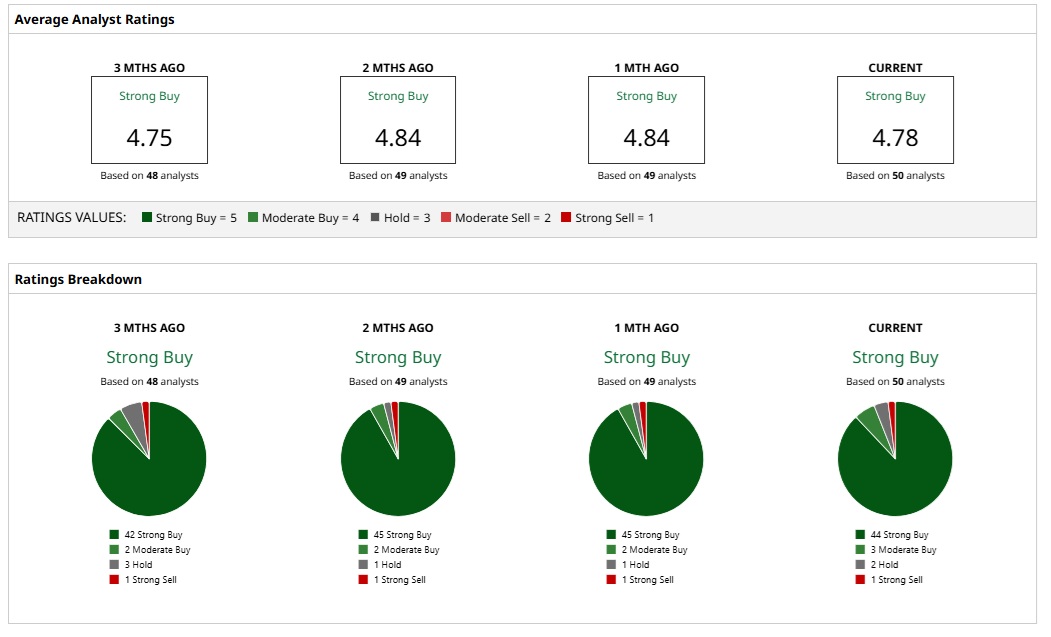

Given the ratings of 50 analysts, NVDA stock is a consensus “Strong Buy.” An overwhelming majority of 44 analysts assign a “Strong Buy” rating to NVDA. Further, three analysts and two analysts have “Moderate Buy” and “Hold” ratings, respectively. Finally, on the bearish side, one analyst has a “Strong Sell” rating.

Based on these ratings, analysts have a mean price target of $254.81 currently, which would imply an upside potential of 36%. Further, the most bullish price target of $352 suggests that NVDA stock could rise as much as 89% from here.

It’s worth noting that NVDA trades at a trailing 12-month price-to-earnings (P/E) ratio of 48. However, with earnings growth for fiscal 2026 and fiscal 2027 expected at 51% and 59%, respectively, Nvidia's PEG ratio is less than 1. This indicates that NVDA stock is not necessarily expensive.

On the date of publication, Faisal Humayun Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Why the Charts Say It’s Still Too Soon to Buy This Beaten-Down Mega-Cap Stock

- As Trump Drops Tariff Threats on Greenland, Should You Buy This 1 Hot Rare Earths Stock?

- As Tesla’s Austin Robotaxi Launch Draws Scrutiny, Consider Buying These 2 Robotaxi Stocks Instead

- Why 1 Analyst Just Slashed Their Price Target on Oracle Stock by More than 30%