Valued at a market cap of $16.2 billion, The Cooper Companies, Inc. (COO) is a medical device company focused on improving vision and women’s health. Based in San Ramon, California, the company develops, manufactures, and markets contact lenses, while also offering a broad range of products and services for women’s healthcare, including fertility solutions and cryostorage services. It is scheduled to announce its fiscal Q1 earnings for 2026 in the near future.

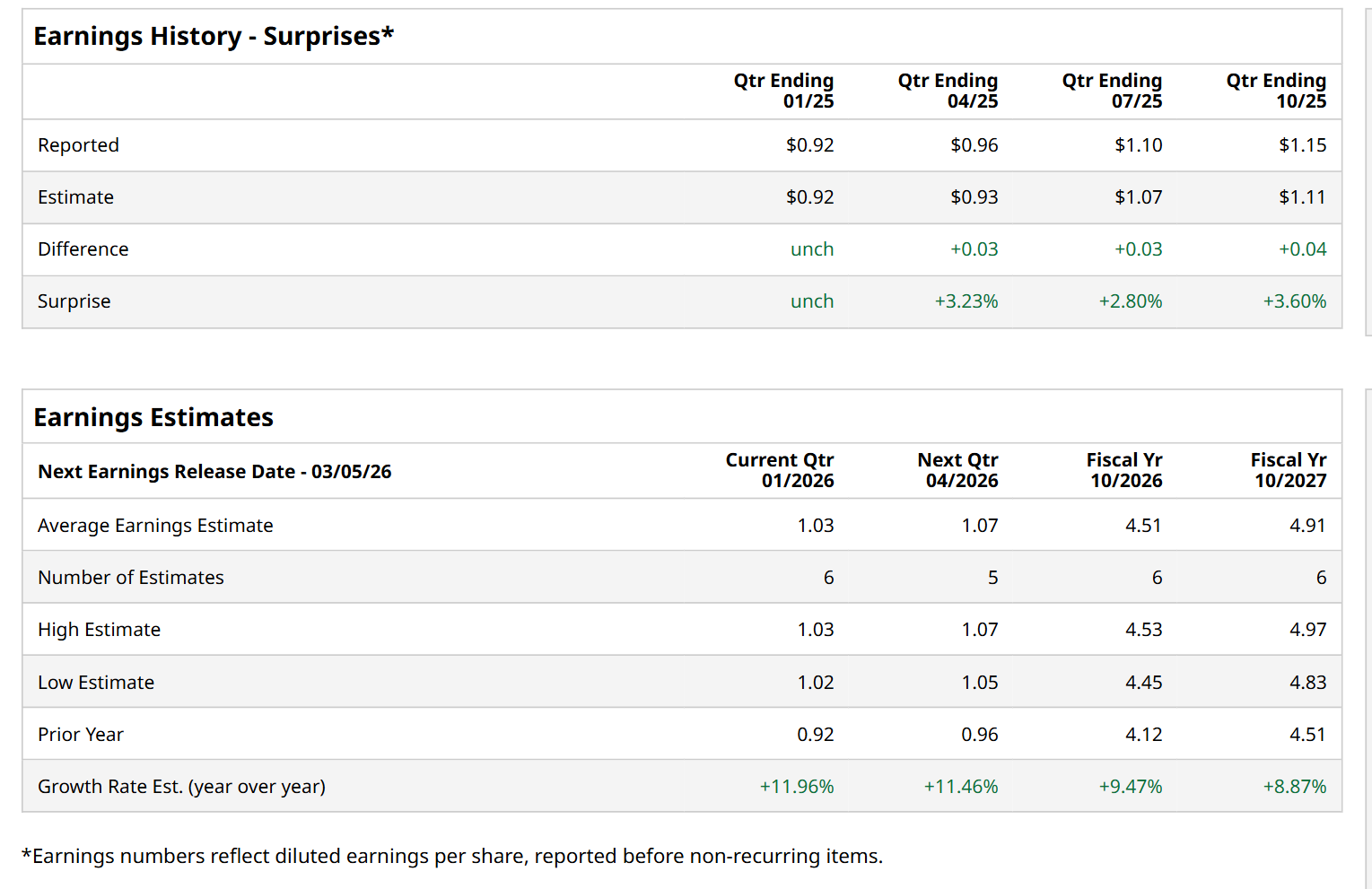

Ahead of this event, analysts expect this healthcare company to report a profit of $1.03 per share, up 12% from $0.92 per share in the year-ago quarter. The company has met or surpassed Wall Street’s bottom-line estimates in each of the last four quarters. Its earnings of $1.15 per share in the previous quarter topped the consensus estimates by 3.6%.

For fiscal 2026, ending in October, analysts expect COO to report a profit of $4.51 per share, up 9.5% from $4.12 per share in fiscal 2025. Its EPS is expected to further grow 8.9% year-over-year to $4.91 in fiscal 2027.

COO has declined 13% over the past 52 weeks, notably underperforming both the S&P 500 Index's ($SPX) 13.6% return and the State Street Health Care Select Sector SPDR ETF’s (XLV) 11.3% uptick over the same time period.

On Dec. 4, COO reported impressive Q4 results, and its shares soared 5.7% in the following trading session. Due to robust growth in revenue across both its reportable segments, the company’s overall revenue improved 4.6% year-over-year to $1.1 billion, meeting consensus estimates, while its adjusted EPS of $1.15 increased 10.6% from the year-ago quarter, topping analyst expectations by 3.6%. Additionally, COO’s upbeat fiscal 2026 guidance, which projects adjusted EPS between $4.45 and $4.60, might have further bolstered investor confidence.

Wall Street analysts are moderately optimistic about COO’s stock, with an overall "Moderate Buy" rating. Among 17 analysts covering the stock, nine recommend "Strong Buy," one suggests a "Moderate Buy,” six indicate "Hold,” and one advises a “Strong Sell” rating. The average price target for COO is $90.12, indicating an 8.8% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart